Summary:

- I’m passing on Affirm Holdings, Inc. stock due to its high valuation of 18x next year’s non-GAAP operating income.

- Despite Affirm’s growth prospects, I’m concerned about its decelerating growth rate and high price.

- Even though Affirm is popular and innovative, I find Sezzle Inc. stock more interesting.

hapabapa

Investment Thesis

Affirm Holdings, Inc. (NASDAQ:AFRM), one of the leading Buy Now Pay Later (“BNPL”) platforms, is a firm no from me.

It’s not that I fail to recognize the appeals of its growth prospects. Instead, I don’t find paying 18x next year’s Affirm Holdings, Inc. non-GAAP operating income appealing enough.

Even though, it’s obvious to most, that BNPL is a massive growth market, that is still nascent. But at what price is one willing to back AFRM? That’s the question that I struggle to get comfortable with.

Rapid Recap

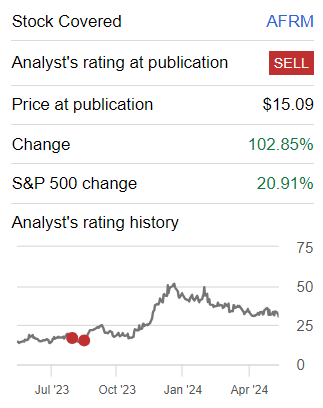

Last August, in a bearish note, I said,

Investors have for a long time been waiting for the moment went Affirm could declare that the business had turned a corner and would be able to point to its operations as an economically viable enterprise.

Not only that, but there are reasons to be optimistic that Affirm could end up positively beating analysts’ revenue estimates for the year ahead.

Nevertheless, I remain bearish on this stock as I find it too expensive for what it offers at more than 65x forward non-GAAP operating profits. Even without having to ponder too long about that, what Affirm offers is a highly commoditized payment solution.

Author’s work on AFRM

I was caught flat-footed, as a few months after I’d written that analysis, AFRM would sizzle hard on the back of its newly improved path to profitability.

However, with the dust settled, while I’m not openly bearish today, I still fail to see the upside of this stock.

Why Affirm? Why Now?

Affirm helps people buy things by offering a way to pay over time instead of all at once. They work with different stores to provide this service, letting shoppers know how much they can spend responsibly. Affirm also uses smart technology to ensure that people who borrow money can pay it back comfortably.

Affirm’s prospects appear favorable, buoyed by a combination of accelerating growth and strategic innovations.

The company has experienced four consecutive quarters of GMV growth, with credit performance stability and better-than-expected yield. Affirm’s strategy now revolves around increasing risk exposure by extending credit to more consumers while maintaining strict control over credit outcomes.

That being said, Affirm also faces challenges. For example, the difficulty in precisely quantifying the benefits from its pricing initiatives makes it challenging to predict their future impact on volume growth.

Furthermore, as Affirm seeks to expand its credit offerings, it must balance this growth with the careful management of credit risks to avoid any negative surprises on its bottom line.

Given this background, let’s now discuss its fundamentals.

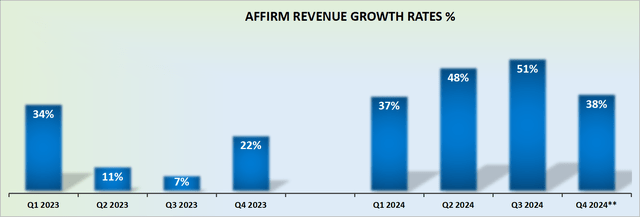

Fiscal 2025 Will See Affirm’s Revenue Growth Decelerate

Affirm has one further strong quarter on the cards, before the comparables with the following year become challenging.

More concretely, I estimate that in fiscal 2025 (starting July 2024), Affirm’s growth rates will moderate to approximately 25% CAGR, against the very high and alluring revenue growth rates expected this year.

As you know, Affirm is a growth stock. And if its growth rates start to moderate too quickly, all of a sudden, growth investors will become unenthused, while the value investors will find Affirm’s bottom line too unappetizing, with too many adjustments and unworthy of investing in.

Given this context, let’s now delve into AFRM’s valuation.

AFRM Stock Valuation — 18x Next Year’s Non-GAAP Operating Income

Let’s presume that Affirm will grow its top line by 25% in fiscal 2025. And let’s also assume that next year Affirms continues to improve its underlying profitability.

This implies that next fiscal year, Affirm will reach $550 million of non-GAAP adjusted operating income. This leaves the stock priced at 18x forward non-GAAP operating income.

Now, you may argue that this isn’t all that expensive, for one of the leading BNPL companies. Perhaps.

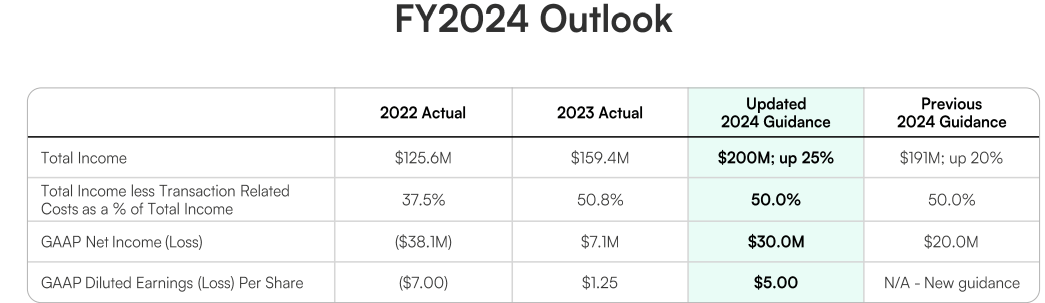

But what if I made the case that Sezzle Inc. (SEZL) is priced at 9x clean GAAP net income?

SEZL Investor presentation

Now, Sezzle is a stock that I’m long, so I’m naturally biased, and you should consider that before we progress further.

And yet, you can look at the table above from Sezzle’s recent investor presentation and take the facts for what they are. Similarly, you can see that Sezzle is also growing at 25% CAGR on the top line to $200 million.

You may contend that Affirm is a much more popular offering in North America, rather than Sezzle. And you may also make the case that Affirm is highly innovative and that Sezzle is more of a tier-two player. And those would be very valid arguments.

But then, you should take another step back and ponder. If I wasn’t already invested and committed to Affirm, would I be willing to buy into Affirm rather than Sezzle? Because if you wouldn’t buy into Affirm knowing this consideration, then you should expect someone else to buy into it, either.

The Bottom Line

Affirm faces several pressing challenges that make its stock less appealing to me compared to its competitor, Sezzle.

Despite Affirm’s growth prospects and its strategic innovations, its valuation at 18x next year’s non-GAAP operating income is heavy.

With projected revenue growth decelerating to around 25% CAGR in fiscal 2025, Affirm might lose its appeal to growth investors, while value investors will find its bottom line unappealing.

On the other hand, I believe that Sezzle presents a more enticing option, being priced at 9x clean GAAP net income while also growing at a 25% CAGR. Though Affirm is a more popular and innovative player, the valuation disparity makes Sezzle a more attractive investment opportunity. Obviously, it’s not just Sezzle, there are many other stocks within fintech too, that are also very compelling.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.