Summary:

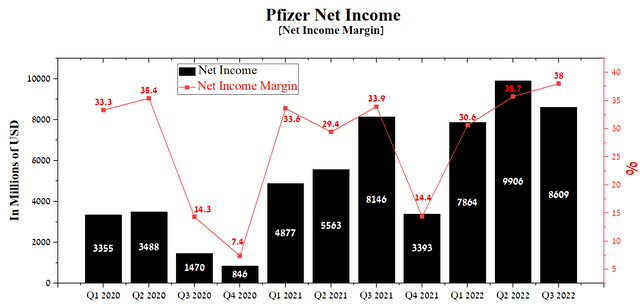

- Pfizer’s net income was $8,609 million in Q3 2022, up 5.7% year-on-year.

- The number of Pfizer product candidates continues to grow at a significant pace due to the continued high sales of Paxlovid.

- Sales of Pfizer’s COVID-19 vaccine have plummeted in recent quarters due to declining public interest in getting vaccinated.

- The company’s total debt was $36,999 million in Q3 2022, down about $3.5 billion from the previous quarter.

- A worsening COVID-19 situation in China and a significant decrease in the effectiveness of monoclonal antibodies against new variants of the virus will bring Pfizer billions of dollars in profits in the coming quarters.

vadimrysev/iStock via Getty Images

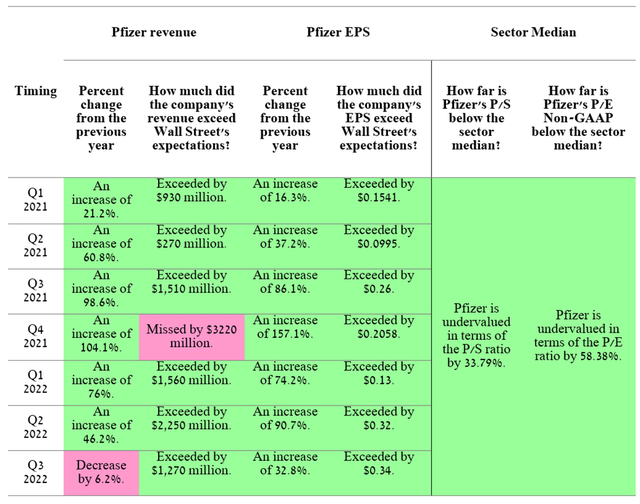

On November 1, 2022, Pfizer (NYSE:PFE) released its Q3 2022 financial report, which showed that the business strategy implemented by the company’s management is beginning to bear fruit. Despite the continued downward trend in sales of the COVID-19 vaccine since Q1 2022, the multibillion-dollar profit generated from its sale in 2021 allowed Pfizer to expand the company’s portfolio of product candidates. In recent quarters, sales of Pfizer’s medicines and vaccines have generally shown upward momentum and thus contributed to beating Wall Street analysts’ expectations. Moreover, maintaining Pfizer’s leading position in various therapeutic areas improves business margins and also has a positive impact on EPS, with a subsequent decline in Pfizer’s P/E ratio below the average for the healthcare sector, and thus allows the company to outperform the SPDR S&P 500 Trust ETF (NYSEARCA:SPY), despite maintaining a difficult macroeconomic situation.

Source: Author’s elaboration, based on Investing.com

Pfizer’s financial position

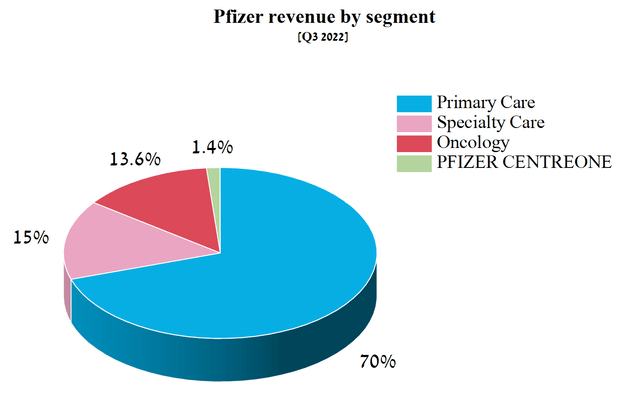

Pfizer focuses on three broad therapeutic areas, namely primary care, specialty care, and oncology, and also has Pfizer CentreOne, which specializes in the supply of intermediates and specialty APIs. Pfizer’s total revenue was $22,638 million in Q3 2022, down 5.8% year-on-year.

Source: Author’s elaboration, based on quarterly securities report

Of these four divisions, the main contributor to the company’s revenue was Primary Care, which, following a reorganization by Pfizer in Q3 2022, consists of the former Vaccines and Internal Medicine product portfolios. Internal Medicine specialized in cardio-metabolic disorders and women’s health. In addition, the Primary Care segment includes products to combat COVID-19, namely the best-selling vaccine Comirnaty and the antiviral medication Paxlovid, which has generated billions of dollars in operation income in recent quarters.

Pfizer’s net income was $8,609 million in Q3 2022, up 5.7% year-on-year. This indicator continues to improve from year to year thanks to the effective policy pursued by Albert Bourla, which uses billions of dollars from the commercialization of Comirnaty and Paxlovid to acquire pharmaceutical companies with drugs with fast-growing sales. In addition, the growth in the company’s net income allows the use of more risky strategies for introducing Pfizer products into medical practice in the US and Europe, and thus has a positive effect on increasing their share in various therapeutic areas.

Source: Author’s elaboration, based on Seeking Alpha

Despite a tense situation in Eastern Europe and double-digit inflation in Europe, Pfizer’s net profit margin continues to rise quarter-on-quarter, while showing some of the highest figures among pharmaceutical industry giants such as Roche (OTCQX:RHHBY) (OTCQX:RHHBF), AbbVie (NYSE:ABBV), Novartis (NYSE:NVS), and Johnson & Johnson (NYSE:JNJ). Thus, the company’s net profit margin was 38% at the end of the 3rd quarter of 2022, an increase of 4.1% compared to the previous year.

The share of Paxlovid in the treatment of COVID-19 is growing

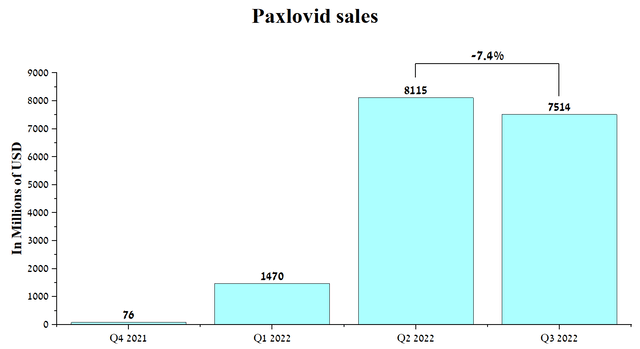

At the moment, the main drug that helps maintain the company’s high revenue relative to pre-Covid times is Paxlovid, approved in most countries of the world to combat COVID-19. The share of this medicine in the Pfizer portfolio continues to grow quarter by quarter, thereby dethroning the COVID-19 vaccine developed in partnership with BioNTech, for which demand continues to fall at a significant pace. At the end of Q3 2022, Paxlovid accounted for 33.2% of all Pfizer revenue, up 27.5% from Q1 2022.

Source: Author’s elaboration, based on quarterly securities report

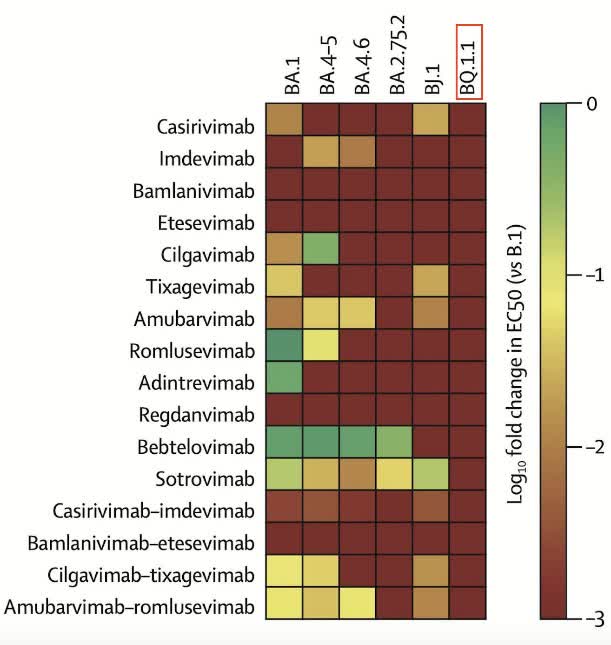

Since 2020, the FDA has issued emergency use authorizations for a variety of medicines as treatments for mild to moderate COVID-19. However, due to the rapid mutation of the virus and the subsequent increase in the number of its variants, the effectiveness of most of them is drastically reduced, forcing regulators around the world to limit their use. The main reason for limiting the use of monoclonal antibodies is that they lose their ability to bind to the spike proteins of new strains of COVID-19, and, as a result, the virus enters human cells. As a consequence, the FDA has already restricted the use of the following drugs, namely Eli Lilly’s (LLY) bamlanivimab/etesevimab, Regeneron’s (REGN) REGEN-COV, GSK (NYSE:GSK) and Vir (VIR) Biotechnology’s sotrovimab. Moreover, a positive factor that will significantly support sales of Paxlovid is not the ability of all monoclonal antibodies to neutralize the Omicron subvariant BQ.1.1, which is dominant in the US, Europe and many Asian countries.

Source: Twitter post

As a result, with a high degree of probability, only Paxlovid and Merck’s (MRK) Lagevrio will remain effective in the fight against COVID-19 since they are antiviral drugs and are less susceptible to virus mutations. With declining public interest in booster doses of Pfizer, Moderna, and Novavax vaccines, the lifting of restrictive measures, and mandatory testing, I expect a significant increase in the number of COVID-19 cases around the world in the coming months, which will bring Pfizer billions of dollars in net income even despite reducing panic in society regarding this virus. Global sales of Paxlovid were $7,514 million in Q3 2022, down only 7.4% from Q2 2022 despite a high double-digit drop in new COVID-19 cases over the same analyzed period.

Source: Author’s elaboration, based on quarterly securities reports

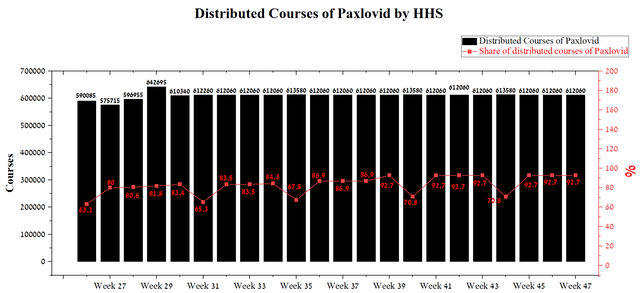

Oral route of administration, retention of effectiveness against new variants circulating in the US, and competitive advantages relative to Lagevrio have led to a significant increase in the share of Paxlovid courses that have been distributed by HHS and is more than 90% at the end of November 2022. At the same time, the share of Paxlovid has remained stable over the past ten weeks, which indicates the continued high demand for it from medical organizations. As a result, I expect Q4 2022 sales of this drug to be no lower than the previous quarter.

Source: Author’s elaboration, based on HHS

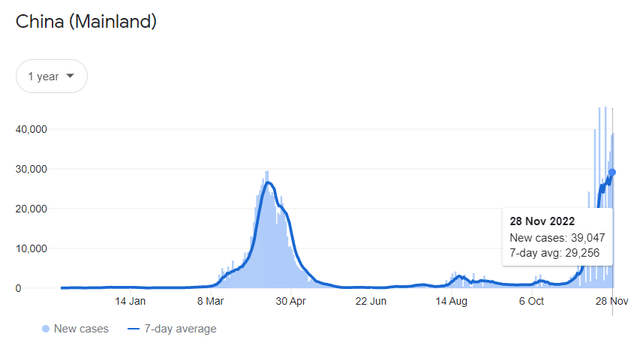

Apart from the US market, an increase in demand for Paxlovid is expected from China, where the number of COVID-19 cases is growing at a significant pace due to the loss of effectiveness of the massively distributed Sinopharm vaccine against new variants of the virus there and the Chinese policy of zero tolerance for coronavirus, which not only helps to reduce infections but only increases tension in society, which then flows into riots. So, on November 28, 2022, 39,791 new cases of COVID-19 infection were registered in China, which is 44.2% more than the previous week.

Source: Information provided by Google

As a result, I believe that COVID-19 and China will play a pivotal role in improving Pfizer’s financial performance in the next two quarters, despite the skepticism of most investors about the commercial prospects of products aimed at combating this virus.

Conclusion

Over the past year and a half, Pfizer’s management has been able to achieve impressive results, including an increase in the number of clinical trials that reach secondary and primary endpoints, and in M&A policy activity. Substantial revenue growth between 2020 and 2022 has rejuvenated the company’s product portfolio and reduced the risks associated with a future decline in sales of some of Pfizer’s key medicines, whose patents are expiring in the next six years.

The deterioration of the epidemiological situation in China due to the increase in the number of Covid-19, with the simultaneous desire of Xi Jinping to reduce tension in society, through the removal of some of the restrictive measures, in my opinion, will only accelerate the spread of the virus in society. The reasons for this are the zero-tolerance policy promoted by the Chinese government, which has shown itself to be incapable of containing COVID-19, and Chinese vaccines have lost their ability to effectively fight against new variants of the coronavirus. Together, these factors will lead to an increase in the number of patients with COVID-19, and demand for Pfizer’s Paxlovid will increase dramatically, which will affect the growth of the company’s cash flow, which can then be used to accelerate the development of next-generation product candidates and stay ahead of competitors. As a result, Paxlovid will become Pfizer’s cash cow for the coming quarters, thereby smoothing out declines in sales of some drugs in Pfizer’s oncology portfolio that are under pressure from more effective drugs developed by Merck and Bristol-Myers Squibb (NYSE:BMY).

Overall, the improvement in EBIT margin, lower total debt, year-on-year growth in dividend payouts, and the company’s cash and short-term investments of more than $36 billion contributed to increased investment interest in Pfizer during the current period of geopolitical tensions in the world. As a result, Pfizer could be a great candidate for investors with a long-term investment strategy looking for assets in the healthcare sector.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.