Summary:

- Abbott Laboratories is one of the smaller holdings in my portfolio, but that won’t be the case for much longer.

- Strength throughout the base business powered the company’s sales higher in the first quarter.

- ABT’s interest coverage ratio approached 25 in the most recent quarter, which supports an AA- credit rating from S&P.

- Shares of the healthcare juggernaut could be trading at an 8% discount to fair value.

- ABT may be positioned for double-digit annual total returns for the foreseeable future.

A team of scientists work in a laboratory. AzmanL/E+ via Getty Images

For my money, the name of the game in dividend growth investing is to buy best-of-breed companies operating in industries with favorable growth tailwinds. That’s because this can help a company deliver the sales and profit growth that is necessary to support a rising payout to shareholders.

Well, few growth trends are as powerful as healthcare. As medical treatments advance, the world ages, and grows in population/wealth, the demand curve for healthcare is moving up and to the right.

More specifically, I’m going to be focusing on one of my favorite healthcare giants today. But before I do, I’ll drop a hint as to which company I am referring to (please pretend to have not read the headline or key points to maintain the suspense).

This company operates as a leader in the medical devices industry. This is an industry that Fortune Business Insights projects will compound by 6.3% annually from $518.5 billion in 2023 revenue to reach $886.8 billion by 2032.

This company doesn’t just generate a plurality of its sales from the medical devices industry. It also has exposure to other growing industries in the healthcare sector. That includes the global diagnostics market and nutritional products market.

This company is none other than Abbott Laboratories (NYSE:ABT). When I covered ABT with a buy rating in March, I was impressed by the company’s core business performance (e.g., excluding the COVID-19 diagnostics testing business). The AA- corporate credit rating from S&P was another remarkably attractive trait. Not to mention that the dividend was comfortably covered by free cash flow in 2023. Sealing the deal, shares looked to be trading just under fair value.

In that time, ABT has only become a higher conviction buy in my books. The company put up robust core business results in its first-quarter results which it shared on April 17. ABT’s growth should remain solid in the quarters ahead due to innovation. The stock’s discount to fair value has also widened a bit, offering a better margin of safety.

Now, ABT is currently a modest holding for me, comprising just 0.5% of my portfolio. However, the fundamentals that I’m about to discuss are enough that I’m likely going to be at least doubling my position in the coming weeks.

The Fifth Straight Quarter Of Double-Digit Base Business Growth

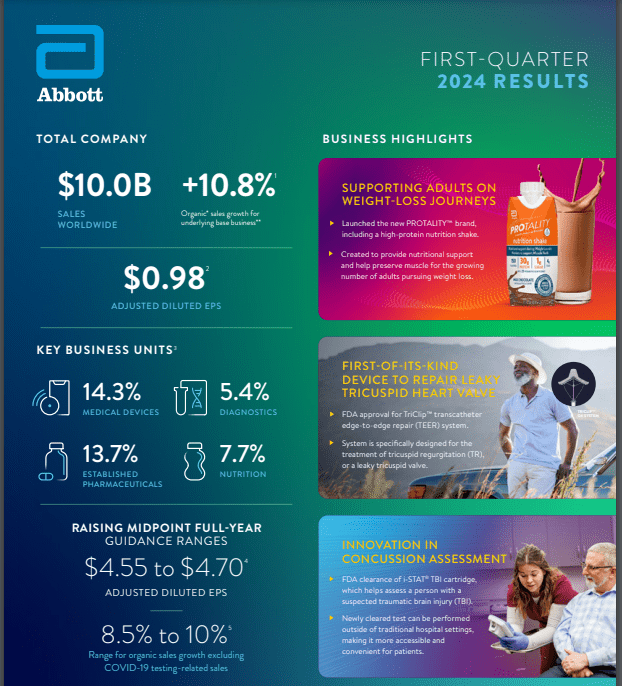

Abbott Q1 2024 Earnings Infographic

As the COVID-19 pandemic has waned, ABT’s COVID-19 testing-related sales have been steadily declining in recent quarters. However, the good news is that momentum throughout the rest of the business has been offsetting these results.

ABT’s first quarter ended on March 31 was the latest example of the underlying base business picking up the slack. Excluding COVID-19 testing-related sales, organic sales growth for the base business (e.g., the Medical Devices segment, non-COVID Diagnostics segment, Nutrition segment, and Established Pharmaceuticals segment) was up 10.8% over the year-ago period. For context, this represented the fifth consecutive quarter of double-digit underlying base business organic sales growth.

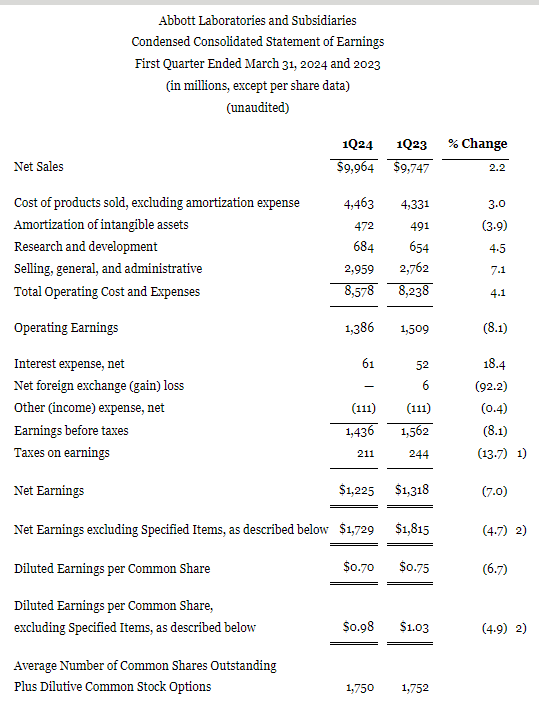

ABT’s sales grew by 2.2% year-over-year to almost $10 billion in the first quarter. According to Seeking Alpha, this came in $88 million ahead of the analyst consensus for the quarter.

This growth was led by the Medical Devices segment. The segment’s sales surged 14.2% higher over the year-ago period to nearly $4.5 billion during the first quarter.

Up 23% year-over-year, FreeStyle Libre’s sales were a heavy contributor to this growth. Per the Q1 2024 Earnings Call, Chairman and CEO Robert Ford anticipates this robust growth will keep up. That’s because of the continued expansion of reimbursement coverage for Libre for those who manage their diabetes with basal insulin therapy.

Recently launched products, including TriClip, Amulet, and Navitor, were also key growth products in the segment. The first-of-its-kind heart valve repair device designed to treat a leaky tricuspid valve was just approved by the U.S. Food and Drug Administration in April. So, this should be a growth catalyst in the quarters and years ahead.

ABT’s Nutrition segment logged ~$2.1 billion in sales for the first quarter, which was a 5.1% year-over-year growth rate. That was made possible by market share gains in the U.S. infant care formula business. International sales growth led by Canada and a few countries in Asia Pacific and Latin America also helped drive growth.

Looking ahead in this segment, ABT’s new nutrition shake launched in January should sustain growth. Marketed as Protality, this provides nutritional support to those pursuing weight loss via GLP-1 medications or weight loss surgery. This is critical because per Ford, a portion of the weight lost is lean muscle mass. The high protein and essential minerals provided by Protality can aid in preserving muscle while people lose weight.

ABT’s Established Pharmaceuticals segment posted $1.2 billion in sales in the first quarter, which was up 3.1% over the year-ago period. Sales in key emerging markets in the respiratory, women’s health, and pain management therapeutic areas were what fueled topline growth.

As I outlined earlier, sales gains in these segments were mostly countered by a 17.6% year-over-year decline in Diagnostics segment sales to $2.2 billion during the first quarter. Factoring out the 20.9% drop from COVID-19 testing sales, organic sales growth was 5.4% for the segment.

Strength in non-COVID testing should be maintained in the quarter ahead. That’s because the company received FDA approval in April for a point-of-care diagnostic blood test (iSTAT Alinity) that could determine if someone has experienced a concussion in roughly 15 minutes. According to Ford, nearly 5 million people in the U.S. visit the emergency room each year to check for concussions.

ABT’s adjusted diluted EPS fell by 4.9% over the year-ago period to $0.98 for the first quarter. That was better than the analyst consensus by $0.03 per Seeking Alpha.

Thanks to ABT’s innovations and momentum from existing non-COVID products, analysts have good reason for their optimism. The FAST Graphs consensus is that adjusted diluted EPS will rise by 4.3% to $4.63 in 2024. For 2025, growth is expected to accelerate to 10.6% to $5.12 due to product launches and easier comps. For those same reasons, another 10.9% growth to $5.68 is projected for 2026.

Abbott Laboratories Q1 2024 Earnings Press Release

Wrapping up the non-dividends portion of my fundamentals analysis, ABT is a financial fortress. The company’s interest coverage ratio in the first quarter was 24.5. That demonstrates ABT can comfortably service its debt with profits.

If that wasn’t enough, a track record of steady product launches and industry leadership puts ABT over the top. This is why S&P awards an AA- credit rating to the company on a stable outlook per the Zen Research Terminal (unless otherwise noted or hyperlinked, all details in this subhead were sourced from ABT’s Q1 2024 Earnings Press Release and ABT’s Q1 2024 Infographic).

Shares Could Be Almost 10% Undervalued

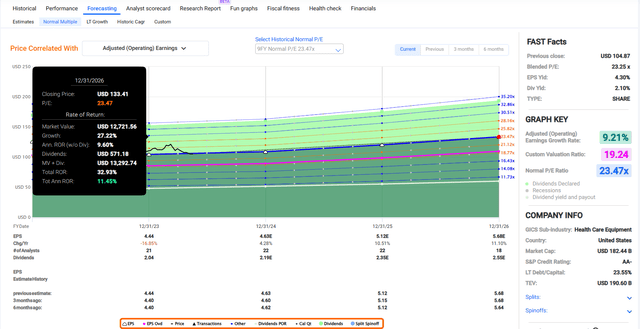

FAST Graphs, FactSet

Relative to the 1% gains of the S&P 500 index (SP500) since my last article, shares of ABT have pulled back 7%. Given the fundamentals of the underlying business, I believe this makes the company a more compelling value.

ABT’s current-year P/E ratio of 22.5 comes in a bit below the 9-year normal P/E ratio of 23.5 per FAST Graphs. The company’s forward adjusted diluted EPS growth consensus is 9.2% annually.

Compared to the 8.4% compound annual growth rate of adjusted diluted EPS in that time, ABT’s growth prospects look to be intact. This is why I believe a reversion to a valuation multiple of 23.5 is a reasonable assumption.

The calendar year 2024 has 61.5% left in it and there is another 38.5% of calendar year 2025 ahead in the coming 12 months. This informs how I am weighing the $4.63 2024 adjusted diluted EPS input and the $5.12 2025 adjusted diluted EPS input. That is how I arrive at a 12-month forward earnings input of $4.82.

Plugging the 23.5 multiple in with my earnings input, I get a fair value of $113 per share for ABT. That would be an 8% discount to fair value from the current $104 share price (as of May 17, 2024). If ABT matches the growth consensus and reaches my fair value multiple, 33% cumulative total returns could be ahead by the end of 2026.

Future Dividend Growth Should Remain Respectable

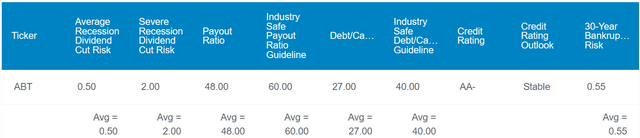

The Dividend Kings’ Zen Research Terminal

In absolute terms, ABT’s 2.1% forward dividend yield probably doesn’t appeal to some investors. However, it is meaningfully better than the healthcare sector’s median forward dividend yield of 1.5%. That’s enough for Seeking Alpha’s Quant System to hand out a B grade for forward dividend yield to ABT.

ABT also pairs this decent starting income with exceptional dividend growth. In the past 10 years, the dividend per share has compounded by 11.4% annually per Seeking Alpha.

The most recent 7.8% hike to $0.55 shows that while dividend growth has slowed a bit, dividend growth remains attractive. The Dividend King should also have the flexibility to keep high-single-digit annual payout boosts going in the years ahead.

That’s because ABT’s 48% EPS payout ratio is below the 60% that rating agencies view as ideal for the industry. Weighing the $4.63 2024 adjusted diluted EPS consensus against slated dividends per share of $2.20, the payout ratio will remain around 47.5% this year.

Risks To Consider

ABT looks to be moving past the one-time bonanza that COVID-19 testing was to its business. However, the company isn’t free from risk. From my view, ABT’s risk profile doesn’t look to have been significantly altered in recent months. So, I’ll reiterate a few risks from prior articles.

ABT’s commitment to regularly allocating approximately 7% of its sales to research and development (6.9% in Q1 2024) is paying off. But if the results from this R&D spending don’t keep up, there is the risk that ABT’s growth could eventually stagnate. I don’t view this as likely, but it’s worth considering, nevertheless.

A similar risk is that ABT’s success depends on its ability to keep attracting and retaining a remarkable talent pipeline. If the company can’t do so, that could harm innovation.

Finally, there is the potential for ABT to experience a major cyber breach. The cyber breach of UnitedHealth Group’s (UNH) Change Healthcare in February was a reminder to the corporate world: The bigger the size, the bigger the target a company is to hackers.

Fortunately, the impact on UNH appears to have been minor. But if the same thing happened to ABT on a large enough scale, there’s no guarantee the consequences would be as immaterial as they were to UNH. As I noted in my previous article, ABT’s proprietary data could be exposed. This could undermine the company’s fundamentals.

Summary: I Want To Own More Of This Wonderful Company

ABT is a business that has everything that I like to see. It’s a leading diversified healthcare company. It isn’t one of those Dividend Kings that is barely increasing the dividend to keep the streak intact. The payout is well-covered and should keep growing at a healthy rate. The financial solvency affords it a prime credit rating. Lastly, shares could be priced 8% below fair value.

For these reasons, I will be adding to my position in ABT within the next few weeks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.