Summary:

- Netflix will announce its Q4 results on the January 19, after market hours.

- We touch upon some of the important themes to look out for during earnings.

- The risk-reward on the charts are not too appealing, and institutions have yet to turn bullish.

- Forward PE valuations may be cheap relative to history, but investors should also be mindful of the earnings growth on offer at those multiples.

Mario Tama

Introduction

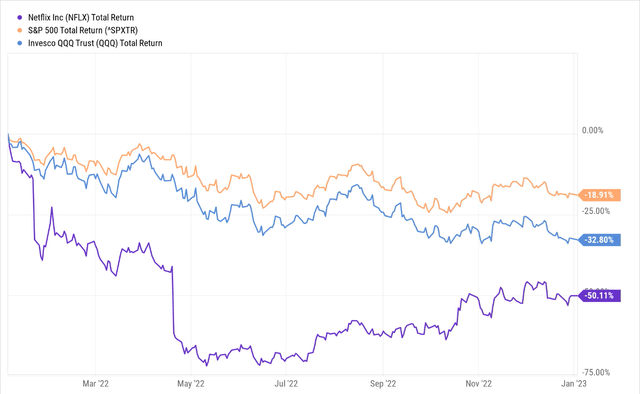

The twelve-month performance for Netflix’s stock (NASDAQ:NFLX) doesn’t make for pleasant reading, particularly as it managed to underperform both the S&P 500 and the Nasdaq 100 by roughly 2.65x and 1.53x respectively.

YCharts

Considering the level of relative disintegration that has already played out, could we see a reversal of fortunes, particularly as you have a potential catalyst on the horizon in around two weeks? Netflix plans to publish its Q4-22 results on the January 19, after market hours (6 PM EST), and it may prove to be an influential event for the stock’s prospects. Regardless, if you’re contemplating a position in NFLX ahead of the results, here are a few important things to note.

Q4 Results- What To Expect?

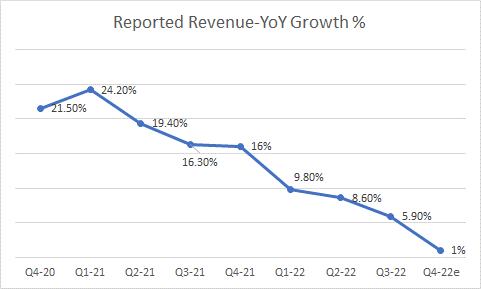

At the Q3 results event on October 18, NFLX management stated that Q4 revenue would likely slow on a sequential basis, and end up coming somewhere close to the $7.77bn levels (Q3 revenue was $7.92bn). If that were to play out, you’d be looking at yet another quarter of lower YoY reported revenue growth, with an implied figure of +1%. For the uninitiated, since peaking in Q1-21, annual revenue growth per quarter has declined consistently for six straight quarters (not including Q4-22).

NFLX 10-Q

Having said that, when the actual reported numbers come out on the 19th, I suspect it won’t be as low as $7.77bn, simply because of what’s happened with the dollar since NFLX last published its quarterly results.

Whilst providing forward guidance then, the management had also stated that in constant currency terms, the Q4 revenue growth would likely be closer to the 9% levels. That would have implied adverse FX effects on the revenue line to the tune of -8% (In Q3 the adverse effect on revenue was -7%); the actual impact will likely be a lot lower, as the dollar index has corrected by ~7% since NFLX last published results.

It looks like consensus has already made some adjustments for FX as currently, the sell-side expected revenue figure for Q4 is at $7.83bn. But even at those levels, you’d still be looking at YoY revenue growth of only +1.7%, implying yet another quarter of slowing YoY growth.

Investors can afford to be more optimistic about subscription net additions, as typically, Q4 tends to be rather strong. Just for some context, net additions had actually declined in Q1 and Q2 by an aggregate of over 1.1m, but this bounced back impressively in Q3, with 2.4m net additions.

In Q3, the company saw impressive average revenue per membership (ARM) growth of 8%, trending up sequentially from Q1-22 and Q2-22 of 6% and 7% respectively). That being said, given the relatively high base effect of Q4 last year (7% growth vs 4% and 5% in Q3-21, and Q2-21), it may be a challenge to improve on the Q3 run rate. Looking ahead to 2023, the ARM could get a boost when the company starts cracking down on password sharing and starts monetizing that (potentially 322m households could come under the net)

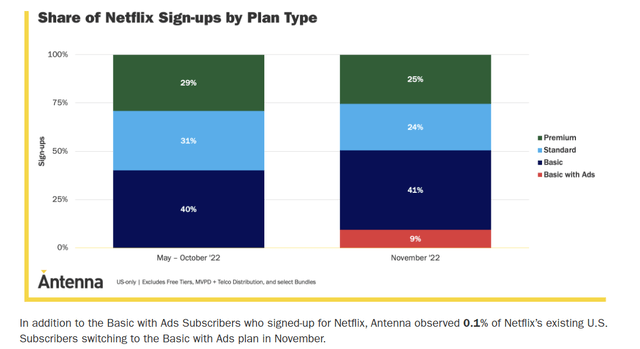

Investors will be looking for some management insight into how the company’s low-priced ad-supported subscription plans have fared; this was launched in the first week of November across 12 global markets believed to account for $140bn of brand advertising spend in streaming and TV. Initial reports suggest that the acceptance has been quite underwhelming; according to a study by Antenna, in the first month of its launch, only 9% of new subscribers, signed up for the “Basic with Ads” plan. In addition to that, in the US alone, just 0.1% of the existing subscriber base traded down to the ad plan!

Antenna

I believe it would be too soon to jump the gun and write this off, as next year Netflix plans to start monetizing its account-sharing initiatives by enabling ease of profile transfer (transfer of recommendation, settings, etc.) and creation of sub-accounts. When they inculcate this, I believe the lower-priced ad plan could see a lot more impetus.

On the operating front, expect FX to leave an adverse mark here as well, although it could be better than Q3 given the dollar’s movements since then (FX had a negative impact of 400bps on the Q3 margin). Expect FX effects to play a key role in Netflix’s medium-term prospects going forward as content costs related to increasingly high global licensing initiatives, are in dollar-denominated terms. Beyond the FX, investors should also note that the company typically ramps up its content and marketing expenditure towards the end of the year (particularly given the festival season and the holiday season), so this could weigh heavily on operating margins.

Some other themes I would be watching for would be the company’s progress in the gaming front, which it entered last year. As of 9M-22 they were offering around 35 games on service and spoke of higher retention. I’d be curious to learn what’s driving retention levels and what proportion of Netflix IP-related gaming they plan to introduce next year.

Management also spoke about finishing the year at around the $1bn mark for free cash flow; it’s worth noting that as of 9M-22 aggregate FCF was already at $1.28bn, so it looks like Q4 could see significant cash outflows to the tune of $100-$300m.

Also note that NFLX’s cash on the balance sheet at the end of 9M-22 stood at $6.1bn (~5% higher than the 6M-22 figure) but this may also likely decline in Q4. The company’s policy is to typically maintain two months of revenue as cash on its books; extrapolating the estimated Q4 revenue figure of $7.8bn, you’d be looking at a cash balance of approximately $5.2bn. I suspect much of the decline will be on account of the Australian-based Animal Logic acquisition which was paid for entirely by cash in October. Even though no official financial terms have been publicly disclosed, the Sydney Morning Herald believes the dollar figure was “ substantial”

Closing Thoughts- Is Netflix Stock A Buy, Sell, or Hold?

If one looks at NFLX’s long-term chart, there are a few things that the price imprints have been telling us. Firstly, note that for close to eight years (until Q1-22), the stock had been trending up in the shape of an ascending broadening wedge or an ascending megaphone pattern. This came to an end in April 2022, when we saw a large-shaped red candle close well below the lower boundary.

Investing

After that we’ve seen a pullback of sorts but notice the size and shape of the pullback candles; they’re all rather small implying an ample lack of conviction, perhaps mostly driven by the retail cohort. If you ask me, this looks more like a bearish flag pattern, where one may see another leg down soon enough.

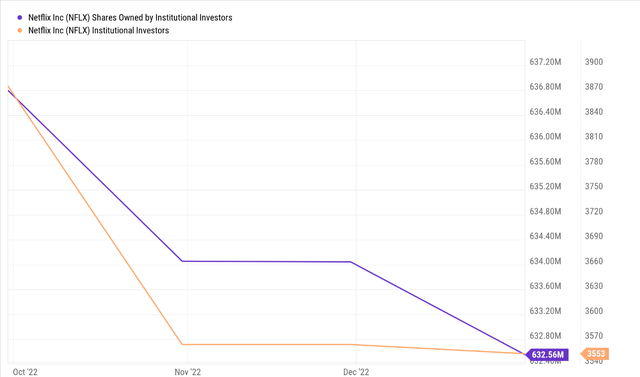

If you’re a glass half-full person, you’d want to believe that this pullback could persist until it negates the entire red candle of April 2022, just below the $400 level. This would also coincide with a resistance zone last seen during 2018-2019. But I feel that if one is to see that sort of persistent strength, you would need the large institutions to come back to the table. That certainly isn’t the case at the moment. Recent data shows that both the number of institutional investors and the net shares owned by them have continued to dwindle since early October, with the fall in December (particularly for net shares owned) coming across as particularly pronounced.

YCharts

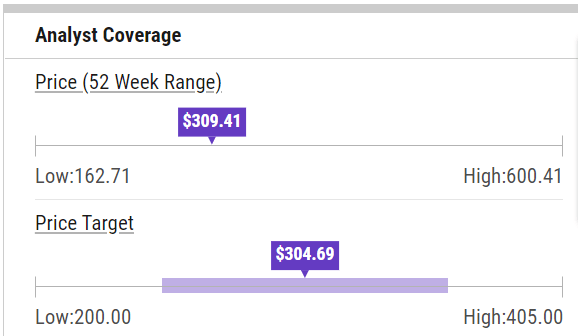

It doesn’t help that NFLX stock is already trading above the average Wall Street Analyst Price target of $304.69!

YCharts

Speaking of analyst positioning, and how that reflects on forward valuations, note that the average EPS figure for FY 2023 currently stands at $10.6, which would translate to a forward P/E of 29.1x, a pretty decent multiple, given that the stock’s 5-year historical forward P/E average works out to 40x!

But then again, consider the level of earnings growth you’re getting for a multiple of 29x. The EPS of $10.60 would imply annual earnings growth of just 2.2% (forward revenue growth will likely be higher at ~7%), translating to an exceptionally pricey forward PEG of over 13x! Just for some perspective, historically NFLX’s forward PEG average range has been a lot lower, ranging from 2x– 7x!

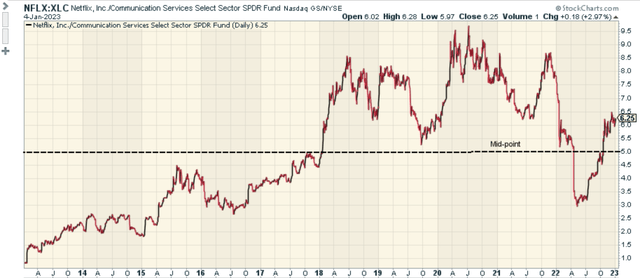

Stockcharts

Finally, I’ll conclude by highlighting how NFLX looks relative to its peers from the communication services sector (as represented by the XLC ETF). Between May and June last year, one could have perhaps made a case for NFLX as a potential mean-reversion candidate in the communication services space, as it was trading below the mid-point of its decade-long range; that is no longer the case with the stock looking a tad overbought relative to its peers.

All things considered, even though Netflix’s business prospects may well pick up in 2023, I see little incentive to turn bullish on the stock at these price levels. The NFLX stock is a HOLD.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.