Summary:

- Microsoft is increasing its spending on AI capabilities and has experienced a strong rebound in top-line growth due to its early success in AI monetization.

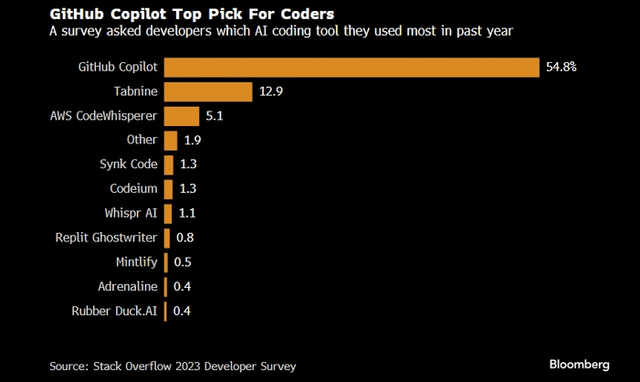

- The company’s AI product, Copilot, has attracted 1.3 million customers and is driving growth across the broader GitHub platform.

- The management mentioned a continued increase in capex on AI infrastructure in FY2025 while managing to maintain margins.

- The stock is currently trading at a premium valuation, reflecting its strong growth rebound in cloud and other AI initiatives compared to its software peers.

- MSFT is highly correlated with broader indexes, which diminishes diversification benefits and exposes investors to higher systematic risk.

Jonathan Kitchen

Investment Thesis

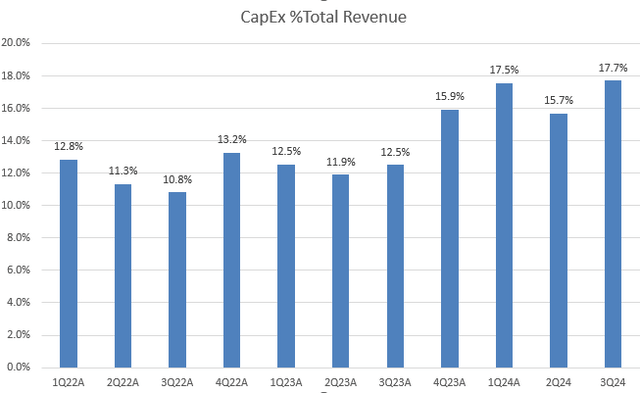

Microsoft (NASDAQ:MSFT) is undoubtedly experiencing many tremendous growth tailwinds under the current GenAI boom. The company has significantly increased its capex by more than 50% YoY over the past three quarters in FY2024. In my previous articles, I have been bullish on MSFT because I believe that faster-than-expected AI monetization can significantly boost its revenue growth. Since my last coverage about a year ago, the stock has achieved a return of 25%, ahead of the S&P 500 benchmark by 7.5%.

Despite these factors, I continue to see massive growth opportunities for MSFT, as the company continues to increase spending on enhancing its AI capabilities amidst the highly competitive industry, emphasizing its ambition to leading AI dominance. The recent strong Q3 FY2024 earnings results also confirmed my bullish thesis on the stock despite its premium valuation. The stock has rallied 15% YTD, which is almost in line with the broader index. Therefore, I reiterate my bullish view on MSFT, as the growth rebound thesis justifies a higher valuation and will continue in coming quarters.

Reaccelerating Growth

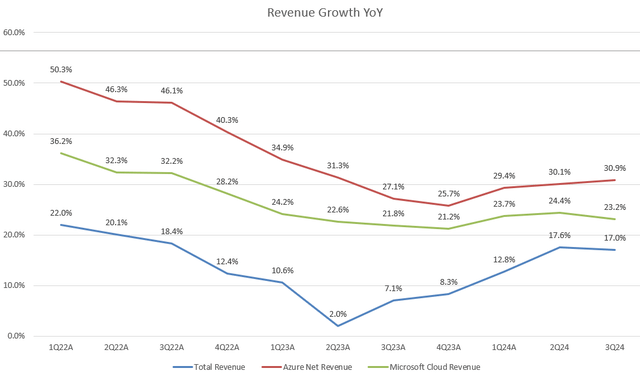

As indicated in the chart, MSFT has reached a key reflection point and is sustaining a robust rebound in its top-line growth. Total revenue accelerated to 17% YoY in Q3 FY2024, up from 7.1% YoY in Q3 FY2023. Particularly, the company’s growth engine, Azure, has been accelerating over the past four quarters, achieving 30.9% YoY growth in 3Q FY2024. This outpaced Google’s (GOOGL) Google Cloud at 28.4% YoY and Amazon’s (AMZN) AWS at 17% YoY in the recent quarter. During the Q3 FY2024 earnings call, the management projects Azure to grow between 30% and 31% YoY on a constant currency basis in 4Q FY2024, maintaining its over 30% growth trajectory. Additionally, MSFT is expected to maintain a double-digit revenue growth in FY2025.

I believe that MSFT has largely rebuilt growth momentum through effective execution of its GenAI monetization initiatives. These include significant traction with Microsoft 365 Copilot, its exclusive cloud relationship with OpenAI, and strong upside performance for Azure.

Copilot Is “On Fire”

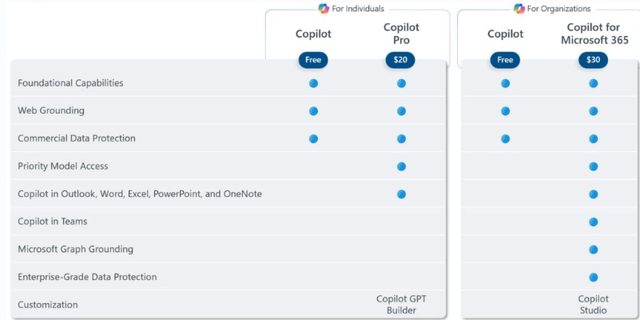

MSFT has been accelerating AI innovations, with over 150 Copilot capabilities added since the beginning of CY2024. According to a Bloomberg article, Copilot has already attracted 1.3 million customers. In the recent earnings call, management highlighted Copilot’s role in democratizing expertise across the workforce, spanning from enterprises to small businesses. Particularly, nearly 60% of the Fortune 500 now employ Copilot, and accelerated adoption is evident across industries.

Moreover, Copilot is driving growth across the broader GitHub platform. With over 90% of the Fortune 100 now GitHub customers, revenue has surged by over 45% YoY. It’s evident that its top-line growth associated with AI products for MSFT is currently outpacing peers like GOOGL.

Elevated Capex on AI Infrastructure

Despite MSFT’s early success on its AI roadmap, I believe the company can continue to expand in the future, especially considering the management’s commitment to significantly increase spending on AI infrastructure. Looking at the chart, we can see that its capex as a percentage of total revenue has risen sharply to the high teens digits in recent quarters from the low teens digits a year ago, driven by the GenAI frenzy starting from late CY2023. During the recent earnings call, the management indicated that capex investments will increase materially on a sequential basis and that FY2025 capex will exceed FY2024 levels. While the elevated spending may create a near-term headwind on FCF, I believe that the decision is supported by a robust demand outlook, buoyed by the gradual resurgence of cloud migrations and the ongoing momentum in AI adoption and monetization.

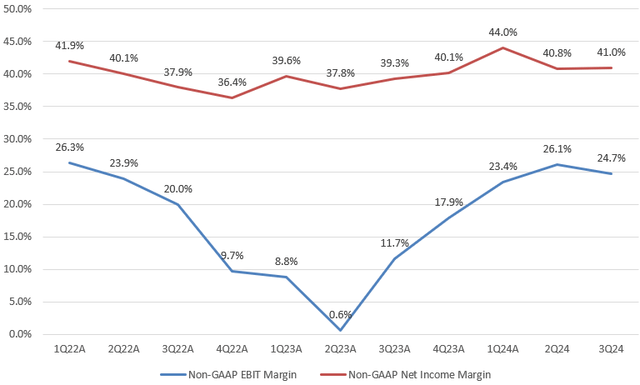

Margins Continue Expanding

It’s remarkable to see that the company has effectively enhanced its operational efficiency, with the non-GAAP EBIT margin expanding since 2Q FY2023. The company achieved 24.7% in 3Q FY2024, reflecting a substantial expansion from 11.7% in 3Q FY2023. Despite substantial capex investments in AI and costs associated with the Activision deal, the management only adjusts the EBIT outlook for FY2025 by -1bps.

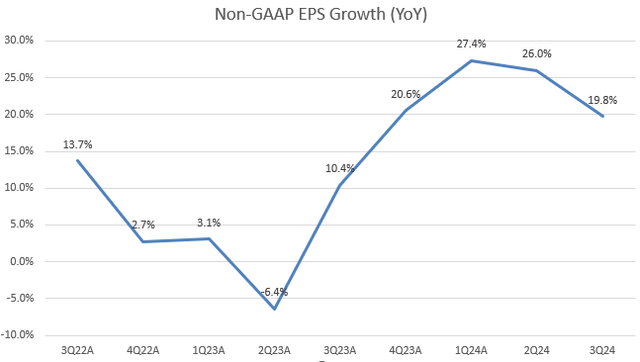

Additionally, we can see a continued expansion in non-GAAP net income margin. The company achieved 41% in 3Q FY2024, compared to 40.8% in the previous quarter and 39.3% in 3Q FY2023. This combination of revenue growth rebound, and ongoing margin expansion demonstrates a significant acceleration in EPS growth. As shown in the chart, MSFT has increased its non-GAAP EPS by 20% or more over the past four quarters, which was justified a 90% stock rally from its CY2023 low.

Valuation

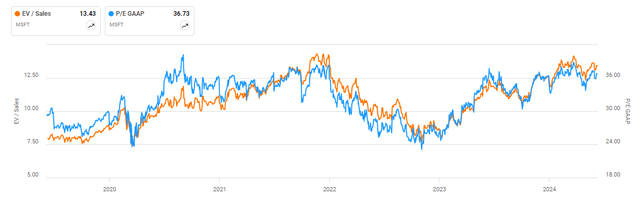

While MSFT is experiencing a faster organic revenue growth, the stock is currently trading at a premium valuation. Normally, I believe that a stock trading above 10x EV/Sales is perceived lofty. Considering MSFT’s forward growth outlook, the stock is still trading at 13x EV/Sales Fwd and 36x non-GAAP P/E Fwd. Meanwhile, we also notice that these valuation multiples are approaching to 5-year upper bound. Indeed, I admit the stock is becoming more expensive, but the current premium valuation justifies its long-term growth potential, which is being unlocked by AI capabilities. Investors should focus on the fact that the company has significantly increased capex to expand its cloud and AI footprint for the future.

What Could Go Wrong

However, I believe there are two risk factors that investors should consider before increasing exposure to MSFT at the current price level. Firstly, due to significant multiple expansion over the past 12 months, the stock has already priced in numerous growth tailwinds stemming from the AI boom. Therefore, the reaction to a downside earnings surprise may be more severe than to an upside earnings surprise. From a risk-reward perspective, I think the stock’s further upside potential would largely depend on its ability to consistently beat market consensus and raise forward guidance.

Secondly, MSFT carries the largest weight in the S&P 500 index, accounting for 7.2%. This implies high correlation with the broader market. Therefore, from a portfolio construction standpoint, MSFT has higher systematic risk and provides less diversification benefit compared to other software peers.

Conclusion

In summary, despite its premium valuation, MSFT stands at the forefront of the current GenAI boom, showcasing an impressive growth trajectory in revenue, particularly fueled by its AI initiatives such as Copilot and Azure. Despite significant capex investments in cloud and AI infrastructure, it’s surprising that MSFT continues to demonstrate robust operational efficiency through margins expansion. However, investors should be cautious of potential downside risks, including the stock’s high sensitivity to negative earnings surprises and its high correlation with the broader market volatility due to its substantial weighting in the S&P 500 index. Nevertheless, I reiterate my bullish view on the stock, as the increase in its spending on AI capabilities and the fast pace of AI monetization will continue to drive the stock higher in the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.