Summary:

- It may be tempting to sell Exxon Mobil Corporation in view of expectations of revenue and EPS growth peaking and the stock being up more than 2.5x since Covid.

- The current Exxon Mobil valuation, however, suggests there could be upside as the EV/EBITDA is close to 50% off its 5 year average.

- Exxon Mobil management expects continued improvements in the company’s cost structure to lead to doubling of earnings and cash by 2027.

- Exxon Mobil recently made a strategic capital allocation choice of boosting buybacks instead of increasing dividends; this enables it to manage expectations and improves its liquidity and future optionality.

- The fact that Exxon Mobil’s dividend yield is 3.35% is also compelling as this is more or less in line with the return on risk-free government paper in developed markets.

JHVEPhoto

When analyzing an industry stalwart like Exxon Mobil Corporation (NYSE:XOM), it’s important to bear in mind that most of its consequential stockholders are invariably large institutional players with long-term investing time horizons.

With this in mind, and looking at the stock’s performance over the past 6 to 12 years, it’s fair to conclude that long-term investors have experienced three markedly different episodes in their journey holding XOM. Broadly speaking there’s the good but not outstanding period between 2010 and 2014, the lackluster and agonizing years of 2015 to Covid in 2020, and the incredible period following the pandemic.

The chart below, which shows how XOM’s market cap has evolved from Jan 2010 to date, illustrates this.

Seeking Alpha

The long and short of this chart is that investors were taken for a superb ride between Q4 2010 and Q4 2014 thanks in large part to favorable global oil prices at the time and the U.S. fracking boom that increased revenue and earnings across the U.S. upstream oil and gas space, including for integrated industry leaders like XOM.

Over this period, XOM’s market cap increased from a low of around $275 billion to a high of approx. $447 billion, representing an upside of around 65% plus dividends to the hypothetical investor who successfully timed the market and held through the rough volatility characteristic of oil and gas stocks. This was not too bad, but also not outstanding.

In comparison, the subsequent period between 2015 and the Covid-19 market crash in 2020 was lackluster at best if not downright agonizing. The highest trough-to-peak increase in market cap was just 25% from around $313 billion in Q2 2015 to approx. $380 billion in Q2 2016. Thereafter, the stock steadily lost value for around 15 straight quarters to approx. $300 billion prior to Covid when it plunged to $130 billion (a level last seen before the year 2000) amid an unprecedented collapse in the global price of oil and a global stock market crash.

While it goes without saying that hindsight is always 20/20, the pandemic crash presented an incredible buy opportunity, as XOM has rocketed close to 2.5x since March 2020 when the pandemic roiled global markets.

XOM’s incredible post-covid performance has been fueled by a range of catalysts such as supply chain disruptions, the Russia Ukraine war, red hot inflation, and economic reopening – these events led to a surge in energy prices and record revenues, earnings and cash for oil majors like XOM.

No hurry to sell

After these kinds of returns, it could be tempting to sell XOM and move to newer opportunities in 2023. After all, XOM operates in a cyclical industry and the good times will inevitably come to an end. However, looking at the current valuation, XOM is still undervalued relative to its historical valuation. It sports an EV/EBITDA (“FWD”) of 4.42x vs a 5 year average of 10.99x. This undervaluation means that – in terms of probabilities – the odds of it increasing are reasonably high (other factors held constant and the triple digit run since covid notwithstanding).

To be clear, XOM is unlikely to replicate its recent performance going forward. I nonetheless believe it will hold on to its current historically high market value of above $400 billion market cap or even increase meaningfully for two main reasons.

The first reason I posit is that XOM’s fundamental picture in terms of the underlying business’s value creation for stockholders has changed significantly. To demonstrate this, I’ll look at four metrics: EPS, Cash, Net Debt and the Dividend, which I believe together tell the overall story of the relative value a business creates for its stockholders over time. The timeframes selected are pre-covid (2016), Covid (2020) and post-covid (Last report).

|

Dec 2016 |

Dec 2020 |

Last Report |

|

|

EPS |

$1.88 |

($5.25) |

$12.23 |

|

Cash |

$3.65 billion |

$4.36 billion |

$30.40 billion |

|

Net Debt |

$39.10 billion |

$39.15 billion |

$15.02 billion |

|

Quarterly Dividend/share |

$0.75 |

$0.87 |

$0.91 |

As far as XOM’s shareholder value creation journey goes, the trend is evidently positive and the company has created tremendous value for shareholders since the pandemic. The fact that the stock is undervalued relative to historical multiples suggests that there could be some upside at current levels.

The second reason why there could still be upside in my opinion is that the management is sending the right message to investors with its current capital allocation strategy, specifically its clear preference of buybacks to dividends.

XOM on December 8th presented its capital plan for FY 2023, which included an aggressive increase in its authorized share buybacks to $50 billion over three years following record free cash flow that reached $22.0 billion in Q3 of 2022. XOM previously had a $30B stock buyback in place that was expected to be completed in FY 2023. The upsized $50B stock buyback will last through FY 2024 and includes the $15B that the company is expected to spend on buybacks in 2022.

Managing expectations is key

Seeking Alpha contributor The Asian Investor in a recent article argued that it would have been better for XOM to spend its capital on dividends instead of these buybacks. I disagree because buybacks give the management team more options vs. increasing dividends. This sends a better message to investors and could support the stock price amid expectations of peaking top line and EPS.

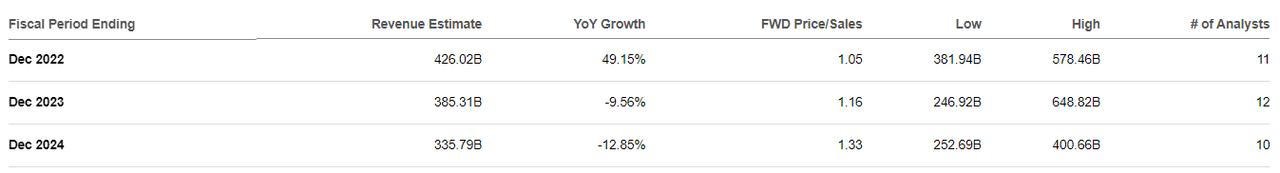

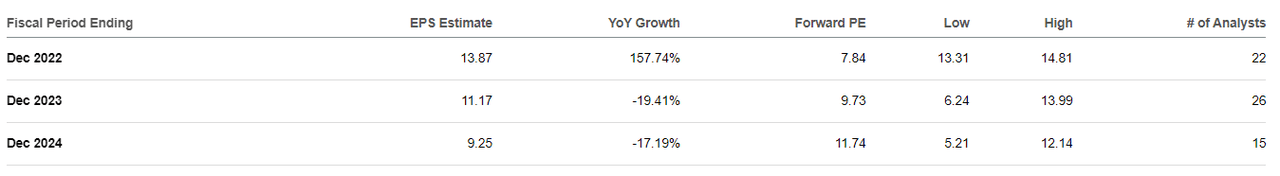

XOM Revenue Estimates (Seeking Alpha) XOM EPS Estimates (Seeking Alpha)

It’s important to note that XOM has consistently increased its dividend since 2002. An abnormally huge increase in dividends right now due to record free cash flow would mean that in later years of moderate profits XOM would have to break its streak of consistent dividend growth or dramatically increase leverage. Whichever choice it makes, the stock will likely suffer a huge drawdown as a result.

When it comes to investor relations, setting expectations is just as important as managing them. That is why in my opinion it is better for XOM to spend excess cash flow on buybacks as this more strategic and provides optionality when compared to increasing the dividend.

Equally important to note is that authorization of a buyback plan and actual execution are not the same thing. The company can basically dollar cost average, ensuring it gets the best value from the buybacks. It also doesn’t need to spend all the cash authorized for buybacks and can underspend in the three year period and use the excess cash on its books to sustain dividend increases in future when oil prices and overall margins are less elevated than they are today.

Conclusion

Exxon Mobil Corporation’s management expects its earnings and cash flow to double by 2027 on continued cost savings initiatives. While we should, of course, take management forecasts with a pinch of salt, it’s important to note that there are several compelling catalysts for continued high oil prices that suggest management is not wrong on the direction of growth of its earnings and cash flow.

Those bearish on oil prices have in my opinion overstated the recession risk and also downplayed the huge impact that reopening in China could have on oil demand. It’s also important to note that the factors that have kept oil prices elevated are not primarily rooted in emotions of greed, but those of fear, which tend to last longer. Concerns over energy security have an outsized impact on oil prices and I don’t expect this to change.

Looking further into the future of Exxon Mobil Corporation, the push for clean energy and ESG investing are not threats to XOM as some may imagine but unexpected tailwinds. These trends are constraining supply of fossil fuels, which is likely to support high oil prices for some time until clean energy reaches a critical mass of adoption. It is also reassuring that XOM, like most of its peers, is a significant player in the shift to clean and sustainable energy, meaning oil will at some point go away but XOM will likely stay in place as an energy industry leader.

In view of these factors, I see no reason to sell Exxon Mobil Corporation if you already own the stock. Locking in some profits may be acceptable, but walking away from the table wouldn’t be the best move in my opinion. Exxon Mobil Corporation stock still has upside given the expected growth in earnings and cash, the low valuation, and the management’s strategic use of capital. The fact that XOM’s dividend yield stands at 3.35% is also impressive, as this is more or less in line with the return on risk-free government treasuries in developed markets, so you can sit on your money and earn some income as you wait.

Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.