Summary:

- Recent developments suggest that the company poses a significant threat in the AI race to other technological hyper-scalers that previously appeared to be leading.

- Apple’s commitment to innovation, including the upcoming WWDC2024 event and the release of the powerful iPad Pro, create positive catalysts for the stock.

- Challenges in product sales are temporary and expected to rebound as developed economies approach inflation targets and monetary policies ease.

- A 15% discount for a stock like Apple makes it a no-brainer investment.

Valen Tino/iStock Editorial via Getty Images

Introduction

I had a ‘Strong Buy’ thesis about Apple (NASDAQ:AAPL) in February. The stock was almost flat since then with a modest 2% price growth, compared to +6% for the S&P 500. As usual, I prioritize developments around fundamentals over short-term share price fluctuations. Apple’s brand and pricing powers are intact, and the company recently announced its brand-new powerful iPad Pro with more AI-featured innovations expected to be announced during the WWDC2024 event on June 10. Headwinds for Products sales are certainly temporary, and I expect a rebound as the world’s developed economies are close to their inflation targets, which approaches pivots in monetary policies. Apple’s current valuation with a 15% discount is an apparent steal for me to buy more stocks for my portfolio. Considering all the positive catalysts, I am inclined to confirm my previous ‘Strong Buy’ rating for AAPL.

Fundamental analysis

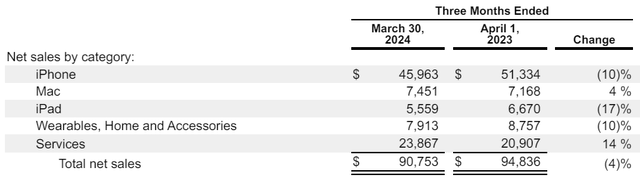

The most important event that happened with Apple over the last three months is fiscal Q3 2024 earnings release. Despite a 4.3% YoY dip in revenue, the adjusted EPS expanded by one cent. The quarter was quite challenging from the topline perspective since only Services demonstrated strong YoY growth. There also was a modest YoY growth in Mac, but it was not enough to offset decreases across other businesses.

Pessimists might say that revenue dynamic is quite bearish with most of the businesses demonstrating double-digit decreases during FQ3. However, challenges for Products are likely to be temporary due to the harsh macroenvironment. Households across the developed world continue facing elevated inflation and high interest rates, which weighs on their discretionary spending. While in the modern world having a smartphone is vital, upgrading from iPhone 14 to iPhone 15 can certainly be categorized as discretionary spending.

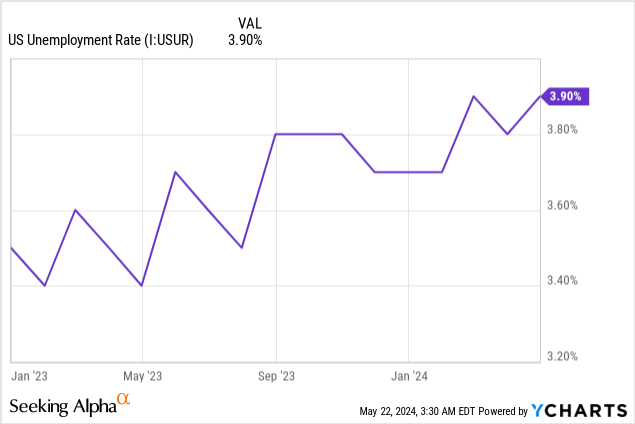

Therefore, I expect the demand for Apple’s products to rebound as monetary policies across developed countries start easing. April CPI continued demonstrating downtrend in the U.S. after a one-off spike in March. The Fed is still cautious about cutting rates but the fact that inflation is cooling down makes the start of interest rates cutting closer anyway. Moreover, the Fed has a ‘Dual Mandate’ which means that it focuses not only on inflation, but also on employment levels. Since the U.S. unemployment rate increased from 3.8% in March to 3.9% in April, there is one more reason that we are getting closer to the start of monetary policy easing. The U.S. unemployment rate clearly demonstrates an uptrend, as shown below.

Canada’s inflation also cooled down to three-year lows, which increased the odds of a pivot in monetary policy from the central bank. Eurozone’s inflation is also cooling down and getting closer to the EU’s central bankers’ targets. I think that central bankers of all developed economies are looking at the Fed’s moves, given the importance of the U.S. economy to the whole world. That said, the first rate cut from the Fed might cause a domino effect for all other prominent central banks. This will highly likely unlock a robust positive catalyst for Apple’s Products business.

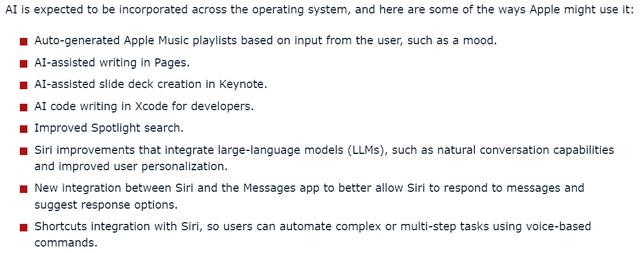

Apple continues betting big on innovation as the company has spent almost $8 billion on R&D in FQ3. The company recently rolled out an iOS 17.5.1 update with some minor bug fixes. However, all eyes are on the WWDC 2024 conference, which will start on June 10. This event might be another robust positive catalyst for AAPL because industry experts expect Apple to roll out iOS version 18, which will be featured with generative AI capabilities.

Since generative AI appears to be the hottest topic at the moment, rolling out iOS 18 powered by AI might be quite positive absorbed by the stock market. The new operating system might also be better tailored to new generation AI-backed apps and this gives Apple vast growth opportunities considering the company has more than 1 billion paid subscribers.

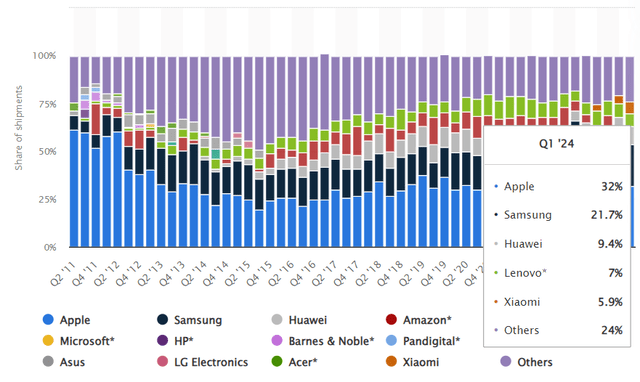

Apple’s firm commitment to innovation is also underscored by the company’s recent ‘Let loose’ event, where new tablets were presented. The event is crucial because it is the first iPad-specific presentation in two years. During the event, Apple introduced the next-generation iPad Pro and iPad Air powered by an all-new M4 chip. According to the company’s release, the new iPad Pro is an ‘outrageously powerful device for AI’, capable of 38 trillion operations per second. Apple dominates the global tablet market with a 32% market share in calendar Q1, meaning a huge fanbase for the brand-new iPad. Therefore, I think that the new iPad will contribute to this fiscal year’s financial performance in a positive way.

While Apple faced criticism in recent past months as it seemed that the company is not participating in the AI race, it turned out to be a mistake. The new iPad pro seems to have robust potential to satisfy the customers’ needs for AI functionality and the company will likely roll out AI features to the new iOS on June 10. For people who are doubtful about the company’s ability to innovate, I would like to remind you that Apple has the ability to recruit smartest engineers and acquire most promising technologies through acquisitions. The company’s $64 billion cash pile coupled with announcing the largest buyback program in the company’s history means that Apple has more than enough resources to innovate and invest in AI development.

Overall, I remain extremely bullish about AAPL. Challenges for Products revenue are temporary, and the situation will highly likely improve soon as we see that inflation levels are cooling down to target levels across the developed world. The company continues delivering awe-inspiring innovations and the WWDC2024 event will likely, add more optimism among investors, given the high probability of Apple rolling out AI-powered new iOS version. Apple’s perseverance in innovation and its status as by far the world’s most valuable brand create a formidable fundamental mix for creating long-term value for shareholders.

Valuation analysis

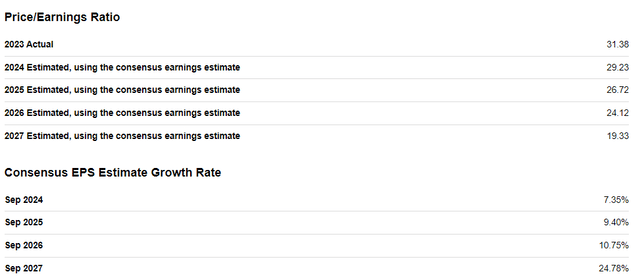

Apple is a unique company which dominates various markets of smart devices, and its ecosystem of products and services is unparalleled. Therefore, it will be unfair to compare Apple’s valuation ratios with other companies. However, looking at how the P/E ratio is expected to behave in future is a useful analysis. The below picture is based on forward consensus expectations, which I consider to be a reliable source. As we see, Apple’s P/E ratio is expected to contract notably within the next five years. This means that the current valuation is reasonable considering the EPS growth potential.

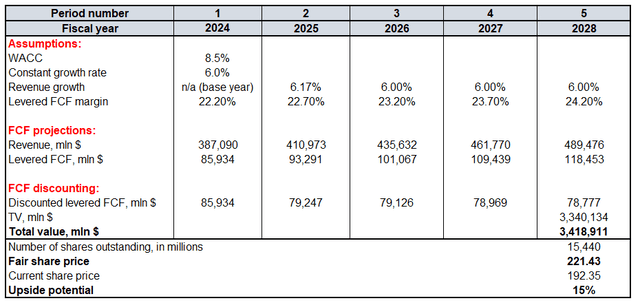

The valuation section looks deficient without conducting a discounted cash flow (‘DCF’) analysis. Future cash flows will be discounted using an 8.5% WACC. Given all the fundamental strengths I have described in my analysis, I reiterate a 6% constant growth rate for Apple’s terminal value (‘TV’) calculation.

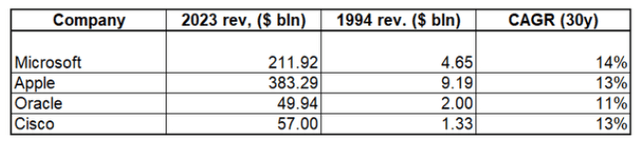

It is extremely likely that bears will challenge my 6% constant growth rate, but I insist that this level is conservative for a company like Apple. In my latest article about Palantir (PLTR) I have shared a table where I demonstrate that Apple sustained above 10% revenue CAGR over the last three decades. Moreover, Apple was not the only company that was able to sustain double digit revenue CAGR over three decades.

With all my respect to companies like Oracle (ORCL) and Cisco (CSCO), their business models do not leverage a massive ecosystem Apple has. Expanding vast AI potential to our smartphones is just a matter of time because AI capabilities are poised to add trillions of dollars to the global economy from increased productivity. As a company that shares the number one spot in the global smartphone market with Samsung (OTCPK:SSNLF), Apple is well-positioned to capitalize on the AI revolution which will highly likely unlock the new robust revenue driver for the company’s subscriptions ecosystem. That said, AAPL’s revenue CAGR over the last three decades, along with the vast potential AI opens up for the company, makes me confident that a 6% constant growth rate is sound.

Relying on FY 2024-2025 revenue consensus is sound because the sample of around 40 Wall Street analysts is representative, in my opinion. For years beyond 2025 I use the same 6% CAGR, in line with the constant growth rate. I use a 22.2% TTM levered FCF margin for the base year, anticipating an annual increase of 50 basis points. My confidence in Apple’s ability to improve its FCF margin is based on the company’s historically strong operating leverage.

My fair share price estimate is $221, 15% higher than the current share price. A 15% discount for a stock like Apple is a steal, in my opinion.

Mitigating factors

Dominating across various smart electronics segments means that Apple’s operations are under thorough scrutiny from antitrust regulatory bodies. For example, the company currently challenges a massive $1.9 billion antitrust fine from the European Union which alleges that the company thwarted fair competition among music-streaming rivals. If Apple fails to overturn the fine, it will be recorded in the company’s P&L and adversely affect EPS. Apple not only faces antitrust problems in the EU, but is also fighting an antitrust lawsuit from the U.S. Department of Justice. Antitrust pressure might adversely affect the company’s ability to drive revenue growth and exercise its pricing power.

China is the third largest market for Apple after the Americas and Europe. The company faces both geopolitical risks in China and intensifying competition in smartphones from Huawei. Apple even lost its smartphone market crown in China in Q1. On the other hand, Apple is not ready to lose this fight and has vast resources to sustain the fight. For example, the company recently initiated a price war in China, which will likely help in regaining market share in this important market.

Conclusion

A stock like AAPL with a 15% discount is a no-brainer. I expect the upcoming WWDC2024 to be an important potential positive catalyst for the stock price. The ease in monetary policies across North America and the Eurozone will also likely help to close the gap between the current share price and its fair value.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.