Summary:

- Microsoft has plans to acquire Activision Blizzard, a leader in game development and interactive entertainment content publisher.

- The acquisition needs antitrust approval from 16 countries.

- With the acquisition, Microsoft becomes the second largest global gaming company behind China’s Tencent.

David McNew

Microsoft (MSFT) plans to buy video game giant Activision Blizzard (NASDAQ:ATVI) for $68.7 billion, and details about the acquisition and reason being it can be read in my Nov. 25, 2022, Marketplace article entitled “Activision: Facing Sony And Antitrust Head On.”

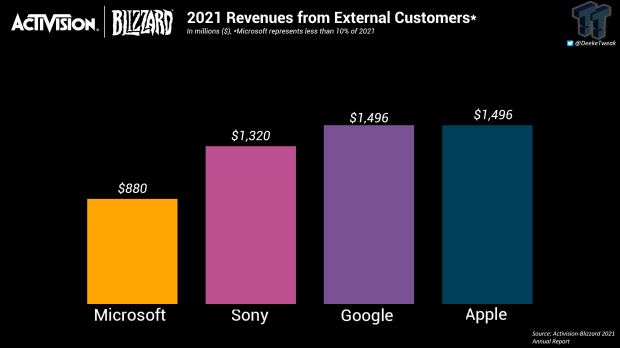

PlayStation alone contributed $1.32 billion to Activision Blizzard’s total year 2021 earnings, as shown in Chart 1. Google (GOOG) (GOOGL) and Apple (AAPL) pay a licensing fee to Activision for its games used on Google Play Store and Apple App Store.

Tweaktown

Chart 1

I noted that a current headwind was a review by the UK’s “Competition and Markets Authority” to ascertain whether the deal violated antitrust laws. But it must be approved by regulators in 16 countries, and only two of them (Brazil and Saudi Arabia) have cleared it so far.

Even if Microsoft survives the barrage of government inquiries it also needs the approval of China.

Reasons Why China Will Block Microsoft-Activision Deal

A Microsoft-Activision Combination Would Erode Tencent’s Dominance

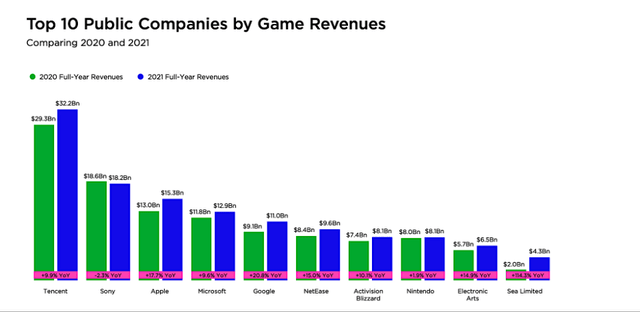

The largest global gaming company is China’s Tencent (OTCPK:TCEHY). Chart 2 shows the top 10 companies for CY 2020 and 2021. All companies increased revenues YoY except Sony (SONY). In 2021, Tencent’s gaming revenues were 2.5X larger than Microsoft and nearly 4X larger than Activision. But combining revenues of both companies, Tencent would only be 1.5X larger, and Microsoft-Activision would be No. 2 in rankings ahead of Sony.

Newzoo

Chart 2

Blocking the Acquisition will be Retribution for U.S. sanctions.

Even under normal times, China has been the sticking point on most mergers. In February 2022, China approved the merger between Advanced Micro Devices (AMD) and Xilinx, but turned down the acquisition of ARM Ltd by Nvidia (NVDA).

But these decisions took place prior to an Oct. 7, 2022, escalation of sanctions imposed on China by the U.S. Government, most of which have been directed at the semiconductor and related high-tech industries.

These U.S. sanctions have an impact on China as a country and have been hurting China’s technology sector. While Chinese President Xi Jinping is seemingly concerned about climate change and has agreed to resume climate change talks with Biden during their meeting in Bali, others in the China government are focused on U.S. sanctions. On Oct. 8, 2022, following the latest round of sanctions, China’s foreign ministry spokesperson Mao Ning said “The United States will only hurt and isolate itself when its actions backfire.”

China’s Huawei has said US sanctions caused $30 billion annual loss in its smartphone business. Huawei had to stop production at a number of its facilities, as many of them relied on U.S.-made equipment.

China’s Semiconductor Manufacturing International Corporation (SMIC) expects fourth quarter 2022 revenue will fall 13% to 15%, and expects the gross profit margin to shrink to 30% to 32% QoQ on weak demand in the mobile phone and consumer market. But SMIC has been struggling because of U.S. sanctions. Capacity utilization was 92.1%, down five percentage points from the previous quarter.

Microsoft Wants to Open a Video App Store

Googleand Apple pay a licensing fee to Activision for its games used on Google Play Store and Apple App Store. Microsoft is willing to pay $68.7 billion to acquire Activision in order to establish an Xbox mobile store to directly offer games on mobile devices, challenging Apple and Google.

Tencent’s has its own App Store, and mobile game development company has surpassed revenues of $500 billion. The company focuses on various aspects of information technology, including social networking, music, e-commerce, and even artificial intelligence.

Tencent has its own M&A Strategy

Tencent is aggressively seeking to own majority or even controlling stakes in overseas targets, notably in gaming assets in Europe.

Tencent has barely made investments in China this year vs. 27 deals worth $3 billion offshore. Currently emerging after two years of China’s crackdown on its games sector as part of a wider move against the technology, Tencent in September 2022 raised its stake in Ubisoft in a deal that made the Chinese firm the single biggest shareholder of the top French games developer, with a stake of 11%. The deal comes just after Tencent in June acquired Copenhagen-based Sybo Games, the developer of hit mobile game Subway Surfer, and in August took a 16.25% stake in Japan’s “Elden Ring” developer FromSoftware.

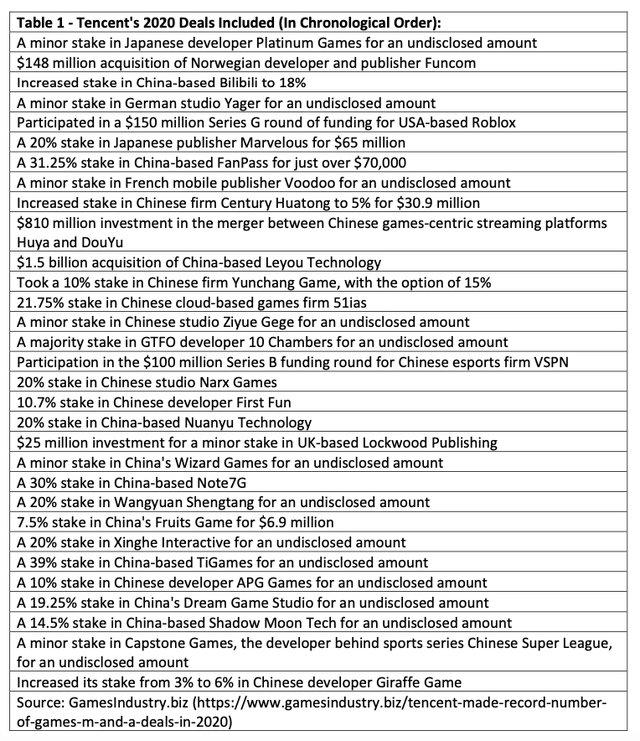

The above are just a sampling of Tencent’s M&A activity. Tencent’s 2020 deals included (in chronological order), are listed in Table 1.

GamesIndustry.biz

Investor Takeaway

As I noted in my Part 1 article, Sony’s attempt to block the Microsoft-Activision acquisition is not sufficiently substantive to stop UK regulators from approval. However, there are too many headwinds facing Microsoft, particularly coming from China. And that excludes the approval from the additional 14 of 16 foreign regulators.

But China has its own story and own agenda. Tencent’s 2016 5% stake in Activision should have no impact on the decision by China’s “State Administration for Market Regulation,” or SAMR to block the acquisition, for the reasons discussed above.

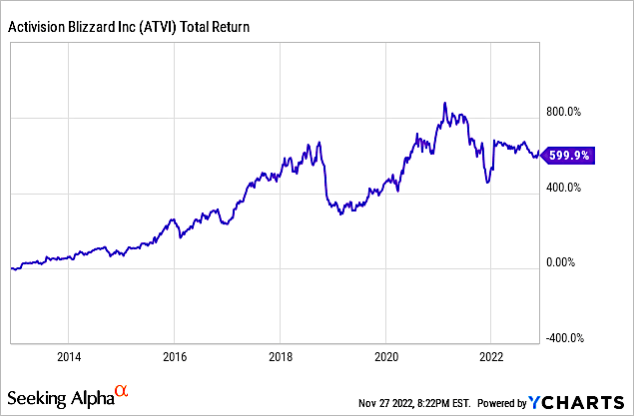

Activision on its own has seen its shares increase 600% in the past 10 years, as show in Chart 3. Share price has gone through several transitions:

- Up until 2019 growth was positive as the Call of Duty video game franchise grew

- 2019 was a down year with Blizzard Entertainment a significant contributor to the decline due to a lack of major game releases.

- Revenue increased with COVID lockdowns as work/study/stay at home demands created demand for mobile devices

- The relaxation of COVID lockdowns cause share price to drop starting in 2021

- The announcement of the acquisition by Microsoft on Jan. 18, 2022, reversed the slide

- Share price has been flat awaiting approval of the acquisition

YCharts

Chart 3

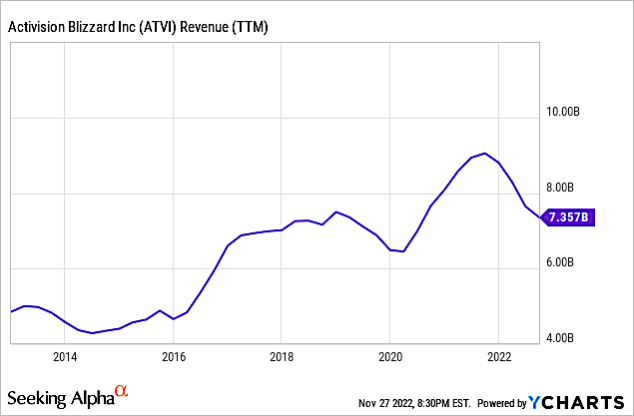

Chart 4 shows similar transitions for revenue over the 10-year period. Unlike share price in 2022 propped up by anticipation of the MSFT acquisition, revenue dropped 28.3% in 2Q 2022 YoY. The company attributes the decline in net revenues and operating income of the Activision segment to lower engagement for the Call of Duty series. However, ATVI expects the numbers will grow in the fourth quarter when it will launch Call of Duty: Modern Warfare II and a new Warzone game. These games are expected to become the main revenue drivers for the company..

YCharts

Chart 4

There are significant headwinds facing the Microsoft-Activision deal coming from China. Unfortunately, if China turns down the deal, it’s over. I would take profits gained from the announcement and buy back if approved. I give Activision a Sell rating.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This free article presents my analysis of this semiconductor and high-tech sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.