Summary:

- PepsiCo has been underperforming the market for the past decade.

- The company is facing significant headwinds, including market share losses in beverages.

- The path to market-beating returns for PepsiCo is uncertain, leading to a downgrade to a Hold rating.

Fotoatelie

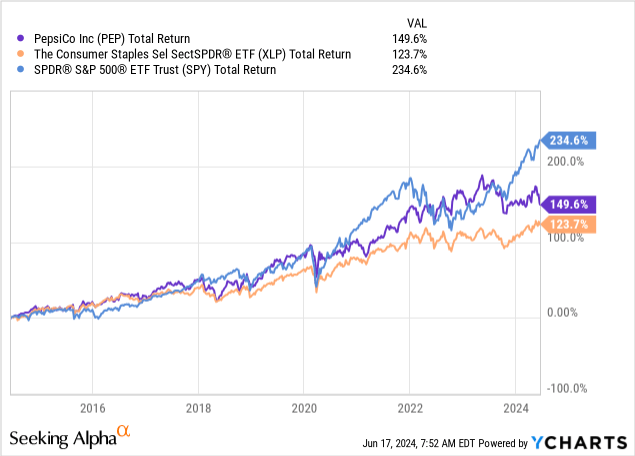

PepsiCo (NASDAQ:PEP), the dividend investor’s darling, has been underperforming the market for the past decade, along with its consumer staple peers.

The list of headwinds is getting longer, as the rise of private labels, volatile foreign currency, cost inflation, and limited growth opportunities, are now joined with significant market share losses, specifically in beverages.

I downgrade the stock to a Hold as I see no path to market-beating returns.

PepsiCo’s Underperformance Amid Staples Woes

I’ve been covering PepsiCo on Seeking Alpha since March of 2023. I initiated coverage with a Buy rating, as the company was consistently taking market share and had a clear path to margin expansion. The main reason for the buy rating, though, was the company’s track record of stable and resilient revenue growth.

At the time, PepsiCo traded slightly below its historical valuation, and I expected it to be a market-beating investment by maintaining its multiple, growing EPS, buybacks, and dividends.

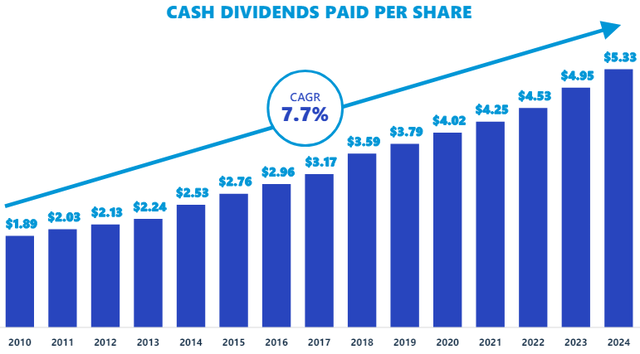

After all, PepsiCo is a dividend darling for a reason, as it’s been one of the most resilient companies in the world since its inception.

PepsiCo CAGNY 2024 Presentation

However, over time, several core aspects of our investment thesis became increasingly uncertain. PepsiCo had two consecutive quarters of little to no growth and the margin expansion story became more bumpy than expected, partially due to a recall.

And while PepsiCo and staple peers struggle to generate actual top-line growth, other parts of the market are surging ahead:

Despite all of the above, I maintained a Buy rating, although this time it was because of valuation. I expected that as long as PepsiCo continues to gain market share, it’ll eventually recover to its historical valuation.

However, that thesis is now broken too. Which leads me to the rating downgrade.

And Now, PepsiCo Is Losing Market Share

The one thing I liked about PepsiCo during the coverage period is that it constantly gained market share. My view was that staple companies are coming out of a wild pandemic period, and they need several quarters, or even years, to realign their operations with normalized trends.

With the consumers’ budget being pressured and private labels providing an exceptional value proposition, I expected a period of struggles.

I did not expect, however, that PepsiCo would start losing share to its peers.

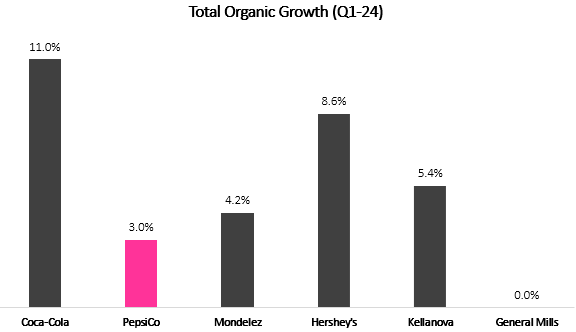

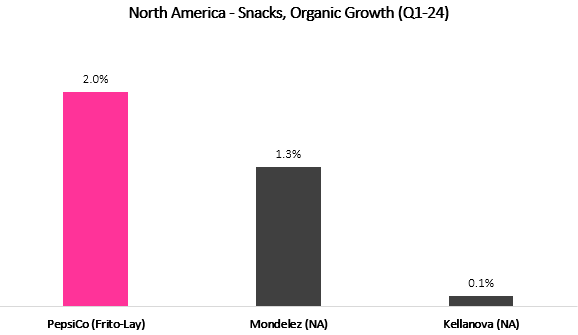

Created by the author using data from the companies’ financial reports.

Besides General Mills (GIS), PepsiCo had the worst first quarter among the peer group. While PepsiCo is the largest in size, historically it wasn’t an issue and the company was able to grow above the majority of its peers.

Importantly, PepsiCo’s numbers were dragged by a recall in its Quaker Foods segment. Yet, looking at the rest of the segment results, we see market share losses as well, specifically in beverages.

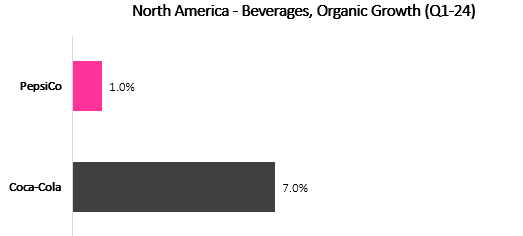

Created by the author using data from the companies’ financial reports.

Coca-Cola’s (KO) North America Beverages segment outgrew Pepsi’s by 6%, the largest gap in years. Notably, the company’s business model is different, with PepsiCo controlling its entire value chain and Coke outsourcing it. Still, Coca-Cola’s total sales far outpaces Pepsi’s, and it has done so with better margins as well.

Created by the author using data from the companies’ financial reports.

The one outlier was PepsiCo’s Frito-Lay North America segment, which outgrew peers. However, 2.0% organic growth, and essentially flat reported growth, is nothing to brag about.

Profitability Improvements Are Not Enough

Historically, PepsiCo’s operating profit was quite stable in the 16% range. That, combined with a steady mid-single-digit organic growth, resulted in PepsiCo’s historical valuation, which was in the 22x-25x P/E range.

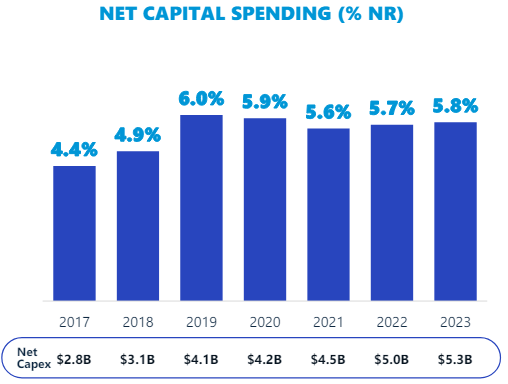

PepsiCo CAGNY 2024 Presentation

Over the past several years, PepsiCo increased its capital investments, as its manufacturing facilities became old and required maintenance, with the primary goal of achieving productivity gains.

So far, those investments have not translated into profitability, as the company is still below its historical highs for operating margins.

For PepsiCo’s shares to work, the company will need to deliver on its high-single-digit EPS growth story. With little to no growth, profitability gains will need to be much more significant, and so far, they are not enough.

Valuation

So many times you see analysts basing their thesis on a company’s historical multiple. Taking for granted, a reversion to the mean sometime in the future.

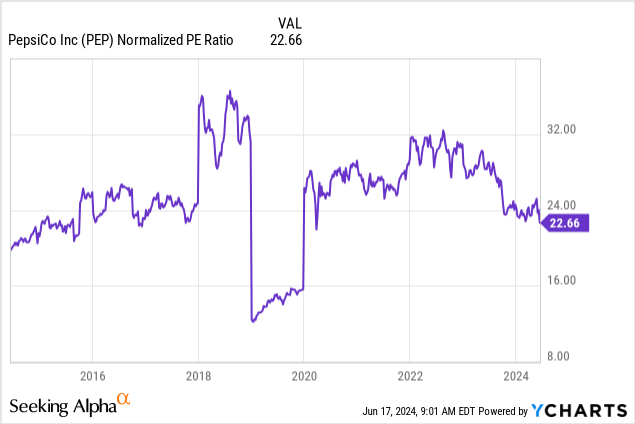

When it comes to PepsiCo, such an exercise will tell us the company is trading approximately 15% below its historical averages, with the company trading at 22 times earnings, compared to the 5-year average of 25 times.

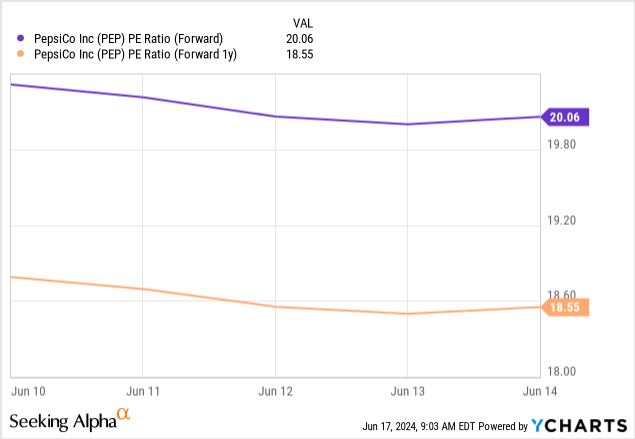

Furthermore, the company is trading at 20x forward earnings, and 18.5x next year’s earnings. Again, on a shallow look, those are seemingly attractive.

However, as we discussed, the current context demands, in my view, a lower multiple. In short, PepsiCo isn’t growing as fast as it used to, as competition is increasing, especially from private labels, and the company is losing share to Coca-Cola. Meanwhile, margins are not expanding fast enough to offset the lower growth, despite an increased level of capital investments.

The combination of all these factors leads me to the conclusion that the path for PepsiCo’s recovery is very much uncertain. Therefore, I wouldn’t want to buy shares here, despite the lower valuation.

I would consider entering a position if we get better clarity on recovery, or if shares are meaningfully lower.

It’s important to note, that even despite the recent struggles, PepsiCo is still trading at a multiple that’s higher than the S&P 500’s.

Conclusion

PepsiCo is one of those companies that attracts prudent dividend investors, due to its long track record of dividend increases and growth.

Being a consumer staples giant, the company is viewed as highly resilient and is perceived as a safe haven.

While I agree it’s hard to envision significant losses from investing in PepsiCo here, it’s equally hard to envision a path to market-beating returns.

With the company’s headwinds piling up and seemingly going nowhere, I downgrade PepsiCo to a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.