Summary:

- Micron announced fiscal Q3 earnings on June 26, but guidance was in-line with consensus, questioning the rationale for explosive share growth in the past three months.

- My analysis shows HBM market to grow from 4% to 15% of global advanced semiconductor packaging market by 2028, with Micron gaining share.

- I expect Micron’s HBM capacity to increase from 5.6% in Q1 2024 to 14.0% in Q4 2025, positioning the company as the fastest growing in the DRAM oligopoly.

JHVEPhoto

Earnings Call Analysis

Micron (NASDAQ:MU) announced its fiscal Q3 earnings on Wednesday June 26. The shares dropped 6.5% in extended-hours trading on Wednesday after the memory chipmaker issued guidance that was in-line with estimates, and are down 6% in the late-morning of June 27.

Micron’s share price reached a high of $136 on June 18, which was up from $93.80 on March 18 – a remarkable increase of 45% in the three months just prior to its fiscal Q2 call on March 20. At that time, Micron’s CEO Sanjay Mehrotra announced:

“Our HBM3E product will be a part of Nvidia’s H200 Tensor Core GPUs, and we are making progress on additional platform qualifications with multiple customers. We are on track to generate several hundred million dollars of revenue from HBM in fiscal 2024 and expect HBM revenues to be accretive to our DRAM and overall gross margins starting in the fiscal third quarter. Our HBM is sold out for calendar 2024, and the overwhelming majority of our 2025 supply has already been allocated.”

That comment was enough to trigger the strong share price growth for the company. However, the current Q3 earnings call guidance was in-line with estimates. For Q4, Micron guided earning between $1 and $1.16 per share, with revenue expected to be $7.6 billion, plus or minus $200 million. Adjusted gross margins are forecast to be between 33.5% and 35.5%, with the estimate at 34.5%. Consensus was for the company to earn $1.02 per share on $7.58 billion in revenue.

This raised the spectre among investors that this AI business may be just hyperbole, particularly after the retrenchment of AI chip leader Nvidia (NVDA) in days leading up to Micron’s Q3 call. In addition, until recently the company’s performance had been lackluster in my opinion, which I detail at the end of this article.

HBM Analysis

The bright spot in the Q3 earnings call was Micron CEO Sanjay Mehrotra’s remarks on AI, and the focus of this article:

“We expect to achieve HBM market share commensurate with our overall DRAM market share sometime in CY25. Our HBM is sold out for CY24 and CY25 with pricing already contracted for the overwhelming majority of our 2025 supply.”

I had reported in an April 25, 2024 Seeking Alpha article entitled I’m Upgrading Micron To A Buy As It Wins The HBM Yield Race With SK Hynix that the unprecedented growth in AI and MU’s technological edge will propel the company to be a leader in AI-based high bandwidth memory chips.

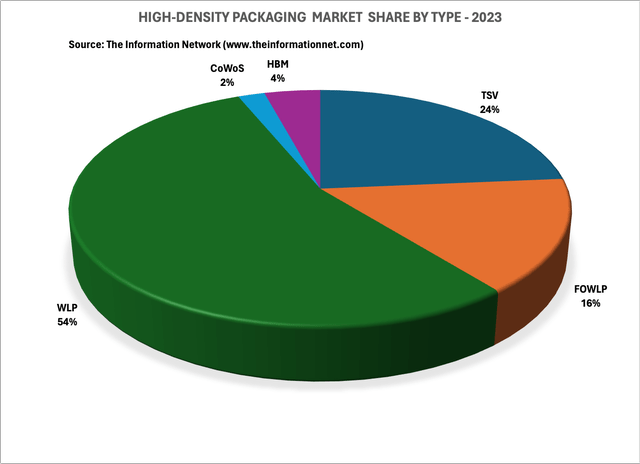

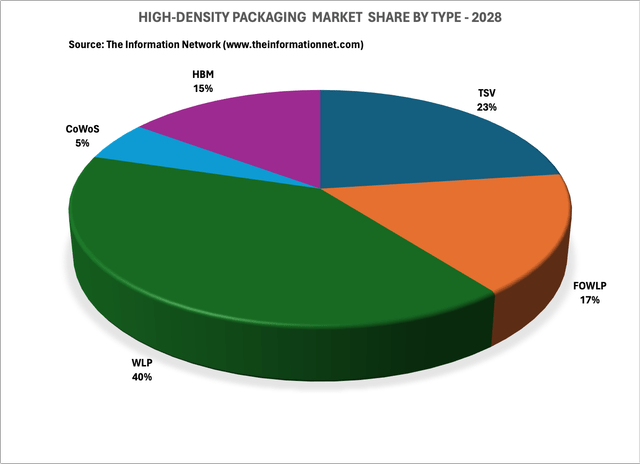

In the past week, new analysis from my report entitled High-Density Semiconductor Packaging: Market Analysis And Technology Trends, the HBM market will explode from just 4% of the global advanced semiconductor packaging market in 2023 to 15% in 2028, growing at a CAGR of 58%.

Chart 1 shows the global market in 2023 and shows my analysis for HBM, CoWoS, WLP (wafer level packaging), FOWLP (fan-out wafer level packaging), and TSV (through silicon via) packages.

The Information Network

Chart 1

In Chart 2 I show the global market forecast to 2028. Here we see HBM increasing to 15% of the market. CoWoS packages made by Taiwan Semiconductor (TSM) for Nvidia and AMD (AMD). As AI memory-based chips increase in demand, WLP packages will decrease to 40% of the market.

The Information Network

Chart 2

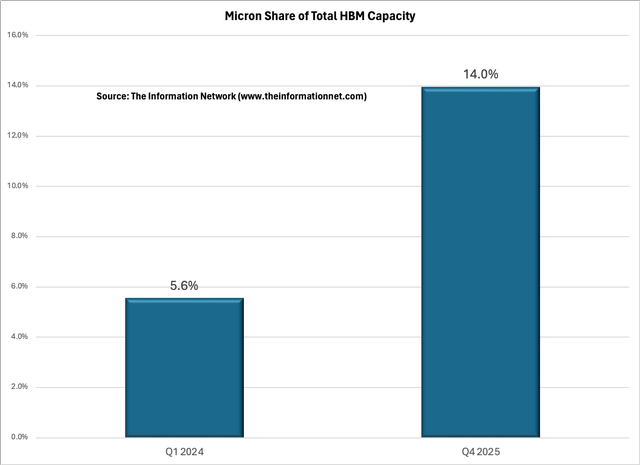

Important for Micron, its share of HBM capacity will increase from just 5.6% in Q1 2024 to 14.0% in Q4 2025, meaning that the company will gain share against SK hynix (HXSCL) and Samsung Electronics (OTCPK:SSNLF) and be the fastest growing of the DRAM oligopoly.

For HBM, I estimate that Micron had a capacity of 5 million units, while Samsung and SK hynix each had a capacity of 42.5 million units. That resulted in a share of just 5.6%.

Micron, while late to enter the HBMx race, will increase its capacity to 62.5 million HBM units in Q4 2025. Samsung and SK Hynix will each increase their capacity to 192.5 million units, giving Micron a 14.0% share of the HBM market.

The Information Network

Chart 3

Investor Takeaway

I rate Micron a Buy. Capacity is low because of its late start in the HBM business at 2.9%, according to my March 18, 2024 Seeking Alpha article entitled, Micron’s Fiscal Q2 2024 Earnings Preview With Eyes On HBMx. But I concur with CEO Sanjay Mehrotra comment in the company’s recent earnings call:

“We continue to expect HBM bit share equivalent to our overall DRAM bit share some time in calendar 2025. Earlier this month, we sampled our 12-high HBM3E product, which provides 50% increased capacity of DRAM per cube to 36 gigabyte. This increase in capacity allows our customers to pack more memory per GPU, enabling more powerful AI training and inference solutions.

We expect 12-high HBM3E will start ramping in high-volume production and increase in mix throughout 2025.”

My caveat on the Buy Rating

I had a sell on this company last year as the CEO continued his big capex spend while missing the downturn in consumer electronics and doubling down with positive guidance as the industry was dropping. This was a repeat of the problems the previous downturn, which I wrote about extensively.

I raised it to a buy a few months ago because of its HBMx endeavors largely because of the high level of engineering the company has, and because SK Hynix was having low yields because they use a certain deposition system from a certain US deposition company that can’t make a SiGe layer without defects and yield issues with Samsung.

However, the undercurrent with HBM and the company’s low capacity is because it was late to the HBM game. Again a reflection on poor management.

Now MU has been rising, but again the CEO commented in the Q3 earnings call:

“Robust AI-driven demand for data center products is causing tightness on our leading-edge nodes.”

Again, he was late to recognize the demand in AI. Nvidia’s data center revenues have been skyrocketing for the past four quarters.

Excessive capex spend in the last two cycles, the first resulting in a “supercycle”, then missing the downturn in smartphones and PCs, then another excessive capex spend despite the promise of “judicious spending” by the CEO. Now missing the HBM benefits and missing the AI demand create too many problems to ignore.

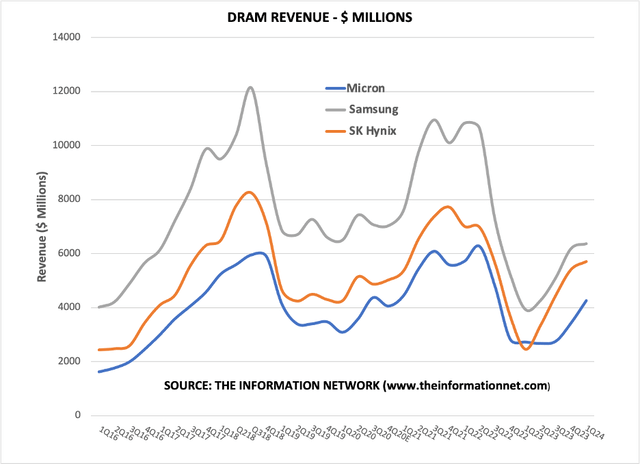

Chart 4 illustrates these cycles. Unfortunately, all three DRAM companies are culprits of excess spending which initiate the cycles, but MU could, but hasn’t broken away from the pack.

The Information Network

Chart 4

In fact, according to my database, in Q1 2018, DRAM revenues were $4,562 million and NAND revenues were $1,919 million. In Q2 2024, the previous quarter as I haven’t analyzed these new numbers yet, DRAM revenues were $4,258 million and NAND revenues were $1,567 million. In the preceding six years, MU has shown no growth in the DRAM or NAND business.

I am optimistic that may change in the next few years because of Micron’s excellent engineering capabilities. But Micron was several years behind in moving to HBM technology, and SK Hynix and Samsung are a moving target that the company must deal with. Otherwise, investors may see another series of miscues in the AI space.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.