Summary:

- Intel is undergoing significant restructuring under CEO Pat Gelsinger, including cost-cutting, asset divestitures, and focusing on the core semiconductor business amid intense competition.

- When the new CEO was appointed in 2021, I thought it was the right move but decided to stay on the sidelines until the company delivers tangible results.

- Intel is expected to present a new reorganization plan to the board later this month, but this is not the main reason why I am changing my stance for Intel.

- The output of a conservatively-built DCF model suggests Intel’s current valuation fails to reflect the company’s turnaround potential accurately, creating a window of opportunity for contrarian investors.

hapabapa

Intel Corporation (NASDAQ:INTC) is a company that I have closely followed for many years because of the strategic importance of the company as a U.S. chipmaker. It would not be true if I were to claim that I was not waiting for an opportune time to invest in the company, too because turnaround opportunities often deliver lucrative returns when projections go according to plans.

When it appointed Pat Gelsinger as CEO more than three years ago, Intel had a difficult task ahead of itself, as competitors such as Advanced Micro Devices (AMD) and Nvidia Corporation (NVDA) were aggressively taking market share from the company. Back in January 2021, when the CEO transition announcement was made, I thought this was a prudent move but decided to stay on the sidelines as I wanted to see some tangible progress before betting on a turnaround.

The execution of Intel’s turnaround plan may not have been perfect, and the market performance speaks volumes. INTC is down more than 60% YTD and at a stock price of close to $19, the recent highs of around $70 registered in 2021 seem a country mile away.

Under CEO Pat Gelsinger’s management, Intel is undergoing significant restructuring amid intense competition and continued financial struggles. Some of these measures include extreme cost-cutting and reorganization of capital expenditure as the company tries to restructure its business to make the most of the booming semiconductor market. According to Reuters, the management team is preparing to present a new plan to the board of directors later this month to get the approval for a major business reorganization, which includes a potential spin-off of key assets and business units. A closer look at the proposed actions and other recent developments suggests Intel is entering a new business phase that would determine its long-term financial future.

After updating my discounted cash flow model for Intel, I finally feel there is a sufficient margin of safety to bet on Intel’s turnaround potential, at least based on my risk tolerance.

Intel’s Reorganization Strategy

Before diving deep into the latest reorganization strategy, Intel is rumored to pitch to its director board, it’s important to understand some of the other recent measures Intel has taken to improve its financial performance.

- After reporting second-quarter earnings in August, Intel announced a major cost-reduction program to slash spending by $10 billion in 2025. Proposed measures include reducing the headcount by 15,000, or nearly 15% of the current workforce.

- Soon after being appointed as CEO, Pat Gelsinger launched the IDM 2.0 strategy to accelerate the manufacturing capabilities of advanced chips to compete with rivals who had surpassed Intel’s technological prowess.

- Under the new CEO, Intel ventured into the foundry business to manufacture chips for other semiconductor companies. Before that, Intel had avoided entering the foundry business despite the success of its arch-rival, AMD.

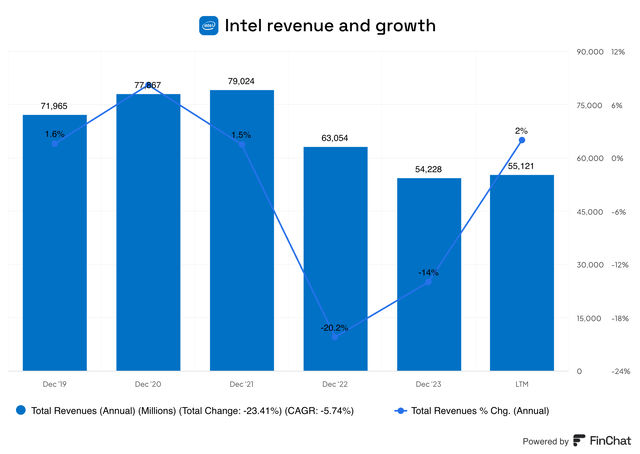

Although these strategies signal progress toward recovery, Intel has yet to see a meaningful recovery in its financial performance. As illustrated below, Intel’s revenue growth has failed to pick up meaningfully despite several promising initiatives introduced by the company.

Exhibit 1: Intel’s revenue and growth

It is important to note that most of the new strategies embraced by CEO Pat Gelsinger are long-term initiatives that would take years to play out successfully. For example, the goal to take process leadership in the advanced chip manufacturing market would take at least three years from now, given the head start of its competitors.

Against this backdrop, Intel is reportedly preparing to pitch a few other strategies to its board of directors to accelerate the business transformation.

The details of Pat Gelsinger’s financial roadmap are to be released during the board meeting scheduled for mid-September. The main goal is to rationalize the business and focus on the semiconductor and integrated circuit business. To achieve this, Intel may divest some of its non-strategic assets, slash the capital investment budget, and commit to even more workforce reductions if needed.

As reported by Reuters, Morgan Stanley (MS) and Goldman Sachs (GS) have been called in by Intel to assist with asset disposals and restructuring efforts. The company targets to cut down capital expenditures to $21.5 billion in 2025, which is 17% lower than the level of 2024, which confirms that the company is planning to be conservative on the deployment of capital in the future. Additionally, according to Reuters, Intel may close down the Ignite accelerator program while simplifying its global partner organization, SMG, to become a leaner and more agile company. Reuters also suggests that Intel may consider divesting Altera, the company’s programmable chip unit, which it acquired for almost $17 billion in 2015. Intel’s recent divestiture of its investment in Arm Holdings, Astera Labs (ALAB), and Joby Aviation (JOBY) confirms that the company is trying to focus on its core business and is planning to raise cash to support investments in technology.

The Rationale For Significant Changes

The restructuring is fueled by the transformation of the company into an AI powerhouse and the need to overcome the worsening financial position. Intel posted a worse-than-expected loss for the second quarter of 2024 on the back of revenue of $12.8 billion, down 1% year-over-year. The company’s overall profitability has deteriorated dramatically in the last five years, with net income declining from $21.05 billion in 2019 to just $1.67 billion in 2023. In addition, Intel had to suspend the quarterly dividend last month on the back of dwindling profits and free cash flow. To revive growth, therefore, the company has to take aggressive, bold actions.

Intel’s Ambitious Goals Are Becoming A Burden On The Balance Sheet Yet Essential

Pat Gelsinger is determined to meet the most ambitious objectives, including transforming Intel into the number one foundry in the world, dethroning Taiwan Semiconductor Manufacturing (TSM). However, these plans have met substantial execution barriers in the real world. For instance, investments in the foundry business have not delivered the desired results so far, with the business unit losing nearly $10 billion annually and only projected to break even by 2027 in the best-case scenario.

The company’s other long-term goals such as delivering five upgrades to its advanced chips within just four years and aggressively expanding manufacturing capacity in the U.S. with the help of funds it has secured from the CHIPS Act seem to be taking a toll on the company’s liquidity profile, evident from the substantial cost-cutting measures Intel has been looking at to bridge the funding gap. Bernstein analyst Stacy Rasgon, commenting on these liquidity issues, said:

The problem is the business itself is not really supportive of those plans. The issue is the revenue assumptions he (Pat Gelsinger) had while they were making these investments.

Some analysts are already questioning the rationale behind a strategic split of the foundry business, which is rumored to be on the cards when Pat Gelsinger presents his new reorganization measures to the board in a few weeks. Moor Insights & Strategy CEO Patrick Moorhead said:

I believe any split before the design and foundry side get healthy is a horrible move. Look at the AMD-GlobalFoundries split. Both companies almost failed.

Overall, Intel seems to be backed into a corner today due to liquidity issues stemming from the undesirable returns from its aggressive turnaround investments in the last three years. Although there is potential for a turnaround in prospects in the long term, the company may have to make bold, unpopular decisions to survive the short-term financial struggles.

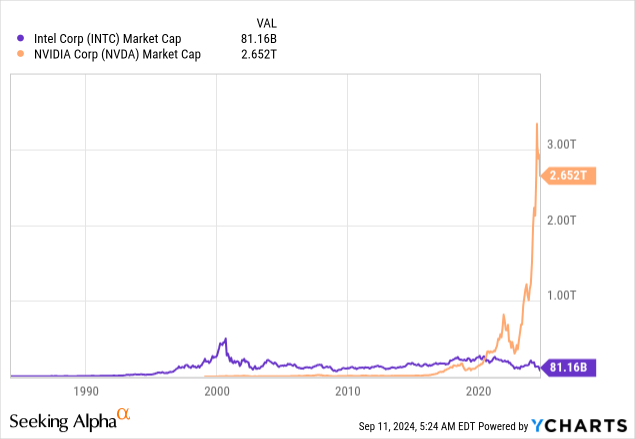

Although the semiconductor sector is thriving due to the AI boom, Intel has not been successful in making the most of it. The company’s technology, particularly related to high-end processing chips, is lagging behind those of Nvidia and Advanced Micro Devices. Cost-cutting measures undertaken by Intel to outsource certain processors to TSMC have incurred sizable losses to the company as well, with gross margins continuing to decline since 2021. In light of these challenges, Intel stock has declined to lows that have not been seen in more than a decade, resulting in a market capitalization of just over $80 billion, a fraction of Nvidia’s market value of close to $3 trillion.

Exhibit 2: Market capitalization of Intel and Nvidia

The rise of Nvidia since 2021 is one for the history books, and Intel may never replicate them. However, as discussed in the following segment, all hope is not lost. Intel may very well regain some of its lost mojo, leading to a reversal in stock prices.

All Hope Is Not Lost For Intel

Despite being positioned unfavorably to benefit from the expected growth of the chip sector, there are some positive developments that suggest Intel may see light at the end of the tunnel if it sorts out the funding issues. For example, the new 18A chip, which is expected to go into mass production in 2025, holds the potential to recapture some lost market share in the advanced chip sector. According to Intel, 18A will be its biggest technological innovation since the launch of FinFETs in 2011. This technology, due to its advanced capabilities, has already won the interest of many clients, which could help boost Intel’s revenues and improve its market competitiveness.

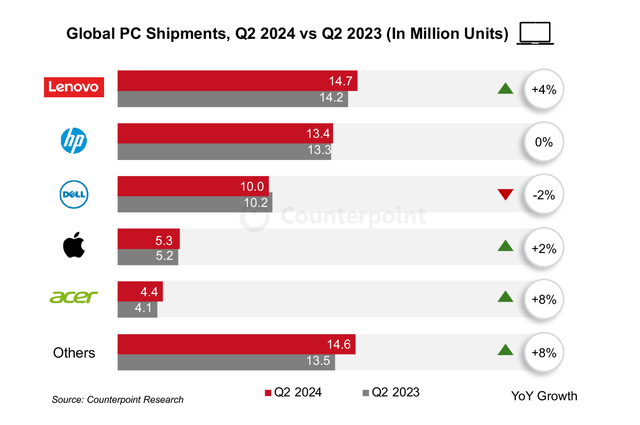

Furthermore, Intel is likely to benefit from the ongoing improvement in global personal computer market trends. In the second quarter, PC shipments grew 3.1% YoY to reach 62.5 million units, and Counterpoint Research projects this positive momentum to continue through the end of this year, aided by the growing demand for AI-powered PCs. This would mark a remarkable comeback following a few years of shipment declines. Last year, PC shipments declined almost 15% to 241.89 million units.

Exhibit 3: Global PC shipments (Q2 2024 vs Q2 2023)

Lunar Lake and Arrow Lake, Intel’s next-gen chips for mobile devices and PCs, will be released this month, and these new chips should position Intel to gain some ground in the PC market. The CPU business segment at Intel could see some recovery owing to the increasing renewability in certain niches due to the PC base overhauls to AI content. Given that the client computing group segment, which records revenue from desktop and notebook chip sales, still accounts for the bulk of company revenue (57% of revenue in Q2 2024), a growth revival in this segment should bode well for the overall financial performance of the company.

Intel’s new Gaudi 2 and the upcoming Gaudi 3 accelerators are promising technologies as well. Even though Nvidia is the current market leader in the AI space, Intel is devising a low-pricing strategy and broadening its AI computing range that would come in handy for customers who are looking for Nvidia alternatives because of the sky-high prices of Nvidia chips. Intel hopes to rake in over $4 billion in sales of AI chips in 2024 and there is potential for Intel to shift the narrative around its AI ambitions by emerging as a competitor to Nvidia. This should help the company regain investor trust as well.

The Valuation Offers An Entry Point For Turnaround Investors

When investing in a turnaround opportunity, it is imperative to do so at the right valuation that offers an attractive risk-reward profile for investors. With Intel expected to announce a new reorganization strategy that focuses on its core business and substantially reduces its cost base while continuing to invest in technology advancements, the company seems to be in a much better position to see revenue and earnings growth compared to the last few years.

Intel is currently valued at a forward price-to-sales multiple of just 1.8 compared to 23.35 for Nvidia and 9.39 for AMD, which suggests the market has already punished Intel for its past financial struggles. Any improvement in the financial performance from here on is likely to attract handsome rewards from Mr. Market, which tilts the odds in favor of long-term-oriented investors today.

I updated my DCF model for Intel to assess whether there is any margin of safety to invest in Intel. Note that I have used very conservative assumptions for growth to make sure my model captures the expected volatility in revenue in the foreseeable future as Intel devises a new reorganization strategy to address growth challenges head-on.

Below are the revenue growth assumptions used in my model.

| Fiscal year | Projected revenue | Implied YoY revenue growth |

| 2024 | $52.06 billion | (4%) |

| 2025 | $55.96 billion | 7.5% |

| 2026 | $59.88 billion | 7% |

| 2027 | $63.47 billion | 6% |

| 2028 | $66.64 billion | 5% |

Source: Author’s projections

Below are some of the other key assumptions used in my model.

- Capital expenditures to average approximately 33% of revenue in the next five years.

- Effective tax rate of 17%.

- Cost of capital of 9.5%.

- Terminal growth of 3%.

Based on these assumptions, Intel’s fair value comes to $30.30 per share, which implies an upside of close to 60% from the current market price. Given my risk tolerance and the conservative assumptions used in the model, I feel comfortable allocating approximately 5% of my portfolio to Intel in the hopes of a major turnaround in the next five years.

Risks To The Thesis

Intel faces many execution risks, which is evident from the company’s failure to gain traction in the last few years despite the surging demand for advanced chips. The company also faces the risk of continued erosion in PC market share if its latest chips fail to attract PC manufacturers. In that case, product development investments are likely to yield disappointing returns in the foreseeable future, potentially leading to a further deterioration in profitability. Investors need to also monitor the risks associated with the new reorganization plan the company may reveal in the coming weeks. If asset sales are part of the plan, Intel will be tasked with attracting potential buyers for these assets, which may take more time than expected or even end up attracting a lower-than-expected value.

Conclusion

The September board meeting is highly important for Intel and will potentially mark the beginning of a new business phase for the company. The potential split of Intel’s product design and foundry businesses has raised questions about the effectiveness of Pat Gelsinger’s strategies in addressing the company’s challenges. Furthermore, as the 18A process node comes closer, it will be important for Intel to attract new clients to the manufacturing business, and the board meeting is likely to include a discussion of Intel’s strategy to do this. Intel seems cheaply valued at a time when major changes are coming, presenting an opportunity for long-term investors. However, investors will have to keep a close eye on the macroeconomic outlook for the chip sector, especially for chips used in personal computers and AI, to monitor the success of Intel’s turnaround strategy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in INTC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.