Summary:

- Micron stock has recently collapsed into a bear market and underperformed its semiconductor peers.

- Investors likely overhyped MU’s AI thesis while understating the cyclical and commoditized risks of the memory industry.

- Micron’s AI growth story is still in the early stages, suggesting potential for market share gains.

- Solid execution is essential, as Samsung has reportedly received clearance from Nvidia for its HBM3E product.

- I argue why MU’s inflection point has finally arrived, as the market has turned too pessimistic on its multi-year growth thesis. Read on.

vzphotos

Micron Stock Plunged Into A Bear Market

Micron Technology, Inc. (NASDAQ:MU) investors who ignored my caution about the potentially higher cyclicality and commoditized nature of the memory industry have likely learned their lessons. Since topping out in June 2024, MU has plunged into a bear market, down more than 45% through this week’s lows. It has also underperformed its semiconductor peers (SMH) (SOXX) over the past six weeks, as the market de-rated the stock massively.

In my previous article, I cautioned Micron investors not to ignore potential oversupply risks from 2026. I also indicated that MU’s price action suggested caution was warranted. As a result, I’m not surprised with MU’s relative underperformance, although I assessed that a significant bottom is likely near.

There have been several significant developments since then. AI stocks have taken a considerable hit, as semiconductor stocks like MU were also battered. However, MU’s relative underperformance is a cautionary tale on the market’s assessment of heightened execution risks in the memory industry.

Micron Faces AI Concentration Risks

There’s little doubt that MU’s recent buying fervor has been predicated on its HBM3E (8-high stack) developments. As a result, the demand for AI servers is fundamental to driving buying sentiments in MU. While the company noted a more robust “recovery in traditional server units,” Micron’s growth story is expected to be intricately linked to the AI gold rush. Furthermore, Micron emphasized that other segments are still facing challenges. Accordingly, “automotive, industrial, retail consumer markets have weakened.”

Based on SK Hynix’s recent earnings release, commentary on ex-AI market segments was even more pessimistic. Accordingly, SK Hynix indicated that “strong demand from AI servers is expected to continue in the second half of the year.” However, the HBM memory leader expects the AI PC and smartphone markets to experience a “gradual recovery in the second half of the year.” In addition, the memory chip leader emphasized that “demand recovery in the PC market is trending relatively weaker than initial expectations.” As a result, I believe the market has likely de-rated MU’s recent optimism, given potentially higher downstream risks. While the surge in optimism driven by Micron’s HBM3E product portfolio is justified, too much FOMO isn’t healthy.

It’s critical to note that the company reported more than $100M in HBM3E revenue in its recent FQ3 report. Micron also guided HBM revenue to reach “several hundred million dollars in FY2024.” The company has also targeted revenue from this critical segment to reach “multiple billions” in FY2025.

Micron Must Execute Well To Gain Share

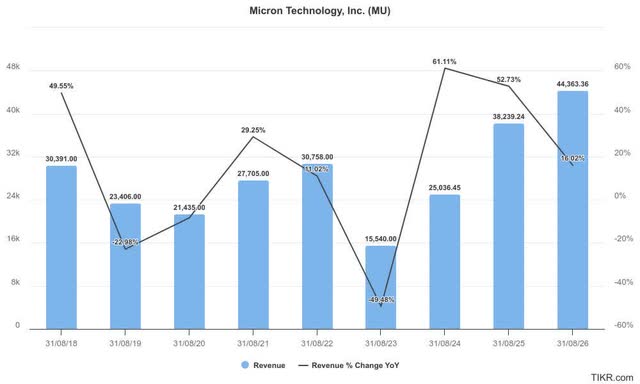

Micron revenue estimates (TIKR)

As seen above, Micron is expected to report revenue of $25B in FY2024 (up 61% YoY) and $38.2B in FY2025 (up 52.7% YoY), respectively. However, the growth rate is expected to slow down in FY2026. Despite that, Morgan Stanley’s estimates indicate a total HBM revenue CAGR of 58% from 2024 to 2027. Therefore, the market might not have fully appreciated MU’s growth prospects through FY2027, leading to a potential upward valuation re-rating if its execution is robust.

I believe that’s the critical question facing Micron right now. SK Hynix is the HBM leader, although Micron anticipates HBM market share gains aligned to its DRAM share (estimated at 20% to 25%) by FY2025. However, it’s critical to note that Nvidia’s anticipated annualized product launch cadence (NVDA) could introduce higher execution risks on Micron’s roadmap. Micron also alluded to “higher complexities” as it advances to HBM4, potentially leading to challenges with “increased yield fallout and higher silicon capacity requirements.” Nvidia faced “design flaws” challenges with its Blackwell architecture recently. Therefore, it’s a reminder that such execution risks shouldn’t be understated, potentially impacting projected growth opportunities.

Furthermore, the intensely competitive nature of the HBM market could intensify such execution risks, leading to potentially significant market share losses. SK Hynix has already shipped its 12-high stack to critical customers for sampling. The memory leader indicates that “mass production and volume shipment is expected in the fourth quarter.”

Micron is expected to move to the sampling stage for its 12-high stack in 2025, suggesting it could still be behind SK Hynix. In addition, Samsung (OTCPK:SSNLF) has reportedly received clearance from Nvidia for its 8-high stack, although “a supply agreement” has not been finalized. In other words, competition is expected to heighten between Micron and its leading HBM peers, behooving immaculate execution. In a highly commoditized market, Micron cannot afford execution missteps, or it could afford Samsung an opportunity to gain market share rapidly at its expense.

Is MU Stock A Buy, Sell, Or Hold?

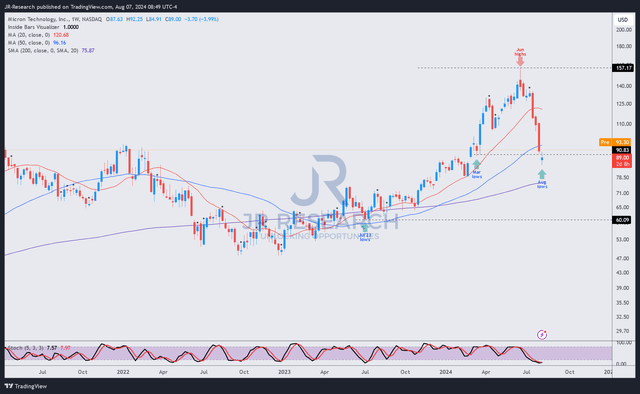

MU price chart (weekly, medium-term, adjusted for dividends) (TradingView)

Notwithstanding my caution, investors must consider the possibility that the market has reflected these risks in MU’s recent 45% plunge from its June 2024 highs.

As seen above, MU has re-tested its March 2024 lows, giving up five months of gains. Therefore, the stunning collapse and relative underperformance have likely “cleared the deck” for a potentially lower-risk entry point.

MU remains in a medium-term uptrend, showing little signs of a long-term bearish reversal. The rapid decline over the past four weeks is also reminiscent of price action indicative of panic selling. Coupled with the more aggressive investments in technical AI infrastructure by hyperscalers, I assess MU doesn’t seem to be close to a cyclical peak yet.

Wall Street’s estimates on MU have also been upgraded, corroborating my bullish thesis. MU’s forward adjusted EBITDA multiple of 5.6x is just under its 10Y average of 5.8x (according to S&P Cap IQ data). Hence, investor concerns about potential MU overvaluation at the current levels aren’t justified.

In addition, Micron’s decision to “resume share repurchases” is expected to strengthen buying momentum at a critical juncture, as MU buyers bought the recent dips. It should also assure investors about the robustness of its capital allocation strategy.

Consequently, I assess the opportunity to turn more bullish on Micron’s thesis as apt, corroborating an upgrade on MU stock.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive comments to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below to help everyone in the community learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMH, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!