Summary:

- Snowflake’s stock has faced volatility due to revised revenue growth expectations, but the recent 40% drawdown seems overdone.

- The company’s resilient backlog and strong bookings growth in the recent quarter suggest robust underlying demand, with revenue growth still exceeding the 30% threshold.

- Despite a slowdown in product revenue growth, the stock is undervalued based on EV/Sales/g ratio, compared to peers and has significant upside potential.

- The decision to include GPU-related costs in expenses and hire key personnel for AI capabilities indicates short-term margin pressure but potential long-term gains in the Generative AI trend.

RerF

Investment Thesis

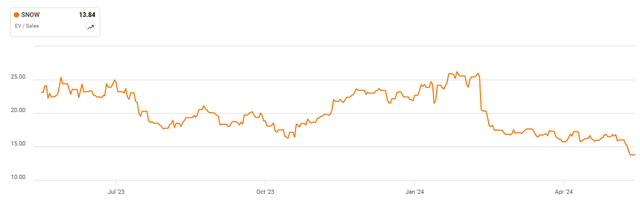

Snowflake’s (NYSE:SNOW) stock has been a roller coaster, largely due to the AI frenzy driving up growth expectations earlier this year, but it faced a reality check when the company significantly trimmed its growth outlook for FY2025. In my previous article, I initiated a hold rating due to the gloomy growth outlook and lofty valuation, which would prevent the stock from sustaining a rally. Since then, the stock was down 9% compared to a 27% rally for the S&P 500 index.

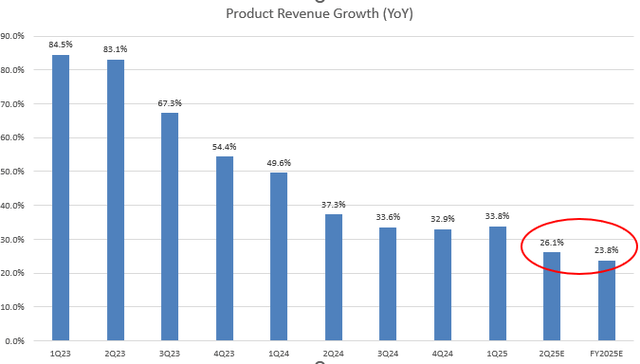

In the recent quarter, the company showed resilient backlog and bookings growth. With a strong product revenue beat and a 33% YoY growth, I believe the management’s full-year revenue guidance is conservative. In terms of EV/Sales/g, the stock is trading at a cheaper valuation compared to the sector average, following a significant reduction in the forward growth outlook. Since the street consensus has largely been set lower, I upgrade my rating to “buy” as the 40% drawdown over the past three months seems overdone.

Not A Hypergrowth Name

As we recall, SNOW projected a 22% YoY growth in product revenue for FY2025 in late February, significantly below the street consensus of +30%. Since then, the stock has fallen by almost 40%. For a software company with a 20% top-line growth, I would classify it as a mediocre “growth” stock rather than a “hypergrowth” stock if we only consider revenue growth. The company’s guidance was based on the assumption that customer consumption behavior would remain consistent with FY2024. According to the recent earnings call, this was largely due to increased revenue headwinds associated with product efficiency gains, tiered storage pricing, and the expectation that some customers will leverage Iceberg Tables for their storage.

Let’s look at the chart, despite projecting 26%-27% YoY growth for 1Q FY2025 back in February, the company largely beat the expectations with a 33.8% YoY growth last quarter. We can see that the product revenue growth rate remained above the 30% threshold, showing a slight uptick on a quarter-over-quarter basis. In addition, the company raised FY2025 guidance by $50 million. Therefore, I believe it’s possible that the management tries to navigate the near-term uncertainty by providing conservative guidance.

Demand is still Resilient

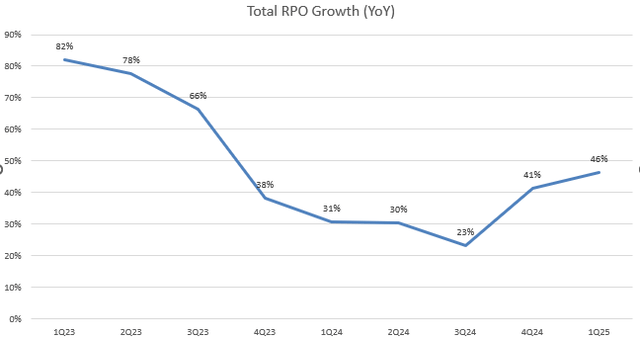

I admit that investors were spooked by a significant slowdown in growth outlook after 4Q FY2024, but its backlog actually accelerated in 1Q FY2025, growing 46% YoY compared to 31% in 1Q FY2024. This implies a strong rebound in bookings, which is the additional contract value that customers commit to in a given period. Robust bookings growth indicates high demand for SNOW’s products and services. Calculating bookings requires two components: revenue and remaining performance obligations (RPO). Although 1Q is typically not a major billing quarter for SNOW, total bookings in the last quarter surged by 78% YoY. I think this may suggest that the contracts may have longer billing cycles than in the past, as revenue growth is slower than backlog growth.

In the earnings call, when an analyst asked about the acceleration in RPO growth, management explained that they added a $250 million deal in 4Q FY2024 and another $100 million deal in the last quarter, which boosted the total backlog. They also signaled that more deals are expected to close in Q2.

Meanwhile, the number of large customers (with more than $1 million in revenue TTM) increased to 485 in 1Q FY2025, up from 460 in the previous quarter. Additionally, the company added over 1,000 customers in the past 6 months. Therefore, I still believe SNOW’s underlying demand remains strong.

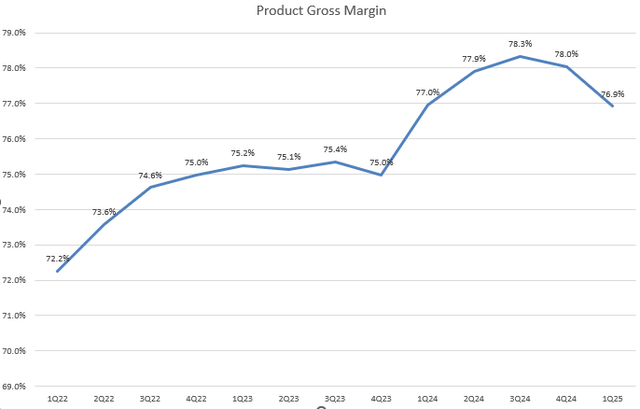

Continued AI investments Impact Margins

Despite a significant slowdown in product revenue growth, it’s encouraging to see that SNOW has achieved 76.9% product gross margin in the last quarter, mostly in-line on year over year basis. However, the management continued lowered the product gross margin outlook to 75% in FY2025, down from the 76% projected in 4Q FY2024. The CFO explained:

“As mentioned on our prior call, we have headwinds associated with GPU-related costs as we invest in new AI initiatives.”

Based on the earnings call, GPU-related costs will be included in both the “cost of revenue” and “research and development” expenses, impacting the gross margin and operating margin separately. Furthermore, the company plans to hire key employees from TruEra to boost AI capabilities for evaluating and monitoring large language model apps and machine learning models in production. Although the AI investments will hurt margins in the near term, I believe this effort will create massive opportunities in the current Generative AI boom.

Is It Really Expensive?

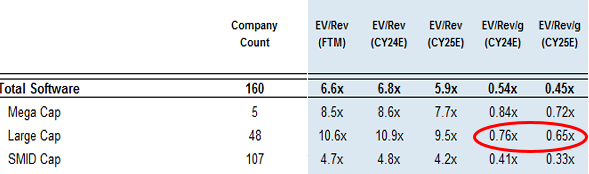

Despite the recent selloff, I know that some investors remain concerned about SNOW’s premium valuation. Currently, the stock is trading at 13.8x of EV/Sales TTM. The multiple is expected to come down to 11.9x if we factor in the revenue consensus for the next 12 months (FTM). This is still higher than the large-cap software sector average of 10.6 times EV/Sales FTM.

JP Morgan

However, when comparing the EV/Revenue/g ratio, SNOW’s multiple is lower than the peers’ average. Since we are currently in the middle of CY24, we can average the numbers for CY25E and CY24E, resulting in a ratio of 0.71, as indicated by the red circles shown above. Seeking Alpha shows that SNOW is expected to have revenue growth FTM of 27.6% YoY. Therefore, its EV/Revenue/g ratio is 0.43, which is significantly lower than the average. Considering the stock has declined by almost 40% over the past three months, I believe SNOW is currently undervalued in terms of its revenue growth potential. Additionally, the street consensus has been largely reset since Q4 FY2024. I believe the stock has many upside opportunities from here.

Conclusion

The bottom line: SNOW has faced significant volatility due to revised growth expectations in February this year, yet its resilient backlog and strong bookings growth suggest robust underlying demand.

Despite a significant slowdown in product revenue growth and near-term margin pressures from AI investments, I believe that the company’s conservative guidance and current valuation indicate potential for significant upside. With SNOW trading at a lower EV/Revenue/g ratio compared to peers and the recent 40% drawdown over the past three months, the stock seems to be consolidating at its current level. I can see the stock is undervalued given its growth potential. That’s why I’ve upgraded it to a “buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.