Summary:

- Apple’s market cap dipped below $2tn in trading for the first time since early 2021. We continue to be hold-rated on Apple.

- We expect Apple stock will drop to $100 as the company cleans up the mess of production disruptions in China.

- We believe it’s time to bring up the discussion of Apple diversifying its production away from China; we expect to see Apple shift away from a China-centered production toward 2024.

- Despite China’s reopening efforts, we expect Apple to still be pressured in the near term by risks of increased COVID cases causing worker shortages.

- Hence, we recommend investors wait for a better entry point on Apple stock.

Scott Olson/Getty Images News

We see our expectations of Apple (NASDAQ:AAPL) stock materialize and hence maintain our hold rating. Apple was the first public tech company valued at $3tn, and on Tuesday fell below $2tn in trading for the first time since 2021. We expect Apple to continue facing churn as it deals with the aftermath of supply chain issues in China. In late November, management warned of significant disruption just before the holiday season, forecasting subdued sales growth around Christmas, amounting to 8%. Despite China’s efforts to rapidly move away from lockdown restrictions, our biggest concern for Apple is still the geographic concentration of iPhone production in China and a potential shortage of workers due to China lifting COVID regulations. We believe Apple will experience a bumpy first half of 2023. We recommend investors avoid buying the dip just yet as we forecast more downside ahead.

We expect Apple stock to fall below $100 per share. The stock has already dropped nearly 18% since we first published our hold rating in mid-September. The following graph outlines our rating history on Apple over the past year.

Time to discuss diversifying production: Exiting China

Despite China’s efforts to move away from lockdown restrictions, we still don’t believe Apple is out of the woods. Apple is working on resorting production after the Foxconn factory went through a series of turmoil from COVID restrictions to worker protests. Apple heavily relies on Chinese Foxconn for 90% of planned production capacity, and we believe Apple’s geographic concentration of production has caught up to it over the past several months. The wait time for Apple’s latest iPhone models, 14 Pro and 14 Pro Max, in the U.S. reached up to 34 days before Christmas. We expect the slowed-down production to reflect negatively on Apple’s earnings in 1Q23. Wedbush Securities analyst Daniel Ives estimates the production disruptions to have cost Apple roughly $1bn a week in November from losses in iPhone sales.

Despite Foxconn now shipping at 90% of peak capacity, we don’t believe Apple will easily compensate for the losses created near the end of 2022. We expect the downside of production issues in China to cause the stock to drop below $100 per share. Our bearish sentiment on Apple in the first half of 2023 is based on the belief that the consequences of production disruptions are still pressuring the company. Additionally, we believe China’s reopening creates a new risk for Apple’s factories: potential worker shortages in factories across the country. Bindiya Vakil, Chief executive of a California-based group that tracks supply-chain services, reported expecting “a lot of operations get impacted by absenteeism, not just at factories, but a warehouse, distribution, logistics and transportation facilities as well.” We expect the next couple of months will be defining for Apple to be able to restore production smoothly and make up for the shortcomings of 2022.

Plans to move more production to India

Apple announced plans to move more production and assembly processes to India in 2024. Foxconn announced it would invest $500mn in an Indian subsidiary to help boost operational capacity. Apple already produces iPhone models in India since 2017; we expect production outside of China to increase as Apple and other global firms adopt a “plus-one strategy” to de-risk themselves from overly relying on China for production.

Apple is expected to move around 5% of the production of its latest iPhone 14 to India, the second-largest smartphone market after China. Additionally, the company is expected by JP Morgan analysts to move a quarter of all Apple products’ production to India by 2025. We’re constructive on Apple’s efforts to diversify production but believe these plans are too late to save Apple from the impact of production issues that occurred late last year.

Valuation

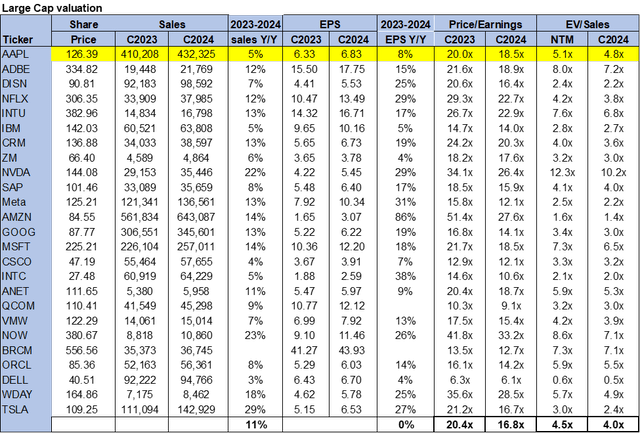

Apple stock is not cheap, trading at 18.5x C2024 EPS $6.83 on a P/E basis compared to the peer group average of 16.8x. On an EV/Sales metric, the stock is trading at 4.8x versus the peer group average of 4.0x. We believe Apple is overvalued for the near-term risks present and recommend investors wait for a better entry point on the stock.

The following table outlines Apple’s valuation compared to the peer group.

Word on Wall Street

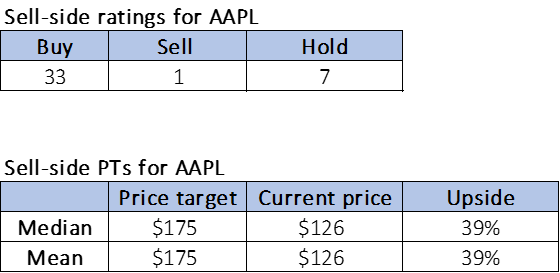

Wall Street is bullish on Apple. Of the 41 analysts covering the stock, 33 are buy-rated, seven are hold-rated, and the remaining are sell-rated. We believe most Wall Street analysts maintain a buy-rating on the stock due to the belief that Apple will be able to weather supply chain issues resulting from China’s supply-chain disruptions. The stock is currently trading at $126. The median and mean sell-side price targets are $175, with a potential upside of 39%.

The following table outlines Apple’s sell-side rating and price targets.

TechStockPros

What to do with the stock

We believe Apple is weighed down by the aftermath of production issues in China alongside weaker-than-expected consumer demand in its strongest market hold in the U.S. We expect the stock to continue to drop further by nearly 21% to trading at $100 per share. Hence, we don’t expect the company to grow meaningfully in the near term. We’re constructive on Apple in the longer term as it plans to outsource more production to India toward 2024. Nevertheless, we expect Apple’s 1Q23 earnings scheduled for early February to reflect the negatives of the holiday season and pull the stock down further. We recommend investors wait on the sideline for the downside to being factored in.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.