Summary:

- McDonald’s is reintroducing a $5 happy meal to address its weakening consumer base that it noted when it released its first quarter results in late April.

- Those numbers came up somewhat short of expectations due to the weakening environment for much of McDonald’s consumer base.

- Same store sales growth has been on the downtrend for many quarters now and the reintroduction of a consumer favorite is unlikely to change that dynamic.

skodonnell/iStock Unreleased via Getty Images

McDonald’s Corporation (NYSE:MCD) is among several well-known names that have noted a weakening consumer within their first quarter results this earnings season. Starbucks (SBUX) was another household name that did the same, and I recently posted an article around that company’s prospects and the challenges it faces going forward.

One of the things McDonald’s is doing to address the stress much of its consumer base is experiencing is to reintroduce its $5 happy meal, which has gotten quite a bit of fanfare. However, this new marketing direction is very unlikely to ‘move the needle‘ for the company or its shareholders. First, the campaign is only going to last one month this summer. It will also be limited in its offerings and will not be available everywhere as some franchisees will not be participating.

It is easy to see why this campaign will be of short duration. It is being subsidized to a certain degree by both the company’s drink supplier, The Coca-Cola Company (KO), as well as franchisees who operate approximately 90% of the company’s locations. Franchisees also have balked at reintroducing this initiative in the past as it is a loss-leader, and this effort is particularly a hard sell in California, which recently implemented a $20 an hour minimum wage mandate for fast food workers. Not surprisingly, the initiative has already cost nearly 10,000 jobs to be lost in the industry across the state.

First Quarter Results:

Let’s take a look at McDonald’s first quarter results to see where the company stands and the pressures it is facing to reintroduce the $5 happy meal, albeit temporarily. McDonald’s posted its first quarter numbers on April 30th. The company delivered non-GAAP earnings of $2.70 a share, three pennies a share below the consensus. On a GAAP basis, profits were $2.66 a share, up nine percent from the same period a year ago.

MCD Q1 Earnings Release Via Seeking Alpha

MCD Q1 Earnings Release Via Seeking Alpha

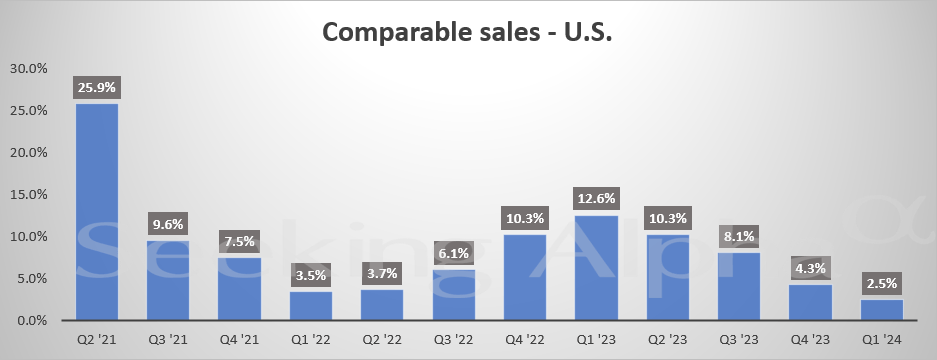

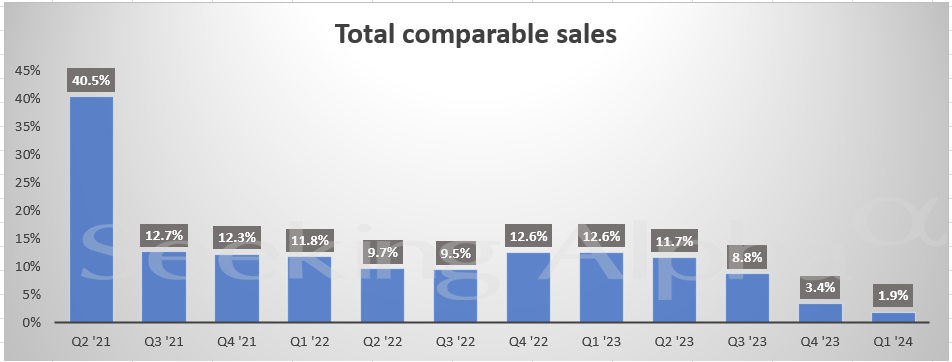

Revenues grew 4.6% overall from 1Q2023 to $61.7 billion, in line with expectations. Global same store sales grew just 1.9% it should be noted and continued a decelerating trend for that key metric. U.S. same store sales rose 2.5%, a bit under the 2.6% consensus. It should be noted the same store sale rise was less than the current overall level of inflation.

McDonald’s CEO noted, ‘Consumers continue to be even more discriminating with every dollar that they spend as they faced elevated prices in their day-to-day spending, which is putting pressure on the [quick-service restaurant] industry‘. The weakening consumer environment was a topic I highlighted in an earlier article this month. Management also stated rising tensions in the Middle East dinged international growth.

Conclusion:

McDonald’s made $11.15 a share of profits in FY2023 on just over $23.8 billion in sales. The current analyst firm consensus is for earnings to grow to $12.20 a share in FY2024 on just north of $26.6 billion in revenues. Revenue growth is projected to be reduced in half to six percent in FY2025, while profits rise to $13.28 a share.

That leaves the stock trading at just over 22 times forward earnings. Given projected 10% earnings growth, that leaves the stock with a 2.2 PEG ratio. The shares also pay nearly a 2.5% dividend yield. For many investors, McDonald’s is a ‘one-decision‘ stock and one they have bought and held for many years, if not decades.

The stock’s valuation and dividend yield would be more appealing in the ZIRP environment that existed for more than a decade until the Federal Reserve started to implement the most aggressive monetary policy since the days of Paul Volcker in March of 2022. However, with short-term treasuries yielding nearly 5.4% and the yield on the 10-Year Treasury closing Friday at 4.42%, MCD does not appear to be giving new investors an appealing entry point. The rollout of the $5 happy meal does not change that conclusion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author’s note: I present an update my best small and mid-cap stock ideas that insiders are buying only to subscribers of my exclusive marketplace, The Insiders Forum. Our model portfolio has more than doubled the return of its benchmark, the Russell 2000, since its launch. To join our community and gain access to our market beating returns, just click on our logo below.