Summary:

- Harley-Davidson is a forgotten brand-name investment idea for many, after years of going nowhere fast, riding around in circles.

- The company is quite inexpensive on a number of financial performance ratios, including attractive enterprise valuations.

- The earnings yield argument suggests owning Harley-Davidson shares at the current quote may produce outsized returns over the next 12-18 months.

- If a deep recession appears, even lower share pricing could open another stellar buy moment for long-term investors, like previous economic downturns.

mpalis/iStock Editorial via Getty Images

Harley-Davidson (NYSE:HOG) has witnessed little business growth over the past decade. However, with interest rates rising, the company’s finance operations are better able to generate cash flow to cover substantially fixed debt interest expense (70% due in 2024 or after). In addition to this positive development, slightly improved demand and margins after the pandemic may encourage a whole new level of shareholder success from this iconic motorized (and now rechargeable electric battery) brand in America.

Harley-Davidson Website, Standard Gas-Powered Motorbike Categories, August 12th, 2023 Harley-Davidson Website, Electric Cycle Models, August 12th, 2023

If you are searching for a company to own, U.S.-built and focused for sales, synonymous with the national flag, mom and apple pie, Harley’s value and growth proposition appears to be very underrated and unappreciated in August 2023. On top of the fundamental buy story, technical trading evidence is hinting at a possible turnaround in the share quote. Let me explain the bullish thesis, focused on a mean reversion for trading in the direction of HOG’s typical long-term valuation.

Undervaluation Logic

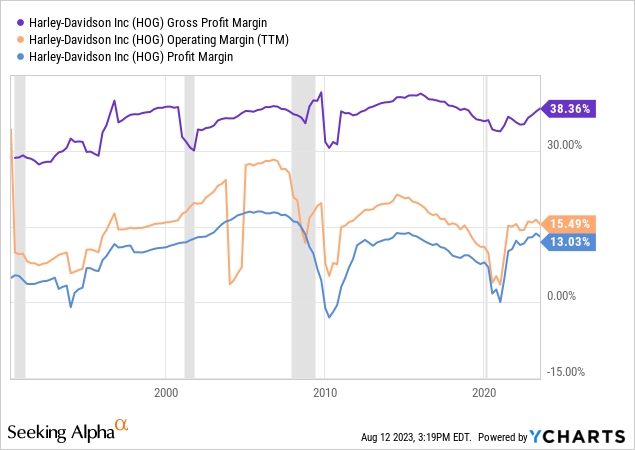

The first point I would like to make is profit margins on sales have been quite steady since the company went public in the late 1980s, and are now the highest since 2017. Below is a graph of gross, operating, and final net profit margins. Differences in valuation can occur based on falling or rising business margins. For some of the long-term charts I will present, understanding that margins have remained relatively consistent over decades (outside of recession swings) is important to compare financial ratio apples to apples.

YCharts – Harley-Davidson, Profit Margins, Recessions Shaded in Grey, Since 1990

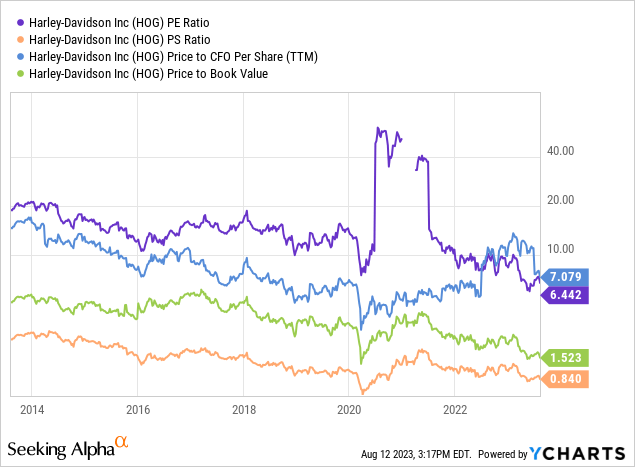

On basic fundamental ratios of price to trailing earnings, sales, cash flow, and book value, Harley is trading near a decade-low valuation (taking the stats in combination). Only the 2020 pandemic panic bottom was even cheaper than today. I particularly like the low P/E ratio of 6.4x vs. an equivalent S&P 500 number in the 20x area. (I will discuss the bullish earnings yield setup later in the article.)

YCharts – Harley-Davidson, Price to Trailing Fundamentals, 10 Years

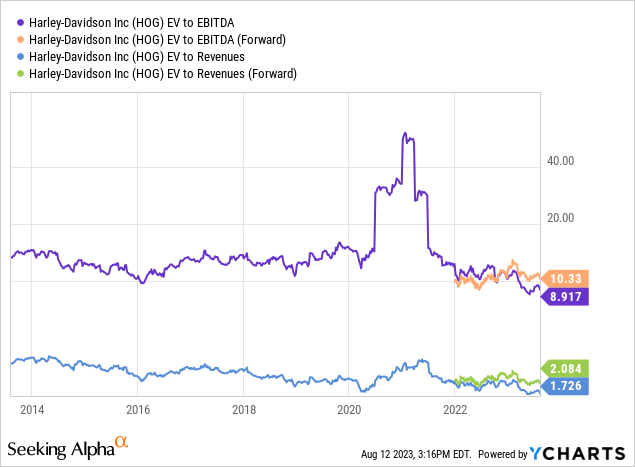

When we include debt and cash totals held on the balance sheet, enterprise valuations may be even less expensive, in a relative sense, to HOG’s trading history. The current EV to stripped-down cash EBITDA multiple of 9x over the summer months is 35% below its 10-year average, while EV to revenue under 2x is a 30% discount.

YCharts – Harley-Davidson, Enterprise Valuations, 10 Years

Earnings Yield Buy Argument

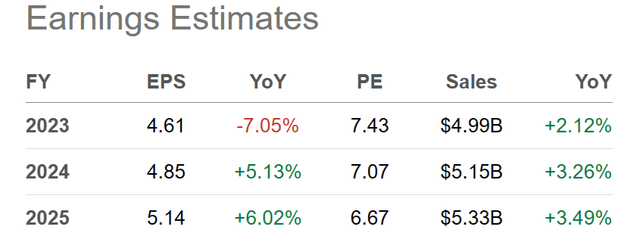

Yet, the smartest pull for my money and research is the earnings yield argument. Assuming earnings are flat to higher over the next several years (which is today’s Wall Street forecast), the 15% earnings yield presently is quite attractive, to say the least.

Seeking Alpha Table – Harley-Davidson, Analyst Estimates for 2023-25, Made August 11th, 2023

If you owned the whole business for yourself at the present share price, you could “pocket” 15% annually right now (after taxes mind you), without affecting future growth or operating results. This is a nicely advantageous investment return compared to “risk-free” Treasury rates around 5% available as an alternative for your capital.

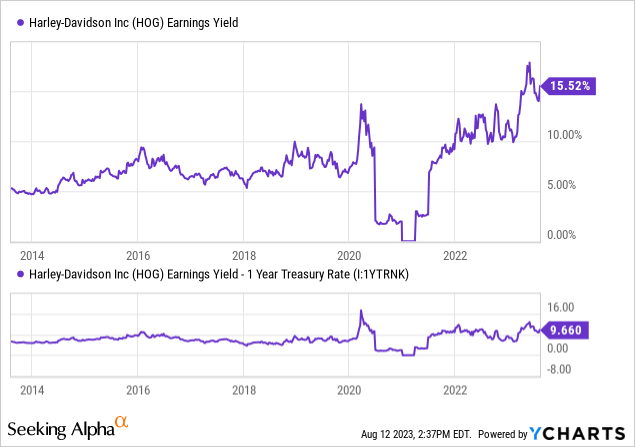

Below is a 10-year graph of the idea, with the positive spread vs. 1-year Treasury yields on the bottom. Over the summer, HOG has been priced beyond a rare and hard to believe +10% relative earnings yield level.

YCharts – Harley-Davidson, Earnings Yield vs. 1-Year Treasury Rate, 10 Years

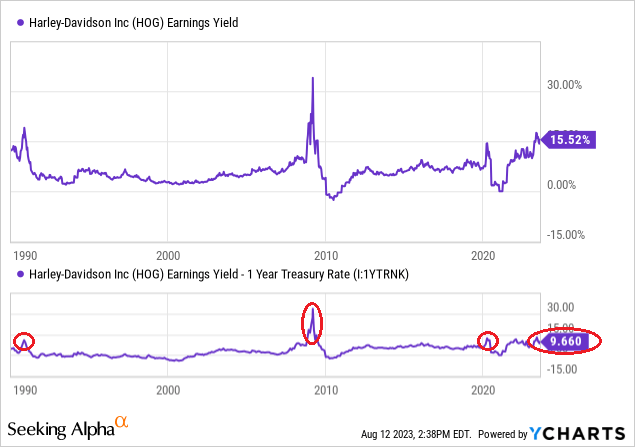

Over the last decade, only the March-April 2020 pandemic dump provided a better entry point on trailing earnings, and it lasted for weeks. If you blinked, you may have missed the opportunity. In fact, spreads of greater than +10% have occurred just three other times since 1990 (1990, 2008-09 and 2020). Each happened around a recession in GDP. I have drawn this idea below on a 33-year graph, with similar buy opportunities circled in red.

YCharts – Harley-Davidson, Trailing Earnings Yield vs. 1-Year Treasuries, Author Reference Points, Since 1990

How did the previous three instances work out a year later? Let’s take a look. Each situation turned out to be a terrific point in time to purchase HOG shares. I have graphed each of the high earnings yield buys below.

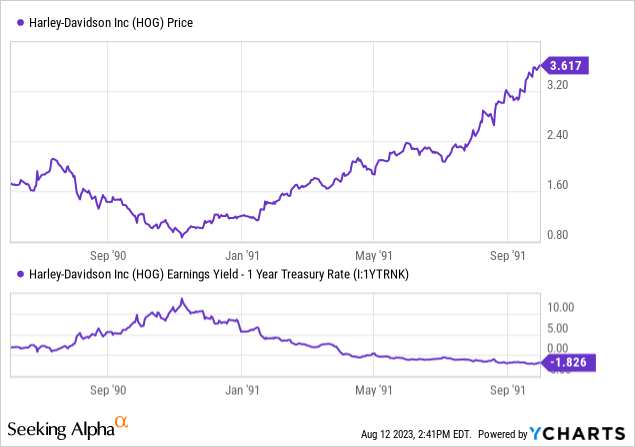

Late 1990 Buy

YCharts – Harley-Davidson, Share Price vs. Relative Earnings Yield to 1-Year Treasury, June 1990 to Oct 1991

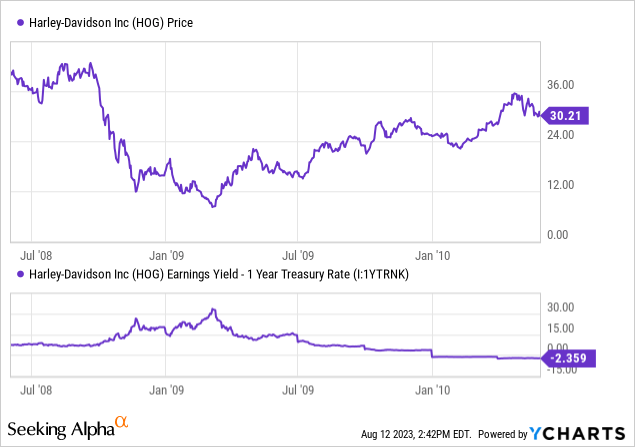

Late 2008 to Early 2009 Buy

YCharts – Harley-Davidson, Share Price vs. Relative Earnings Yield to 1-Year Treasury, June 2008 to June 2010

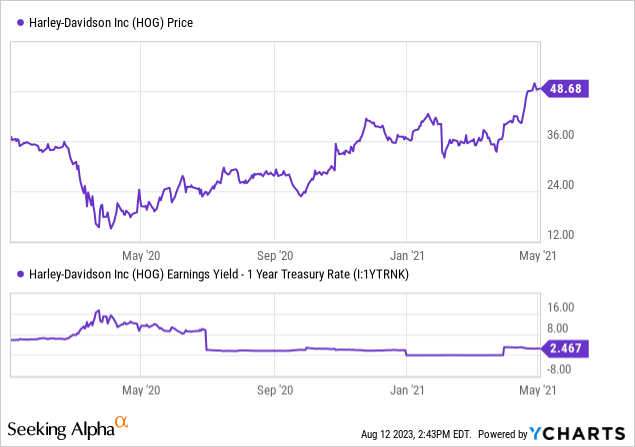

March-April 2020 Buy

YCharts – Harley-Davidson, Share Price vs. Relative Earnings Yield to 1-Year Treasury, Jan 2020 to May 2021

All three instances of HOG’s relative spread of earnings yield to Treasury rates beyond +10% proved an excellent time to buy. And, as price continued lower into recession, even better buy entries appeared. Measured from the share price bottoms for each period, 1990-91 experienced a 12-month price gain of +300% thereafter, 2009-10 another jump of roughly +300%, and 2020 an advance of +250%. My conclusion is acquiring a starter stake now, with plans to buy additional shares on any weakness into the autumn, could be a productive strategy for long-term investors.

Technical Trading Pattern

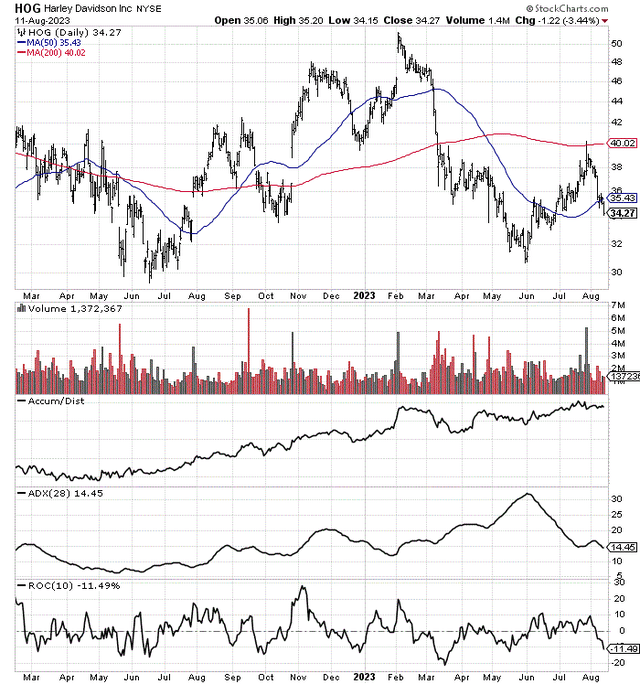

I did make a successful long trade between $34 and $38 in the June-July span. I am now working on reentering a position. Technical reasons to buy are now appearing, although at a slower pace than I would like.

Drawn below, the Accumulation/Distribution Line has been quite strong, despite a flat price over the latest 18 months of trading. The 28-day Average Directional Line has declined under 15, a score that usually means a basing pattern with lower volatility has been the recent pattern.

The 10-day Rate of Change signals the selloff from $40 to $34 over two weeks may be overdone. If a bounce back above the 50-day moving average around $35.50 happens this week, it may signal a rising price trend has resumed off the May low price of $30.85. If not, a retest of the $30 to $32 area could be next (the lows of 2022 and 2023).

StockCharts.com – Harley-Davidson, 18 Months of Daily Price & Volume Changes

Final Thoughts

A rebirth of investor interest could easily push Harley back to February’s high of $50 (+45% for new investors) or even $60 (+75%) a share in 12 months without any material change in operations, especially if the overall economy is not hit by a serious recession. Despite a rebound in many cyclical industrials this year, Harley has been unfairly left behind. This disconnect in performance could be opening a terrific buy opportunity, as a simple reversion-to-the-mean valuation move may be in the offing. Using 10-year average multiples of price to earnings, sales, and book value, Harley-Davidson is worth at least $70 today, all other variables remaining the same.

An investment in HOG may depend on your outlook for the economy. If you are concerned a recession is inevitable, from inverted Treasury yield curve spreads and elevated to rising interest rates, I completely understand you may decide to skip this choice in your portfolio. Keeping HOG on your watch list for lower prices may be the short-term way to go, given a recession.

Of course, if a material contraction in U.S. GDP is reality over the next 6–12 months, Harley-Davidson may only be able to tread water for price (as a worst-case scenario). Higher default rates on its existing 2-wheel and 3-wheel vehicle loans, combined with slower than expected new sales, would definitely eat into profits. The question is – how much lower can the valuation go, assuming some sort of operating profit can be achieved in 2024?

However, if we experience a soft landing, where slow GDP growth remains over the next 12 months, Harley’s results may be able to beat current Wall Street expectations. So, a little increase in investor optimism from a low-base valuation could support a nice upturn in the share quote.

Harley retains a bullish valuation on earnings yield calculations, despite a timid growth outlook (at least according to Wall Street estimates today). It is sitting in the exact opposite valuation position of NVIDIA (NVDA), a sell suggestion I made last week here. NVIDIA has a miniscule trailing earnings yield of 0.5% vs. 1-year Treasuries at 5.5%. Plus, NVIDIA is priced at a 2% forecast on the profit-yield on your investment price for 2024-25 (even after assuming amazing AI-chip demand), still a wild miss vs. risk-free cash alternatives. In my experience, owning the forgotten blue-chip with lackluster growth has routinely beaten the performance of super-popular yet expensive names, after a rebalance of risk/reward inevitably takes place in the future.

Historically, a HOG earnings yield above 15% has proven a great time to acquire shares since the company went public. For those paying attention, the timing window to buy shares under this condition has usually only lasted for months, limited to three other instances over the past 33 years!

I rate HOG a Buy under $40. Unless we enter a deep and prolonged recession, I expect shares to hold the $29.50 to $30.00 price zone. Traders could entertain using a stop-sell order at a trigger price under $29.50, to keep potential losses limited to -10% to -15%. Then reevaluate the investment setup at that point. However, a larger break below $30 with the advent of a recession could open a truly excellent opportunity to buy Harley-Davidson on the cheap, if history repeats.

Assuming price falls all the way to $25 on the advent of a serious recession into the end of the year, a recovery back to 10-year normalized enterprise valuations on EBITDA and sales, roughly equal to decade average readings of 15x EPS, 1.5x sales and 3x book value could support $70 or $80 in price by the end of 2024. Such would be good for another +200% historical advance for astute investors with impeccable timing. Nevertheless, I doubt a drop under $30 will take place without a recession. So, opening a small position today makes complete sense, mindful of shorter-term risks.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in HOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.