Summary:

- Bank of America stock has outperformed the S&P 500 by two times since mid-August 2023 when my initial bullish thesis was published.

- The bank’s consolidated revenue and EPS stagnate, but the situation does not look bad when we look at the segments level.

- The Consumer and Global Banking segments are struggling due to temporary headwinds caused by high interest rates.

- On the other hand, the other two segments are demonstrating positive dynamics, adding to my optimism.

- The bank continues driving organic growth to expand its operations, which is vital to maximize its cross-selling potential.

jetcityimage

Investment thesis

My initial bullish thesis about Bank of America (NYSE:BAC) aged well because the stock outperformed S&P 500 by around two times since mid-August 2023. A lot of developments happened over the last ten months, and today I want to update my thesis. The situation around interest rates adds uncertainty from the short-term perspective. However, from the secular point of view, BAC’s strategic positioning is still intact. Moreover, the valuation is still very attractive. All in all, I reiterate my “Strong Buy” rating for BAC stock.

Recent developments

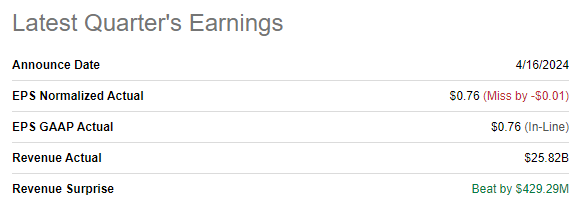

The latest quarterly earnings were released on April 16, when BAC surpassed revenue expectations and met EPS forecasts. On a consolidated level revenue declined by 1.7% YoY, the EPS shrunk from $0.94 to $0.76.

Seeking Alpha

If we look at the segments level, two out of four demonstrated revenue and net income growth. To remind readers, BAC’s segments are Consumer Banking [CB], Global Wealth and Investment Management [GWIM], Global Banking [GB], and Global Markets [GM].

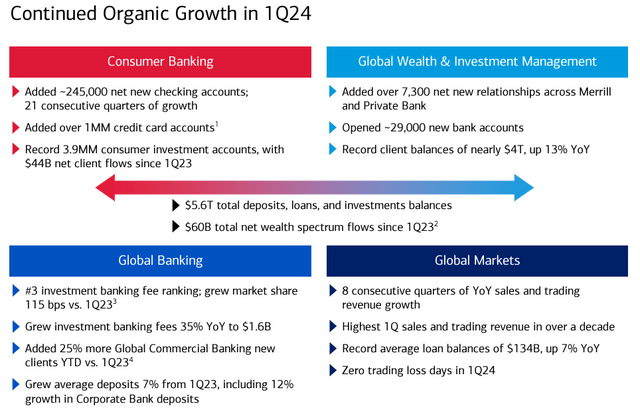

CB’s revenue declined by 5% in Q1 due to lower deposit balances, which has led to a 15% decrease in the segment’s net income. The business’s net income was also hurt by slightly higher loan loss provisions. It appears to me that this segment’s challenges are temporary and mostly caused by the tight monetary policy.

GWIM’s revenue was up 5% mostly thanks to higher asset management fees. A 13% increase in client balances also contributed to the segment’s top line growth. As a result, the segment’s net income increased by 10%. The growth in this segment is a bullish sign because it diversifies BAC’s business with a revenue stream less dependent to changes in interest rates.

GB’s revenue suffered from reduced net interest income and recorder a 4% decline in revenue. There also was a $229 million loss provision recorded in Q1, compared to a $237 million loan loss reversal in the same quarter last year. As a result of interest rates headwind and one-off provision charges, the segment’s net income fell by 22%.

Last but not least, GM’s revenue rose by 5% YoY, fueled by increased sales and better trading outcomes. The segment’s revenue growth in Q1 enabled to expand net income by 2%.

BAC’s latest earnings presentation

As we see from the above by-segment analysis, the bank diversifies towards businesses less vulnerable to fluctuations in interest rates, which is good for investors. Moreover, challenges faced by CB and GB segments look temporary to me. All segments demonstrated expanding number of new accounts and relationships, which is vital for any bank offering diversified services.

Attracting new customers is crucial because BAC’s four segments means that the bank has vast cross-selling potential, and that is the way any business builds sustainable value for shareholders. Cross-selling certainly reduces customer acquisition costs and highly likely increases switching costs for customers.

BAC’s latest earnings presentation

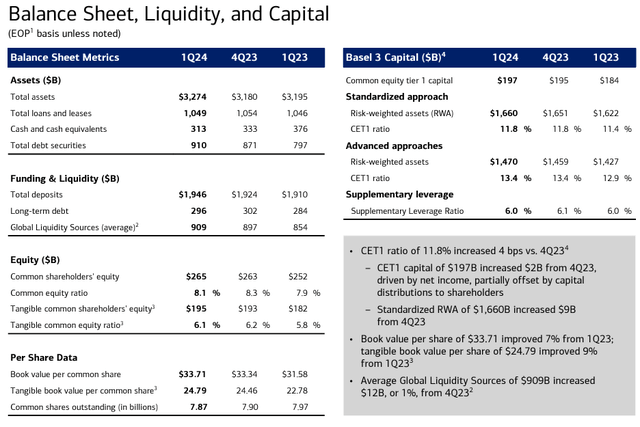

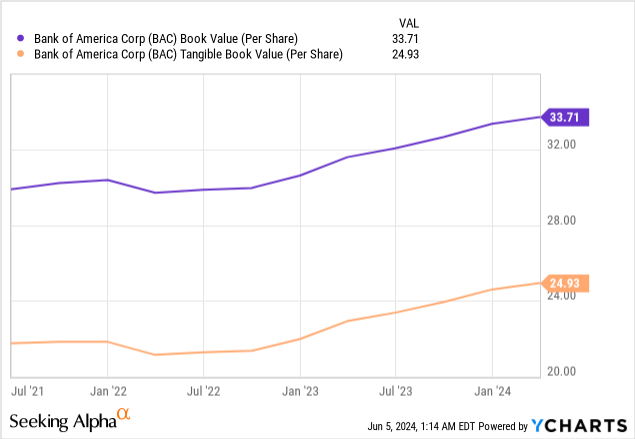

BAC’s financial position is a fortress, meaning that the bank is well-positioned to weather temporary challenges. As of March 31, the common equity Tier 1 capital was 13.4%, a notable increase compared to 12.9% at the end of the same quarter in 2023. Book value per share is also expanding consistently, reaching $33.7 compared to $31.6 at the end of the same quarter last year. Tangible book value per share also demonstrates robust trend over the last three years.

My optimism is also backed by BAC’s plan to expand into nine new markets by 2026. It is not new information as the plan was announced in 2023, but I want to emphasize that BAC is unlikely to delay this plan despite temporary challenges. I arrived at this conclusion after I discovered that there are currently 3,792 job openings from BAC on LinkedIn, meaning that the management is confident in its expansion plans.

My optimism is also backed by the strength of the U.S. economy. Resilience of the world’s largest economy was the major reason OECD upgraded its growth outlook for the global economy.

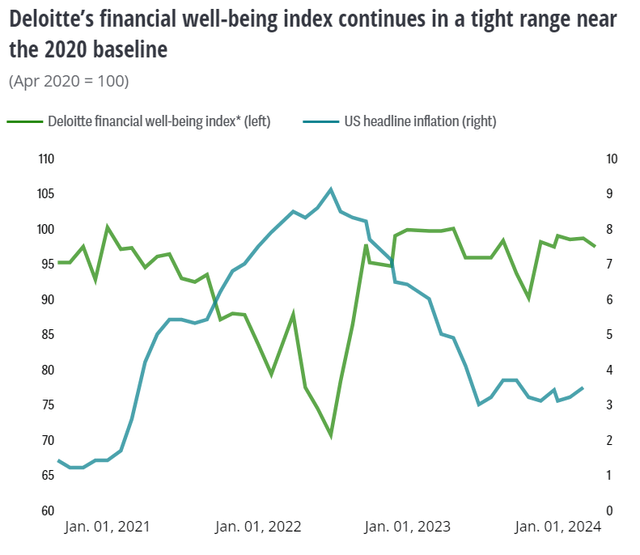

Consumer spending is one of the major drivers of economic growth, and the picture looks bright in the U.S. According to Deloitte’s latest report, the financial well-being index is stable and recovered relatively rapidly after a temporary dip in 2023.

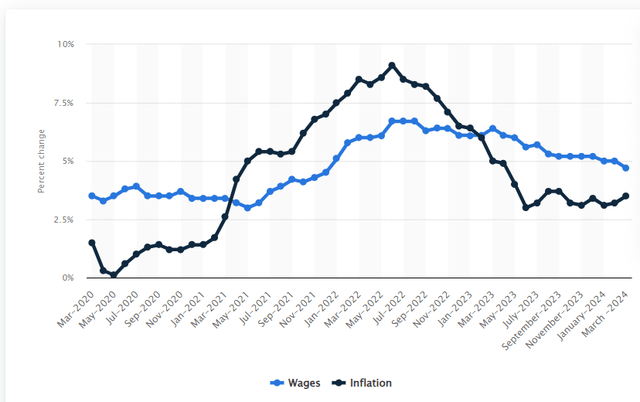

Consumers’ financial well-being is dependent on real growth in wages. From this perspective, consumers are likely to be healthy, as wages growth has been outpacing inflation since March 2023. The U.S. households’ wealth is also at record levels, which is also a positive factor to support consumer spending in the foreseeable future.

To conclude, despite the challenging monetary environment weighing on BAC’s consolidated financial performance, there are several reasons to remain bullish. The bank continues driving organic growth of key underlying business metrics, nurtures its wealth management business, and the U.S. economy is likely to remain strong in the foreseeable future.

Valuation update

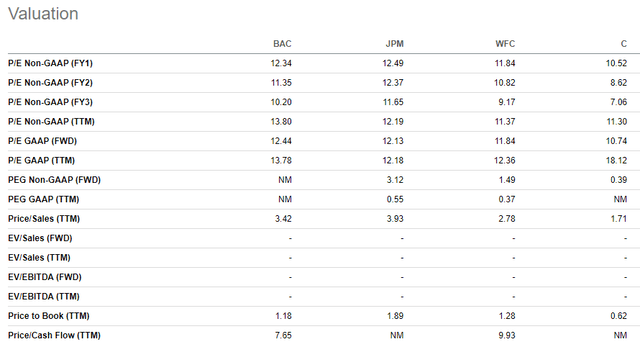

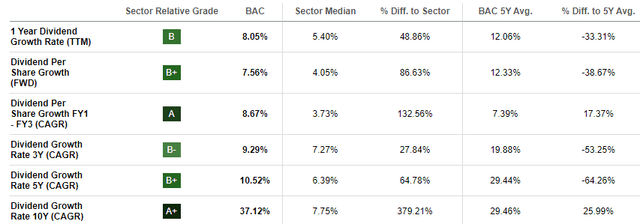

BAC’s valuation ratios look approximately in line with other largest American banks. There is a slight premium compared to Wells Fargo (WFC) and Citigroup (C). However, I believe that this premium is fair because of BAC’s superior scale, much better dividend growth, and better profitability metrics. I have compiled a comparison of all four banks’ key metrics, which readers can find here.

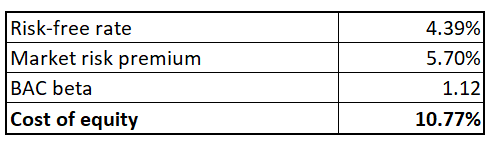

BAC is a dividend machine, so I am using a dividend discount model [DDM] approach to calculate the stock’s fair value. Cost of equity is the discount rate for the DDM, which I derive using the capital asset pricing model [CAPM] approach. All assumptions are publicly available, BAC’s 24-months beta obtained from Seeking Alpha.

Author’s calculations

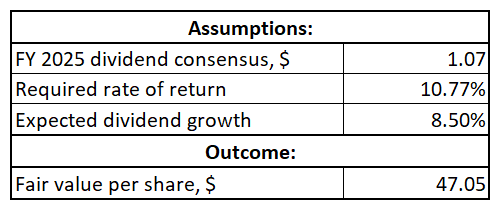

Expected dividend growth will be deducted from the cost of equity for the DDM purposes. Growth assumptions are always tricky and there is a high level of uncertainty, but for large corporations like BAC it is always useful to look at history. BAC’s dividend growth over several past years is stellar, and I think that using an 8.5% growth rate for my DDM is reasonable.

Last but not least, I have to figure out the base-year dividend. Since I am calculating target price for the next twelve months, I use an FY 2025 dividend consensus estimate, which is $1.07. Incorporating all the above assumptions into the DDM formula gives me a fair share price of $47. That said, the stock is around 19% undervalued, which means that the current price is quite attractive.

Author’s calculations

Risks to consider

The uncertainty around the Fed’s monetary policy poses elevated risks for BAC’s investors. Federal Funds rates have direct and indirect impact on investors. The uncertainty around interest rates decreases predictability for the bank’s net interest income, directly impacting profit margins. Demand for loans is also significantly affected by interest rates, with higher rates typically leading to lower loan demand.

With its massive footprint across the USA and high exposure to consumer loans, BAC’s financial performance significantly depends on the health of the broader economy. As I mentioned in “Recent Developments”, at the moment, the world’s largest economy demonstrates resilience despite all the global challenges of the last few years. However, this strength means that the Fed might keep rates higher for longer, and this might ultimately cause a severe recession. Recession might adversely affect BAC’s financial performance and balance sheet with increased non-performing loans. Moreover, a recession will highly likely trigger a big selloff in the banking industry, as it happened in 2008-2009.

Bottom line

To conclude, BAC is still a “Strong Buy”. Challenges that we see in revenue and EPS decline are highly likely temporary and are caused by the harsh monetary environment. At the same time, the bank continues building a solid basis for sustainable revenue growth over the long term, with delivering organic growth via increased number of customer accounts and relationships. Moreover, BAC also aggressively drives growth in its GWIM segment, which is less vulnerable to swifts in monetary policy. The valuation is still quite attractive despite the recent rally.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.