Summary:

- Meta stock crashed in 2022 with disappointing financial results.

- The investments look too bad in this macro environment and FCF got annihilated.

- We analyze all possible faces of the metaverse.

- Messaging apps can drive revenue growth in the short to medium term.

- The macro headwind will eventually become a tailwind.

Justin Sullivan/Getty Images News

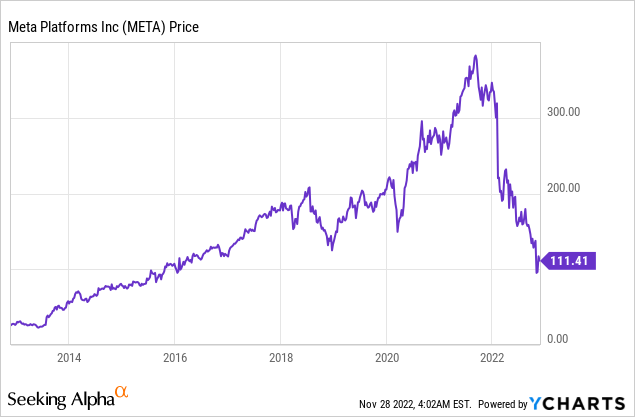

It has been an extremely difficult 2022 for Meta (NASDAQ:META), marked by a series of extremely poor and disappointing quarterly data, which led the stock to lose ⅔ of its early-year price and to a price level it had not seen since 2015.

Let us try to understand and analyze the most worrying points for investors.

Investors were shocked by the accounting and financial results in the latest quarterly report.

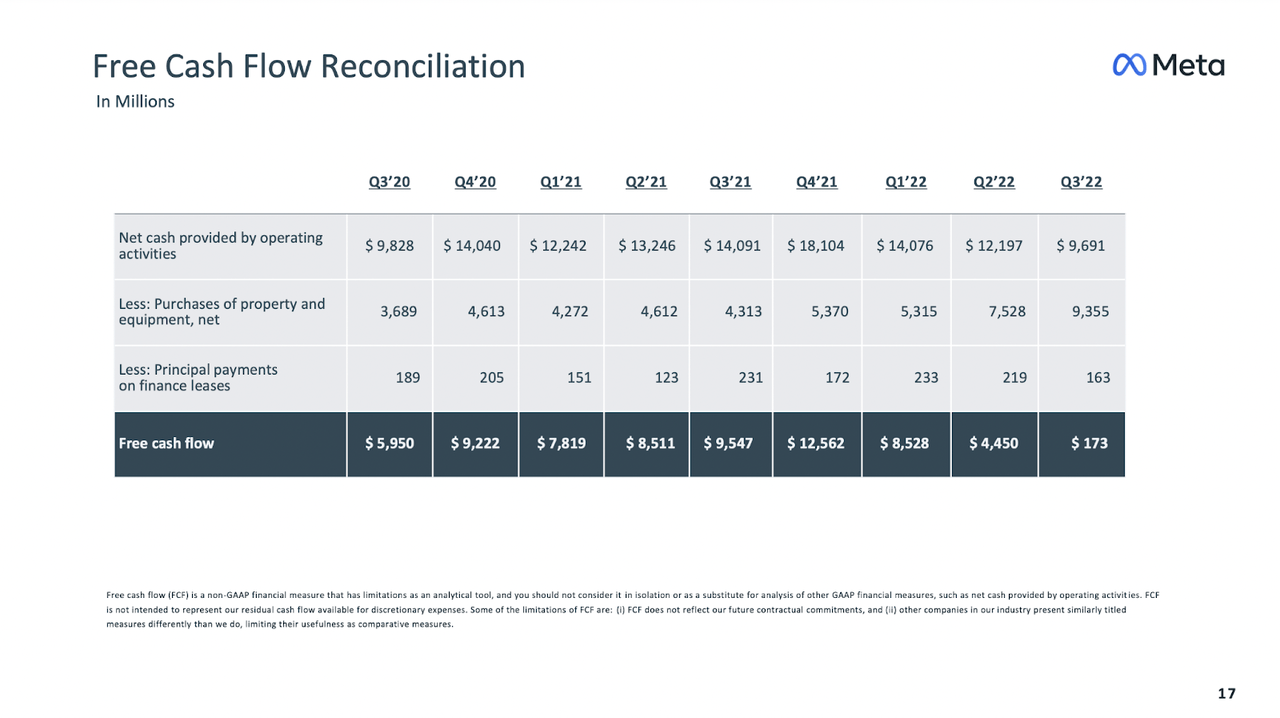

The one that worries me most as an investor is the company’s free cash flow: from $10 billion last year, to go to $200 million in free cash flow is a worrying figure, with CapEx doubling in the space of a year.

META Q3 Investor Presentation

But I am not the only one concerned, given the market reaction, which led Meta to lose about 20 percent of its price following the quarterly report, but especially given the responses of Meta itself, which decided to lay off 11,000 employees, representing approximately 12.6% of the 87,314 employees recorded at the end of Q3 2022.

From a cost perspective, the turnaround was seen in conjunction with Meta’s name change and increased focus on the metaverse.

For a proper initial analysis, it may be interesting to discuss what we mean by metaverse.

The Metaverse Explained

When speaking generically about the metaverse, Meta refers to four subcategories, each with opportunities for growth and a different stage of development.

Social Metaverse

The first thing we think of when we talk about the metaverse is a place for users to interact with each other using avatars representing us. In the call, it is described this way:

We do is sort of the social company that’s about people interacting, how you express yourself in all forms, the kind of expressive avatars, the photorealistic avatars.

Giving a figure to the social metaverse addressable market is undoubtedly complex; it could contain within five years the gaming market and the social network digital advertising market, with a total TAM of more than $1.1 trillion as of 2027.

Virtual Reality [VR]

When we think of viewers, we often refer to VR. Virtual reality is characterized by the fact that the subject is completely immersed within a virtual world (thus not interacting with reality) and must use hardware such as motion sensors and visors to operate. A new mass-market product costing $500 is announced in the call:

And there, I think that there’s going to be a consumer-focused product that probably will reach very large scale, but there’s also, I think, going to be a work-focused product that — it’s like you don’t do most of your work on a $500 device.

Thinking about the value of the gaming market, together with the expectation of the headset market, it could be a market worth over $350 billion by 2027.

Augmented Reality [AR]

AR, unlike VR, involves interacting with the world around us through digital information (such as QR codes). This information is overlaid on the device to create an interlaced experience in which digital information alters the user’s perception of the real world.

AR can be implemented on smartphones, computers, or other tech devices and is often used in areas such as education or enhancing the customer shopping experience.

The total estimated market for this segment is $97 billion in 2028.

Brain-Computer Interface

It is the segment furthest behind in development time but also the most futuristic. Elon Musk’s Neuralink is involved in developing these kinds of products.

From the call, we see how Meta is thinking about integrating everything into a pair of glasses, without the need for any controller or necessarily voice control:

And we think by the time that you have glasses, and you’re kind of walking down the street with glasses, you’re not going to have controllers with that, you’re not going to want to have your hands kind of like hovering in the air, and you’re not always going to want to talk to the thing, even though that’s going to be one way that we use them a bunch of the time.

This is undoubtedly the most premature but potentially largest market, with possible adoptions of various kinds (Brain-computer interfaces could replace every aspect of our relational life with computers). Still, there are no mass products to try to draw conclusions from.

Other Growth Drivers (Short to Medium Term)

With such a reduction in staff, it is clear that the metaverse’s ambitions for rapid growth are somewhat diminished, so it is fair to ask where Meta’s short-term growth might come from. Will we be forced to see a slow decline over a series of years?

WhatsApp And Messenger

The two messaging apps are virtually still unused for monetization purposes by Meta. This expands the range of possible monetization within the “Family of Apps” (FoA) in an important way.

Specifically, according to Reuters, Zuckerberg reportedly said in a recent meeting with Meta employees:

We talk a lot about the very long-term opportunities like the metaverse, but the reality is that business messaging is probably going to be the next major pillar of our business as we work to monetize WhatsApp and Messenger more.

Improving Macro Environment

And let’s not forget the macroeconomic situation. Certainly, Meta has changed its budget structure with a major revival of expenses. And equally true, macro conditions have affected Meta’s revenues and are partly to blame for the company’s reduced margins.

In a different macroeconomic environment, with declining inflation and more expansionary, or at least neutral, monetary policies, Meta could begin a new growth path.

Of course, in this respect, the situation in the short term remains uncertain with downside risks. (For further discussion, I recommend our latest article on the U.S. situation and the assessment of the S&P 500 (SPY)).

Costs

The big shift in market focus has gone to costs. This has been somewhat amplified by how the market analyzes a company. If in 2020 and 2021 we saw the reckless growth of innovative companies, 2022 was the turn of free cash flow, earnings, and dividends, with markets focused on today’s value versus tomorrow’s value. This surely has a logical explanation related to higher interest rates, which raise the cost of capital for any company. Betting on tomorrow’s revenue, giving up today’s free cash flow costs much more today and will cost much more tomorrow than it did in 2021.

Hence the dual impact of Meta, with accelerated investment, R&D and CapEx growth leading to reductions in operating margin and free cash flow, respectively, accompanied by stagnant sales due to current economic conditions.

Research And Development (R&D)

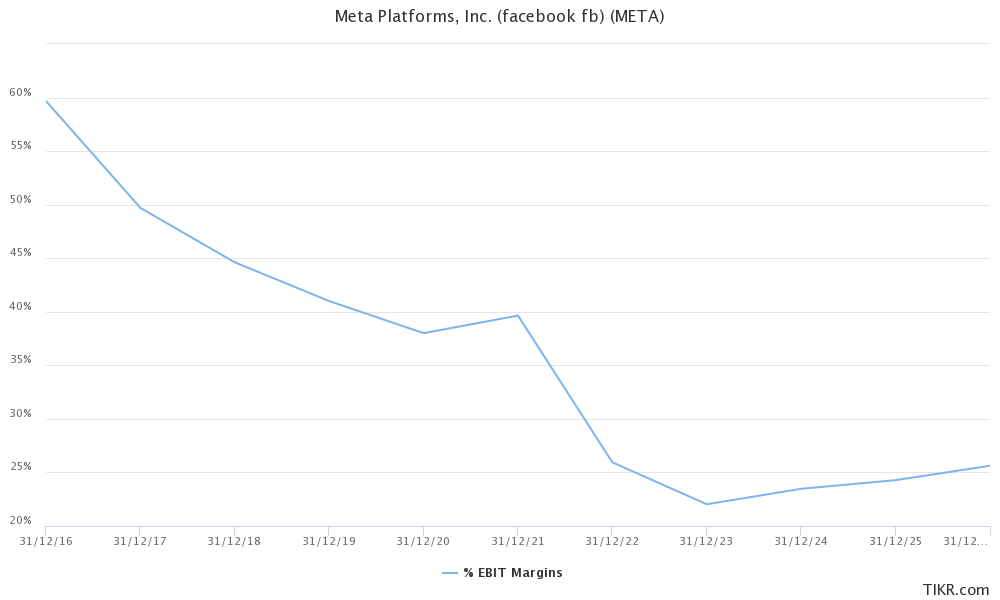

A first look goes to Facebook’s income statement and the huge increase in expenses booked for the current year. In particular we see that the operating margin is expected to be around 26 percent, compared to almost 40 percent in 2021. The first question must be about the structural nature of this change. Is it something we can expect to change to a return toward the previous marginality? Probably not, or at least not as long as these are the economic conditions. Let’s look at how Facebook’s operating marginality has actually deteriorated year after year from 2016 to the present.

Tikr.com

The expectation is that the situation may change marginally over the next few years. Indeed, the company has done what it can to have a tangible result on the balance sheet more quickly, as we said earlier, by laying off a good portion of the workers.

As analyzed in a magisterial way by Professor Damodaran in his article META Lesson 2: Accounting Inconsistencies And Consequences, the ever-increasing expenditures in research and development need to be put into context since often, these are expenditures that, from a logical point of view should be capitalized, as investments with an impact over several years. From this point of view, in the author’s model, R&D expenditures are amortized over a 3-year life, and his adjusted income is about 50 percent higher.

The impact on margins in recent years is naturally reduced but still visible, with a major drop between 2017 and the last 12 months.

CapEx

A similar talk concerns CapEx, which has seen a surge over the past year, with an expected jump from $18.6 billion to $31.8 billion in 2022, an increase of more than 70 percent. The expectation is for this to be a structural change in the industry and the company, so CapEx will remain at these levels for the next few years, with progressive investments in AI being evaluated as the company grows revenues.

Why Invest Now?

The increase in Meta’s expenditures has been affected partly by the industry’s competitive situation, as well as the ecosystem change made through Apple’s IFDA. Even today, Meta is still investing in creating a new system to optimize advertising within its FoA.

In addition, investments are needed to cope with new competitors, such as TikTok, and the renewal of applications. As we said three months ago:

The shift to heavy use of AI will not revolutionize the company, but it will certainly make it different from what we know today, a little less social but a little more creator-friendly.

Conclusions

The VR market might be worth about $85 billion in 2028, with 45 percent annualized growth. A very high-growth market, certainly, but even in 2028, after years of investment, still lower than Meta’s current revenue.

If we project current Reality Labs revenues, holding market share steady, we have revenues of about $18 billion in 2028. For the current costs to be worth it we would have to hope that we are in a winner-takes-all market, with META gaining market share, or that Metaverse use could grow much higher than expected.

It is quite likely that the socials of 2032 will not be what we use today. Meta so far has always managed to buy into (or copy) the trend of the moment, but with TikTok, it seems to have found a major stumbling block (although reels are starting to kick in and may soon contribute substantially to revenue). As for the next few years, revenue growth could be driven by WhatsApp and Messenger, as well as a general improvement in the world economy. What’s next? Will Reality Labs be able to repay its investments? We believe the company can turn around with a new increase in margins over the medium term, which is the only possible bet for Meta.

Assuming FoA revenue growth of 5 percent annualized and the growth we were talking about in Reality Labs, we can think of revenues of around $170 billion in 2028.

At that point, the following factors will make the difference:

- Will margins be closer to 20 percent, driven by competition in the online advertising business, or rather 40 percent, as in years past, due to Meta’s great power position and a better situation in the Reality Labs business? In one case, profits would be about $35 billion, in the other $70 billion, quite a difference.

- In the second half of the 2020s, could Meta experience a new period of growth driven by the metaverse? If so, multiples could return with the historical average, with price-to-earnings around 20. Conversely, a multiple closer to 10 might be appropriate.

Therefore in the next five years, Facebook will still experience highs and lows.

Do you think a recovery in marginality and the metaverse could bring a new period of growth for Meta? The stock could quadruple in the next 5 years.

Conversely, do you think Meta may struggle, with margins steadily declining and revenues struggling to grow? Then the current price might even be too high, and in 5 years Meta might hold steady around this price level.

With Meta at around $100 per share, it seems compelling for us to bet on the growth of new revenue sources and global economic recovery.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in the article is provided for informational purposes only. It should not be construed as investment advice or advice on buying, selling, or other types of transactions relating to an investment in products or services, much less an invitation, an offer or a solicitation to invest.

The information in the article is provided solely by virtue of the fact that everyone will independently make their own investment decisions: the report does not take into account investment objectives, nor specific needs or financial situation. In addition, nothing in the article represents or is intended to express financial, legal, accounting or tax advice.