Summary:

- Exxon Mobil’s foray into lithium mining is a positive development, but it will not significantly alleviate the potential pain for current long-term stockholders.

- I believe the decline of fossil fuel demand and the rise of renewables will lead to declines in Exxon’s revenues, even when including its growing lithium and carbon capture businesses.

- Exxon’s current valuation is likely to drop lower as its finances deteriorate, and the company is fundamentally overvalued in the long term.

olaser

Introduction and Thesis

I first wrote about Exxon Mobil Corporation (NYSE:XOM) in August 2023. Considering that my articles are written with a 5-10 year timeframe in mind, I didn’t anticipate writing a new piece on the company so soon after the first article. However, material developments regarding Exxon’s business that I wasn’t fully aware of have prompted me to rethink Exxon’s prospects.

Interestingly, this article is technically my second time revisiting a company that I have covered previously on Seeking Alpha. My first “second article” on Tesla was really a comparison of its short-term and long-term prospects and the prospects of its competitors, the Detroit Three automakers. That article was more of a restatement and a re-contextualization of my unchanged thoughts on that company; this second article on Exxon is more of a full reevaluation of the company’s long-term prospects, accounting for new information on Exxon’s developing operations that I was missing before.

If you haven’t read my initial Exxon article, it might be worth a look so as to understand my underlying rationale for Exxon’s prospects. To briefly recap my thesis, I concluded my initial Exxon article as follows:

I believe that the oil industry, and the fossil fuel industry at large, is experiencing its last boom. Renewables are virtually at price parity with fossil fuels, declining further in cost, increasingly supported by regulators and governments, less risky in terms of geopolitics and national security, and are universally adoptable. Oil companies in particular have gained a negative reputation and a lack of loyalty from their customers, who will abandon them at the first opportunity. The headwinds that will catalyze said abandonment will strengthen over this decade, and soon the house of cards that is the oil industry’s financial security may collapse quite suddenly. Subsequent revenue and earnings shortfalls will then trigger a major selloff of oil stocks, leaving many investors as blindsided bagholders.

…

As for Exxon, needless to say, the company as we know it today is likely done for. Even if it becomes the undisputed king of the oil industry, it would make no sense to own the company’s stock as the energy transition progresses, since Exxon will be taking a bigger slice of a shrinking pie. While renewables rise, fossil fuels, the oil industry, and Exxon itself will all be forced to contract in size, meaning that XOM stock will likely decline. As such, buying or holding XOM for the long term would only result in the destruction of shareholder capital.

Therefore, for long-term energy investors, I rate XOM a strong sell, and I suggest that long-term investors also reconsider their ownership of all other fossil fuel holdings.

When I wrote this conclusion, I thought that all the company’s assets and operations were centered on the production, refinement, and sale of oil and gas and that the only outlier segment, carbon capture and storage, or CCS, was more of a declaration of the company’s carbon neutrality aspirations than an actual plan to become carbon-neutral. Due to the technological nascence of CCS, I dismissed it as highly speculative and little better than greenwashing. As a result, I believed that Exxon’s dependence on oil and gas foreshadowed a significant risk of its collapse as a company, at least in its current form.

While I still think CCS is still highly speculative, Exxon’s rather serious foray into lithium mining is a different story. Lithium demand will be reliably raised for many years, and lithium production methods are tried and true, so Exxon getting involved in lithium is a positive development.

However, while I believe it bodes well for the company in the long term, I also believe it will not significantly lessen the pain for current long-term XOM stockholders, even if it buoys the company significantly in the future. I am still as sure now as I was in August 2023 that Exxon, and XOM stock, are set for a long, hard fall. Furthermore, this fall can be demonstrated via long-term revenue projections for the company. The difference in my viewpoint between August 2023 and now is that I now see lithium mining, and to a much lesser degree CCS, as providing a cushion for the company to fall onto.

As a result, while XOM stock’s long-term prospects are better now in my view than when I first wrote about the company, the stock should still be abandoned by investors anticipating growth for the company during its operational transition away from massive markets in structural decline (oil and gas) and toward growing, but smaller, markets (lithium and CCS).

Exxon is Likely to Shrink into a Shell of its Former Self

Exxon Mobil, according to several press releases and news reports, is entering the lithium mining and CCS spaces. While Exxon’s current oil and gas-based business model strikes me as inherently unsustainable, I believe mining – or better yet, metals recycling – has a much longer runway, especially if the metal involved is lithium, a core component of batteries used in electric vehicles, renewable energy storage, and other technology centered on sustainable energy usage.

As for CCS, I am much more skeptical about it to say the least. I have called it the “speculative path” toward reducing emissions due to its status as a half-baked, barely scaled, unprofitable technology at this time, and I still tend to believe it. To be clear, I am not rooting for its failure – I just would not bet on its success, as an investor or otherwise.

But let’s say I am wrong. For the sake of this section, let us assume that the CCS business, fueled by Exxon’s deep pockets, will be as successful for Exxon as its lithium mining business, and that in time Exxon will scale CCS into a relatively productive, and perhaps even profitable, operation. In the end, it will barely matter: Exxon’s new business lines can’t make up for its oil and gas business decline.

The Math – Numbers Don’t Lie

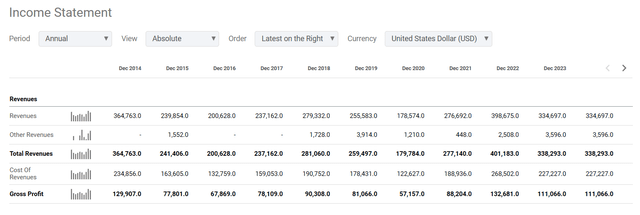

Over the past decade, Exxon has brought in around $300 billion in revenue annually, almost all of it from oil and gas.

However, as I covered in the previous Exxon article, renewables are fast replacing oil and gas as a fuel source in transportation, energy, and industrial use, three of the biggest sources of oil and gas demand. How fast is this replacement happening? Hard to know, but one big factor prompting global regulatory changes to speed this transition along is the Paris climate agreement. Notably, as part of the agreement, the world must reduce carbon emissions by 43% by 2030, with bigger percentage reductions over time.

The Bull Case Calculations

Let’s say the world only makes it to 30% emissions reduction, which should ultimately correspond to a 30% reduction in global fossil fuel use. Exxon, as a primarily fossil fuel-based company, should therefore see its revenues fall by a similar amount. But Exxon doesn’t have much exposure to coal, likely the fastest-declining fossil fuel, so let’s say Exxon’s revenue drops by only 20%. $300 billion less 20% is $240 billion in revenue in 2030.

By 2030, what should Exxon’s lithium business be bringing in? According to the IEA, electric vehicles require about 9 kilograms of lithium each, and Exxon wants to mine enough lithium for 1 million EVs per year. At today’s lithium price of $15 per kilogram at the time of writing, Exxon’s lithium business could generate $135 million annually.

To be more generous though, let’s account for high lithium demand over time pushing the price of lithium up to ten times the current price. This results in likely revenues of around $1.35 billion per year for Exxon’s lithium business; let’s round this up to $1.5 billion. So by 2030, Exxon’s oil business ($240 billion) plus its lithium business ($1.5 billion on the high-end) will bring in only about $241.5 billion in revenue. Adding in the CCS business, which we will assume will do just as well as the lithium business, this brings in $1.5 billion more, totaling $243 billion. This is a significant decline from Exxon’s current revenues, which is not what investors are looking for – and this is the bullish scenario.

The Base Case Calculations

Now, let’s get more realistic. The cheapness of renewable energy and electric transportation compared to fossil fuel alternatives means that consumer preferences, i.e., market forces, will likely propel the world to reach the Paris agreement’s long-term goals, if not exceed them. In that case, let’s say that emissions reduction, and thus fossil fuel use, falls by 40% globally by 2030, and that Exxon’s revenues fall by 30% as fossil fuels decline in use. $300 billion less 30% is $210 billion for Exxon in 2030.

For this scenario, let’s also put Exxon’s lithium business at a clean $150 million in revenue, plus $150 million in revenue for the CCS business to match it. $210 billion in oil revenue plus $300 million (or $0.3 billion) for the lithium and CCS businesses totals $210.3 billion in revenue for Exxon in 2030. Even if lithium prices rise by 3 times current prices, and CCS keeps up with the lithium business, that’s only $211 billion for 2030.

This is a severe decline from Exxon’s $300 billion in revenue currently and implies that a sharp correction is in store for the company and its stock over the next several years. As the company’s revenue shrinks, in my opinion, its market cap and stock price will follow.

Exxon Beyond 2030

Exxon’s shrinkage is unlikely to cease in 2030. Whatever size the lithium and CCS businesses reach, their future revenues almost certainly will not grow to reach the size of Exxon’s current oil and gas revenues, and the Paris agreement calls for even greater reductions in emissions (and therefore reductions in fossil fuels) as the years pass.

Paris agreement aside, if renewables and electrified transport do become universally preferred by consumers in the market, as I laid out in my previous Exxon piece, there will be little demand for fossil fuels, from Exxon or others, leading to an organic collapse in fossil fuel sales for Exxon that leaves only its lithium and CCS businesses standing. Even if Exxon ultimately brings in $50 billion in consistent revenue from the lithium and CCS business lines over the next few decades as its mining operations ramp up and CCS technology develops, that is a drop in revenue of over 83% from today’s levels of $300 billion if global consumption of oil and gas is mostly eliminated on the way to reducing emissions.

Pivoting to $50 billion in revenue from new markets is better than not pivoting at all, but it may be cold comfort if the $300 billion in revenue from once-reliable fossil fuel demand eventually falls to zero. Worse yet, if CCS fails to evolve into a profitable and effective climate technology, $50 billion in revenue from lithium and CCS may not be economically feasible for Exxon at all. If fossil fuel demand also collapses, then Exxon and XOM’s fall could be even steeper than 83%.

Valuation

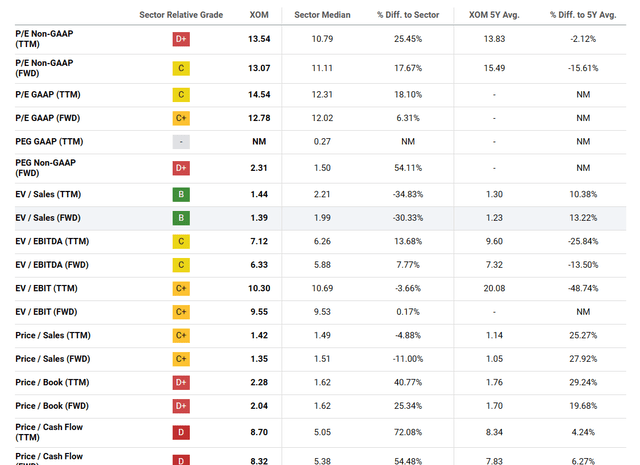

Here are XOM’s current valuation metrics at the time of writing:

To recap my summary regarding XOM’s valuation:

As long as the oil market remains healthy, XOM’s premium is likely a fair price to pay to own one of the world’s premier energy companies. However, a collapse of the oil market will rob Exxon of the revenues it needs to prop up its finances, ultimately devaluing XOM stock. Those with faith in the continued dominance of oil might feel comfortable investing in XOM, but in my opinion, this stock might be ripe for a decline…

My opinion today remains largely unchanged from my initial Exxon article. In light of the probable decline of Exxon’s finances as fossil fuels are abandoned over time, I think XOM’s valuation will drop lower. Even if current multiples remain intact, Exxon’s lower revenue and profit numbers will mandate a reduced market capitalization. However, it is hard to know when this downward revision of financials will become apparent, or whether XOM’s valuation metrics will fall before the company’s finances do.

In any case, assuming my thesis on Exxon and the fossil fuel industry holds, Exxon’s finances are likely to deteriorate within the next 10 years due to fossil fuel abandonment. XOM stock would be valued much lower as a consequence since most investors tend to shy away from underperforming firms in lagging segments of their industries, particularly if they are hemorrhaging revenues and profits. As such, I see XOM as fundamentally overvalued looking at it over the next decade. Even if it plays a significant role in the lithium and CCS spaces, the revenue and profits lost from its oil and gas business will likely be too great to sustain its current market cap.

Risks

Broad risks to this thesis include the possibility that fossil fuels are not set to fade into the background in the next decade, which would mean Exxon would have a large and stellar base upon which to build up its new lithium and CCS businesses. There is also the possibility that the lithium and CCS businesses do not pan out well for Exxon, with better competitors in both spaces dispatching Exxon as it dips its toes into two new markets far from the company’s traditional area of expertise.

Of course, Exxon is currently wealthy enough to buy its way into new markets, as seen in its Denbury acquisition for CCS and its major Arkansas deposit purchase for lithium, both in 2023. Still, Exxon may still fail to fully capitalize on these investments by diligently building upon its lithium and CCS assets, leaving the company at the whim of competitors.

Conclusion

Exxon’s new lithium and CCS businesses are welcome sources of revenue, but they will barely move the needle compared to its legacy business, and investors should not jump into Exxon stock for these new business lines alone.

The company is synonymous with fossil fuels for good reason. Exxon is an oil and gas company first and foremost, since that’s where nearly all its money comes from. A little lithium and CCS revenue won’t change that, especially an amount small enough to be almost imperceptible against Exxon’s current revenues.

But, contrapositively, Exxon as the titan we know today, cannot exist without oil and gas, – that is to say, absent demand for oil and gas, lithium and CCS revenues would be grossly insufficient to sustain both Exxon’s current market cap, and its current position as a revered company to own. As the energy system and transportation systems begin to electrify around the world and pivot away from oil and gas, XOM’s main source of revenue will be greatly imperiled as oil and gas demand plummet.

If Exxon wants to transition to lithium mining and carbon capture to hedge against this trend, more power to it. But XOM investors should note that the combined revenues and profits from these businesses will, at best, only justify a fraction of XOM’s current market cap. Investors should therefore pay attention as fossil fuel demand falls. Current XOM investors in particular stand to lose out the most over the long term, since XOM, one of the biggest oil and gas sellers, is likely to fall the hardest as demand dries up.

As a result of all these factors, Exxon Mobil may end up surviving the energy transition by transforming itself into a lithium miner and CCS company; this is a positive sign, as I previously believed that the prospect of Exxon’s very survival of the transition was in severe doubt. Unfortunately, for current XOM investors, the long-term revenue from these businesses will be paltry compared to the oil and gas business the company is known for today, and I suspect that shareholders could see significant capital losses as Exxon struggles to survive.

With lithium being a critical and highly-desired battery material, Exxon’s entry into the lithium mining space means it may have finally found a demonstrably sustainable business to pivot to, even if the revenues from this business will be lower than what it brings in now; for that reason, the company now has a much better chance of surviving the EV transition and electrification of the energy sector than it did otherwise. In my opinion, it consequently deserves an upgrade from “strong sell.” For investors, though, the news that Exxon may now survive will not significantly lessen the impact of the likely capital destruction in the meantime.

Therefore, for long-term energy investors, I upgrade my rating for XOM from “strong sell” to “sell.” Exxon Mobil could potentially become quite the powerhouse in lithium mining and CCS a decade or two down the line, but there will be significant pain for current XOM investors along the way, and there is a good chance that even in the best version of the company’s future, it may never be as good an investment as it was during the last age of oil. Current XOM shareholders need not endure the coming capital losses in the meantime, and I still think they should strongly consider exiting any long positions in the stock as soon as possible, at least until the global transition from fossil fuels to renewables is complete.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.