Summary:

- Micron Technology, Inc.’s fundamentals and share price have moved in opposite directions over the past three months, making its valuation extremely attractive.

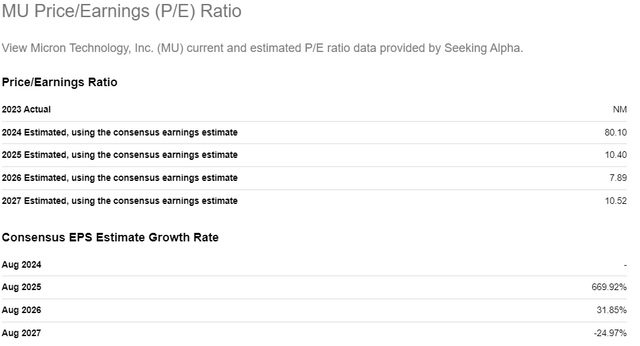

- Valuation analysis shows Micron’s P/E ratio will be slightly above 10 in FY 2025 and around 8 in FY 2026, indicating substantial undervaluation.

- Discounted cash flow (“DCF”) simulation also indicates substantial undervaluation.

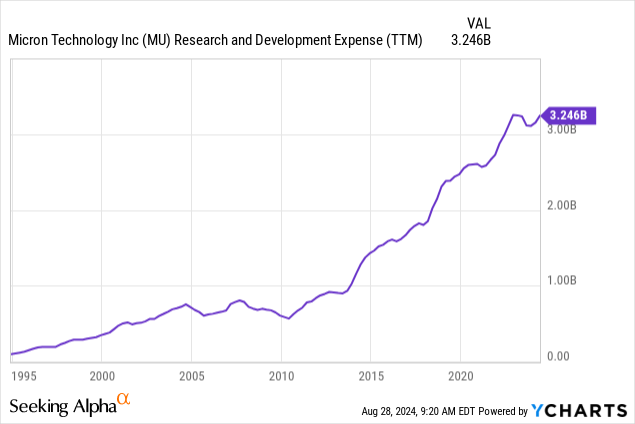

- Micron’s aggressive R&D investments and rapid product rollouts highlight the company’s strong innovation pipeline and position it to capitalize on favorable secular trends.

BING-JHEN HONG

Introduction

Micron Technology, Inc. (NASDAQ:MU) stock has declined by around 23% since May 20, which means that my “Strong Buy” recommendation is not doing well so far. At the same time, my fundamental analysis suggests that Micron is still very strong fundamentally and enjoys massive growth momentum across all segments. The pullback since my previous thesis made the valuation compelling, and I am inclined to give MU a “Strong Buy” rating again.

Fundamental analysis

Micron’s closest earnings release is scheduled for September 27. According to quarterly earnings estimates, revenue is expected to grow by 91.3% YoY. The EPS will improve YoY from -$1.07 to +$1.12. Moreover, EPS will almost double on a QoQ basis, which is also crucial. According to quarterly estimates, Micron is expected to sustain an above 40% YoY revenue growth over at least the next six quarters. Therefore, revenue growth momentum is still very strong, which is an apparent fundamental plus.

SA

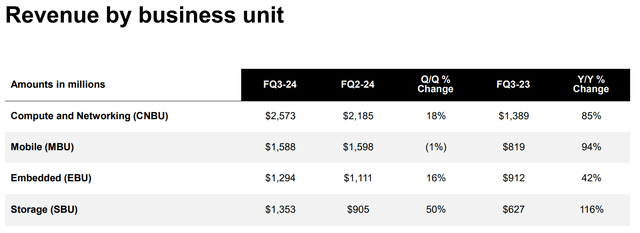

Such a strong optimism from consensus is explainable, and I agree with this optimism. Micron’s biggest segment, CNBU, is heavily tied to cloud server demand. The AI boom has driven substantial growth in the cloud industry over the past few quarters. Synergy Research Group notes that the cloud market’s growth remained strong in calendar Q2, 2024. The company highlighted that robust demand for AI servers was a key driver of its strong financial performance in fiscal Q3. A strong indication of accelerating momentum in CNBU is its strong 18% QoQ revenue growth in FQ3. Since tech giants continue ramping up their investments in data centers, I expect this trend to remain strong for longer.

Micron’s FQ3 presentation

Another indication of the company’s fundamental strength is its robust business mix. The above by-segment revenue growth breakdown suggests that all four business units delivered massive YoY growth. Another positive sign to me is that apart from CNBU, all other segments have approximately the same weight, which is good to mitigate concentration risks.

Another strong bullish information is that Micron has sold out its high-bandwidth memory (“HBM”) capacity up to 2025. There are still four months left in 2024, and the fact that the company sold out in HBM capacity for the next year is very impressive. This clearly indicates robust demand from customers, which will fuel impressive revenue growth for longer.

Another indication of the company’s fundamental strength is Micron’s aggressive ramping up of investments in R&D. The company’s pace of initiating and rolling out new products is impressive, meaning that R&D spending is quite efficient. In early August, the company announced that it develops the industry’s first PCIe Gen6 Data Center SSD for ecosystem enablement. Just a few days before this announcement, Micron said that it started volume production of 9th generation NAND flash technology.

In late July, Micron also introduced the innovative Micron 9550 PCIe Gen5 SSD, which the company claims to be the world’s fastest data center SSD. I believe that it is a crucial development as the SSD industry is thriving, and it is expected to observe a 17.6% CAGR over the next five years.

Valuation analysis

Prefer to start my valuation analysis by looking at how MU’s forward P/E is going to behave in the upcoming years. According to Seeking Alpha’s below table based on consensus estimates, Micron’s P/E ratio will be slightly above 10 in FY 2025 and as low as around 8 in FY 2026. These are extremely low levels that clearly point to substantial undervaluation.

SA

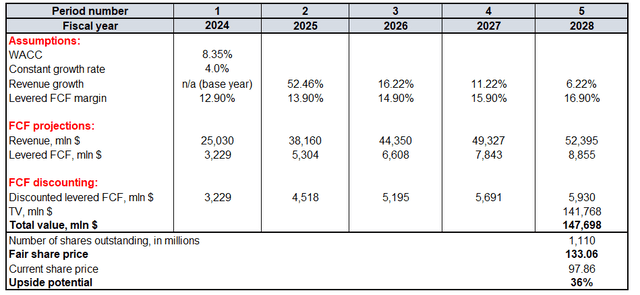

To figure out the stock’s fair value, I need to run a discounted cash flow (“DCF”) simulation. Future cash flows will be discounted using an 8.35% WACC. Revenue estimates for 2024-2026 from consensus are based on the opinions of at least 20 Wall Street analysts, which I find sufficiently representative. For the years beyond 2026, I prefer to take a conservative approach by factoring in a notable five-percentage-point revenue deceleration annually. However, given strong industry tailwinds, I believe Micron can achieve a steady 4% constant growth rate, which will be used to calculate the terminal value (“TV”).

I incorporate a zero FCF margin for FY2024 because Micron’s TTM leverage FCF margin is negative. However, the adjusted EPS is expected by consensus to expand by several times in FY 2025, achieving a $9.4 level. The last time Micron delivered a comparable EPS was in fiscal year 2018, when the company achieved a 12.9% levered FCF margin. Therefore, I’ve incorporated this margin for FY 2025. Given that my analysis indicates MU is well-positioned to benefit from AI tailwinds, I believe FCF margin improvements should be considered. However, since the revenue growth assumptions are already aggressive, I think it’s prudent to be more conservative with FCF margin expansion, projecting a reasonable one percentage point increase per year. There are currently 1.11 billion outstanding MU shares.

Calculated by the author

MU’s fair share price is $133, approximately in line with my previous estimate. After the recent dip, MU trades with a deep 36% discount, which is an attractive deal for one of the AI winners.

Mitigating factors

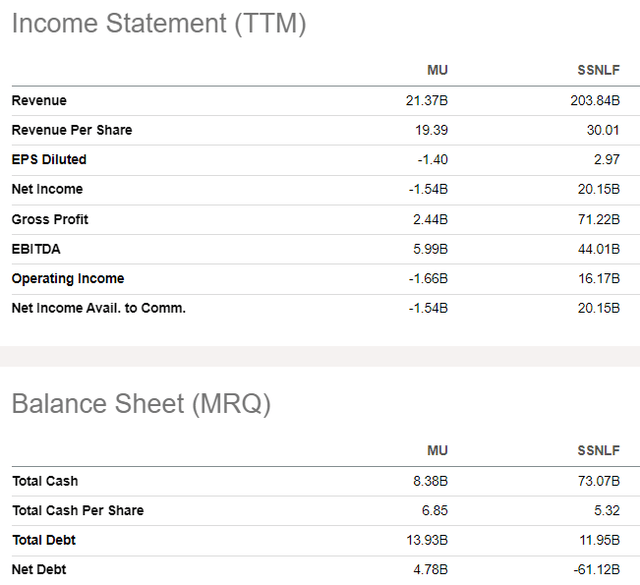

Micron is not a monopolist in the industry. Direct competitors are formidable players, and Samsung Electronics (OTCPK:SSNLF) is the closest rival. This behemoth far surpasses Micron in size, contributing over 20% to South Korea’s GDP and boasting enormous financial strength. The two companies are not comparable when it comes to financials, both on the income statement and balance sheet. Consequently, Micron is exposed to significant competitive threats. However, memory solutions are only a part of Samsung’s broader business, whereas Micron is solely focused on this sector. This focus might provide Micron with an innovative edge where the companies go head-to-head.

SA

Readers should also note that 2023 was an extremely challenging year for Micron. Challenges were largely due to the effects of the U.S.-China geopolitical tensions. The ban on selling Micron’s chips in China was a big adverse factor. It caused the company’s revenue to nearly halve from 2022 levels. Micron’s ties to the Chinese market remain significant, as the FY 2023 10-K report shows over $2 billion in revenue from Mainland China, and the company also operates manufacturing facilities there. Micron’s exposure to China still presents considerable geopolitical risks. But the worst is likely over from this perspective.

Conclusion

I think that Micron Technology, Inc. is a fundamentally strong company, and its stock is very attractively valued. Therefore, I reiterate my bullish opinion about MU.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.