Summary:

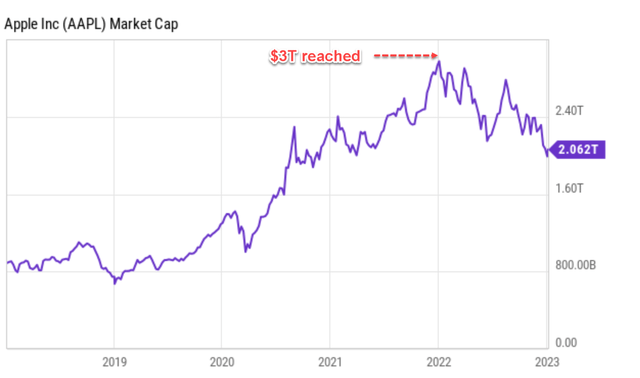

- Early in 2022, Apple became the first company to reach a $3T market cap, even though only very briefly.

- A range of macroscopic headwinds brought it back to the current $2T level.

- However, in my opinion, it is only a matter of time before it returns to $3T again – with style and more permanently. And the time might be sooner than you think.

- Apple’s transformation into a service company and the launch of its own chips are two powerful catalysts.

- Massive share buybacks are even more potent thanks to the temporary stock price setbacks.

nayuki

Thesis

Early in 2022 (Jan 3, 2022 to be exact, as you can see from the following chart), Apple (NASDAQ:AAPL) became the first company to reach a $3T market cap during intraday trading. Then a range of macroscopic headwinds brought it back to the current $2T level.

The thesis here is to explain why I see it as only a matter of time before Apple’s market cap returns to $3T. And, very likely, this time it will do it with style and also on a more permanent basis. The pullbacks were largely caused by macroscopic conditions, not AAPL’s products’ issues. Some of the key issues include the ongoing supply-chain disruptions, the persistence of COVID-19 (especially in China), high inflation, and unfavorable currency exchange rates. And I see all of these issues to be only temporary.

And the time for its market cap to climb back to $3T might be sooner than you think. Its hardware remains hugely popular and sales in pretty much all categories set a record in FY 2022 despite all the above challenges. For the year, Apple set sale records for the flagship iPhone (up 9.7% YOY to $42.6 billion), its iconic Mac line of personal computers (up 25% YOY, to $11.5 billion), and also wearables.

Besides its traditional product lines, there are at least two more powerful catalysts at work even as we speak: its transformation into a service company and its success with its own chips. And we will detail these immediately below.

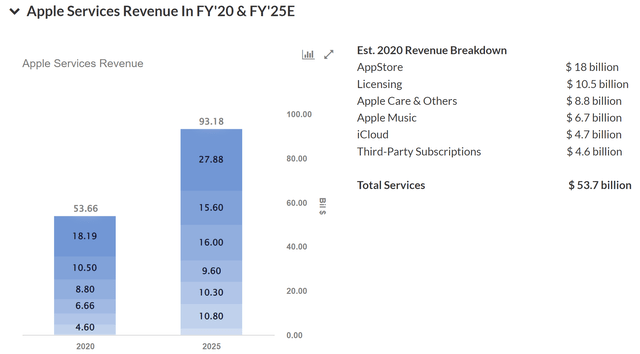

Transformation from a hardware company to a service company

Many investors associate AAPL mostly with hardware (iPhone, Mac, et al) simply because it is so hugely successful with them. However, the main reason I am bullish on its long-term picture is its transformation into a service business. Apple’s installed base of active devices set all-time highs in all of its major product divisions and geographic regions in 2022. And its services-related revenues are making up an increasingly larger portion of the total sales as seen in the chart below. To wit, according to this Trefis analysis, APPL’s Services business raked in a total of $56B of revenues in FY 2020, which already is its second-largest segment and contributed about 19.5% of its total revenues. Looking forward, this segment is projected to almost double to reach sales of more than $93B.

And I think the projection is totally plausible (and you can see the details of the projection by following the link provided above). AAPL’s immense installation base already laid the foundation for the rapid growth in its service revenues, which enjoy higher margins and better recurrence.

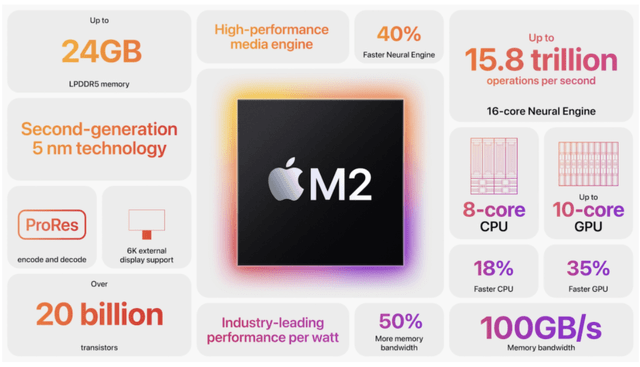

Strategic shift to its own chips

Another very powerful catalyst at work in my view involves AAPL’s strategic launch of its own chip lines. Back in June 2022, AAPL unveiled the M2 chip, its next-generation chip following its M1 chip. The M2 chip is designed based on the SOC concept (System on a Chip) and it’s developed for use in both the Macs and iPads product lines. The M2 chip design is vastly better than its M1 chip and also the Intel chip it used to deploy as its CEO Tim Cook commented in the 2022 Q2 earnings report (slightly edited and the emphases were added by me):

Last month we announced another breakthrough with M1 Ultra, the world’s most powerful chip for a personal computer. The incredible customer response to our M1-powered Macs helped propel a 15% year-over-year increase in revenue, despite supply constraints. We now have our most powerful Mac lineup ever, with the addition of the entirely new Mac Studio.

The M2 chip is more power efficient and computationally powerful at the same time. To wit, according to data from CPU Ninja, drawing the power, the M2 integrates 25% more transistors than the M1 (20 billion transistors in total) and 50% faster memory speed than M1 (up to 100GB/s) memory speed. These advancements are directly reflected in its end products such as battery life and impressive multi-threaded performance in apps like the Mac Studio Tim Cook mentioned above. Take the battery life in an M2 Mac as an example. With M2 chips, it can last up to 2x longer compared to earlier generations installed with Intel chips.

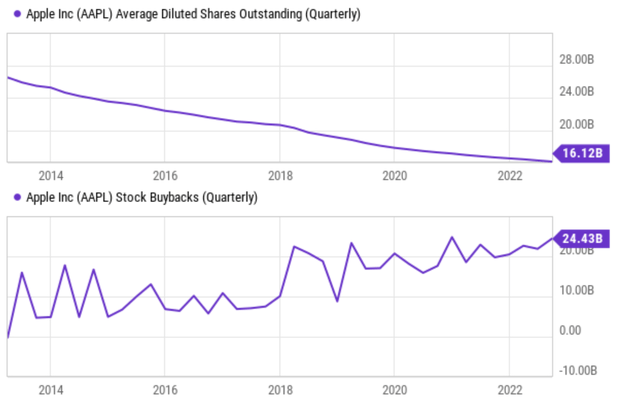

Share buybacks are even more potent now

Finally, AAPL’s aggressive share repurchases will add another catalyst, financial catalysts in addition to the above business catalysts, to push its valuation back to $3T.

AAPL is a large buyer of its own shares in recent years as seen from the following chart. In 2014 when it first started its share repurchase program, its total shares outstanding stood at 23.5B shares (adjusted for its split). And now it stands at 16.12B as seen, translating into a total reduction of almost 1/3 (32.5% to be exact). Each AAPL shareholder now owns 1/3 more of the company than in 2014.

Looking forward, AAPL’s pace of repurchasing will very likely continue, and its cash flow certainly can support it with no problem. As its CFO Luca Maestri repeatedly mentioned the Board’s commitment to share repurchases and AAPL’s plan to become net cash neutral over time. All told, in 2022, the board has authorized an additional $90 billion for share repurchases in the years to come. And this massive $90 billion repurchases only became more potent at the current compressed valuations as illustrated in my analysis below.

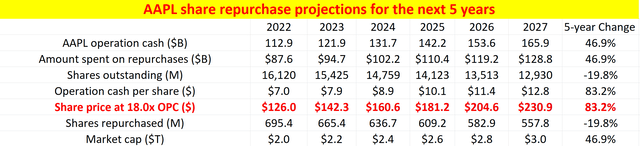

The results are my projected of the share buybacks in the next few years, and my numbers are based on a few simple assumptions as detailed in my earlier articles:

- I assumed AAPL distributes the $90B as a constant percentage of its operating cash flow, which turns out to be 78%

- I assumed that AAPL profits grow at an 8% CAGR according to consensus estimates.

- Finally, I also assumed an average repurchase price of 18.0x of its operating cash (which is about its current multiple as of this writing).

You can see that its total shares count would further shrink by another 19.8% in the next 5 years. And each AAPL shareholder would own ~20% of the company without really doing anything. Finally, you can see that its market cap would reach $3.0T somewhere around 2026~2027.

Source: Author based on Seeking Alpha data

Risks and final thoughts

To reiterate, there is indeed a range of immediate headwinds facing AAPL as aforementioned, including supply-chain congestion, the COVID-19 pandemic, inflation, and also the possible U.S. or even economic growth slowdown. These headwinds could prompt businesses and individual consumers to ease up on their discretionary spending. However, I do not see any long-term structural risks to AAPL. But these headwinds are more general and not unique to AAPL. A more unique and serious risk to AAPL is its large reliance on China. And I have a dedicated article analyzing its China exposure, entitled Apple’s China Antithesis.

In terms of upside risks to my above analysis, I see the assumption of an 18x cash flow multiple as too conservative. A business like AAPL should be easily worth at least 20x of its cash flow. And if its valuation indeed reverts back to 20x cash flow, this little reversion would hasten its climb back to $3T to a timeframe around 2025~2026 – you have already been warned that the time might be sooner than you think!

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.