Mastercard: Turning Cautiously Positive On The Business As Recession Looms Ahead

Summary:

- After a very strong year for Mastercard and a relatively muted share price response, future returns appear more attractive.

- As M&A activity has cooled down, some risks for shareholders have been reduced and management has prioritized higher returns to shareholders.

- Although I am turning cautiously positive on Mastercard, there are still risks that need to be considered.

istanbulimage

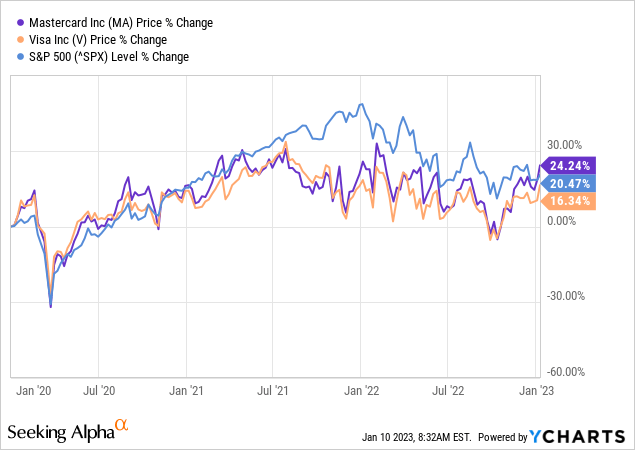

The performance gap between Mastercard (NYSE:MA) and the S&P 500 that opened in 2021 has now been completely closed. Although a recession is still to be expected within 12-18 months, the case for investing in MA has improved considerably over the past few months.

Back in April of last year, I was fairly cautious in my views of the company even as cross-border volumes were expected to improve rapidly.

Higher cross-border volumes will likely be the main tailwind for Mastercard’s results as management aims to return to pre-pandemic levels.

Source: Seeking Alpha

Over the course of the year, however, consumer spending remained robust and cross-border transactions improved more than initially expected, and with that, Mastercard’s share price had a strong tailwind on its back.

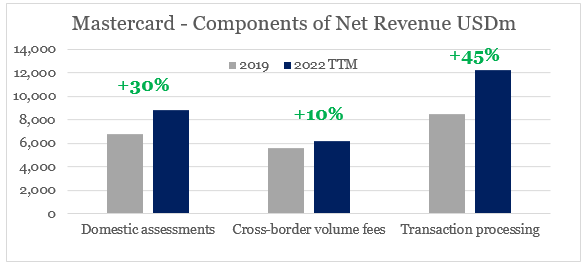

But it wasn’t all just a result of outside factors, as Mastercard’s network and strong brand allowed the company to significantly expand revenues and achieve significant growth on its pre-pandemic figures.

Prepared by the author, using data from SEC Filings

All that has been quite encouraging and is also a testament to the company’s robust business model. Nevertheless, it wasn’t among my main concerns at the start of 2021.

Capital Allocation Normalizing

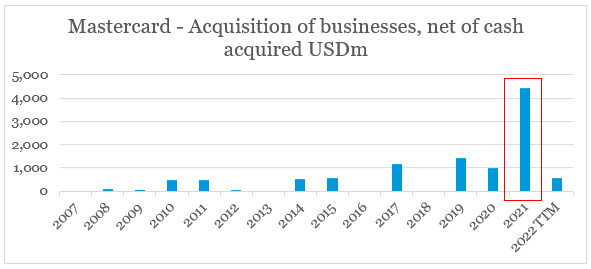

The sharp increase in Mastercard’s acquisitions activity was among the red flags that made me take a ‘wait and see approach’. Although a sudden increase of M&A activity is not the sole reason to avoid a company, it significantly increases risks for shareholders.

Mastercard’s aggressive M&A strategy is another area where potential investors need to have their eyes on since such strategies are often predecessors to operational and strategic difficulties.

Source: Seeking Alpha

It is even more worrisome when the sector where the business operates in is faced with disruption and intensifying competition. The reason being that management teams are often incentivized to embark on an acquisition spree just to stay relevant and fend off newly emerging competition. Needless to say that such strategies are almost always very painful for shareholders.

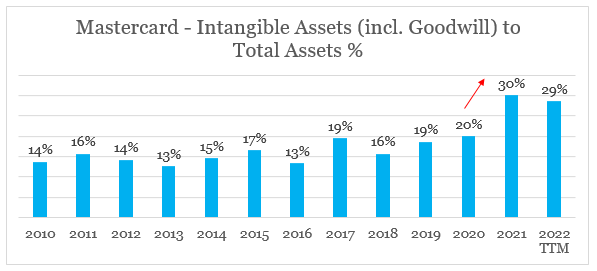

The first condition of disruption and new entrants in the space was met, and Mastercard saw a sudden spike in its M&A activity (see the graph below).

Prepared by the author, using data from SEC Filings

All the deals were made in a very short period of time and were significant both on an absolute basis (see the graph above) and on a relative size to Mastercard’s assets (see the graph below).

Prepared by the author, using data from SEC Filings

Moreover, almost all of the deals made in 2021 were related to areas such as, artificial intelligence, e-billing, digital identity verification, and credit decisioning (more on that here), which suggests that Mastercard might be experiencing significant deficiencies in these areas.

Over the course of 2022, Mastercard’s management has significantly scaled down its M&A activity, which is encouraging that the company’s Digital First Initiative is now well-supported by internal resources.

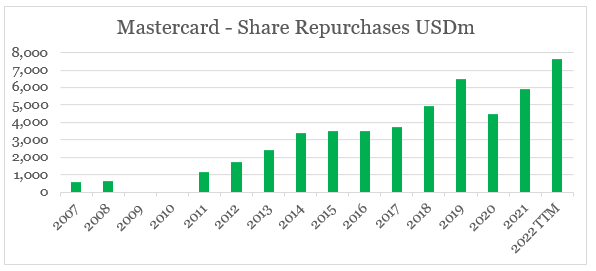

Lower cash requirements for outside deals have also made possible the rapid increase of the company’s annual dividend payments and its share buyback program.

Seeking Alpha

While the dividend increase is definitely a vote of confidence by the management in Mastercard’s future success, the record-high amount of share repurchases is a bit more controversial as shares trade near all-time highs with a recession looming on the horizon.

Prepared by the author, using data from SEC Filings

Better Pricing

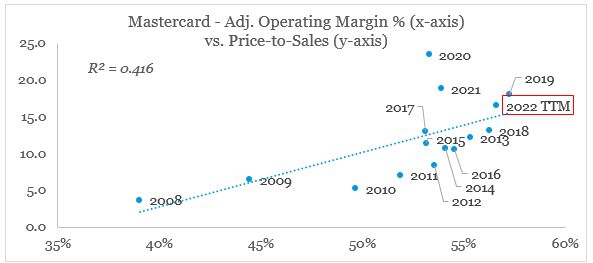

Pricing relative to the company’s fundamentals and its peers was another red flag. Although in this case, valuation multiples were pointing to short-term pressures for Mastercard’s share price and not to potential problems with the business strategy.

Following the margin expansion in the first nine months of 2022 and the relatively flat share price, Mastercard now trades at more attractive levels relative to its business fundamentals.

Prepared by the author, using data from SEC Filings and Seeking Alpha

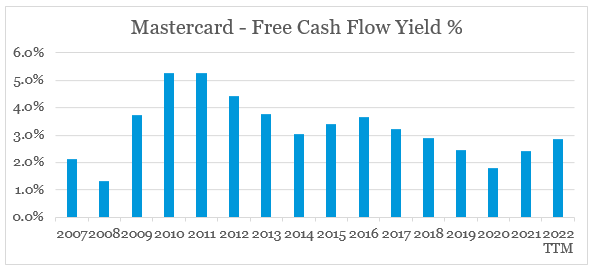

As a result, the company now also trades at a more attractive free cash flow yield, which now approaches 3.0%.

Prepared by the author, using data from SEC Filings

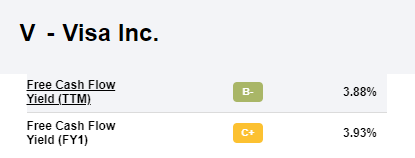

However, it is still lower than the historical average and more importantly much lower than the free cash flow yield of its major peer – Visa (V), which has higher margins and remains among my favourites in the sector.

Seeking Alpha

As we saw above, Mastercard’s rapid growth over the past year had a positive impact on margins, which are now near all-time highs. While this has certainly made MA more attractive when combined with the currently lower valuation multiples, investors should keep a close eye on rising competitive pressures.

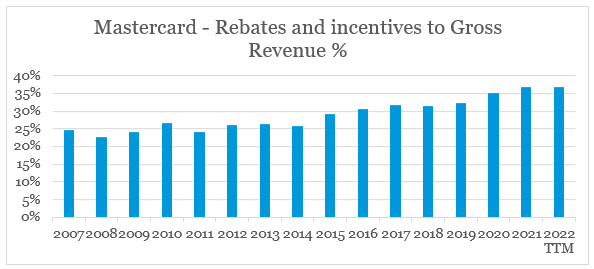

We continue to face intense competitive pressure on the prices we charge our issuers and acquirers, and we seek to enter into business agreements with them through which we offer incentives and other support to issue and promote our payment products.

Source: Mastercard 2021 10-K SEC Filing

The reason why I am flagging this issue is that the recent margin improvement came to some extent from the supportive macroeconomic environment and in this process, Mastercard was able to provide an increasing amount of incentives in order to compete. As a share of gross revenue, rebates and incentives have now reached a multi-decade high and stand at 37%.

Prepared by the author, using data from SEC Filings

Although this is not an immediate problem, it highlights the risk of possible margin pressure in the coming years.

Conclusion

Without a doubt, Mastercard has one of the best business models within the broader payments sector. Following a sudden M&A spree during 2021, the company’s capital allocation policy now seems to have normalized and the focus has shifted towards more internal growth and higher shareholder returns. Moreover, the business grew significantly over the past year and margins remained near all-time highs, all the while, the share price remained relatively flat. All that now makes Mastercard a more attractive long-term opportunity, even as we are likely facing recessionary headwinds over the coming 12-18 month period.

Disclosure: I/we have a beneficial long position in the shares of FISV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.

All the research in this article is based on The Roundabout Investor strategy. An investment philosophy which finds high quality and reasonably priced investment opportunities. It capitalizes on inefficiencies in the market by avoiding short-termism, momentum chasing and narrative driven expectations.

In addition to exclusive roundabout investment opportunities, the service offers a concentrated portfolio based on the highest conviction ideas. A more holistic overview to the equity market is also utilized through the lens of factor investing techniques.

To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.