Summary:

- Ford stock dropped 20% after Q2 results, missing EBIT estimates by 25% due to increased warranty costs and lower profitability.

- Ford’s outlook remains weak with ongoing warranty struggles, delayed product adjustments, and losses in the electric vehicles business, contributing to a negative investor sentiment.

- Overall, I question Ford’s ability and willingness to allocate capital in a shareholder friendly manner, e.g., through buybacks.

- I use a residual earnings model to calculate the value of Ford shares, and my calculation indicates an implied fair target price of $9.5 per share.

Vera Tikhonova

Ford (NYSE:F) stock dropped as much as 20%, the worst drop in over 15 years, after the company released results for the June quarter. While Ford’s revenue was higher than expected, its profitability and free cash flow were below consensus estimates, largely due to increased warranty costs and higher manufacturing expenses. Overall, Ford missed consensus estimates on EBIT by around 25%, which has opened up a big disappointment of the company’s performance vs. expectations, and as a consequence, it is likely that investors–myself included–question Ford’s ability to return significant amounts of capital to investors over the next 12-24 months. Post Q2, I remain negative on Ford stock, and I updated my residual earnings model for the company’s stock. My calculation calls for an implied target price of $9.5 per share.

For context, since the start of the year, Ford shares have notably unperformed the broader market: YTD, F stock is down about 7%, compared to a gain of approximately 14% for the S&P 500.

Ford Disappoints In Q2

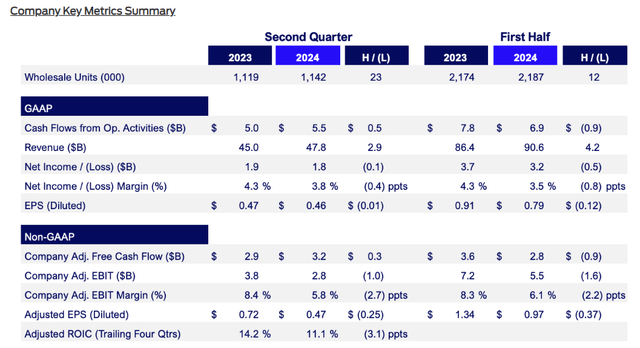

Ford reported results for the second quarter on Wednesday 23rd July, and disappointed the market: During the period from April to end of July, the U.S. automotive giant sold 1.14 million cars and generated $47.8 billion of revenues, up about 2% and 6% YoY, respectively. Although sales were well above Wall Street estimates of about $45 billion, according to data collected by Refinitiv, investors were enormously disappointed by the company’s weak adjusted EBIT due to higher warranty costs, which may have negatively contributed between $800 – 1,200 million in operating income. Meanwhile, Model E segment continues to experience significant losses (~$1.1 billion in Q2 2024), with no change for FY 2024 adjusted EBIT guidance for Model E. Adjusted EBIT came in at $3.8 billion, down about 26% YoY, and almost a billion below consensus estimates, missing by 25%. EPS were reported at 0.36 cents, down 1 cent compared to the same period one year earlier.

Outlook Looks Weak

Despite soft results in Q2 2024, Ford raised its free cash flow guidance by $1 billion, to $8 billion at the midpoint. But the increased guidance is less a function of strong commercial traction than of cost saving. In fact, the guidance update includes plans to keep capital expenditure near the lower end of the guidance range, which may cause a CAPEX surge later down the road. On a product level, projections for Ford Pro’s full-year EBIT have increased to $9.0 billion to $10.0 billion, while, Ford Blue’s outlook has been revised downward to $6.0 billion to $6.5 billion due to higher-than-expected warranty costs. The anticipated full-year loss for Ford Model e remains unchanged at $5.0 billion to $5.5 billion.

On warranty costs, I point out that issues are far from resolved and additional headwinds for the remainder of 2024 should be expected. To address the issue, Ford is focusing on improving quality control by holding additional inventory for quality checks and emphasizing over-the-air updates to address technological issues. However, it is important to point out that the company anticipates a 12-18 month lag before these efforts yield significant benefits. Moreover, to address warranty risk, Ford has postponed the launch of the updated Bronco, Explorer, and Maverick to allow for further quality control inspections. This may give rise to negative competitive pressure in late 2024 and early 2024, as automotive peers including Stellantis (STLA) and General Motors (GM) are aggressively launching new models. And of course, the negative press coverage on warranty issues is certainly a headwind for consumer trust in the Ford brand.

In general, investors should note that the overall environment for the auto industry remains soft, with little support for light vehicle sales growth and average transaction price upside. Stellantis and General Motors all dropped aggressively on earnings, like Ford, pointing to weak consumer demand and softening pricing power. On that note, in my opinion the direction of consumer sentiment is downwards, which may add to macroeconomic weaknesses in Q3 and Q4 this year, potentially negatively affecting sales and profitability.

Capital returns to equity holders, notably the absence of share buybacks, appears to be another major investor concern; and I question Ford’s ability and willingness to allocate capital in a shareholder friendly manner. On that note, Adam Jones from Morgan Stanley appears to share my thinking as he challenged CEO Jim Farley. Below is an interesting excerpt from the Q2 earnings call:

Adam Jonas: Hi, everybody. Jim, you said that Ford is a different company from what it was three years ago, but the stock market really doesn’t seem to agree with you at all on that. Stock is down about 10% after hours and around $12 a share. And my team just ran the numbers, Ford ranks 494 out of 500 companies in the S&P on PE. Jim, do you — my first question is, do you think Ford’s stock is good value?

Jim Farley Yes. Yes, we’re …

Adam Jonas: Then why does your — then why does your Board refuse to authorize a share buyback? And people on this call, I think they understand the reason, like the family element. But in your opinion, if you’re telling me the stock is a good value, and it’s like the bottom one-percentile of the S&P, what’s the plausible reason why — do you really think you have better uses of capital than that?

Jim Farley: Yes, we do. And I have to tell you that it’s hard for people to understand those possible uses of capital, but we have so many exciting businesses to invest in. And Pro is a great example. I’m not going to get into specifics, Adam, but I think people will understand over time how many exciting opportunities there are at Ford. And I’m not just referring to vehicles, I’m referring to non-vehicle activities. We have 27,000 service base. There’s lots of opportunities.

And as I said, when you look at Ford Pro, I’ll just deep dive on that one, and I’m so glad you asked this question, by the way. So Ford Pro is a very, very high percentage of our company’s profit. Just look at the ratio between the overall company’s EBIT in Pro and our guidance. And then think about our after-sales business, only 24% of our revenue comes from Pro-related vehicles.

And we could spend a lot of time talking about this opportunity, but that’s why I highlighted in my comments, there are so many places for us to grow Pro on the physical services. They’re like 35% margin, but it’s hard stuff, right? It’s like bays and technicians and a lot of work. We have very exciting electrical architecture investments that we have to make in our future that will really change our ICE vehicles and their revenue potential. Because that revenue won’t be just when we sell the vehicle, it will be over time, which we’re seeing with Pro already.

Target Price: Lower To $9.5

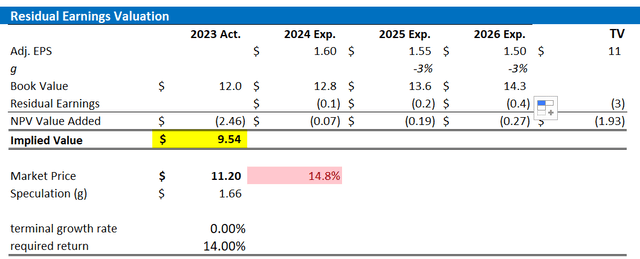

Following Ford’s Q2 earnings report, I tweak my residual earnings model for the company’s stock. Specifically, I update my EPS expectations for 2024, 2025, and 2026, to $1.6, $1.55 and $1.50, respectively. I continue to project a 0% terminal growth rate post-2026, pointing to little structural growth. I set my cost of equity estimate at 14%, to reflect competitive pressure and structural changes in the global automotive sector. Considering these assumptions, I now calculate a fair implied share price for Ford stock at $9.5.

For context, the value “Speculation” is just the difference to fair implied value. A positive value implies a premium; or in other words, markets are speculating to price a more fundamental upside compared to my estimates.

Refinitiv; Company Financials; Cavenagh Research’s EPS Estimates and Calculation

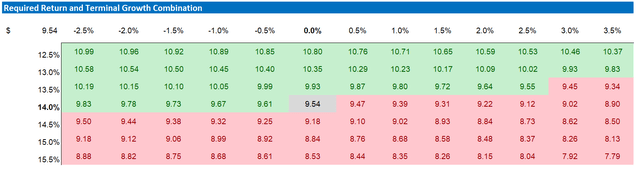

Below is also the updated sensitivity table.

Refinitiv; Company Financials; Cavenagh Research’s EPS Estimates and Calculation

Investor Takeaway

Ford stock plummeted a historical 20%, marking the worst drop in over 15 years, following the release of its June quarter results. Despite revenue exceeding expectations, Ford’s profitability and free cash flow fell short of consensus estimates, primarily due to increased warranty costs and higher manufacturing expenses. Overall, Ford missed consensus EBIT estimates by approximately 25%, leading to significant disappointment regarding the company’s performance compared to expectations. Now, looking at the remainder of 2024, I see (i) ongoing warranty struggles, (ii) delayed product adjustments, (iii) ongoing losses in the electric vehicles business and (iv) a soft macro backdrop for car sales, all while I (v) question Ford’s ability and willingness to return substantial capital to investors. Concluding, following Q2, I remain negative on Ford stock and have updated my residual earnings model for the company. My calculation now indicates an implied target price of $9.5 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.