Avoid Arrival – Management Needs To Show Some Execution

Summary:

- Since going public a year ago, Arrival’s market cap fell by 90%. Although market dynamics were adverse for all high-growth small caps, Arrival had its own reasons for the decline.

- I believe that “minor” production delays hide serious production issues, warranting a look at the nuts and bolts of recent business performance and pipeline execution.

- The business model promised a short buyback period. However, Arrival has raised significant external funding and will need further raises to support growth.

- The valuation discount is explained by uncertainty regarding the production launch and further share dilution. Steer clear of the stock until the first vans are entirely built at a microfactory.

Editor’s note: Seeking Alpha is proud to welcome Georgy Shishkov as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

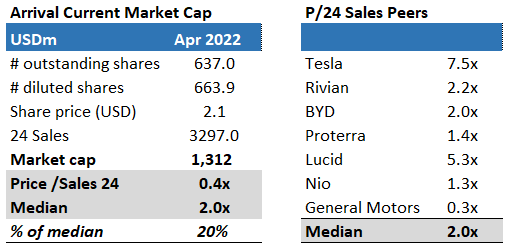

Arrival (NASDAQ:ARVL) is one of the EV startups that went public during the SPAC boom. It got an astonishing $13 billion valuation pitching a capex-light innovative business model to investors. Since then, the stock price has plummeted, and some might think it became attractive based on its $1.5 billion market capitalization with low valuation multiples (0.5x vs. 2.0x peer median). I believe investors should avoid Arrival until management shows the first signs of execution. So far, management has not proven itself and revised initial guidance significantly. I expect further vehicle rollout delays and high cash burn. In addition, Arrival needs a capital raise in late 2022. Otherwise, it will run out of cash within a year from now.

Overview

Almost a year ago, Arrival went euphorically public and achieved a $13 billion market cap, while shares traded at ~$23. As it often happens with euphoria, it did not last long. Since then, market capitalization has plummeted by 90% burning pockets of long-term investors.

Some may say that Arrival stock declined along with the overall trend in high-growth small caps. Indeed, if you look at Cathie’s fund (ARKK) or recent SPAC listings, its dynamics are quite similar to Arrival. But the main reason for discouragement among investors lies in Arrival’s underperformance vs. the ambitious plans announced in the SPAC presentation.

Starting from the second quarter of 2021 (referred to as Q2-21 going forward), management began postponing the execution timeline and even abandoned the initial forecast. However, at the Q4-21 earnings release, management was proud to produce a vehicle skateboard in an automated robotic cell. It claimed that the business plan was on track despite some changes in bus production plans. I do not share management’s optimism. Delays in bus production may hide serious issues that Arrival does not want to acknowledge.

In November 2021, the Federal Reserve announced a tighter monetary policy to curb inflation. It led to the overall stock market decline. Arrival had managed to raise $660 million before it, leveraging the positive macro environment. From Arrival’s perspective, raising funds was an intelligent decision strategy-wise and time-wise. However, the market reaction was adverse. It had become clear that Arrival had huge capex needs as opposed to the capex-light business model presented initially. In case of a successful production launch, Arrival will require further capital raises to support expansion. They will lead to share dilution and dampen share price performance.

Recent sluggish performance might continue despite management’s confidence

Initially, Arrival was committed to develop four microfactories in 2021/22 and start production of vehicles (including large vans) in 2022. Full utilization of microfactories was planned for 2023. A successful rollout would have allowed it to develop rapidly and achieve 258k vehicles in 2024.

However, in Q2-21, Arrival announced a shift of bus production start to the UK from the U.S. Until the Q4-21 earnings release, Arrival was still planning to produce buses at the U.S. microfactory (Rock Hill), but recently management claimed further delays in its plans. It was explained by the willingness to be closer to the first bus potential customer – First Bus operator of a five thousand bus fleet located in the UK. Below is Michael Abelson’s (CEO of Arrival Automotive) comment on this:

However, because we’ve seen significant potential near-term customer demand for our buses in the UK, we’ve decided to shift our focus to producing buses in the UK. To be clear, we are still expecting to build buses at Rock Hill at a future date.

The reasoning has sounded strange to me as management often claimed that demand was not an issue for Arrival. Definitely, the first sale is the most difficult as you need to prove that your buses function safely and reliably. But I doubt there is no demand for EV buses in the U.S. (the rapidly growing backlog by Proterra (PTRA) proves the opposite).

I believe that the shift of bus production from Rock Hill to a still building microfactory in the UK is explained by production issues rather than lacking U.S. demand. Arrival does not have a proven manufacturing concept. So far, only the skateboard assembly in a robotic cell has been achieved, while the rest of the chassis and the body are still to be completed.

Arrival is planning to start van production in Q3-22, likely in September at the earliest, as Arrival expects to produce only 400 to 600 vans this year (a pretty low number vs. 20,000 annual production capacity of two microfactories). As an adaptation of the production process to bus manufacturing will take some time, I doubt that management will be able to start the rollout of buses in the second half of 2022.

In addition, Michael Abelson has already started preparing investors for potential further production delays (linked to above):

As we progress toward started production, we continue to monitor our supply chain and associated logistics. Unfortunately, we’ve started to see some parts and equipment delivery delays. While these delays have not yet affected our started production timing, we will watch these areas closely in the coming months.

This is strange to hear. At the March Auto Conference webcasts (link to the first and the second), senior managers said that they were not concerned about supply-side issues. It is one more argument supporting my view that Arrival is concerned with production technology and tries to disguise it with industry-wide challenges.

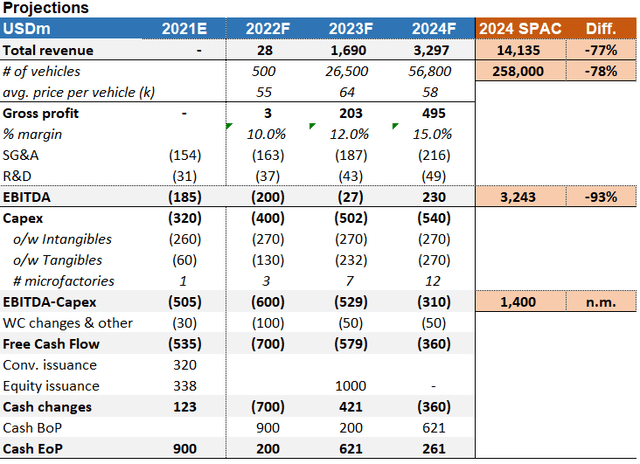

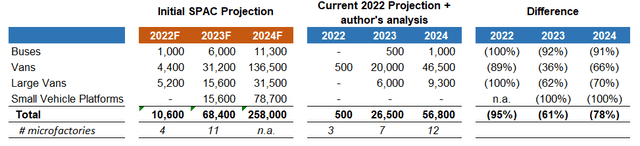

Based on recent guidance for 2022, vehicle production numbers are 95% lower than the initial SPAC projections. Based on my analysis, If Arrival does not face further significant production delays and certification issues, it can produce 56.8k vehicles in 2024 (~80% lower).

Source: Arrival, author’s projections

To get production figures over 2023-24, I estimated production capacity based on the following:

Vans

Two van microfactories opened in 2022, achieving 12k van production (60% of max) in 2023 and 20k van production (full capacity utilization) in 2024. 2024 van production is supported by three microfactories opened in 2023 (operating at 80% of capacity) and four microfactories opened in 2024 (running at 35% of the annual total).

Buses

The bus factory is expected to operate at 50% capacity in 2023 and 2024. Due to technological inefficiencies, I do not expect Arrival to achieve the total 1k capacity claimed in the SPAC presentation. 2024 bus production is supported by the two more bus factories (25% of annual production capacity due to set-up timing).

Large Vans

No exact information was presented in the SPAC presentation regarding the production of large vans. The manufacturing process still remains in a “blueprint” phase. Large van production is expected to start only in 2023, so I estimate that Arrival will achieve only ~9k large vans in 2024 (~20% of van production capacity, the ratio is broadly in line with SPAC projections).

Small Vehicle Platform

The rollout plans are shifted beyond 2024.

The “Short payback” narrative contradicts simple math until production scale is reached

Initially, Arrival announced savvy microfactory economics with low capex needs of $44 million per factory. Each factory was promised to achieve $100 million Gross Profit operating at total capacity (10k vans or 1k buses). Later, Arrival revised its Capex requirements to $50 million per factory and announced a $10 million higher initial Opex to secure logistics. If Arrival did not incur any further costs, this would still make a business case look promising and self-financing. However, in Q4-22, Arrival raised $660 million capital via convertible shares and new equity issuance.

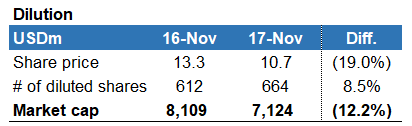

The stock market reacted quite negatively to it, and the market capitalization decreased by 12% on the first day after the dilution announcement (share price fell by ~20%, while the number of shares increased by ~9%).

Source: author’s analysis

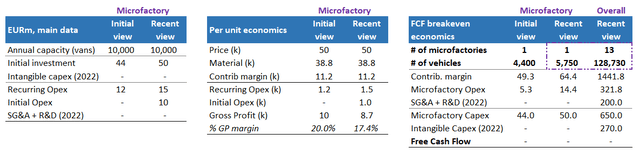

The market was surprised by dilution and believed in the self-financing business model. Investors were impressed by a short payback period of a single microfactory. A microfactory needs to produce only 4.4k-5.8k vehicles to get a breakeven cash generation. Unfortunately, a simplified microfactory view does not consider centralized opex (marketing activities and R&D) and intangible capex. If we include these costs, Arrival needs to produce ~130k vehicles at 13 microfactories to achieve breakeven cash flow.

Let’s look at the calculations. I have prepared a comparison of Arrival economics based on (i) the initial view presented in the SPAC presentation, (ii) the most recent view presented in earnings reports, and (iii) the economics of the entire company and not just one microfactory.

Source: Arrival, author’s analysis

Microfactory view explained

Arrival communicated multiple times that the price of its vehicles would be above gasoline peers and primary savings would come from maintenance. The price of a smaller Renault Kangoo is ~$35,000, so it is reasonable to assume the van’s target price at $50,000.

The target contribution margin is derived from communicated 20% gross margin. Although it may sound that the first-year gross margin will be 17.4% because of the additional initial opex, 2022-2023, actual gross margins will be much lower. Arrival communicated only targeted gross margins that can be achieved via scale and optimized manufacturing technology.

Based on high marginality and low capex, Arrival must produce only 4.4k-5.8k vehicles to get a breakeven cash generation for a microfactory. Even if a microfactory works on one shift, its investments can be repaid within one year. The picture changes substantially when the overall company is analyzed.

Overall view explained

Based on 2022 communicated revenue and EBITDA and 2021 performance, I estimated marketing, administrative, R&D expenses, and capex.

SG&A expenses are expected to achieve ~$150 million in 2022, mainly consisting of marketing expenses. These are key for a strong positioning in a rapidly growing market. On the one hand, Arrival’s sales team has shown a strong execution track record, with pre-orders doubling to 134k in Q4 vs. 64k in Q3. On the other hand, Arrival’s spending looks elevated, as its key competitor Proterra spends only ~$60 million on SG&A p.a. It is also important to mention that pre-orders are mainly concluded via non-binding letters of intent (quite typical for the industry).

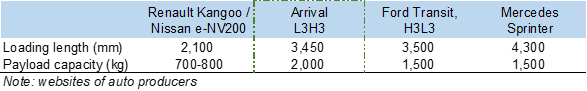

BEV market is in its infant phase; only 10% of all cars are electric in Europe, 5.7% in China, and 2.0% in the U.S. European EV cars penetration is at 5.5% in 2021, while penetration is at 2.3%. The market momentum is currently building with about 20 van options for the fleet, dominated by small vans that are not direct competitors to Arrival (Renault Kangoo accounting for 26% of sales, followed by the Nissan e-NV200 with 17%). Lack of supply in a “bigger van size” can result in potential market backlogs and unsatisfied demand. Therefore, big customers try to secure future orders already at this moment – e.g., UPS ordered 10k (with optionality for an additional 10k) vans by Arrival, taking into consideration its payload characteristics and competitive pricing vs. its peers.

Source: company websites

The company expenses some portion of R&D, but the most significant part is capitalized. Capex spent on intangibles in 2022 is expected at ~$270 million (equal to capex for five microfactories). High capex and SG&A spending explain well that Arrival needs to operate at scale (~130k vans) to achieve breakeven cash generation.

Business projections signal further share dilutions

Let’s examine how Arrival is going to develop in the forthcoming years. Initial SPAC presentation expected positive cash generation already in 2023. There is no way Arrival can achieve it. On the contrary, if Arrival manages to assemble a vehicle in a robotic cell, it will need to raise further capital within one year.

Let me elaborate on some of the critical assumptions. I expect the initial van price to be higher than the $50 thousand target price mentioned earlier due to the lack of economy of scale and high raw material prices. I would expect van prices to go down over the following years, while the weighted average price remains high due to the sale of more expensive buses and large vans.

I would expect a low gross profit margin in 2022, reaching its target marginality over the following years. EBITDA can reach positive territory in 2024, but it remains 90% below SPAC projections.

Arrival will not be able to generate any funds and would need to raise $1 billion in funds in late 2022 or early 2023. Arrival’s continued high intangible capex would be required to develop large vans, small vehicles, and microfactory optimizations.

Low valuation does not mean convergence to the median of the peer group

Source: SA, author’s analysis

Arrival is trading at a 0.4x price/2024 sales multiple, quite a discount vs. the 2.0x median multiple of the peer group. Some may conclude that Arrival should converge to the median and, therefore, it is a buy. I believe it is too risky to buy now. If Arrival cannot start van rollout by the end of the year or microfactory economics changes, it will not be able to raise additional funds by year-end. Without this raise, it will be out of cash within one year. The risks are too high for me, given prolonged execution so far.

Let’s first walk through the valuation methodology.

Why is P/2024 sales as a critical valuation ratio? Arrival does not generate any significant revenue in 2022 and 2023. Therefore multiples based on current and the following year’s revenue do not show much. Those buying Arrival shares do it because of its potential rapid business scalability. Therefore, I took 2024 sales as a basis. It also allows comparing Arrival with more mature peers. I do not apply EBITDA as a basis because I would need to take a later year to get meaningful results. It would have added more uncertainty to the results. I do not apply DCF as Arrival does not generate any positive cash flow shortly. Later years would have a too-high weight in this case.

The peer group contains such hype names as Tesla (TSLA) and Rivian (RIVN), but it also has Chinese Nio (NIO), which valuation is penalized due to Chinese geopolitical risks. In addition, it includes main Arrival’s competitors Proterra and BYD (OTCPK:BYDDY). Surprisingly, based in China, the BID has a higher valuation than its American peer, Proterra (this is a topic of another article). General Motors (GM) is trading at very low multiples as it is perceived as a traditional car player despite all the efforts to transition to the EV space.

Risks – View at Arrival via a bullish lens

Bulls can claim that Arrival has a significant valuation gap compared with peers affected by the overall negative market sentiment toward startups. However, Arrival has already managed to assemble a skateboard in a robotic cell, which is the most sophisticated part of the manufacturing process. Thus, the risk of manufacturing delays has decreased. In addition, Arrival will not face substantial supply-side risks due to its innovative production method and established battery supply from LG. Management has sufficient expertise in the automotive industry. Therefore, certification risks are low.

I cannot believe that the rest of the production process will go as smoothly. So far, management has announced new delays every quarter. To illustrate the point, Arrival was initially planning to build 1k busses in 2022. Recently, zero buses have been expected in 2022.

If the manufacturing process succeeds, there is little hope that Arrival will be able to achieve its promised economics with a 20% gross margin. Arrival softened the wording during recent earnings calls and said that a 20% margin was a “targeted one.” I will not be surprised if Arrival gets a low single-digit margin explained by high raw material and energy prices. In addition, Arrival has not commented on its extensive intangible capex in any of its earnings calls. We can guess that it is used for manufacturing process optimization. I expect it will remain elevated, given plans to devise large vans and small vehicles over the following years.

The main U.S. competitor of Arrival, Proterra, suffers from lacking resins used in numerous vehicle applications (wheels, door handles, valve covers, and so on). Arrival might face similar issues leading to delayed business scale-up.

Conclusion

Arrival’s business forecast until 2024 is based on the assumption that Arrival will be able to meet its 2021 targets. If you lower 2024 sales, the attractive valuation multiple can get much higher. In order to achieve $3.3 billion sales in 2024, Arrival needs to complete manufacturing of the vehicle in a cell and start production in Q3-21 as announced. Even in this case, there are high risks that van parts are not perfectly interchangeable with bus parts, and further bus adaptation timing and costs are required.

In addition, Arrival is exposed to certification and regulatory risks that should be cleared within the next quarters. So far, management has not shown any meaningful track record and has made significant overstatements during the SPAC roadshow. Without $1 billion in external funding in late 2022, Arrival will lack cash in early 2023.

Despite a moderate valuation, I am not investing in Arrival until I see some execution progress and management proves its capability to deliver. One quarter without any delays would already be a positive sign. Arrival will report Q1-22 results on May 10.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.