Summary:

- Agilysys reported its FQ3 2023 financial results on January 24, 2023.

- The firm provides a range of management, processing and related software and hardware solutions to the hospitality industry.

- The company has produced growing revenue and profits while recently announcing a ‘transformational’ customer win in Marriott selecting its PMS system.

- AGYS is also well-positioned to benefit from China’s reopening and the likely greater demand from the Asia-Pacific region.

- My outlook is a Buy at around $81.00 per share.

itsskin/E+ via Getty Images

A Quick Take On Agilysys

Agilysys (NASDAQ:AGYS) reported its FQ3 2023 financial results on January 24, 2023, beating revenue and EPS consensus estimates.

The company provides a range of hospitality management software for customers worldwide.

While AGYS’s stock has certainly enjoyed a strong run in the past 12 months, I believe the best is ahead for the firm as it capitalizes on the ‘transformational’ Marriott customer win and a reopening of hospitality in Asia.

My outlook on AGYS is a Buy at around $81.00 per share.

Agilysys Overview

Alpharetta, Georgia-based Agilysys provides software and hardware solutions for a wide variety of industries.

The firm is headed by Chief Executive Officer Ramesh Srinivasan, who was previously CEO of Ooyala and president and CEO of Innotrac Corporation.

The company’s primary offerings include:

-

Point of sale

-

Hospitality management

-

Inventory & procurement

-

Reservations management

-

Seat solutions

-

Payment services

The firm acquires customers via its direct sales and marketing efforts.

AGYS’ customer base tends to skew toward the middle to upper level of the hospitality market.

The company serves a wide variety of sectors within the hospitality complex:

-

Hotels & Resorts

-

Casino Resorts

-

Tribal Gaming

-

Cruise Lines

-

Managed Foodservice

-

Sports & Entertainment

-

Restaurants

Agilysys’ Market & Competition

According to a 2022 market research report by ResearchAndMarkets, the market for hotel property management software was an estimated $5.9 billion in 2021 and is forecast to reach $10.9 billion by 2027.

This represents a forecast CAGR of 10.7% from 2022 to 2027.

The main drivers for this expected growth are a return to public events as the effects of the COVID-19 pandemic wane and a desire by hospitality providers for more efficient operations.

Also, hotels will likely increase their demand for SaaS-based solutions as well as for mobile technology integrations as their customer base requires more advanced and convenient interactions.

Major competitive or other industry participants include:

-

Guesty

-

Schneider Electric

-

Lodgify

-

eZee FrontDesk

-

Protel

-

StayNTouch

-

Infor

-

NEC Corporation

-

HMS Infotech Pvt. Ltd

-

Intertec Systems

-

SABRE GLBL

-

Winhotel Solution SL

-

Siemens

-

Trawex Technologies Pvt Ltd.

-

Hostaway

-

IRIS Software Systems

-

Risk Management Solutions

The company sells solutions for other aspects of hospitality management and payment processing.

Agilysys’ Recent Financial Performance

-

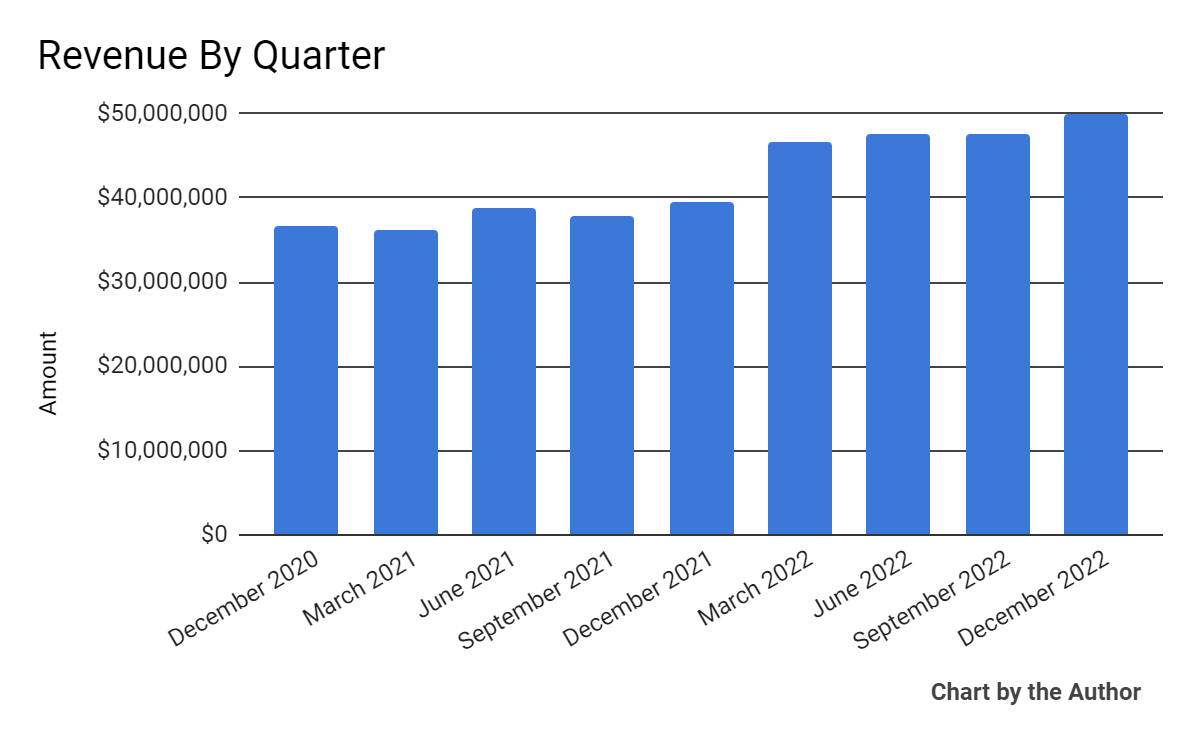

Total revenue by quarter has grown per the following chart:

Total Revenue (Seeking Alpha)

-

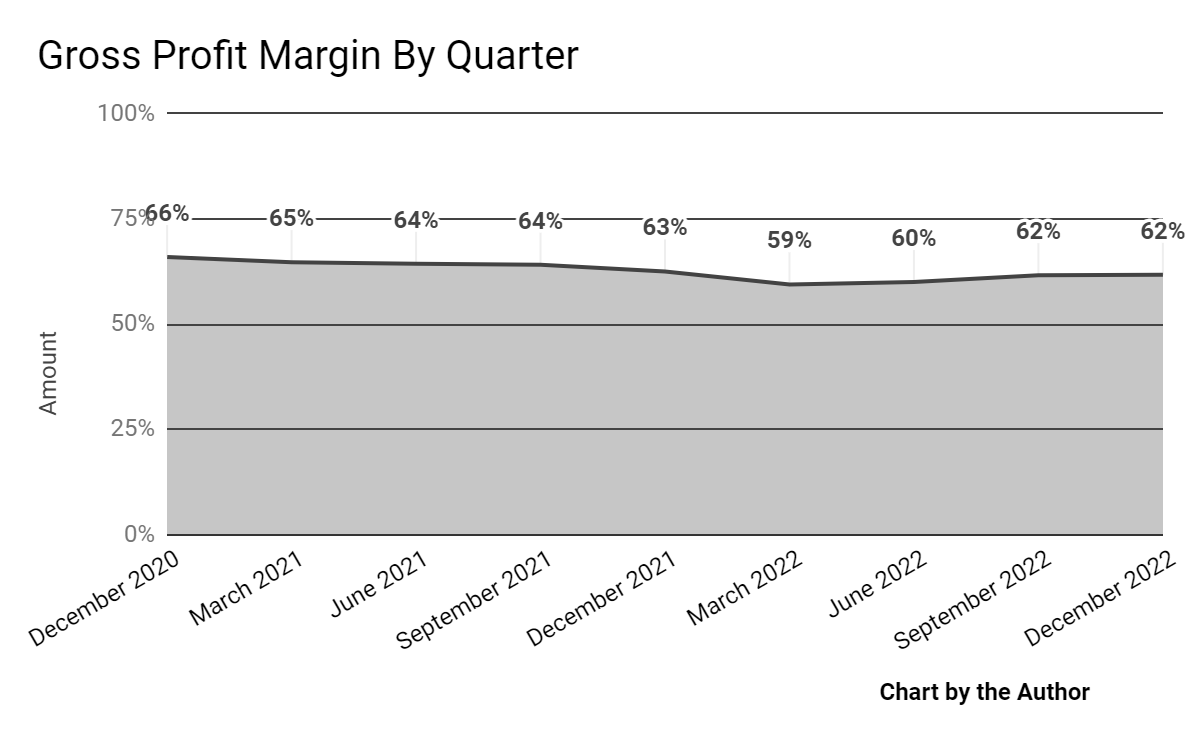

Gross profit margin by quarter has trended lower in recent quarters:

Gross Profit Margin (Seeking Alpha)

-

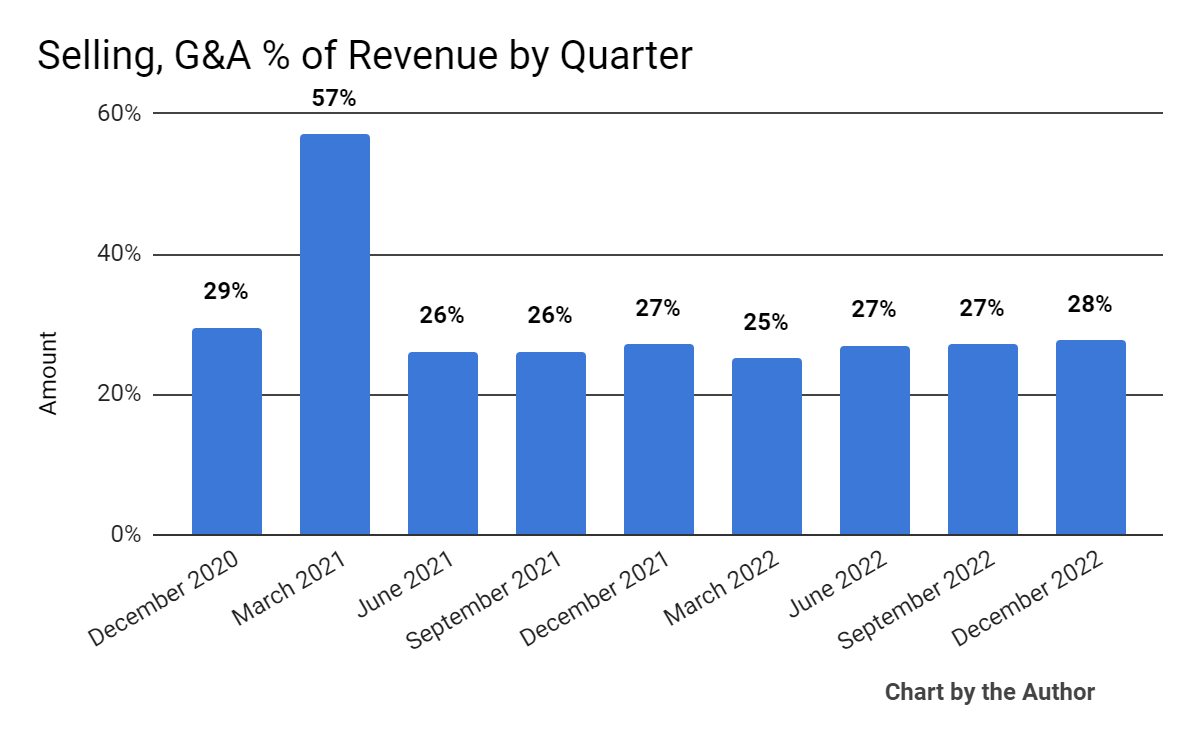

Selling, G&A expenses as a percentage of total revenue by quarter have increased more recently:

Selling, G&A % Of Revenue (Seeking Alpha)

-

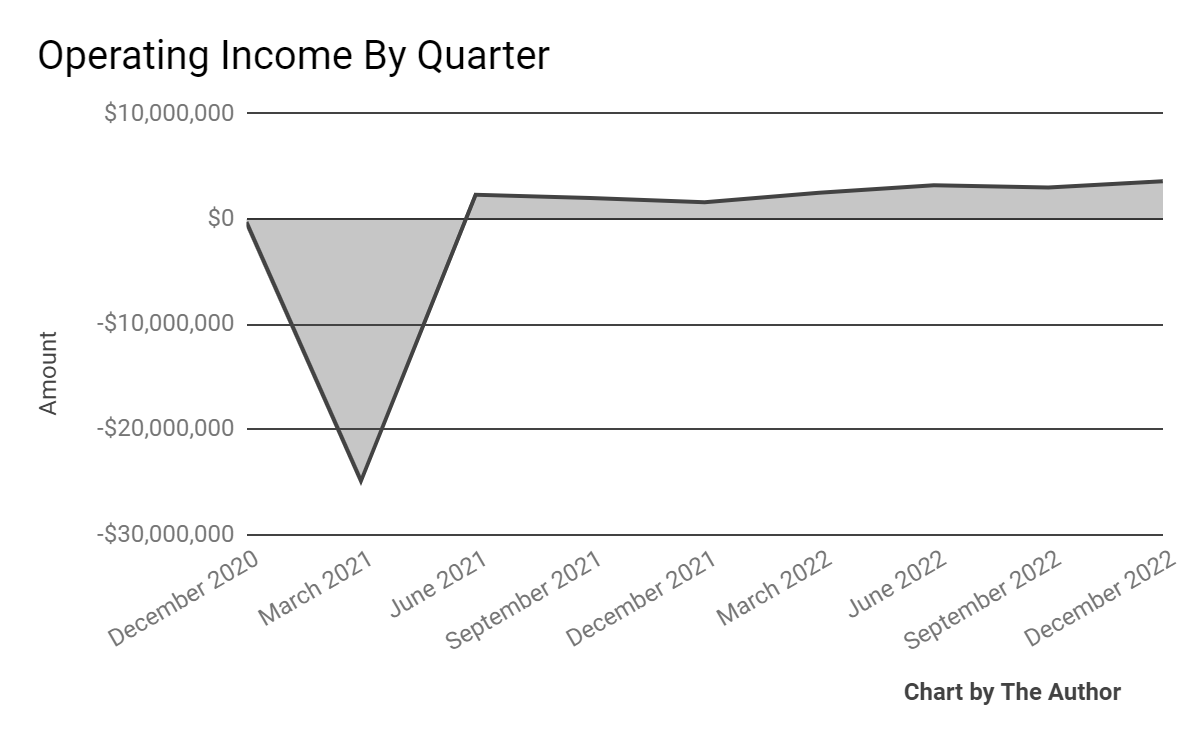

Operating income by quarter has increased very slightly recently:

Operating Income (Seeking Alpha)

-

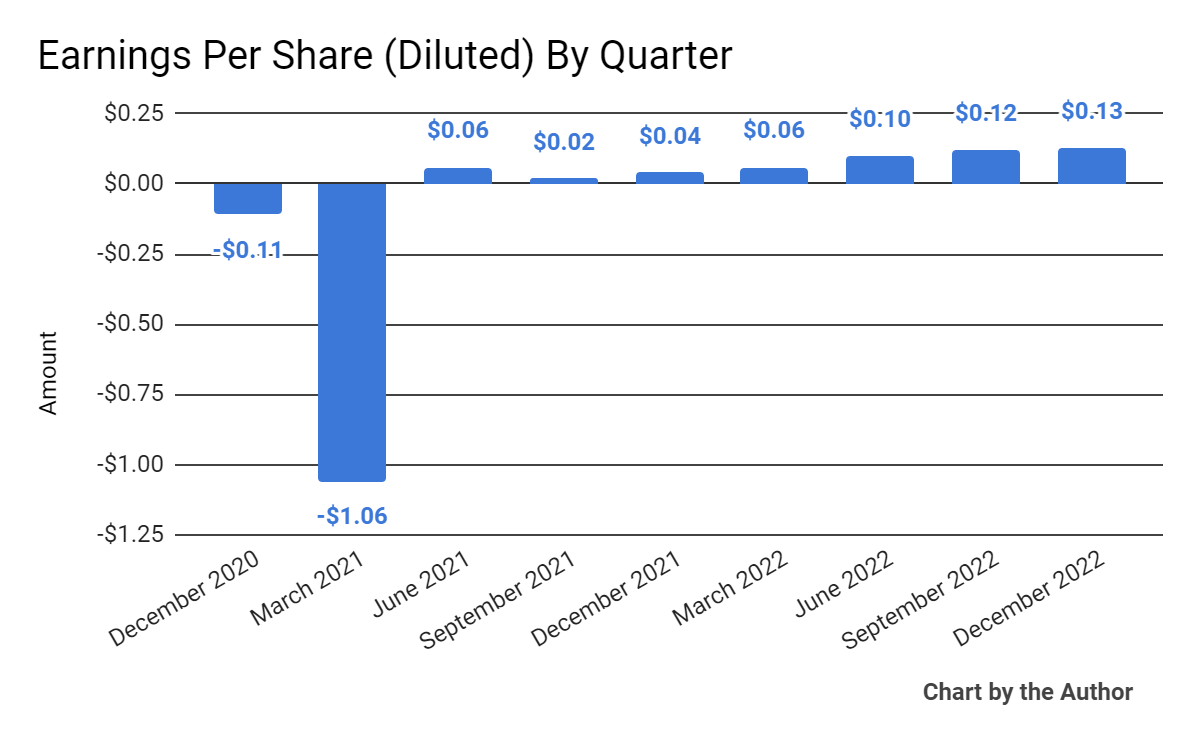

Earnings per share (Diluted) have risen per the chart below:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

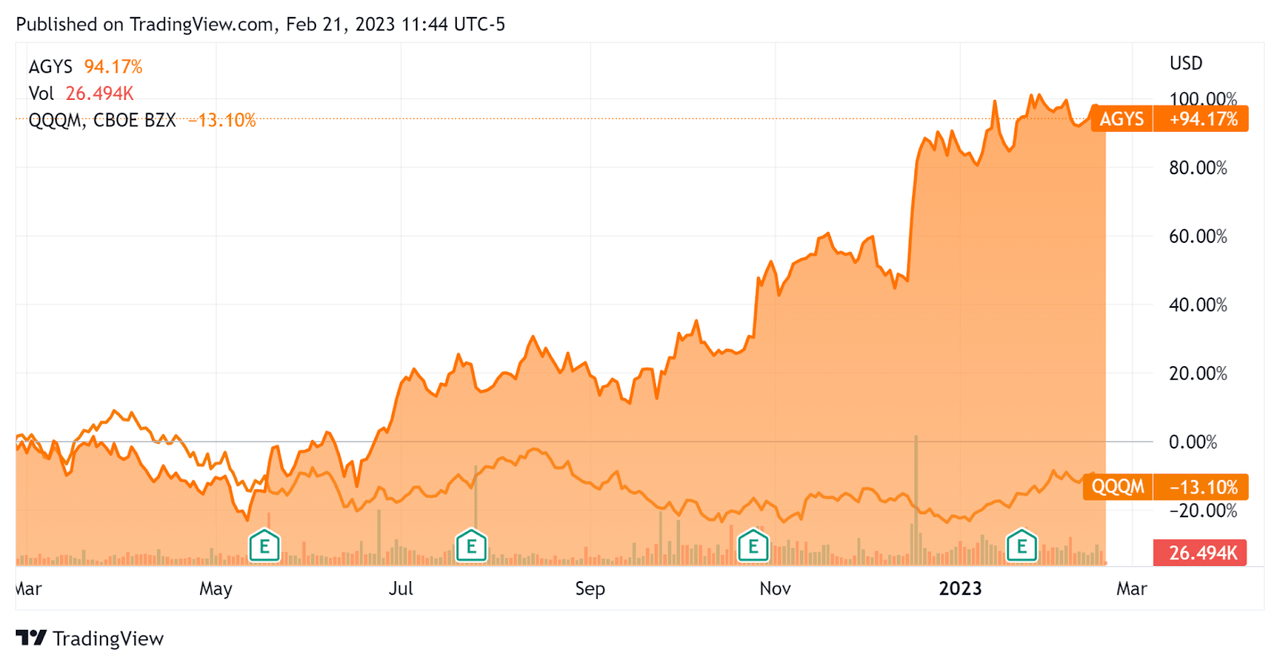

In the past 12 months, AGYS’s stock price has risen 94.2% vs. that of Nasdaq 100 Index’s drop of 13.1%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Agilysys

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

10.4 |

|

Enterprise Value / EBITDA |

124.4 |

|

Price / Sales |

10.6 |

|

Revenue Growth Rate |

25.8% |

|

Net Income Margin |

6.5% |

|

GAAP EBITDA % |

8.4% |

|

Market Capitalization |

$2,050,726,270 |

|

Enterprise Value |

$1,996,154,370 |

|

Operating Cash Flow |

$24,340,000 |

|

Earnings Per Share (Fully Diluted) |

$0.41 |

(Source – Seeking Alpha)

Commentary On Agilysys

In its last earnings call (Source – Seeking Alpha), covering FQ3 2023’s results, management highlighted the company’s recent customer win with hospitality giant Marriott for the firm’s PMS system, although that win will take at least 18 months before it can be implemented and revenue has begun to be recognized.

The company is also seeing a strong increase in interest from Asian prospects and existing customers, as China’s reopening due to the removal of COVID-19 restrictions adds to the potential for new business growth there.

Notably, leadership has ‘not seen any significant effects of the recent negative macroeconomic environment.’

Management believes the hospitality industry has been poorly served by partial technology solutions and that its integrated approach is increasingly appealing to operators seeking to attract and retain customers that are used to more advanced capabilities in other areas of their lives.

As to its financial results, total revenue rose 26.5% year-over-year to a record $49.9 million for the quarter.

Management did not disclose any company retention rate metrics.

Gross profit margin has been trending lower and management expects that to continue, especially after adding resources to handle the Marriott PMS implementation efforts over the coming years.

SG&A as a percentage of revenue has also been ticking upward, although earnings per share have consistently been increasing sequentially in recent quarters.

For the balance sheet, the firm finished the quarter with $105.8 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash flow was $20.6 million, of which capital expenditures accounted for $3.7 million. The company paid $13.2 million in stock-based compensation in the last four quarters.

Looking ahead, full fiscal 2023 revenue is expected to be around $196.5 million at the midpoint of the range. EBITDA is forecast to grow at 15% over the prior fiscal year.

Regarding valuation, the market is valuing AGYS at an Enterprise Value / Revenue multiple of 10.4x and an EV / EBITDA multiple of 124.4x.

The primary risk to the company’s outlook is a slowing macroeconomic environment which may lengthen sales cycles and slow revenue growth.

A potential upside catalyst to the stock could include a strong reopening by Chinese prospects and greater activity in the Asia-Pacific region.

While AGYS’s stock has certainly enjoyed a strong run in the past 12 months, I believe the best is ahead for the firm as it capitalizes on the ‘transformational’ Marriott customer win and a reopening of hospitality in Asia.

My outlook on AGYS is a Buy at around $81.00 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This report is for educational purposes and is not financial, legal, or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or be removed at any time without notice. The author is not an investment advisor. You should perform your own research on your particular financial situation before making any decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!