Johnson & Johnson: Vital Signs Decent, A Compelling Value Case

Summary:

- The Health Care sector has been stagnant while other areas of the stock market reach record highs, leaving some value opportunities in drugmakers and pharma stocks.

- I have a buy rating on Johnson & Johnson (JNJ) given its stable earnings growth and lofty yield.

- JNJ’s diversified portfolio and pipeline provide stability, despite some weaknesses in certain areas.

- I highlight key price points to monitor on the chart ahead of a busy corporate presentation schedule.

JHVEPhoto

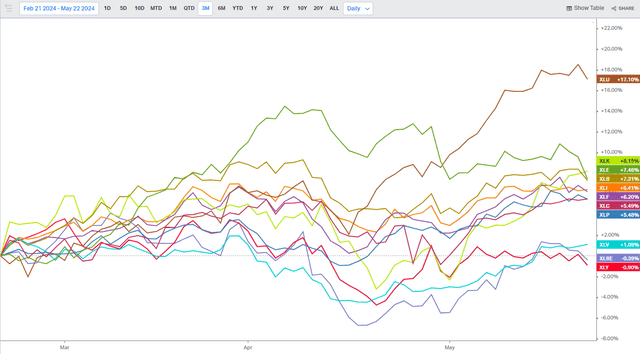

The Health Care sector continues to meander, while more risk-on areas of the stock market hit fresh record highs. In the last three months, the Health Care Select Sector SPDR ETF (XLV) is among three S&P 500 sector ETFs merely skirting the flat line. A recent resurgence in tech and the momentum trade, including new highs in the glamour drugmaker Eli Lilly (LLY), has left many high-dividend blue-chip US large-caps in the dust.

Still, I reiterate a buy rating on shares of Johnson & Johnson (NYSE:JNJ). Earnings growth over the next few years appears stable along with steady top-line gains. And with shareholder-friendly activities, this is a stock to own in a market valued at about 21x earnings.

Health Care Sector Sags Last Three Months

Koyfin Charts

According to Bank of America Global Research, Johnson & Johnson is a leading global Health Care company that develops, manufactures, and markets a diversified portfolio of products in pharmaceuticals and medical devices.

Back in April, JNJ reported a decent set of first-quarter results. Q1 non-GAAP EPS verified at $2.71, beating the Wall Street consensus estimate of $2.65 while revenue of $21.4 billion, up 2.3% from year-ago levels, was on par with expectations. The management team guided FY 2024 top and bottom-line numbers close to in-line with estimates, too, though the forecast for its MedTech division was below what analysts were anticipating.

Shares dipped 2.1% in the session that followed, however, as a downtrend that began more than a year ago persisted. Looking ahead, analysts see a slight year-on-year EPS drop in the current quarter, and there have been significantly more negative EPS revisions than positive revisions from sellside analysts.

So, sentiment is not all that strong today – in the Q1 report the primary bearish culprit was a soft outlook for JNJ’s Carvykti cancer drug as its sales were seen as lackluster. Weakness was also seen in the JNJ vision unit. Heightened competition and timing issues were cited as the reasons for the drug’s low revenue numbers. Big picture though, the management team is executing well and JNJ’s diversified portfolio should continue to provide stability in the stock price compared to other more volatile areas of the market.

The pharma giant’s pipeline includes trials for nipocalimab, TAR-200, JNJ-2113, and aticaprant, which could be bullish catalysts if positive developments come about. And then just a few days ago, it was reported that JNJ’s Tremfya medication hit goals in its late-stage trial for ulcerative colitis.

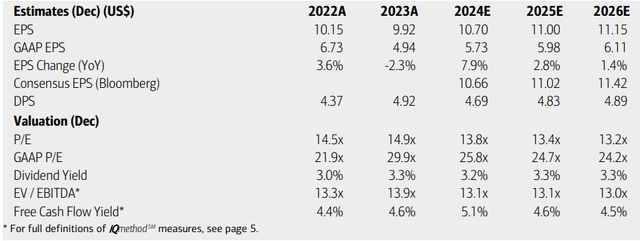

On valuation, analysts at BofA see earnings rising meaningfully this year, with continued modest gains in the out year through 2026. The current Seeking Alpha consensus estimates call for comparable profit growth, with operating EPS potentially reaching $11.40 by FY 2026.

What’s more, the stock currently yields 3.2% – more than twice that of the broad market, and BofA sees the dividend increasing looking out several quarters. And with a low to mid-teens earnings multiple and an EV/EBITDA ratio that is at a discount to the S&P 500, I see shares as a decent bargain. Free cash flow is also robust – the FCF yield is close to 5% today.

JNJ: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

On valuation, if we assume normalized operating EPS of $10.80 over the next four quarters and apply the stock’s 5-year average non-GAAP forward P/E, then shares should trade just shy of $180, making the stock rather significantly undervalued today. While it may take time for shares to recover, investors are paid to wait given that the dividend yield is about half a percentage point above the 5-year average.

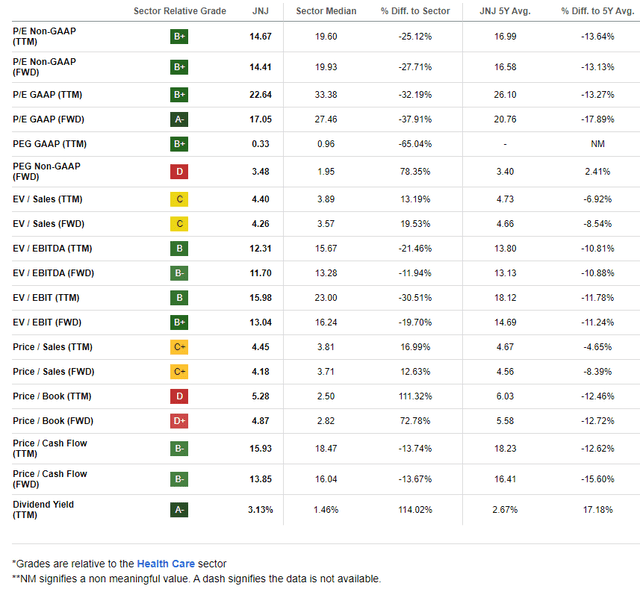

JNJ: A Low Price/Earnings Ratio, Strong FCF, and High Yield

Seeking Alpha

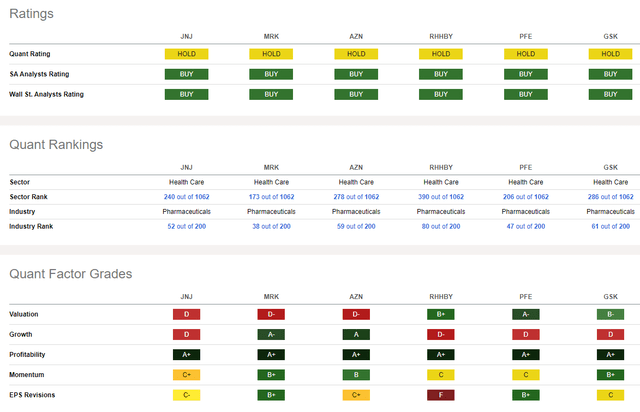

Compared to its peers, JNJ features a weak valuation grade, but profitability trends and its yield are compelling factors to consider. And while the growth outlook is also less than stellar, JNJ’s strong position in the Health Care sector should offer stability for diversified investors and those seeking a defensive holding. As mentioned before, sellside sentiment is soft while the share-price momentum is likewise troubled – I will detail key price levels on the chart to monitor later in the article.

Competitor Analysis

Seeking Alpha

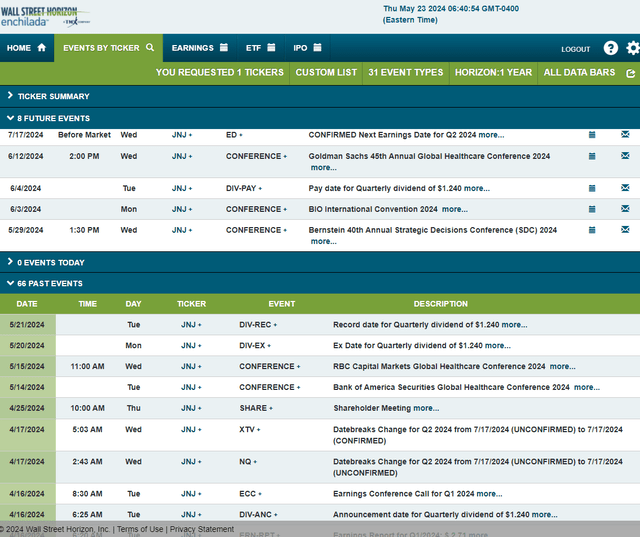

Looking ahead, as is often the case with JNJ, it’s an active corporate event calendar, highlighted by a trio of conference appearances by its management team.

Speaking engagements over the next few weeks include presentations at the Bernstein 40th Annual Strategic Decisions Conference (SDC) 2024, the BIO International Convention 2024, and the Goldman Sachs 45th Annual Global Healthcare Conference 2024. JNJ then has a confirmed Q2 2024 earnings date of Wednesday, July 17.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

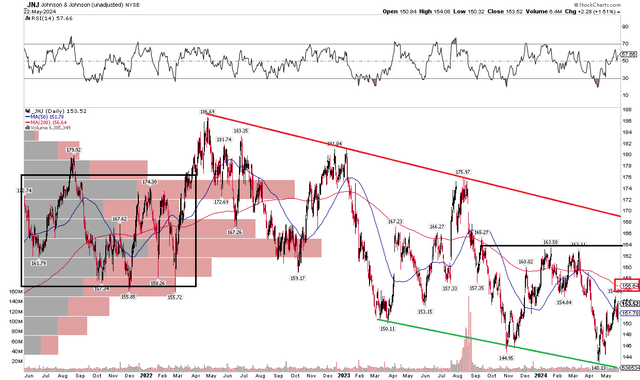

With an attractive valuation and juicy yield, JNJ’s technical situation is less than stellar. Notice in the chart below that shares are mired in a protracted downtrend. At the turn of the year, I noted a downtrending resistance line, and that is still in play, but JNJ’s chart now shows a series of lower lows. All the while, its long-term 200-day moving average is negatively sloped, suggesting that the bears are in control of the primary trend. Furthermore, the RSI momentum oscillator at the top of the graph is merely bouncing off extremely oversold readings.

I see near-term resistance in the low to mid $160s, while support comes into play around $140 – slightly below the April nadir. Rallies could be sold into, given that there is a high amount of volume by price in the $155 to $175 zone – there’s a significant amount of overhead supply in that range, which is a natural area of potential selling pressure.

Overall, JNJ’s chart is weak on an absolute and relative basis.

JNJ: Bearish Downtrend, $165 Resistance

Stockcharts.com

The Bottom Line

I reiterate a fundamental buy rating on JNJ. I see the defensive Health Care stock as a compelling value play despite a weak technical chart.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.