Summary:

- Airbnb’s business continues to perform well but tailwinds are fading. While growth should remain solid through 2024, it will likely soften later in the year.

- While Airbnb has introduced Icons, there is still little on the product expansion front that will drive growth in a meaningful way.

- The supply of new housing entering the market could lead to an oversupply in the short-term rental market, potentially pressuring Airbnb’s profitability.

- Airbnb is focused on improving the quality of listings on its platform and has removed low-quality listings in support of this.

Jessie Casson/DigitalVision via Getty Images

Airbnb’s (NASDAQ:ABNB) business has continued to perform well in recent quarters, even as economic conditions have normalized, creating a less favorable demand environment. While Airbnb has given soft guidance for the second quarter, I expect the company to continue to perform well in 2024, aided by a number of non-recurring events (solar eclipse, Olympics, etc.).

Moving beyond 2024, there are potential headwinds though. I have been suggesting for a while that the enormous stock of housing currently under construction could ultimately contribute to an oversupply in the short-term rental market. This hasn’t really occurred so far, but it is a situation that is still developing. Of note, Airbnb is potentially taking advantage of the situation by upgrading the listings on its platform while maintaining a healthy balance between supply and demand.

Market Conditions

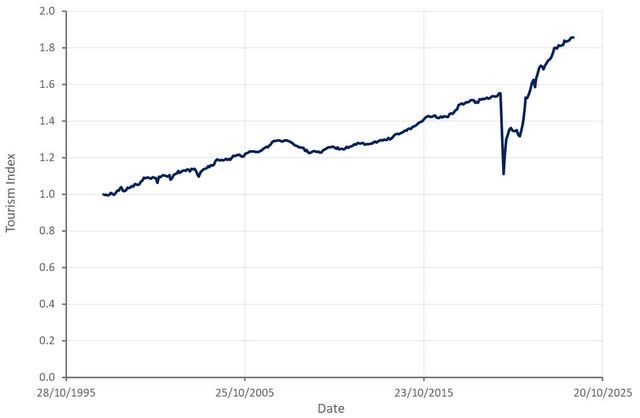

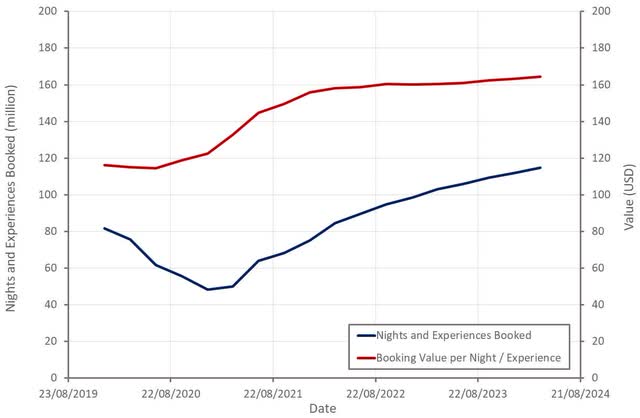

While growth in tourism and travel appears to be moderating, Airbnb continues to benefit from a reasonably healthy demand environment, recording a 9.5% YoY increase in Nights and Experiences booked in Q1, driven by growth in all regions. There are also a number of events in 2024 which should be supportive of growth, like the solar eclipse in North America, the Paris Olympics and the UEFA European Football Championship.

Figure 1: Tourism Activity Index (source: Created by author)

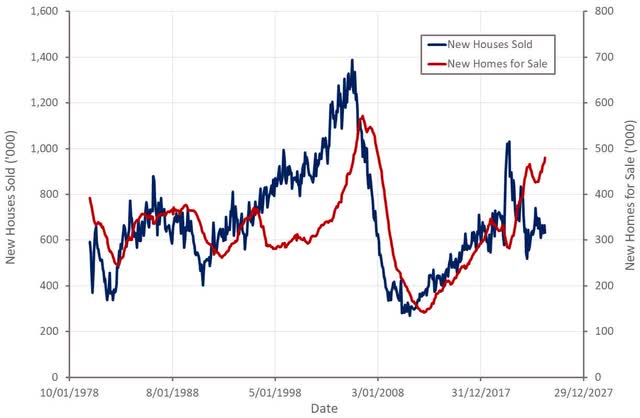

The supply of new housing entering the market in the US is a potential threat though, as I have been suggesting for a while. This hasn’t been a problem so far, in part because the market for existing housing is largely frozen. Growing supply, along with softening demand, will likely begin to cause problems in time though.

Figure 2: New Houses Sold and New Homes For Sale (source: Created by author using data from The Federal Reserve)

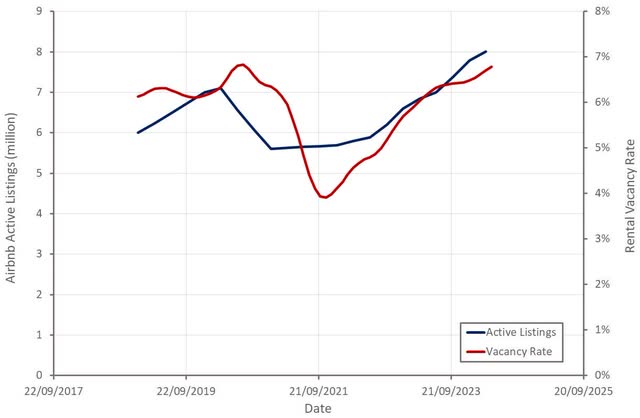

While this may seem orthogonal to Airbnb’s business, excess housing in the long-term rental market could lead to increased short-term rental supply. This would pressure pricing, and in turn Airbnb’s profitability. Rental vacancy rates continue to increase at a fairly rapid pace and are already at an elevated level given the strength of the labor market.

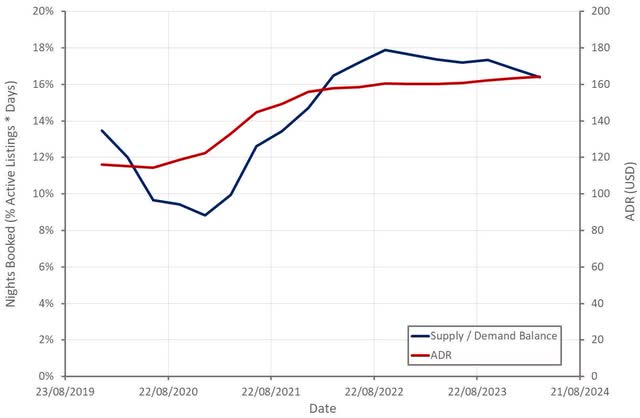

Supply growth on Airbnb has outstripped demand growth for some time now, although this hasn’t caused pricing issues yet. Airbnb removed thousands of low-quality listings in the first quarter, which is part of a broader effort to improve the overall Airbnb experience and make it more consistent. Excluding this, active listings grew 17% YoY, with double-digits growth across all regions. Removing listings potentially has a secondary benefit of reducing oversupply and supporting pricing.

Figure 3: Airbnb Active Listings and Multifamily Rental Vacancy Rate (source: Created by author using data from Apartment List and Airbnb)

Airbnb Business Updates

Airbnb has a number of strategic initiatives, including:

- Making hosting mainstream

- Improving the core service

- Expanding services

To support increased supply on the platform, Airbnb continues to try and drive awareness, along with improved tools and support for hosts. It is difficult to argue that there is a shortage of supply on the platform though, and Airbnb must be mindful of the balance of supply and demand. As a result, it appears that efforts to attract hosts are driven more by a desire to improve the quality of listings on the platform and increase the diversity of listings.

Airbnb removed a significant number of listings from the platform in Q1. The reduction in supply reportedly hasn’t had any impact on global bookings, which Airbnb suggested was because these low-quality properties were not receiving many bookings and were lowering overall conversion rates.

In support of improving the quality of the service, Airbnb also recently introduced several new features. Guest Favorites was launched in November and is an attempt to drive users towards popular (ratings, reviews, reliability) properties. Over 100 million nights have already been booked at Guest Favorite listings.

Airbnb has also introduced a verified badge, which indicates a listing has passed through a verification process. Over 2 million listings across five countries have now received this badge, and Airbnb plans on introducing new tools to make this process easier. These initiatives are aimed at helping guests to find high-quality and affordable stays and it appears that Airbnb believes that by improving quality it can take market share from hotels.

In terms of product expansion, Airbnb recently introduced Icons which is a category of experiences from renowned names in music, film, sports, etc. Initial Icons include Pixar’s Up house, a night at the Ferrari Museum and a 2D replica of Marvel’s X-Mansion. Icons is supposed to drive awareness of Airbnb outside of its core accommodation use case, but it is unlikely to drive meaningful revenue and appears to be more of a marketing move.

Airbnb has been talking about product expansion for some time now but has made little tangible progress. Ideally, the company would be gaining traction in areas like trip planning and experiences. There is also a large opportunity to monetize host tools, although Airbnb still appears to be prioritizing the health of the platform over maximizing revenue. At this stage, it is probably just too early but product expansion will be an important part of the story going forward and Airbnb will need to begin showing progress soon.

Airbnb is trying to drive growth in its less mature markets and appears to be having success in this area. In the first quarter, nights booked in expansion markets increased at twice the rate of Airbnb’s core markets. This is potentially an important driver of supply growth on the platform as well. Airbnb’s most penetrated markets are the US, Canada, Australia, France, and the UK. Markets with significant growth potential include Mexico, Brazil, Germany, Italy, Spain, Switzerland, the Netherlands, Japan, Korea and India.

Airbnb also continues to support demand through product innovation, recently introducing a set of new features (messaging, invitations, property wishlist) for group trips. This is important as over 80% of bookings on Airbnb are group trips. Airbnb’s attempts to increase the number of longer stays is also paying dividends, with the number of stays in excess of 3 months increasing nearly 25% YoY.

Airbnb also appears to be focused on driving users towards its app. This makes sense as conversion rates are reportedly higher on the app, and it potentially helps to reduce competition between platforms. Airbnb app downloads in the US increased 60% YoY in Q1 and nights booked through the app globally were up 21%. Airbnb has suggested that the increase in app downloads has been organic. While this may not have a large impact in the short run, it is important from a competition and profitability perspective longer term.

Financial Analysis

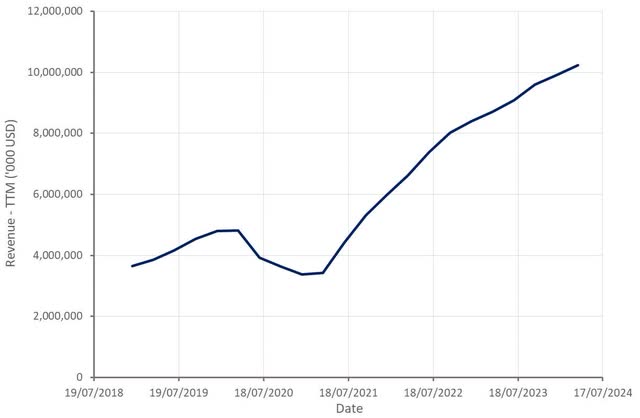

Airbnb generated 2.14 billion USD revenue in Q1, an increase of 18% YoY, driven by solid demand, the timing of Easter and the fact that 2024 is a leap year. Absent the impact of these, revenue growth would likely have continued to decelerate in Q1. 133 million nights and experiences were booked in the first quarter, up 9.5% YoY, with solid growth across all regions. ADR increased 3% YoY to 173 USD, with ADRs up across all regions, driven largely by price appreciation. ADR stability is somewhat surprising given strong supply growth and the rapid growth of Airbnb’s business outside of markets like the US, Canada, Australia, and the UK. The average price of hotel rooms globally was up 3% YoY in March, compared to a 2% decline for one-bedroom listings on Airbnb.

Airbnb expects 2.68-2.74 billion USD revenue in the second quarter, representing 8-10% YoY revenue growth. Given that Q1 results were quite strong, recent share price weakness appears to be the result of Airbnb’s soft guidance. The second quarter should be supported by the solar eclipse, although there will be a headwind from the timing of Easter. Airbnb estimates that 500,000 guests stayed on the platform during the solar eclipse in North America. The Summer Olympics in Paris should also provide a tailwind in the third quarter, along with the Euro Cup in Q2/Q3.

Figure 4: Airbnb Revenue (source: Created by author using data from Airbnb) Figure 5: Airbnb Nights Booked and ADR (source: Created by author using data from Airbnb)

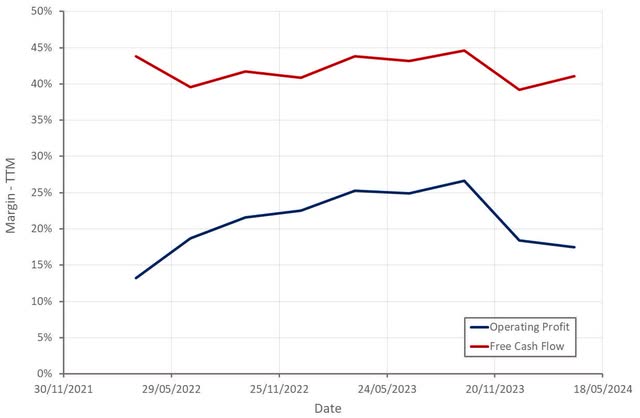

Airbnb’s profitability has fallen off slightly in recent quarters but is still healthy, particularly from a cash flow perspective. Some of this difference is due to the fact that Airbnb’s stock-based compensation expense is still relatively high.

Figure 6: Airbnb Profit Margins (source: Created by author using data from Airbnb)

Looking forward, increased supply and a less favorable demand environment could pressure Airbnb’s margins. Despite removing a significant number of listings in the first quarter, supply continues to outpace demand on the platform, although this hasn’t really had an impact on ADRs yet. Removing listings and introducing features which drive users towards high-quality listings are both levers which should support pricing. This is something I hadn’t really considered previously, but Airbnb probably has considerable room to maintain ADRs through mix shift, even if pricing does materially decline. Taking this into consideration, a large decline in Airbnb’s share price will likely require a broad-based decline in demand, which would likely only come about due to economic weakness.

Figure 7: Airbnb Supply/Demand Balance and ADR (source: Created by author using data from Airbnb)

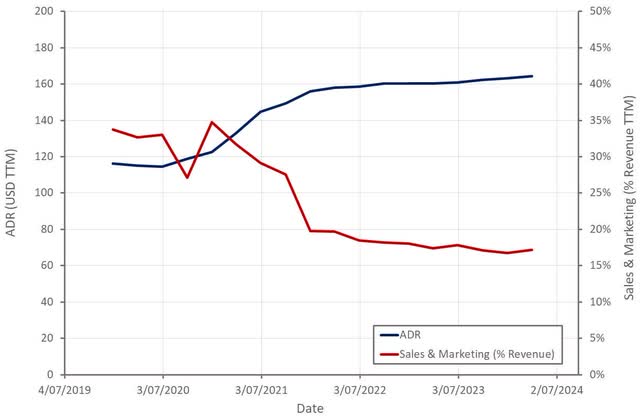

It is also possible that an oversupply of listings will force Airbnb to increase its sales and marketing investments. This hasn’t really happened so far, but Airbnb certainly isn’t generating operating leverage in this area anymore.

Figure 8: Airbnb ADR and Sales and Marketing Expense (source: Created by author using data from Airbnb)

Conclusion

Airbnb will benefit from a number of temporary tailwinds in 2024, and the demand environment is still healthy at the moment. Consumer spending is likely to come under increased pressure later in the year though. The growing supply of housing is also likely to cause problems at some point and this could bleed over into the short-term rental market. An over supply could reduce Airbnb’s gross profit margins and force the company to invest more in sales and marketing. Airbnb has the option of removing supply from its platform to support ADR, but the company is likely to be cautious in this regard as it will not want to create a backlash.

Figure 9: Airbnb EV/S Ratio (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.