Summary:

- Coca-Cola’s elevated relative valuation metrics are counteracted by compelling residual value.

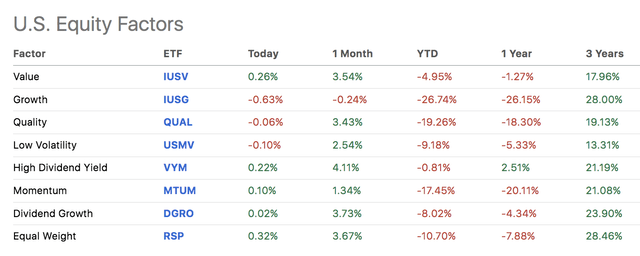

- Sector rotation in a risk-off climate might provide systemic support.

- Coca-Cola’s “best-in-class” status is advantageous amid excess market volatility.

- Earnings momentum is crucial, and a favorable ESG rating reduces crash risk.

- We assign a strong buy rating with a twelve-month horizon.

Maksim Safaniuk

Thesis

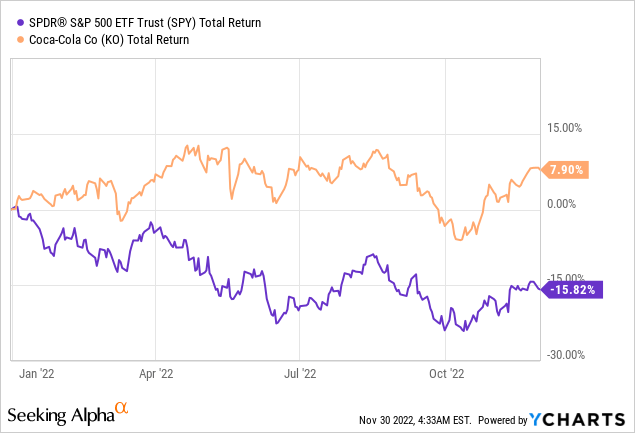

Coca-Cola (NYSE:KO) stock has managed to fend off 2022’s bear market by exhibiting resilience during a turbulent time for the financial markets. Many investors might wonder whether the stock’s performance was a fluke and if it will revert to mean. In addition, Coca-Cola stock is trading at 25.19x its earnings and 11.85x its book value, which could prompt many investors to reassess their outlook.

Despite the stock’s unfavorable relative valuation metrics, science provides substance to an argument for continued outperformance; here’s why.

Robust Performance And “Best-In-Class” Sector Rotation

The proclivity of investors to rotate their portfolios into low-volatility and dividend-paying stocks such as Coca-Cola during questionable economic periods provides a central argument to work from.

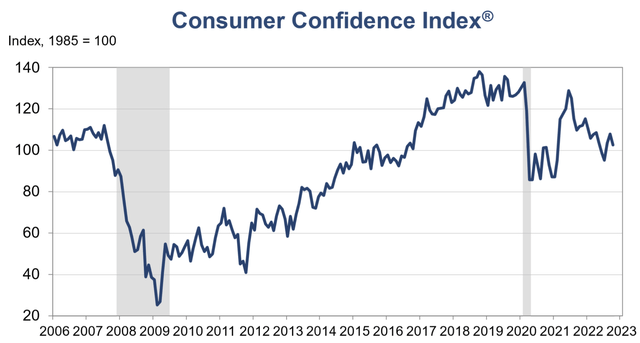

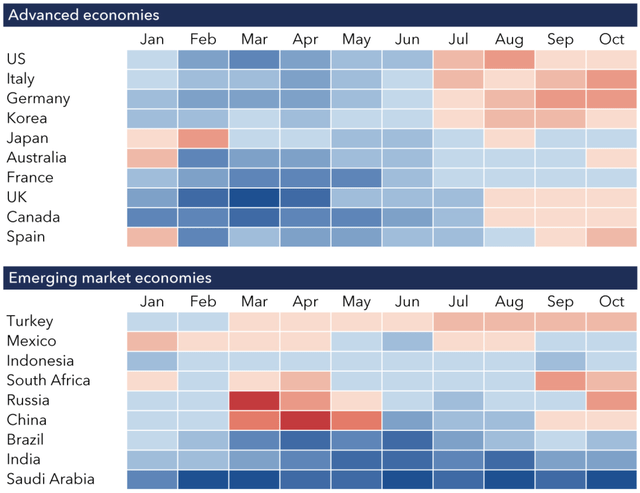

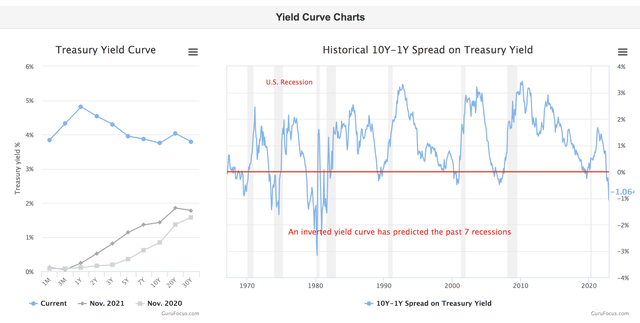

Despite many journalists trying to justify economic growth, the fact of the matter is that the global economy will likely be up against it in 2023. A parsimonious analysis of yield curve inversion, cyclicality, consumer confidence, and manufacturing indexes paints a gloomy picture. In addition, the ongoing war in Ukraine, continuous lockdowns in China, energy shortages in the EU, rising populist politics from both the left and the right, and hyperinflation in nations such as Turkey and Argentina could add pressure to the global economic sphere in 2023.

The Conference Board Global PMIs (‘IMF’) The U.S. Yield Curve (Gurufocus)

Despite the stock market’s various economic challenges, investors could stay invested in certain sectors, such as consumer staples and healthcare, as they’re countercyclical. Thus, Coca-Cola’s consumer staples characteristics could provide it with “key habitat” support in 2023.

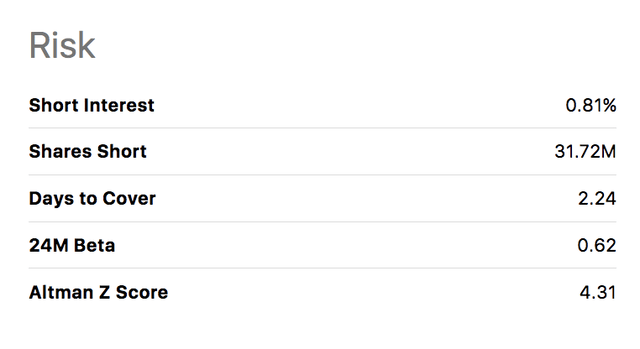

Furthermore, as previously mentioned, investors settle for certain style-based investment options during trying economic times. Coca-Cola’s beta coefficient of 0.62x means it’s 1.61 times less risky than the S&P 500, categorizing it as a low beta stock. On top of that, Coca-Cola’s dividend yield of 2.78% and its dividend coverage ratio of 1.41x indicates that its dividend profile is both lucrative and sustainable. Therefore, the asset can be included in high-dividend, low-volatility brackets, aligning it with investors’ current appetite.

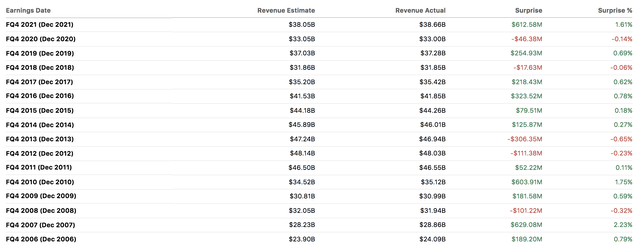

Coca-Cola’s microeconomic features illustrate the company’s robustness as its long and short-term performance has fended off economic challenges. The firm beat its revenue estimate by $600 million during its previous quarter, meaning its three-year compound annual growth rate reached 5.55%. Moreover, Coca-Cola beat its earnings-per-share target by five cents per share.

The beverage distributor’s omnichannel approach could yield significant results in the coming years, as it allows consumers to purchase in their desired manner. The omnichannel concept is a popular retail concept, and increased utilization of data analytics could streamline the company’s supply chain and consumer targeting.

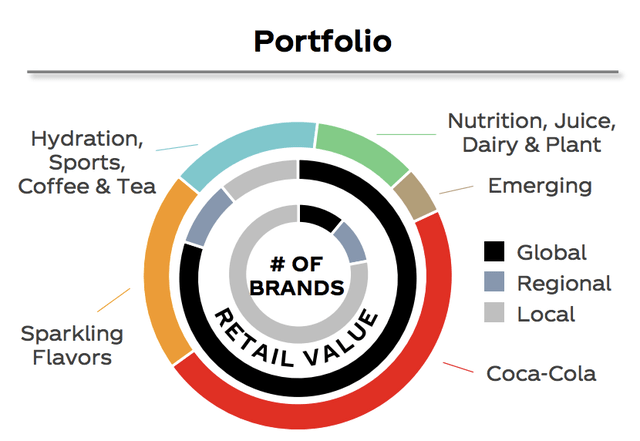

Furthermore, Coca-Cola’s horizontally-integrated business model means it can capture value and synergies from a broad range of beverage segments. For example, the company has expanded into the hot drinks space with its Costa acquisition in 2019, which has been the UK’s favorite coffee shop for 11 consecutive years.

Progress in the company’s juices and plant-based liquids is certainly noteworthy. Coca-Cola has established full ownership in brands such as Innocent, Ades, and BODYARMOR, to expand into “new era” consumers.

Let alone, the company’s iconic Coca-Cola beverage gives it market dominance in a sphere that exhibits tremendous customer loyalty. Let’s face it, sugar sells.

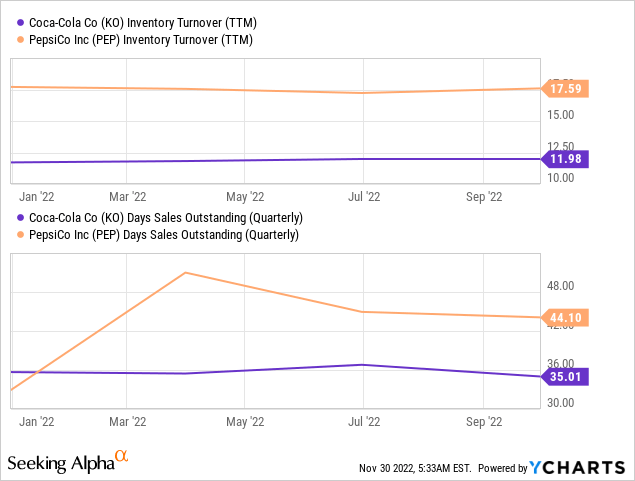

Lastly, Coca-Cola hosts phenomenal operating efficiency, which could be seen as a bonus by risk-off investors. For example, it possesses better inventory turnover and days sales outstanding ratios than its arch-rival PepsiCo (PEP). The latter means its supply chain could be more succinct than PepsiCo’s, while the prior indicates a lower cost of goods sold per unit of inventory.

Pricing The Asset

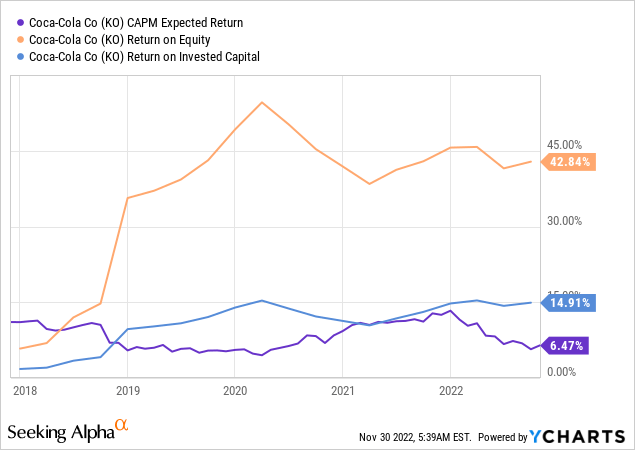

The thesis’ central argument is that relative valuation metrics shouldn’t be a concern to investors. A proxy to relative metrics is residual value analysis, which measures a firm’s return on capital relative to its demanded return from investors.

Coca-Cola’s return on equity and return on invested capital dominates equity investors’ required return (CAPM), illustrating value in abundance.

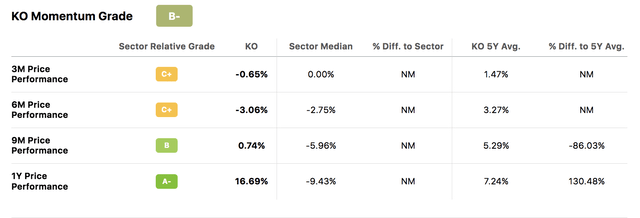

Furthermore, the momentum anomaly could prevail. The momentum anomaly is a scientific finding stating that stocks could be slow to revert to their mean due to investor herding. The anomaly says stocks that outperformed in the previous twelve months are likely to outperform in the succeeding twelve months.

The company’s reputation as an earnings beater and its favorable ESG score add substance to the momentum argument. The prior argues that earnings beaters benefit from traders speculating on earnings acceleration, and the latter concludes that high-ESG stocks could avoid momentum crash risk due to high earnings quality.

Earnings Surprises (Seeking Alpha)

Potential Risks

All arguments need to be juxtaposed to sustain objective decision-making. In Coca-Cola’s instance, there are few counterarguments apart from systemic risk and valuation.

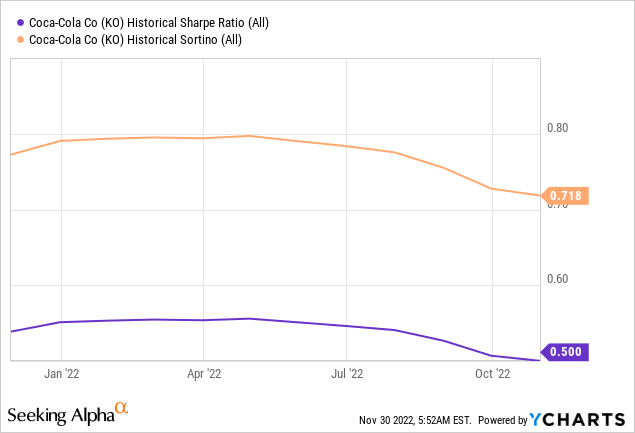

Although Coca-Cola didn’t shed market value during 2022’s bear market, all assets are exposed to systemic risk, meaning additional market drawdowns could negatively impact the stock.

Retrospective increases in systemic risk have resulted in quantitative risk adjustments, leading to suppressed Sharpe and Sortino Ratios for Coca-Cola, implying that the stock’s recent risk-adjusted returns have been questionable.

Furthermore, although we argue against it, relative valuation metrics need to be considered for holistic decision-making. The stock’s trading is at a premium relative to its cyclical averages, which could result in the abating of many of its existing investors.

Concluding Thoughts

Although Coca-Cola’s relative valuation metrics paint a bearish picture, key indicators suggest the stock’s residual value remains intact. Furthermore, risk-off sector rotation and Coca-Cola’s “best-in-class” characteristics could play a significant role in 2023.

To boot, Coca-Cola could benefit from the momentum anomaly amid its proven cross-sectional momentum and earnings momentum. Moreover, the company’s favorable ESG rating could prevent crash risk.

We assign a strong buy rating with a twelve-month horizon.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>