Summary:

- We’re moving Microsoft to a sell as we expect more downside in the near term.

- While there’s a lot of hype around Microsoft’s investment in ChatGPT and its cloud-based Azure, we don’t expect the company will benefit from these tailwinds in the near term.

- Microsoft reported slowing growth in its core segments and a decline in net income by 14%. We expect the stock to dip further as the company maneuvers macroeconomic headwinds.

- We believe Microsoft is pressured in the near term by weaker-than-expect IT spending due to the uncertain macro environment; hence, we don’t believe the stock has bottomed yet.

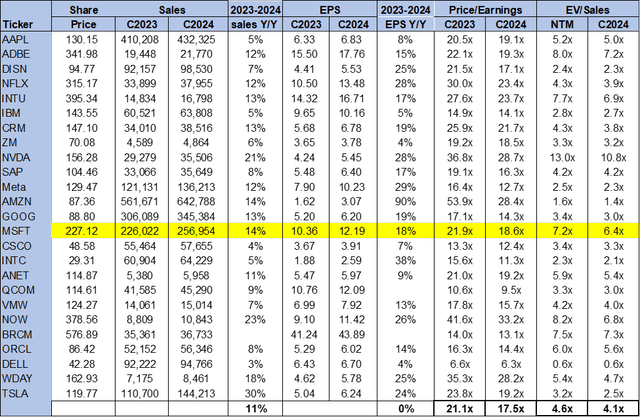

- While we’re bullish on Microsoft in the long-run, the stock has yet to provide an attractive entry point, trading at 6.4x EV/C2024 Sales versus the group average of 4.1x.

lcva2/iStock Editorial via Getty Images

We’re moving Microsoft (NASDAQ:MSFT) to a sell. While most analyses of Microsoft are hyping the bullish case on the stock after the sell-off last year, we still don’t believe it’s time to buy in. At TechStockPros, we abide by the slogan buy low, sell high; hence, we’re bearish on Microsoft as we expect the company to drop further in the near term. Our bearish sentiment is based on our belief that Microsoft will be under pressure for the next few months.

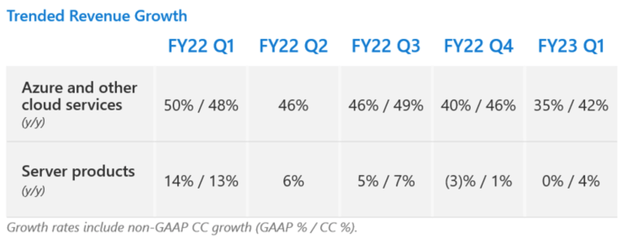

We expect the spending environment to continue to be weak across the board in the tech space and don’t believe Microsoft is immune to the slowdown. Microsoft’s latest quarter, 1Q23, reported a slowdown in its three core segments and a significant decrease in net income, down 14% Y/Y. Even Microsoft’s fastest-growing segment, Intelligent Cloud, accounting for 40.5% of revenue, has slowed down sequentially, achieving an increase of 35% in 1Q23 compared to 40% in 4Q22. We believe Microsoft has a rough few months ahead and will not be surprised to see the stock dip below $200 per share or lower over the next few months.

Tailwinds to materialize in the long term, not the near term

We’re bearish on Microsoft in the near term as we believe the company has a rough few months ahead of it before it will be able to enjoy tailwinds from cloud-driven demand for Azure or the potential ChatGPT investment. We’re bullish on Microsoft toward 2024 but recommend investors be cautious not to feed into the market noise around Microsoft’s growth drivers just yet. We expect things will get worse before they get better. We don’t share the bullish sentiment dominating the market based on two fronts:

1. Weak spending environment

It’s no secret that the current macroeconomic environment is not a breeding ground for growth; IT spending is reported to have weakened significantly over the past few quarters, and Microsoft is not immune. A brief published by J.P. Morgan tracking the macro situation elaborates on this, stating that higher costs are pressuring even the biggest names in the tech space. Microsoft’s Intelligent Cloud is its fastest-growing segment and is one of the top three cloud-computing services dominating the market alongside Amazon’s (AMZN) AWS and Alphabet’s (GOOG) (GOOGL) Google Cloud. Despite this, Microsoft’s cloud segment achieved lower growth rates from the prior quarter; we believe this is due to slowing spending from corporate customers amid economic uncertainty. We believe the negative impact of inflationary pressures and spiked interest rates has translated to weaker IT spending on cloud services. According to tech market analyst firm, Canalys, the annual growth rate for cloud “fell below 30% for the first time.” While bulls believe it’s time to buy the bottom, we believe we still haven’t seen the bottom. We expect the macroeconomic environment to continue pressuring Microsoft in the near term.

The following graph outlines Microsoft’s revenue growth trend in its fastest-growing segment, Azure and Other Cloud Services.

Microsoft is not suffering through the weaker spending environment alone; Snowflake (SNOW), Salesforce (CRM), and Amazon, among others in the tech space, also show signs of slowing revenue. Data reports from the Information Services Group (‘ISG’), a global tech research and advisory firm, highlighted that even while cloud demand remains at an all-time high, there are visible pullbacks in spending. We believe this is due to economic uncertainty causing enterprises to delay decision-making and prolong sale cycles. The ISG Index found that the total number of managed service contracts in 3Q was up only 3% Y/Y. Hence, we expect Microsoft to have a rough few months ahead and the stock to drop in response to customer spending behavior.

2. Timeline on returns from the ChatGPT investment

While we’re constructive on Microsoft’s potential $10B investment in ChatGPT by creator, OpenAI, we don’t expect the company (or investors) to enjoy returns overnight. Microsoft invested $1B in OpenAI in 2019, and the San Francisco-based company has made headlines recently for its new chat box, ChatGPT. Essentially, ChatGPT uses Artificial Intelligence tech to answer questions instantly and generate human-like responses to various requests (essays, poems, codes, or anything that comes to mind.). The platform got more than a million users in the first five days after its launch in December; we believe ChatGPT will be a major growth driver for Microsoft in the long run. Still, we believe there are a lot of technicalities that need to happen before Microsoft enjoys returns from the platform. While the prospects for the investment are great, we don’t expect anything to materialize before OpenAI figures out how to make money off ChatGPT.

Aside from the technicalities of Microsoft’s investment, we believe ChatGPT still has to lay a solid foundation to compete with Google’s search engine, which still dominates the market with an 85% market share. We’re bullish on Microsoft’s collaboration with OpenAI but believe it to be a long-term growth driver rather than a near-term one.

Valuation

We don’t believe Microsoft is cheap yet. The stock is currently trading at 18.6x C2024 EPS $12.19 on a P/E basis compared to the peer group average of 17.5x. On the EV/Sales metric, the stock is trading at 6.4x C2024 versus the peer group average of 4.1x. While most analyses of Microsoft are bullish, we maintain our non-consensus sell rating as we expect Microsoft to have more downside to be factored in before the stock becomes an attractive investment.

The following graph outlines Microsoft’s valuation.

Word on Wall Street

Wall Street is bullish on Microsoft. Of the 52 analysts covering the stock, 46 are buy-rated, and the remaining are hold-rated. We attribute Wall Street’s bullish sentiment to Microsoft’s leading position in cloud computing. We believe there is a lot of excitement about buying the stock after the sell-off last year, but we recommend investors hold off and wait for a better entry once the near-term headwinds pass.

Microsoft is currently priced at $227. The median sell-side price target is $285, while the mean is $294, with a potential upside of 25-29%.

The following graph outlines Microsoft’s sell-side ratings and price targets.

(TechStockPros)

What to do with the stock

We’re sell-rated on Microsoft. Our bearish sentiment is based on our belief that Microsoft will be pressured in the near term as corporate customers “tighten the belt” on IT spending. We’re constructive on Microsoft’s long-term growth drivers, namely its position in the cloud market with Azure and its potential investment in ChatGPT. Yet, we don’t believe the stock provides an attractive entry point yet, and expect the stock to drop further toward $200 per share. We recommend investors sell the stock at current levels as we see more downside ahead as Microsoft maneuvers the macroeconomic environment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.