Summary:

- Harley-Davidson, Inc. is likely a deep value opportunity after its sluggish performance in the past three years.

- We think the company’s valuation metrics have realigned.

- Our judgment call of Harley-Davidson’s key drivers suggests a fundamental inflection point might emerge.

- The firm’s operating metrics have improved since our latest coverage.

- Risks such as questionable performance from LiveWire shouldn’t be neglected. However, we are net bullish, and, therefore upgrading the stock to a Buy.

vesilvio

This article revises our outlook on Harley-Davidson, Inc. (NYSE:HOG) and its stock. We last covered the asset in June 2021, stating that it outperformed its fundamental capacity. We were correct with our call. However, numerous systematic and idiosyncratic variables have shifted since then, prompting us to revisit our stance on Harley-Davidson.

Our Previous Article (Seeking Alpha)

After revisiting the stock, we decided to upgrade Harley-Davidson to a buy from our previous sell rating; here’s why.

Recent Performance

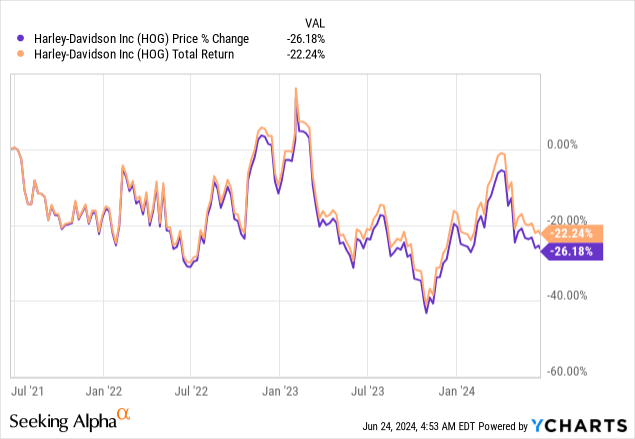

As shown in the following diagram, Harley’s stock has suffered in the past three years. In our view, Harley’s demise was driven by systematic factors such as the inconsistent demand for durable goods. Moreover, when we covered Harley in June 2021, its stock had questionable valuation multiples and foggy operational metrics, which likely contributed to its slump.

With all that mentioned, Harley-Davidson has reached a much different price level since our latest coverage. In addition, key operating dynamics have shifted. Let’s dive into Harley’s fundamentals.

Assessing Harley’s Q1 Earnings Beat

A good way to measure Harley’s fundamental aspects is to start by reviewing its latest earnings report. Harley-Davidson triumphed in its first quarter, delivering a revenue beat of $128.56 million and an earnings-per-share beat of 18 cents.

HOG Stock Earnings (Seeking Alpha)

Let’s discuss Harley’s top line. Other metrics are discussed in the following section.

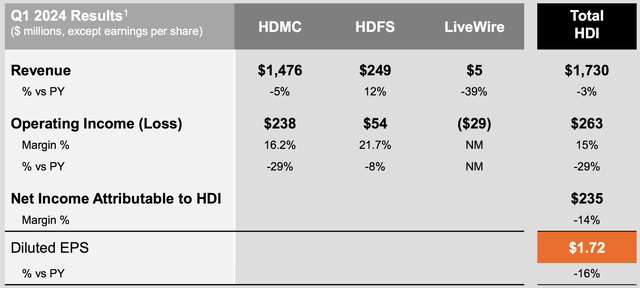

Most of Harley’s recent momentum stemmed from its financing and insurance unit (HDFS), which grew by 12% year-over-year in the last quarter, leading to an operating profit margin of 21.7%.

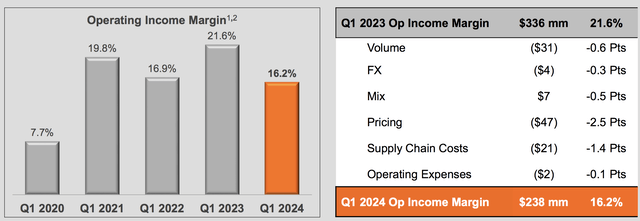

Furthermore, Harley-Davidson’s motorcycle and parts sales dipped by 5% year-over-year, giving the segment an operating profit margin of 16.2%. Moreover, LiveWire, which is Harley’s electric motorcycle segment, dipped by 39%, settling at an operating loss of $29 million.

So, what do we make of Harley’s sales trajectory?

Well, consumer confidence has been low around the globe. Therefore, we don’t think its lower year-over-year sales trajectory is structural. In addition, the company achieved a record unitary profitability of $3700 (ex-LiveWire) in 2023, suggesting it has inflation pass-through abilities. We think motorcycle sales will recover once consumer confidence recovers, which is likely to occur when interest rates drop (because Harley-Davidson sells durable goods that are often financed).

Furthermore, we anticipate Harley-Davidson’s credit and insurance departments to hold up throughout the economic cycle, presenting sustainable growth. Although the breadth of global yield curve inversion implies that a broad-based drop in interest rates is inevitable, we think higher net loan margins are probable due to a contemporaneous rise in credit spreads (credit spreads and interest rates are usually inversely related).

Although we are positive about most of Harley’s top-line prospects, we remain concerned about LiveWire. The segment was set up to attract an alternative consumer base and provide Harley-Davidson with a way out of traditional motorcycles. However, LiveWire’s sales haven’t been impressive, raising the possibility that capital expenditure inefficiencies might occur.

Key Metrics

Harley-Davidson’s motorcycle profitability shrunk to 16.2% in Q1, showing a retracement from its record unit profitability in 2023. Nevertheless, we think Harley’s strong branding will sustain its proportionate inflation pass through. Additionally, we expect the firm’s supply-chain costs and operating expenses to decrease in the next quarters amid a drawdown in global inflation.

Motorcycles Operating Profit – ex-LiveWire – (Harley-Davidson)

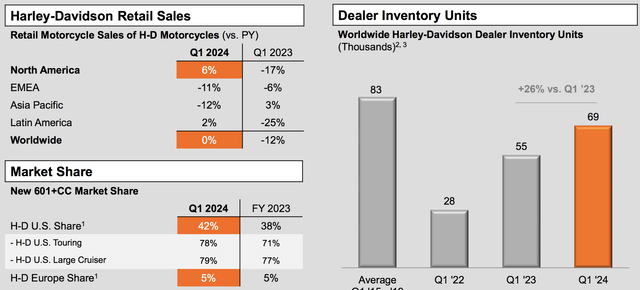

Furthermore, Harley-Davidson has grown its broad-based market share in the U.S. by 400 basis points, primarily due to its touring motorcycles. Although we don’t think the brand will resonate in Europe, we won’t be surprised if Harley grows its market share in developing regions such as Africa and Latin America. If sustained, the firm’s illustrious market share will likely enhance Harley’s bargaining power over suppliers and pricing power in the market.

Despite being positive about most of its financial metrics, we would like to flag Harley-Davidson’s high inventory levels. As mentioned, we are in a global disinflationary environment, which could impact inventory values, leading to losses via impairments.

Market Share & Inventory (Harley-Davidson)

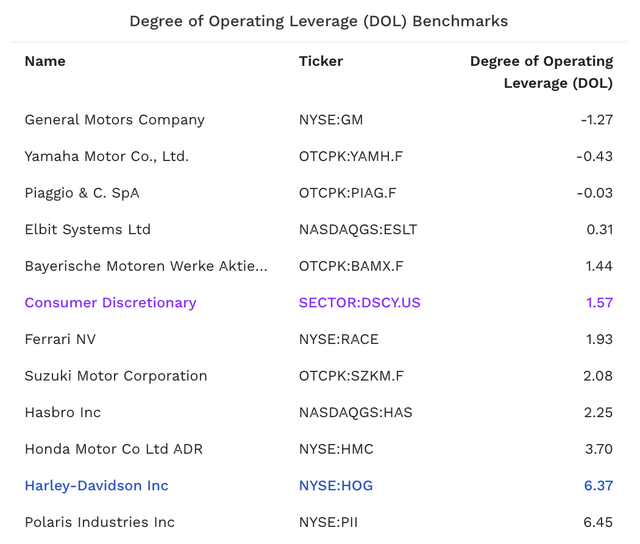

Lastly, we like Harley’s best-in-class Degree of Operating Leverage ratio. The ratio measures the degree of EBIT sensitivity to sales, indicating that Harley would experience higher EBIT margin growth than most of its competitors in the event of broad-based industry sales growth.

Degree of Operating Leverage (Harley-Davidson)

Potential Shareholder Returns

Absolute Valuation

We used a price-to-earnings expansion formula to set a price target for Harley-Davidson’s stock. Although an isolated and somewhat simplistic metric, the P/E expansion ratio holds validity among financial analysts as a parsimonious measure of a stock’s value.

According to the formula, Harley-Davidson could reach $54.94 per share by December 2024, placing Harley in undervalued territory on this basis alone.

Aside: Harley-Davidson’s stock closed at $33.67 per share on Friday, 21/06/2024.

| Metric | Value |

| 5-year Avg. Forward P/E | 12.6x |

| December 2024 EPS Estimate | $4.36 |

| Price Target | $54.94 (rounded) |

Source: Author (Data from Seeking Alpha)

Relative Valuation

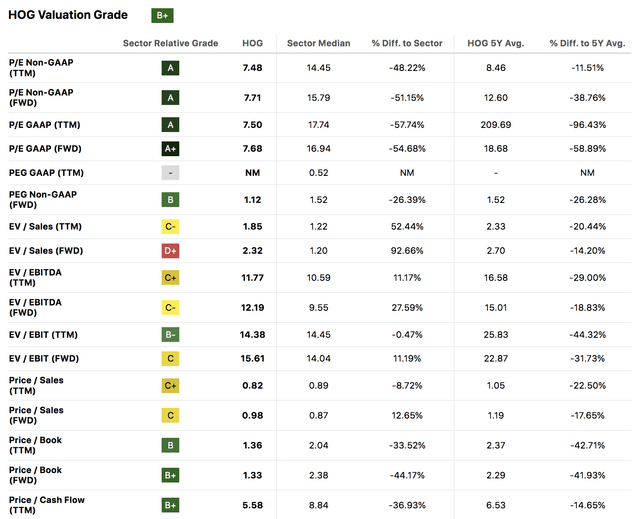

Another alternative way of examining Harley-Davidson’s valuation is through a relative valuation, which compares its current and past valuation multiples. I highlight this methodology because Harley is a cyclical stock, meaning its point-in-time versus its averaged multiples paint a clear picture. The following diagram shows that Harley-Davidson’s salient multiples are below their 5-year averages, suggesting the stock is at a cyclical discount. In fact, Harley had a GAAP-adjusted P/E multiple of 38.92x when we last covered it, illustrating the disparity between its valuation then versus now.

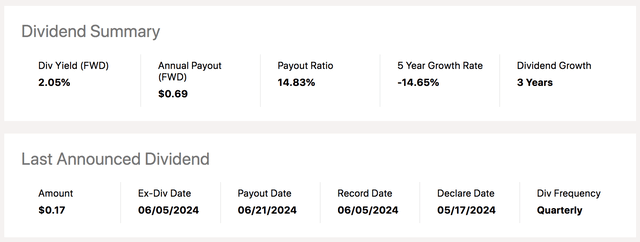

Dividends

Harley-Davidson has a forward dividend yield of 2.05%, which we don’t think is high enough to add a floor to its stock’s price. However, we believe that Harley’s dividend adds a nice touch as it provides a diversified form of return. Additionally, we think that Harley-Davidson’s payout of 14.83% is low, suggesting latitude exists for future dividend hikes.

Consolidating Harley’s Risk Factors

I mentioned some of Harley-Davidson’s risk factors throughout the article. Nevertheless, I wanted to consolidate them in a discreet section to add balance to the article.

Firstly, as mentioned, we remain concerned about LiveWire. The electric motorcycle industry is forecasted to grow by 21.21% until 2030, meaning systematic support is intact. As such, we are disappointed by LiveWire’s realized results, as we think Harley needs to tap into a newer generation via rapid growth in electric motorcycle sales.

Furthermore, Harley-Davidson is struggling to grow its EMEA market share. We have doubts about the company’s ability to tap into European and Asian consumer bases as we see a disparity between brand preferences in North America and the EMEA. This might ultimately lead to inefficient CapEx.

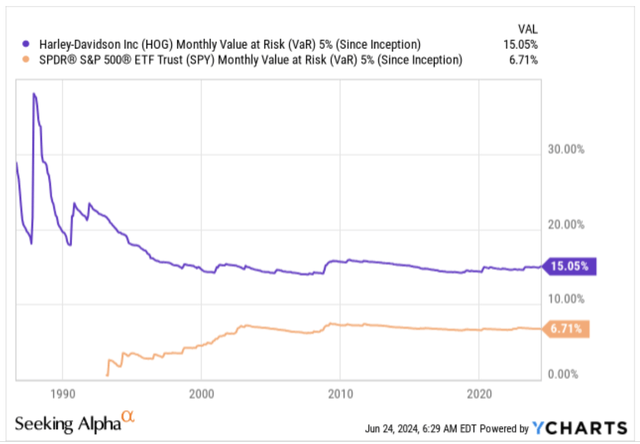

Lastly, as shown below, and compared to the SPY ETF (SPY), Harley-Davidson has a high monthly value at risk at the 95th degree of confidence, conveying that Harley has lost at least 15.05% of its market value in 5% of its traded months.

Final Word

In our view, it is an excellent time to buy Harley-Davidson’s stock as it has shed a large amount of value in the past three years, realigning its valuation multiples. Moreover, Harley-Davidson’s fundamental aspects seem set to establish consistency in the coming years.

Although risk factors such as underwhelming support from LiveWire and slowing year-over-year sales growth exist, we are confident about the stock’s prospects.

Consensus: Buy/Market Outperform

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.