Summary:

- I find it challenging to recommend Accenture plc given its high valuation and recent downward revision of growth prospects.

- 20x forward free cash flow raises questions about the justification for paying such a premium.

- Despite its solid balance sheet and cash flow generation, uncertainties surrounding Accenture’s growth trajectory and valuation warrant caution.

Thomas Barwick/DigitalVision via Getty Images

Investment Thesis

Accenture plc (NYSE:ACN) specializes in consulting services. And its stock is priced at 20x forward free cash flow. A multiple that is expensive for what Accenture offers investors.

And to compound matters, the problem with paying this sort of high multiple for its stock, is that investors expect (or they demand?) that Accenture not only meets and beats its guidance but that Accenture should raise its revenue growth rates.

What investors truly find unacceptable is for management to reduce their growth prospects. And that’s what’s happened here. Accenture downwards revised its growth outlook for fiscal 2024 by a trifling amount, approximately 200 basis points.

Nonetheless, however small the downward revision, the outcome is the same, investors forcibly question whether paying a high premium for stock still makes sense?

Ultimately, I believe that the answer is no. Today, an investment in Accenture doesn’t make sense. Therefore, I’m moving to the sidelines ahead of the upcoming earnings release pre-market on June 20th.

Rapid Recap

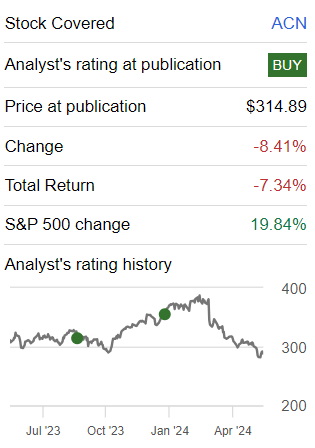

Back in January, I said,

[Accenture is] a stably growing, well-managed business. The stock is not blemish-free. Indeed, I openly discuss that its growth rates are practically non-existent.

However, I maintain that ACN is an attractive stock to consider. Not because of its unappetizing growth rates, but rather because the business oozes cash flows, and its balance sheet is so strong.

Author’s work on ACN

It turns out, I made a poor call on Accenture. Today, rather than doubling down on my conviction, I’m reconsidering my position and moving to the sidelines.

Accenture’s Near-Term Prospects

Accenture helps businesses succeed in the digital age. They provide consulting and outsourcing services to optimize operations, adopt new technologies, and drive innovation. They work across various industries to help organizations adapt to market trends.

Moving on, given Accenture’s record number of clients securing quarterly bookings exceeding $100 million and a significant increase in GenAI sales, makes Accenture is well-positioned to capitalize on future growth opportunities. Furthermore, its strategic investments in expanding its workforce, particularly in data and AI practitioners, reflect a commitment to adaptability.

However, Accenture also acknowledges a slower pace of spending, posing potential obstacles to revenue growth in the short term. Additionally, the evolving nature of client priorities, with a shift towards larger transformational projects, may impact the speed at which revenue from new bookings materializes.

Given this balanced background, let’s now discuss its fundamentals.

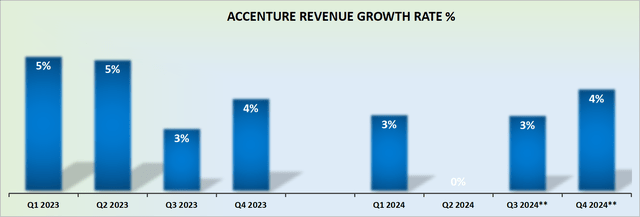

Revenue Growth Rates Slow Down

In my previous analysis, I said,

Accenture’s growth days are now a distant memory. The business is now on a path to deliver $70 billion of annual revenues and as such, its growth rates have all but evaporated.

The graphic above is a reminder of this aspect. Accenture is struggling to deliver mid-single digit growth rates.

For a while, investors are not overly perturbed by these lackluster growth rates, since this is a high-quality company. But now that the share price is moving lower, investors will start to ask questions. Difficult questions. With increasing rapidity.

Or, in other words, as long as the share price was moving higher, the lackluster growth rates didn’t perturb anyone. But now that the curtain has been pulled, investors are asking uncomfortable questions. If before, the thesis was, to invest first and ask questions later, today’s investors looking at Accenture’s stock are going to ask plenty of questions and most likely avoid buying the stock.

Given this framework, let’s now discuss its valuation.

ACN Stock Valuation — 20x Forward Free Cash Flow

At the high end of Accenture’s free cash flow guidance, the free cash flow is expected to increase by approximately 3% y/y, largely in line with its topline growth.

This is once again a reminder that Accenture has already maxed out all its operating efficiencies and the free cash flow can only increase, for the most part, alongside its topline.

To support my contention, consider this from the second quarter earnings release:

Days services outstanding, or DSOs, were 43 days at February 29, 2024, compared with 42 days at both August 31, 2023 and February 28, 2023.

Accenture’s DSOs are increasing. The DSO figure hasn’t meaningfully changed from the same period a year ago, but it’s evidently not decreasing either.

With that consideration in mind, I question whether it makes sense to pay 20x forward free cash flow for Accenture, a stock with low-mid-single digit growth rates.

That being said, the one overarching aspect of the bull thesis that we haven’t yet discussed is Accenture’s balance sheet. Accenture holds nearly no debt, and $5.1 billion of cash and equivalents. This has allowed management to pay out a fair dividend with a yield of approximately 1.8%.

But is this yield going to be enough to entice investors back into the stock? I’m not convinced.

The Bottom Line

Given the current evaluation of Accenture and its recent downward revision of growth prospects for fiscal 2024, I find it difficult to recommend further investment in the stock at this time.

Case in point, with Accenture’s stock priced at 20x forward free cash flow, investors may question the rationale for paying such a high premium, especially considering its low to mid-single-digit growth rates.

While the company boasts a solid balance sheet and a history of generating cash flows, uncertainties surrounding its growth trajectory and valuation make me hesitant to advocate for further investment in Accenture now. Therefore, I’m looking to deploy my capital elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.