Summary:

- Driven largely by $19 million in accelerated depreciation of older machines, Bitfarms reported a $23.7 million operating loss in the first quarter of 2022.

- BITF has aggressive expansion plans and is guiding to triple the current level of exahash per second by the end of the year.

- While there is $124 million in balance sheet liquidity and no debt, unit economics of the underlying business will deteriorate in the next report.

- Bitfarms is looking for its 3rd CEO in two years, with the latest departure seeking $27 million in damages for claimed breach of contract and wrongful dismissal.

CentralITAlliance/iStock via Getty Images

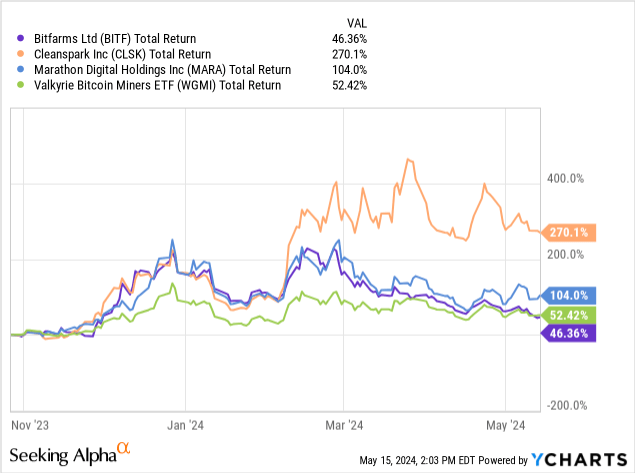

When I last covered Bitfarms (NASDAQ:BITF) (TSX:BITF:CA) for Seeking Alpha in late-October, I noted the company’s mining efficiency, growth plans, and debt reduction. In the months following that note, BITF rallied roughly 200% from those late-October levels. While the company’s stock is still ahead of the S&P 500 since then, BITF has lagged the sector leaders and even the sector itself, as expressed through the Valkyrie Bitcoin Miners ETF (WGMI).

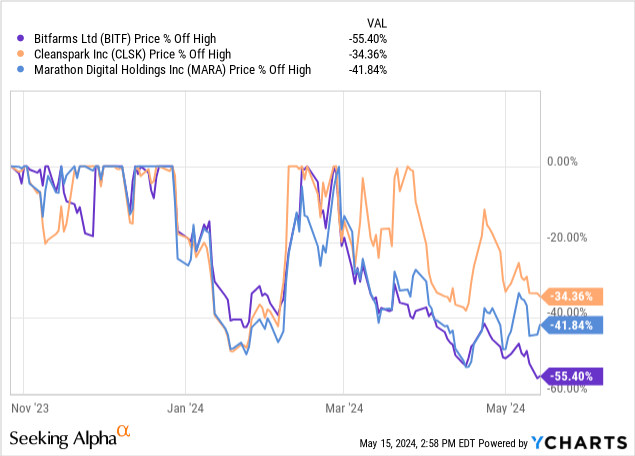

Again, BITF is still up versus late-October levels. But the stock has struggled to hold gains to the same degree as mining peers like CleanSpark (CLSK) or Marathon Digital (MARA). Each of which have given up less from recent highs than Bitfarms:

In this update, we’ll look at the company’s recently announced Q1-24 earnings, April production, and additional considerations to assess if the worst might be over from Bitfarms’ stock price drawdown over the last couple months.

Bitfarms Q1 2024 Earnings Report

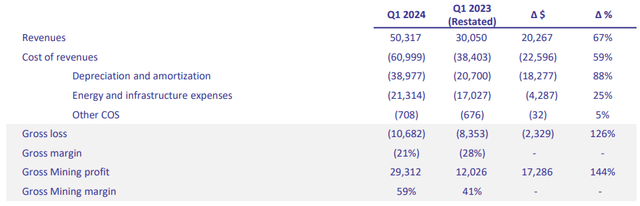

For the first three months of 2024, Bitfarms mined 943 Bitcoin (BTC-USD). From this production, the company reported 67% year over year quarterly revenue growth from $30 million to $50.3 million. Despite the growth, this revenue came against $61 million in cost of revenues for a gross margin loss of 21%, or $10.7 million.

Q1-24, $ in thousands (Bitfarms)

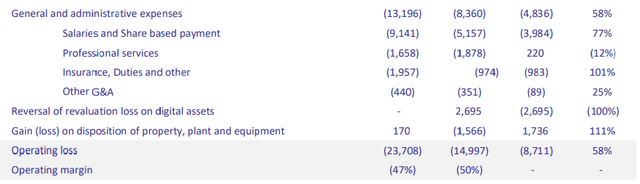

64% of cost of revenues came from depreciation and amortization. A significant factor in this cost of revenue number is about $19 million in accelerated depreciation as Bitfarms works toward replacing older mining machines. The company cites a gross mining profit of $29.3 million, or 59%. Getting to opex, we can see a 58% increase in SG&A from $8.4 million in the prior year to $13.2 million in the latest quarter – this was a modest sequential decrease.

Q1-24, $ in thousands (Bitfarms)

Total operating loss for the quarter comes in at $23.7 million. So even adjusting for the accelerated depreciation on machines, it was still an unprofitable quarter for BITF shareholders and one that has resulted in a 45% year-over-year increase in weighted average shares outstanding. To be clear, Bitfarms is far from the only mining company utilizing an ATM to grow production, but it’s important to mention, nonetheless.

Adding the company’s $13.2 million in SG&A with the $61 million in cost of revenue and then dividing that figure by the 943 BTC mined in the quarter gives us a true breakeven cost close to $79k BTC. Stripping out the $19 million in accelerated depreciation and doing the same calculation again gives us a Q1 breakeven price of over $58k. And all of this production data pre-dates the block reward halving from April.

April Production and Expansion

Speaking of the halving, we don’t yet have a full month of production data to assess in a post-halving world. That said, much of the impact from the halving on April 20th was nullified by a massive surge in transaction fees following the launch of the Runes protocol during the halving block. Even still, Bitfarms managed just 269 BTC mined during the month of April.

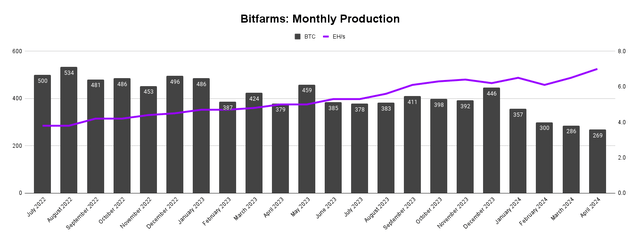

Author’s chart (Company filings)

Zooming out over the last 22 months, April 2024 was the company’s lowest month of BTC production, Bifarms starts making despite it also being the company’s best month for exahash per second. To continue mining BTC at the level that it currently does, Bitfarms has to either scale EH/s faster than global hash rate or global hash rate has to come down as mining becomes less economical and weaker machines turn off. The company does not appear to be banking on the latter.

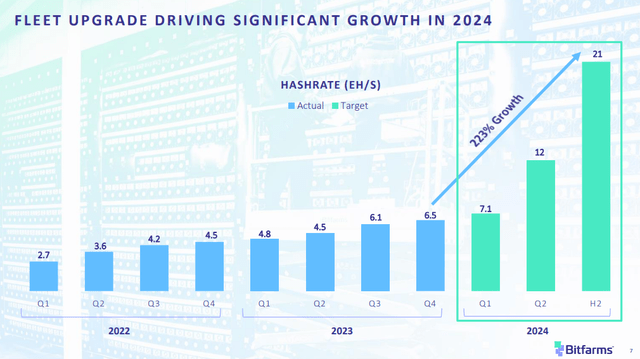

Q1 earnings deck, Slide 7 (Bitfarms)

Bitfarms is one of several companies that is planning to have an exahash figure that eclipses 21. Many of the other companies that are guiding for comparable production growth are starting from a larger EH/s position than that of Bitfarms. In my opinion, Bitfarms is projecting extremely fast growth as it is eyeing a tripling of EH/s per second by the end of the year.

Frankly, the company has done a phenomenal job of paying down debt over the last several quarters and now has $124 million in liquidity between cash and BTC on the balance sheet. Personally, I’m of the view that scaling this quickly is probably a long shot given the growth trajectory that we’ve seen up to this point, but it’s certainly possible if Bitfarms starts making distressed miner acquisitions. Possibly making that strategy a challenge is the situation with the company’s CEO position.

The Elephant in the Room

Bitfarms CEO Geoffrey Morphy was terminated two days before the release of Q1-24 earnings. The company previously disclosed the planned departure of Morphy back in March in what appeared to be an amicable parting. Attributed to Morphy in the March press release:

It has been the greatest privilege of my career to serve Bitfarms, our shareholders, and our employees. I am extremely proud of what we’ve accomplished as a team

Things took an uncomfortable turn on March 13th when Bitfarms disclosed a two-day delay in the company’s Q1 earnings release and the termination of Morphy in separate press releases. Evidently, the March parting announcement has not turned out to be as amicable as initially believed. Morphy has since sued the company and claimed breach of contract and wrongful dismissal. He seeks $27 million in damages. From Bitfarms:

The Company believes the claims are without merit and intends to defend itself vigorously. Nicolas Bonta, Chairman and Co-Founder of the Company, has been appointed interim President and Chief Executive Officer, and will lead the Company until the executive search is completed and his successor is appointed.

It is expected that the next CEO will be announced within the next several weeks. On May 15th, interim CEO and company founder Nicolas Bonta introduced the conference call and spoke very briefly. Chief Mining Officer Ben Gagnon and Chief Financial Officer Jeff Lucas handled most of the presentation and the Q&A session. So, for all intents and purposes, they appear to be the ones overseeing the day-to-day operations of the company.

To this point, it isn’t entirely clear why Morphy was leaving the company to begin with. He was promoted to CEO from COO in late 2022 after Emiliano Grodzki stepped down from the position. Not counting Bonta’s interim presence, Bitfarms will be on its 3rd CEO in less than 2 years when Morphy’s official replacement is found. I’m not of the view that this is a good sign.

Closing Summary

I’ll reiterate something I said in my prior Bitfarms article; I really appreciate the current leadership’s commitment to the core competency of Bitcoin mining. In this market, it’s easy to be swooned by the allure of HPC services and generative AI. I’m not sure if that approach to AI, or lack thereof, has had any impact on why the company is looking for a new CEO. But in my personal view, I think Bitfarms has quite a bit to sort out.

The company is planning what I’d call an aggressive expansion during a period of uncertainty for both Bitfarms and the unit economics of the underlying business. It’s certainly possible the worst is priced in already here. But I see a company that is looking for yet another CEO, just reported another net loss, and is battling a very difficult post-halving mining fundamental environment that has yet to be reflected in a quarterly report. I think there are better options out there right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD, MARA, CLSK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.