Summary:

- I am reiterating my Buy rating due to strong pricing dynamics and expected significant uplift in HBM revenues.

- The memory market is highly cyclical, with recent capacity constraints and strong demand leading to price increases and strong sales growth for Micron.

- Micron was late to the HBM market but is gaining share, and I believe the company is likely to beat on estimates in Q3 with compelling results and guidance.

hapabapa

Prelude

I initiated coverage of Micron Technology, Inc. (NASDAQ:MU) following Q2 earnings, calling it a blowout report. Today, I’m following up and reiterating my Buy rating on strong pricing dynamics in the memory industry. The market heavily rewarded Micron after fiscal Q2, given the surprisingly strong HBM performance and early return to profitability. Following the Q2 report, I wrote

I am now much more bullish on Micron’s medium-term outlook. The growth story here is compelling as long as you believe demand for AI accelerators will be robust. I do believe this demand is robust at least through 2024, and therefore am initiating coverage of Micron with a Buy rating. Micron is a leader in the memory industry and will be a critical player in the ongoing build of accelerated computing infrastructure.

This thesis has held water. The stock has returned 23% since my initial coverage, and the fundamentals of the memory industry continue to improve. In March, Chosun reported that NAND flash inventories are stabilizing while prices and production are increasing. Meanwhile, Tom’s Hardware reported in May that “prices of HBM memory are expected to increase by 5% to 10% next year… Furthermore, prices of other types of DRAM will likely increase as well, with DDR5 predicted to increase by 15% to 20% due to memory manufacturers shifting priorities to HBM production.”

Much of this is driven by the surging demand from data centers, which is also supporting SSD demand. Robust demand, NAND supply/demand re-balancing, and re-allocation of production capacity to HBM has led to higher than previously expected price hikes across the industry.

This leads to my thesis for this article: a strong Q3 beat and very upbeat Q4 guidance. The market doesn’t re-price stocks based on industry reports suggesting strong price hikes, it re-prices based on real results from companies. Micron’s upcoming report will show the impact of the stronger than expected price recovery, and it will be re-priced accordingly.

Valuation

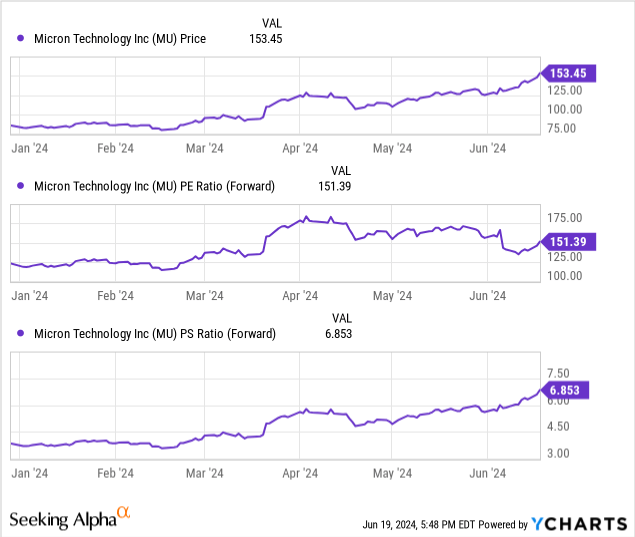

While Micron’s current prices suggest all upside is priced in, I believe the stock has further room to run. I would not typically recommend buying a stock with such high current valuation multiples, but the market has shown its willingness to pay such prices recently. Look no further than Broadcom’s (AVGO) recent 20% post-earnings pop despite a strikingly high sales multiple.

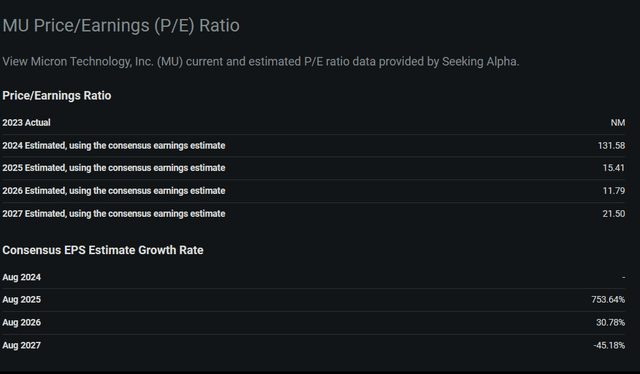

The current non-GAAP FWD P/E ratio sits above 130, which is obviously a steep price to pay. This is a temporary phenomenon though, as strong sales growth, gross margin explosion, and record levels of demand across numerous end-markets is expected to drive the earnings multiple down materially in the next few years. Paying 15x ’25 earnings for a leader in an explosive growth, albeit commoditized and highly cyclical, industry that’s experiencing numerous fundamental tailwinds is a very reasonable price to pay. The memory industry’s cyclicality is benefitting Micron right now, and it’s unwise to bet against a cyclical upswing.

Seeking Alpha Micron Valuation Tab

I find it highly likely Micron will post a strong beat on estimates in Q3 and provide even stronger guidance given a broader industry recovery and strong share gains in HBM. HBM continues to dominate the narrative, but supply/demand dynamics in non-HBM segments could provide surprising uplifts in revenue. Herein lies the key risk core to this thesis: meeting expectations.

Risks: High Expectations, Difficult Execution

Micron has set the audacious goal of capturing roughly 25% of the HBM market by 2025. Yet, the only public design win currently is the H200, while SK Hynix touts the highest volume AI chip, the H100, and Samsung is in validation for the B200. Meanwhile, Samsung is supplying HBM3e for the MI325x.

This risk was mitigated recently by a report from Business Korea, stating that Micron’s HBM3E will be used in Nvidia’s GB200 chip. Yet in the same article, Business Korea reiterates the incredible rise and meaningful risk:

The semiconductor industry has taken note of Micron’s rapid advancements. Choi Jung-dong, an industry expert, remarked, “When the U.S. lab researches the 1st and 3rd generation processes, the Japanese lab handles the 2nd and 4th generation processes. Over the past five years, they have nearly halved the development time compared to competitors.” This ‘zigzag’ strategy has allowed Micron to stay ahead in the technological race. However, the competition is not without its challenges. An industry insider noted, “Although there are still many issues with production volume and yield, in terms of performance alone, many evaluations suggest Micron is the most advanced.” This sentiment is echoed by another insider who stated, “Latecomers like Micron are taking aggressive, almost gambling-like strategies to compete.”

Further, Micron’s continued dependence on the NCF approach to HBM manufacturing, while SK Hynix uses MUF and Samsung is rumored to be exploring it as well, could signal they are at risk of being left behind if MUF is indeed the superior approach.

While I do believe it’s likely Micron will beat and raise in the upcoming quarter, the stock could still be hurt if the company doesn’t gain as much market share as expected. Any comments on market share or manufacturing challenges will be met with a very negative market response.

With that, let’s dive into the core of the article. From here, I’ll provide a brief overview of the memory industry, a look into the current state of the HBM market, and finally will reiterate why I believe Micron remains a good option despite high valuation and strong YTD performance.

The Memory Market

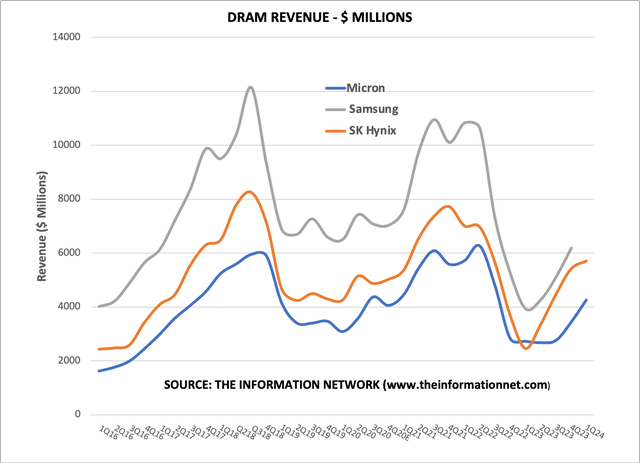

The memory market is dominated by supply/demand dynamics. When business is booming and demand outpaces supply (or some exogenous shock reduces supply), price increases cause strong sales growth and margin expansion. As end markets cool off and prices fall amidst a demand shortage or supply glut, memory prices reconcile with the sudden imbalance. Lower prices cause a significant drag on earnings. This graphic from Robert Castellano’s recent article “I’m Upgrading Micron To A Buy As It Wins The HBM Yield Race With SK Hynix” illustrates this cyclicality quite well.

Memory makers enjoyed strong demand through 2016-2018, and prices remained consistently high. At the end of 2018, unseasonably low smartphone demand caused a supply glut and a subsequent erosion of pricing power. This remained the case until COVID caused a severe supply shortage and sent prices rocketing back upwards. Once global supply chains recovered and inflation began to erode demand for consumer electronics globally, the market faced another supply glut and price downturn. The bottom came for Samsung (OTCPK:SSNLF) and SK Hynix in the first quarter of 2023 while Micron remained flat until later in the year before just recently experiencing a strong DRAM sales recovery.

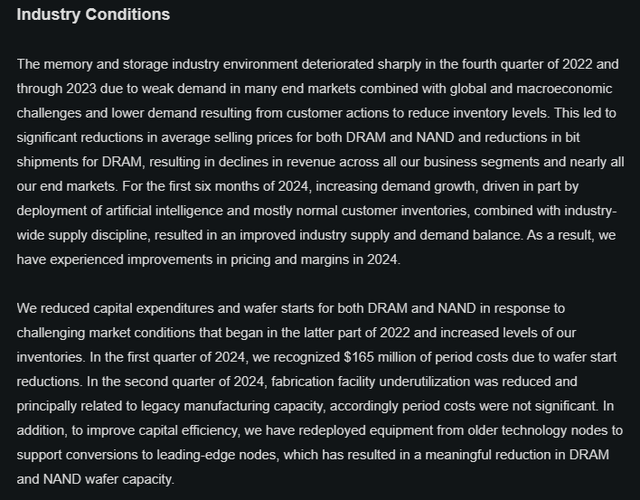

Micron described this same sentiment in the recent 10-Q while also making an important comment about manufacturing capacity. Amidst record demand for HBM, a subsegment of DRAM (dynamic random access memory), Micron has “redeployed equipment from older technology nodes to support conversions to leading-edge nodes, which has resulted in a meaningful reduction in DRAM and NAND wafer capacity”.

This will cause supply constraints on older technology and suggests price growth on non-HBM products. Samsung and SK Hynix are also reportedly slowing the rate of capacity expansions for non-HBM DRAM and NAND products, causing prices to climb.

Despite the sensational performance of AI chips in 2023, the broader semiconductor industry didn’t actually grow. 2024 has seen a more broad-based recovery, with 2025 expected to be a full recovery, according to ASML in its recent earnings report.

The memory story for this year, however, remains entirely focused on HBM, so let’s drill down further.

HBM Market Dynamics and Roadmap

Micron was late to the HBM game, as illustrated by the DRAM sales plateau throughout the first half of 2023. At the time, Micron got the measly leftovers from Samsung and SK Hynix, capturing around 10% of the market. SK Hynix took the early lead in HBM with its MR-MUF (Mass Reflow Molded Underfill) stacking method, which reportedly offers superior heat dissipation compared to Micron and Samsung’s NCF (non-conductive film) method.

eetimes.com

This lead began to erode as early as March of this year as yield issues caused increased scrutiny from NVIDIA (NVDA). This is also reflected in the graphic above showing DRAM revenue trends. I highly recommend Robert’s article linked above for more insight into this.

While SK Hynix enjoyed the explosive growth from its H100 design win, Micron and Samsung quickly announced their respective next-gen HBM3e products. Dealsite believes Micron is also likely to grapple with yield issues despite the announcement of mass-production and inclusion in Nvidia’s H200 chip. There is a broader debate ongoing about whether Micron’s HBM3e announcement means the product has passed Nvidia’s qualification test or if that test is ongoing and still inconclusive, according to the same Dealsite article.

Samsung unveiled an HBM3e 12H product, with the ’12H’ representing the number of DRAM stacks at 12. Micron and SK Hynix are currently in production with 8 high stacks. Industry reports quickly claimed that Samsung would be the sole HBM3e 12H supplier for Nvidia starting in September 2024. It was later reported that Samsung was struggling to pass Nvidia’s qualification test and that this timeline is at risk. There is some rumor that the qualification test was fitted for SK Hynix’s MR-MUF design and therefore not fit for purpose with Samsung’s NCF design. This would also impact Micron since it’s built on NCF technology, but this is unconfirmed.

It’s equally likely that Samsung is grappling with yield issues. HBM yield is inversely related to the number of die stacks. If each individual DRAM die has a yield of 95%, then an 8-stack HBM die will have a yield of about 66% (.95 times itself 8 times). A 12-stack die will have a yield of about 54%. As of early June, Nvidia and Samsung are still working to certify this product for high volume use.

Still, Samsung is likely to win some HBM business from Nvidia. Despite TSMC’s (TSM) best efforts, the CoWoS advanced packaging bottleneck is persistent. This bottleneck is compounded by a shortage of silicon interposers, which is pushing Nvidia toward Samsung. According to THE ELEC:

…this shortage in interposers is likely why Nvidia will inevitably place some orders to the South Korean tech giant. Samsung is one of the few chipmakers that can design and produce its own interposers. It also has HBM and 2.5D package production capacity. Samsung stressed earlier this month in its Samsung Foundry Forum that it was the only company that can offer memory, interposer, and package in turn-key. More challenging for Samsung is to catch up to SK Hynix’s HBM, which was designed with characteristics customized for Nvidia’s GPU. This is a position that Samsung, the world’s leader in memory chips, has never found itself in before. Will Samsung’s HBM pass Nvidia’s quality test? It seems so. But it is the how of it, not when, that will matter.

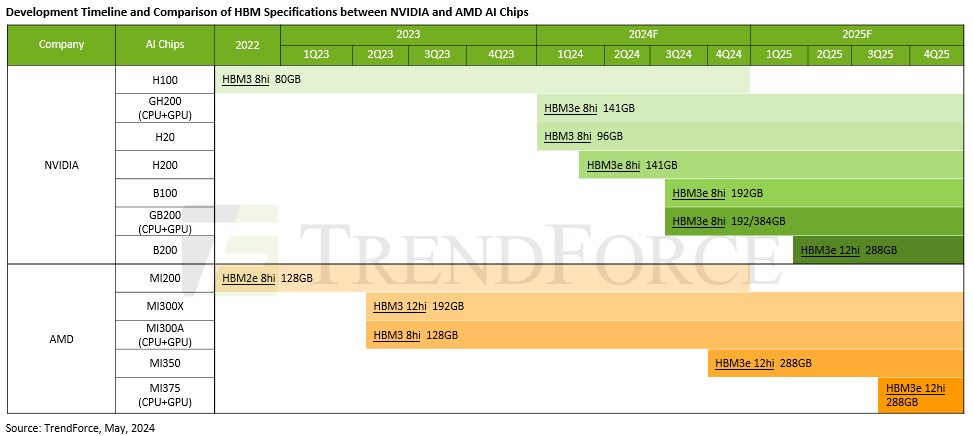

The current state of HBM is characterized by fiercely intense competition. It’s all-hands-on-deck to be first to market with new technology. Winning the HBM market is of utmost importance for these three companies. HBM3 prices have reportedly increased 5x since 2023 and HBM3E carries a higher price tag. TrendForce expects that HBM prices will increase another 5-10% in 2025, with the shift to 12-stack HBM expected mid-2025.

TrendForce

Both Micron and SK Hynix have reportedly sold out of HBM capacity for 2024 and most 2025 capacity is spoken for. SK Hynix currently supplies HBM for the H100 and Micron is in the H200 and has reportedly won the GB200 design. Samsung is working through verification for the B200.

Meanwhile, SK Hynix has accelerated its timeline for future generations of HBM, according to this report citing unnamed sources. SK Hynix will mass produce HBM4 this year and HBM4e in 2026, both a year ahead of plan, to keep pace with Nvidia who has also shortened the cadence of new chip releases from 2 years to 1 year.

Despite SK Hynix’s accelerated timeline, demand is still very much up for grabs. A release plan is just that, a plan, which is still rife with execution risk. Nvidia chose Micron for the H200 because SK Hynix is grappling with yield issues, which suggests that Micron has become a legitimate contender in the HBM fight despite being late to the game.

Adding fuel to this fire is a recent Digitimes headline stating that Micron currently has the edge in Nvidia’s next-next-gen platform Rubin and its HBM4 memory chips. To its credit, Micron is aggressively expanding production capacity, according to Nikkei Asia (emphasis added):

…Micron Technology is building test production lines for advanced high-bandwidth memory chips in the U.S. and is considering manufacturing HBM in Malaysia for the first time to capture more demand from the AI boom, sources briefed on the matter said.

Micron has said it aims to more than triple its market share for HBM, a crucial component in AI chips, to the “mid-20” percentage range by 2025. That is about the same level as its share in the market for more conventional dynamic random access memory (DRAM) chips, which TrendForce data puts at about 23% to 25%… Micron’s biggest HBM production site is in the central Taiwanese city of Taichung, where it is also adding capacity.

While Micron was late to HBM, they have become a strong force in the industry. Micron has grown HBM market share amidst a huge demand spike and continues to push forward to add more capacity and capture more share. According to the same Nikkei article, “Micron trails the other two by a large margin: SK Hynix controls more than 50% of the global market for HBM, while Samsung has a 42.4% share, according to market research TrendForce.”

While SK Hynix’s MR-MUF stacking method offers superior heat dissipation and Samsung is the only vendor that can provide memory, package, and interposer together, Micron claims that its HBM consumes 30% less energy than its competitors. As server power consumption has become top-of-mind in the TCO (total cost of ownership) consideration, offering the most energy-efficient product is a promising position to be in.

Q3 Expectations and Investor Takeaway

I find it likely Micron will provide very compelling results and guidance this quarter. The sales growth will be mostly caused by sequential increases in average selling prices, so gross margin will expand. Production capacity expansions support stronger than expected guidance as well.

The company beat the high end of sales guidance by $300m or 5.45% in Q2 and guided for sales of $6.4b-$6.6b in Q3. Considering CEO Sanjay Mehrotra commented that HBM capacity was sold out through 2024, this suggests sales growth will be the result of strong price increases. This is why recent reports of strong pricing power in memory make me more bullish.

Strong data center tailwinds are further supported by the beginnings of consumer electronics tailwinds as AI begins to proliferate the edge. As more AI products emerge, more capacity will be dedicated to HBM. This will further exacerbate the supply/demand imbalance for NAND and non-HBM DRAM products, which will support further price increases. Additionally, Micron guided for OpEx to remain flat, so the gross margin expansion will also translate to operating and net margin expansions.

In my eyes, all signs point to a very strong quarter for Micron and another strong guide. The market has been heavily rewarding companies this year, and I expect Micron will be similarly rewarded. Therefore, I reiterate my Buy rating on the company at least until the Q4 earnings report. It seems unwise to bet against a company with a promising market position amidst drastic, industry-wide price increases during one of the strongest bull markets in recent history. This is clearly a momentum play, but it is one which I feel quite conviction in.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.