Summary:

- Micron Technology reported FY2024 results and outlook, disappointing investors’ high AI expectations after the June rally. We say load up on the pullback.

- Our positive outlook is based on our expectations of higher DRAM sales due to AI-driven demand for HBM and the arrival of AI PC in 2025.

- We expect hyper-demand from AI for HBM to put DRAM into shortage for the next 1-2 years, at least.

- We think MU will outperform the peer group substantially in the first half of 2025.

franckreporter

Micron Technology (NASDAQ:MU) reported its third quarter of FY2024 results and outlook last week, but the stock traded off after guidance didn’t fulfill investors’ high AI-driven expectations. We reaffirm our buy rating on MU and recommend investors load up on the pullback. We expect MU to outperform the peer group substantially in the first half of 2025 due to better demand-supply dynamics in the memory market.

Our positive outlook is based on two factors:

The first has already begun playing out: Artificial intelligence. We expect the AI-led demand for HBM or high-bandwidth memory will serve as a tailwind for MU’s sales this year and 1H25. The appeal is that HBM comes with a higher average selling price or ASP, so it does well to boost top-line growth while memory demand from PC and smartphone markets remains muted for the year. This AI strength is showing up in DRAM sales as training AI servers requires DRAM for high-speed computing, which is good news for MU as DRAM accounts for 69% of total sales.

The company’s DRAM sales increased 13% Q/Q this quarter and 21% the quarter prior. We expect MU will outperform on higher DRAM content share in AI servers and MU’s strategic positioning with “HBM, D5, LP5, high-capacity DIMM, CXL, and data center SSD products” as mentioned on the call with most emphasis on HBM series. CEO Sanjay Mehrotra noted, “We are gaining share in high-margin products like High Bandwidth Memory, and our data center SSD revenue hit a record high, demonstrating the strength of our AI product portfolio across DRAM and NAND.” The roadmaps announced at Computex also served as a positive for MU. The long-term roadmaps of MU’s customers like Nvidia (NVDA) reflect strong AI server-related momentum for years, in our opinion.

The second is the recovery of PC and smartphone end demand in 2025, with more emphasis on the former. PC and smartphone recovery is crucial for MU to boost unit sales. Management has the following outlook on each market for the year – “PC: Unit volumes remain on track to grow in the low single-digit range for CY24,” and smartphone: “Mobile: Smartphone unit volumes in CY24 remain on track to grow in the low-to-mid single-digit percentage range.” We do believe the inventory correction cycle for both markets is complete now, but we think we’re stuck in the no-man’s land between the bottom and true demand recovery, and the best solution would be a catalyst to reignite TAM growth. This takes us back to the reason we’re more optimistic about PC, which is because we believe it has a 2025 catalyst: AI PC.

Management noted on the call that AI PCs require 40% to 80% more DRAM content. We think this is the second driver that will bring more upside for MU next year. AI PCs have been a more highlighted topic of discussion this year, especially at Computex, and the recent announcement of Qualcomm’s (QCOM) arm-based AI chips. This is a positive for the industry, but not necessarily for shareholders. There’s still no actual PC TAM growth this year, or in other words, even if the product is there, the market is not ready yet (and without a market, there are no sales). We think the market will be ready next year, driven by Microsoft (MSFT) Windows’ End of Life or EOL, which should necessitate an upgrade cycle and the expansion of PC TAM.

Essentially, Windows EOL is a policy that dictates the duration for which a specific version of Windows will get updates and technical assistance or, in other words, will be supported. We think EOL will be a driver for PC because support for Windows 10 Home and Pro will end on Oct. 14 of next year. This should act as the catalyst we’ve been waiting for.

Stock Performance

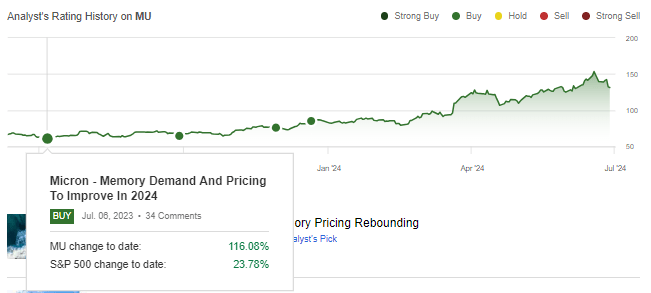

Since we upgraded MU to a buy in late 2022, the stock has been up 135%, compared to the S&P 500’s up 41.5% during the same period; then, the stock was trading at roughly $55 per share, while now it’s at around $130 and hit a high of $157. The stock’s CAGR (compound annual growth rate) since our upgrade until now is around 64%. We see a similar high double-digit CAGR playing out over the next 1.5 years due to (1.) AI server-led demand for HBM, and (2.) PC and smartphone recovery, with more emphasis on AI PC. Our December article forecasted “MU to reaccelerate top-line growth in 2024, supported by a new product cycle and better DRAM and NAND pricing dynamics,” and that’s played out. This year, we’ve seen better overall pricing for both DRAM and NAND. Management noted on the call, “Pricing trends remain positive, supported by favorable supply-demand conditions,” and continues to forecast gross margin expansion on higher pricing and better product mix. DRAM and NAND ASP increased 20% Q/Q each, respectively, this quarter and have been increasing sequentially since the start of FY24.

The image below shows our rating history on the stock.

SeekingAlpha

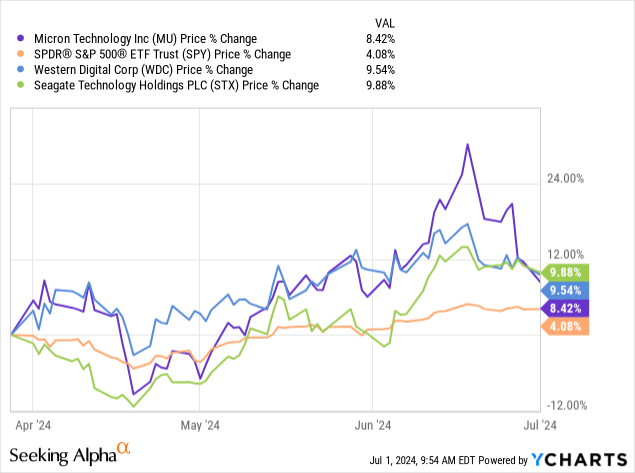

The following three-month graph shows the market’s overreaction to MU’s results and outlook this quarter. The stock underperformed Western Digital Corp (WDC) and Seagate Technology (STX).

YCharts

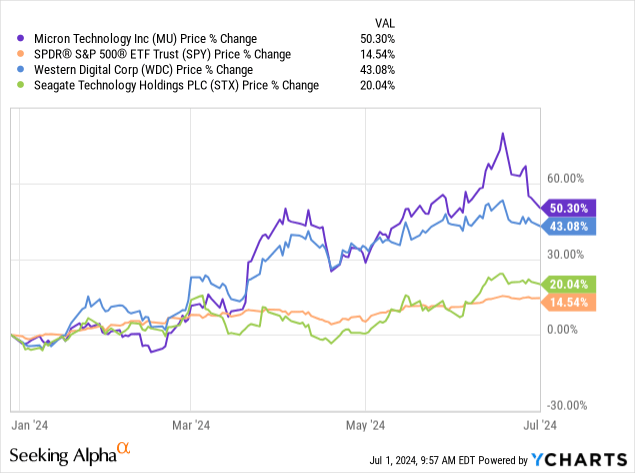

While the six-month chart shows MU’s outperformance and momentum. We think the stock is trading at a discount given its upside potential. MU outperforms the S&P 500 and its peer group.

YCharts

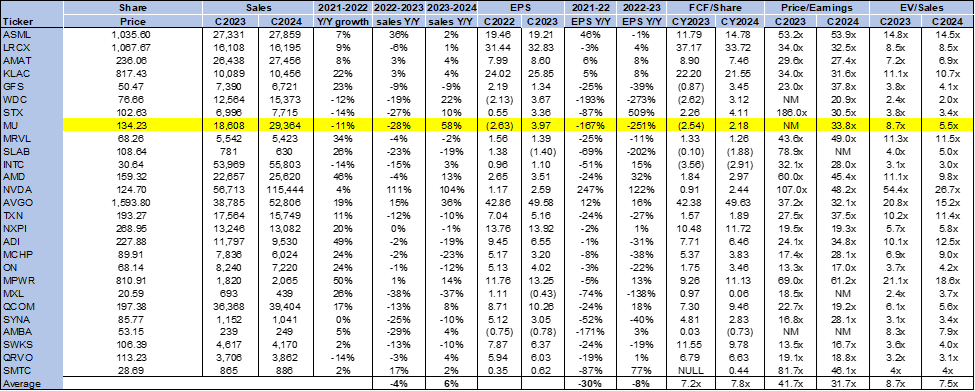

Valuation and Word on Wall Street

MU remains relatively cheap, in our opinion. The stock is trading at 5.5x EV/C2024 sales, not much higher than the ratio of 5.3 it held when we last wrote about it in December, and still lower than the semiconductor peer group average of 7.5x. We understand investor concern over MU’s financial health, particularly cash flow from operations, after the company’s mixed performance this quarter. The company reported cash flow from operations for the quarter at $2.48B, trailing expectations at $3.24B. The market overreacted to the results and outlook this quarter because expectations were prematurely pricing in near-term hypergrowth from AI. The quarter’s results don’t shake our belief that MU will grow into its position within the AI market, but we do think this will happen more meaningfully in the December quarter and 1H25. The following chart outlines MU’s valuation against the peer group average.

TechStockPros

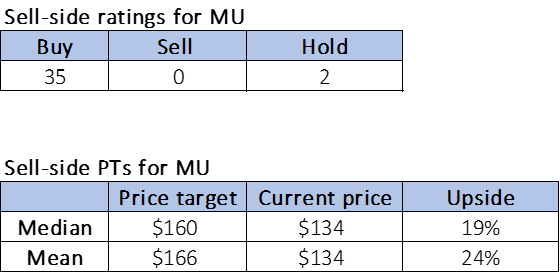

Wall Street remains positive on MU, consistent with our view. Of the 37 analysts covering the stock, 35 are buy-rated, and two are hold-rated. The forecasted upside from current sell-side price targets is much more significant now than it was last December. The median price target is $160 per share, and the mean is $166, with a potential upside of 19%-24%. The following charts outline Wall Street’s sentiment on the stock.

TechStockPros

What to do with the stock?

MU is now guiding for 12% Q/Q growth in 4QFY24 to $7.6B, slightly outpacing consensus estimates at $7.58B, which forecast growth to be based on higher pricing. Management also announced that FY25 capex will be in the mid-30% range of revenue, which would be higher than this year due to slower WFE spending that’s expected to make a comeback next year. There’s also been concern over the high capex, but we think it’s necessary for MU to gain a DRAM share on HBM demand. These investments are going to support the assembly and test equipment for HBM, the demand that comes with industry product transition and construction plans for Idaho and New York greenfield (which will be roughly over half the capex FY25, alone.)

We’re still positive on MU and recommend investors initiate or add to their position on any pullbacks, including the most recent post-earnings one. Our positive sentiment extends to WDC, which also has a similar exposure through HDD and Flash demand, but is at a less strategic position than MU in the AI field. We expect hyper-demand from AI demand for HBM to put DRAM into shortage for the next 1-2 years, at least. This isn’t all that surprising when you connect the dots of the higher DRAM content on both AI servers versus traditional compute servers and AI PC vs. traditional PC. We say load up on the pullback.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.