Summary:

- Micron Technology is set to report earnings on June 26, 2024, with 26 positive and 1 negative EPS revision by analysts.

- MU is ramping up production of HBM3E and expects to see an increase in sales in e2h24 with strong tailwinds in eFY25.

- The Company should realize strong tailwinds driven by AI servers and the next refresh cycle for general compute servers with the release of HBM4E.

hapabapa

Micron Technology (NASDAQ:MU) will be reporting earnings on June 26, 2024, with lofty expectations for both top-line growth and some margin expansion as the firm enters the next cyclical upswing as customers have been destocking inventories for the last few quarters. Management denoted that customers are still rightsizing inventories as a result of the supply shortage followed by the surplus following the C19 supply chain lockup. As firms moved away from a bloated inventory level and back to a more normalized level, management anticipates buying to experience a strong upswing going into e2h24 followed by strong tailwinds throughout eFY25 driven by AI factory buildouts. Analyst EPS estimates have been revised up 26x and 1x down in the last 90 days, suggesting that analysts are relatively optimistic about the growth trajectory of MU and that earnings may have bottomed. I maintain my STRONG BUY recommendation with an increased price target of $35/share at 13.24x eFY25 EV/aEBITDA.

Be sure to review my previous coverage of Micron here:

Micron Will Experience Strong Tailwinds As GPU Capacity Loosens Up

Micron Operational Updates

Management remains optimistic about Micron’s growth trajectory going through e2h24 and anticipates a significant acceleration throughout eFY25 as firms continue to build out their regional AI factories at an accelerated pace. Management’s forecast for infrastructure and endpoint devices remains relatively aligned with my thesis for the industry, as outlined in my previous reports covering Nvidia (NVDA), Hewlett Packard Enterprise (HPE), and Dell Technologies (DELL), in which I discerned significant growth across data center infrastructure driven by AI servers accelerated by H100 GPUs with relatively flat growth across consumer handhelds and PCs. If this thesis continues to play out, we can expect a major uplift in DRAM sales going into e2h24-eFY25 as hyperscalers and enterprises build out their next-generation data centers and AI factories. Though the traditional server business is forecast to experience some tailwinds going into the end of eCY24, which will drive NAND sales, management anticipates most of the growth in the near-term to be driven by investment in AI infrastructure that will drive sales of their DDR5 32Gb server DRAM products as firms further explore memory-intensive GenAI applications.

Mr. Sadana recently spoke at the Goldman Sachs Global Semiconductor Conference on May 30, 2024, where Mr. Sadana outlined the roadmap for the duration of eFY24 & eFY25. At a high level, Mr. Sadana suggested that capex for eFY24 will come in at the higher end of their provided range of $7.5-8b for the year as the firm continues to invest in the next generation of memory chips and HBM chipsets. He mentioned at the conference that management anticipates a strong upswing in HBM3E chips as they offer significant storage benefits to data centers. Mr. Sadana mentioned that a year ago, HBM chips accounted for less than 2% of chips sold and now are over 10% with the expectation of a 50% CAGR going forward. He also mentioned that HBM3E chips are seeing strong demand across data center customers as they feature -30% power consumption when compared to their next alternative. Micron is continuing to ramp up production of these chips and anticipates:

several hundreds of millions of dollars of fiscal ’24 revenue with HBM, and going to fiscal ’25 and calendar ’25, getting to multiple billions of revenue in HBM, and that’s the trajectory we are on.

Sumit Sadana

Following HBM3E will be HBM4E, with some expectations of logic being integrated into the base die of the HBM with a more customized approach. This next generation of HBM chips can very well drive margins further beyond what is expected for HBM3E, given the cost and complexity of the chips. Mr. Sadana also discerned on certain adjustments to long-term agreements for these chips that should create a more beneficial engagement between Micron and the customers in which the agreements will no longer be focused on quarterly volumes but, rather, on pricing and volumes. This should alleviate a lot of the guesswork and delineate from a commodity-like product into one that’s more specialized. As he had mentioned in the Goldman Sachs conference, pricing and volumes are set for eFY25.

In automotive, Mr. Sadana mentioned strong interest in HBM, which will be utilized for driver-assist capabilities in vehicles. Since the summit, Micron announced their full suite of automotive-grade solutions for Qualcomm’s (QCOM) automotive platforms. Micron suggested that they will contribute their LPDDR5X memory chips, UFS 3.1, Xccela flash memory, and their quad serial peripheral interface NOR flash that will be pre-integrated into Snapdragon automotive solutions and modules. These chips will be applied in all digital features of the vehicles, including the infotainment system, ADAS system, and the digital cockpit. Though I do not anticipate an improvement in automotive sales for the duration of eFY24 and eFY25, additional content sales per vehicle may create some tailwinds to Micron in a flat automotive market.

A similar thesis is set for smartphones and AI PCs, in which growth is anticipated to be flat for the duration of eFY24 as consumers remain stretched resulting from elevated inflation rates. Mr. Sadana suggested that AI-enabled smartphones and AI PC sales would be more of a replacement sale rather than sales growth, suggesting that consumers may not be seeking to upgrade to the next generation of devices. Announced on May 7, 2024, Micron is delivering the LPCAMM2 with LPDDR5X memory chips for the AI-enabled Lenovo ThinkPad P1 Gen 7 Workstation. This stack is said to consume up to 58% less active power and provide 64% space savings when compared to DDR5 SODIMM. In addition to this, Micro announced the start of customer sampling of their next-generation GDDR7 graphics memory chips for gaming and AI. These 32Gb high-performance memory chips are power-optimized and offer up to 60% higher bandwidth and are 50% more power-efficient than GDDR6 chips. This will provide gamers with faster response times, smoother gameplay, and reduced processing time.

Micron Financial Forecast

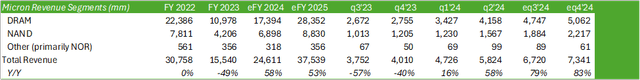

Forecasting out financials, I anticipate strong growth in DRAM going into eq4’24 and further into eFY25 as customers destock inventories in anticipation of the next buying cycle. NAND will also experience strong tailwinds going into eFY25 as general compute servers pick up during the next refresh cycle.

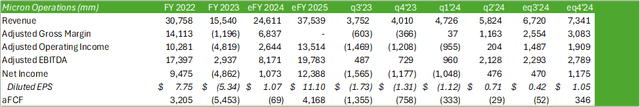

In addition to strong growth going into e2h24 and eFY25, I anticipate strong margin expansion as HBM3E ramps up to a more significant proportion of total sales and as the firm rolls out the next generation HBM4E. I increased my financial forecast when compared to my previous analysis as linked above in the summary as a result of strong AI server sales by both Dell and HPE. My recent report covering Oracle Corp. (ORCL) confirms the strong growth for AI factories as the firm builds out 200MW AI factories and is in the process of constructing a 1GW AI factory. Though I anticipate the majority of AI infrastructure sales to remain with the hyperscalers for the duration of eCY24, I do anticipate enterprises to begin ramping up their AI infrastructure in eCY25 as the supply chain for Nvidia H100s loosens up and as hyperscalers adopt H200s and Blackwell GPUs. If this occurs, Micron may realize significantly higher growth for memory and storage chips for both CPU and GPU servers.

Valuation & Shareholder Value

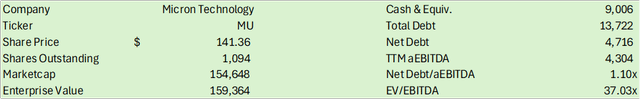

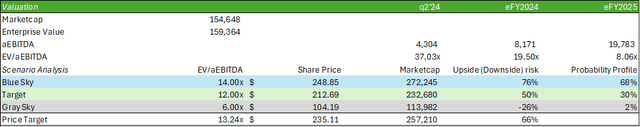

Looking ahead to the upcycle for Micron, I anticipate significant margin improvement and cash generation as a result of higher-spec chip sales. Compared to my previous valuation of MU shares, I have increased my model to the upper end in my scenario analysis as I anticipate a stronger ramp-up of AI infrastructure going into eFY25. Despite MU shares being up 67% YTD, I anticipate significant room for share price growth as the firm moves into the next cyclical upswing in memory and storage chips.

I reiterate my STRONG BUY recommendation for MU shares, with an increased price target of $235/share at 13.24x eFY25 EV/aEBITDA.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.