Summary:

- Airbnb’s strong market dominance and innovative strategies position it well for future growth, despite recent underperformance compared to the S&P 500.

- CEO Brian Chesky’s vision includes new services like a co-hosting marketplace, which is expected to significantly increase listings and revenue.

- Current market estimates undervalue Airbnb. My DCF model suggests a fair value of $160 per share, making it a Strong Buy.

- Risks include consumer sentiment and potential black swan events, but the long-term growth potential in international markets remains robust.

Editor’s note: Seeking Alpha is proud to welcome Thomas Veth as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

stockcam

Overview

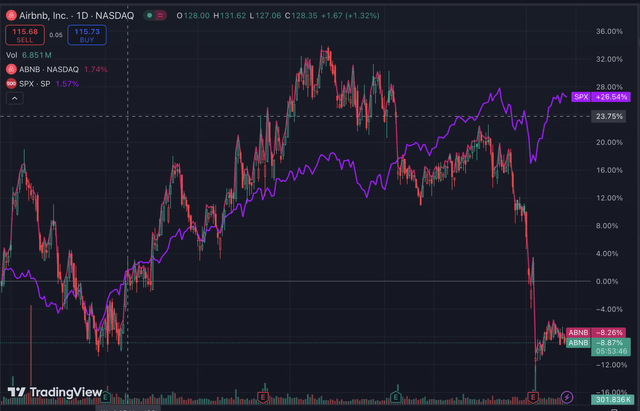

Housing rental platform Airbnb (NASDAQ:ABNB) has not participated in the recent market rally. While the S&P500 index (SP500) has rallied 26.54% in the past year, Airbnb is down 8.87%. In this article, I will discuss whether Airbnb stock presents an opportunity for attractive long positions.

S&P500 index vs. AirBnB stock (Tradingview)

My thesis on Airbnb

Airbnb is poised to transform its income statement in the coming years, as it leverages its operating efficiency and economy of scale to in innovative as they have always done. By claiming their strong position in either a duopoly with Booking.com or oligopoly with others like Expedia (EXPE) and local housing rental platforms as well, the company is positioned to benefit from a recovering travel industry after the pandemic and come out on top of the industry as the giant that it is. CEO Brian Chesky told investors on the earnings call:

We’re now beginning to prepare the next chapter of Airbnb. And I want Airbnb to be one of the most important companies of our generation and to do that, we’re going to do more than one thing. We’re going to do multiple new things. We’re going to have to have multiple new products and multiple new services. This fall, this October, we’re going to be launching a new host service which is really important. It’s essentially a co-hosting marketplace. So, there are people that have homes but they don’t have time. There are other people in the world that have time but they don’t have a home. And so, there’s a Venn diagram of people today who have both that get host. But what if we can match those two people together? That would unlock a lot more inventory. That’s what we’re going to be launching later in October.

The vision that the CEO laid out on the Q2 conference call makes me confident in the ability of management to keep innovating and unlocking new verticals. This sets Airbnb in a quasi monopolistic position, as they can operate in a niche (Housing rental) with greater focus than their competitors, as they also have hotels and flights that are offered. I expect that the ability to connect people with houses, and people who want to manage houses for other people on this platform will increase listings by a great deal, as discussed on the earnings call. Airbnb will merge as the clear platform to which most real estate owners would want to rent out their real estate on, attracting even more career landlords. It is uncertain how this will affect both gross margins, and what the return on investment will be when unlocking new verticals. But to the bottom line in absolute numbers, I expect nothing but increases from here on.

Airbnb has had very steady growth in revenue, listings, nights booked and free cash flow per share in the past. The recent EPS miss in the most recent quarter and slowing revenue guidance for the following quarter create a once in a decade opportunity to buy a premium company on a discount. The ability that Airbnb has to generate free cash flow per share like a cash cow will make investors drive the stock price up and to the right in due time. Patience is all it takes for Airbnb stock to return nice profits.

Q2 2024 Readout

The second quarter results, surprised investors negatively, lowering revenue guidance, and missing on EPS expectations did not get cheered by the market and thus the stock price fell to the $110-$120 range where it still is as of today. Revenue was up 10.63%, to $2.74 billion, gross profit was up 9.26%, to $2.24 billion, presenting a gross margin of 81.59%. The gross margins tell us that Airbnb has great pricing power, as it is in the upper range of tech companies, despite concerns after the first quarter’s earnings report where gross margins had deteriorated to 77.59%. However, net income was a miss, and 14.62% lower than last year. This mainly had to do with increased SG&A and R&D expenses, indicating that reinvestment in the firm is needed to sustain growth. While it is unclear for now, if these high costs will remain, that is something investors will need to look out for and not be dismissive of.

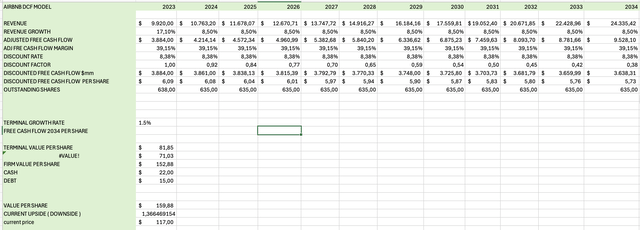

Reverse DCF model

In a reverse DCF model, we can see what the market is implying for the future, seeing what growth rates are expected for this current price to be seen as fair value. For my assumptions, the market gives Airbnb a WACC of Risk Free Rate of 3.88% and a 4.5% risk premium. Terminal growth rate is 1%. With these assumptions, a revenue CAGR of 4.2% and a Free Cash Flow margin of 39.15% is what makes the $117 price range fair value. Furthermore, the market expects a share buyback that will sustain a 1% share count decrease per year in the coming decade.

(My excel is in European mode, and can’t be changed. Because my model is interactive with all the variables, I can’t make my percentages with a “.”. I use a “,” like the Europeans do in my model, excuse me for that)

Reverse DCF mode; (Thomas Veth)

You can see that this brings us to the current value that the market gives Airbnb. In my opinion, these estimates are way too low. Let’s look at a DCF model, which is very fair in my opinion for Airbnb.

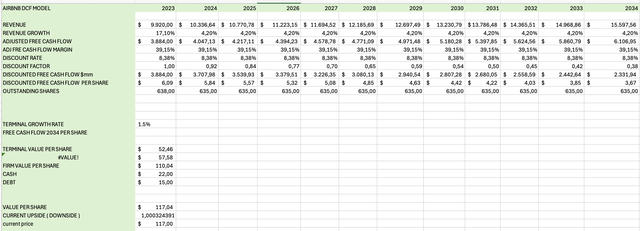

My model (fair value in my opinion)

For my model, I use an all the same assumptions as the market as in the reverse DCF model, only not for revenue growth, as I think that these assumptions are fair. The only thing I would assume differently in my own model is that Airbnb can grow its revenues quicker. To remain conservative and not just make the model look pretty, let’s keep Airbnb growing its revenue at a 8.5% revenue CAGR.

As you can see, this gives a fair value of $159.88 per share, which makes Airbnb undervalued by 36% in my opinion.

Growing in international markets

On the Q2 conference call, CEO Brian Chesky reminded us that Airbnb is active in 220 countries in the world, making it one of the most global companies in the world. However, he also noted that the only markets where Airbnb really penetrates are: US, UK, France, Australia and Canada. Noting that, for example, Spain, Brazil, Italy and Germany can be seen as massive growth markets in the future, leaving room for more revenue growth in EMEA and South America. You should also ask yourself the question, why does Airbnb not penetrate these markets as of now? And this mainly has to do with local sites, booking.com and a more oligopolical market. This can either be a headwind, where Airbnb does not win the race to the top in the winner takes all market, everyone does kind of fine in the competitive market, or Airbnb emerges as the biggest winner in the market.

Risks to the thesis

There are a couple of risks that I want to put a little bit of focus on. Airbnb is a consumer platform, which makes it highly subject to consumer sentiment and strength. If there is a narrative that gets spread like fire about how Airbnb would not be a good platform, consumers could stop booking on Airbnb. Furthermore, there is always the possibility for a black swan event, for example COVID-19 which could disrupt the business. If for some reason, Airbnb manages to not perform in the coming two years, you should just move on, as the stock has been trading sideways since its IPO for years by then, there would then be enough reason to believe that management is just not able to execute.

My price target

I iterate a price target of $160, making Airbnb a ‘Strong buy’. I also put my money where my mouth is, and today I opened a position worth 5% of my portfolio. Thank you for reading. Please let me know in the comments what you think about Airbnb and my article.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.