Summary:

- Initiating coverage on Tilray Brands with a “Sell” rating due to weak fundamentals and sustained bearish momentum.

- Tilray’s diversification into craft beer indicates potential struggles in the cannabis sector, with overestimated growth in the beer market.

- Cannabis segment growth is decelerating, with disappointing international revenue and heavy reliance on acquisitions, leading to equity dilution.

- Tilray’s financials show weak fundamentals, negative operating cash flows, high leverage, and margin compression, making it unattractive compared to other cannabis players.

Morsa Images

Initiating Coverage

I am initiating coverage on Tilray Brands (NASDAQ:TLRY)(TSX:TLRY:CA) with a “Sell” rating. Tilray stock has been in a downtrend, with a correction of almost 50% in the last 12 months. I believe that the bearish momentum for the stock is likely to sustain on the back of weak fundamentals. This initiating coverage discusses the reasons to be bearish on Tilray from a fundamental perspective.

An important point to note at the onset is that the cannabis industry continues to face regulatory headwinds. Further, there is over capacity in the sector and the industry is likely to witness consolidation in the coming years. There will be winners and laggards.

In my personal view, Tilray Brands is among the laggards. This does not necessarily imply that Tilray is unlikely to survive intense competition. However, I see better investment options in the cannabis sector. This thesis will elaborate on the reasons that make Tilray relatively unattractive.

I must also add here that Tilray stock is prone to speculative activity. A sharp rally from oversold levels is a possibility if meme stocks are back in action. However, purely from an investment perspective, Tilray stock is likely to remain in a downtrend.

Diversification Is Bad News

It would be reasonable to say that the cannabis industry is still at an early growth stage. While companies have been operating for several years, industry growth has been impacted by regulatory headwinds. However, there is no doubt that the addressable market is significant. One estimate suggests that the global cannabis market is expected to be worth $444 billion by 2030.

Of course, there can be deviations from these estimates based on the global regulatory stance. However, my point is as follows: If the addressable market is big and the industry is at a nascent stage, it makes more sense to leverage on the early mover advantage.

By diversification, Tilray Brands seems to be indicating one of the two things. First, the company is unable to compete, and it makes sense to look for other avenues of growth. Second, the industry potential is overstated.

Last year, the entire focus of Tilray was on acquiring craft beer brands in the United States. The acquisitions have continued in 2024. Recently, Tilray completed the acquisition of three craft breweries from Molson Coors Beverage Company (NYSE:TAP). With this, Tilray has further strengthened its position as the fifth-largest craft brewer in the United States.

The markets, however, remain unimpressed, and the same is reflected in the stock price trend. It’s worth noting that Tilray has indicated that the U.S. craft beer market is expected to grow at a CAGR of 7.2% through 2030. However, in the last five years, industry revenue has declined at a CAGR of 3.8%. The IBIS world report estimates that “growth is on the horizon but at a vastly subdued rate.”

Tilray’s estimate of growth might therefore be overstated. Broadly, the craft beer segment is not a high-growth market and is unlikely to contribute significantly to growth acceleration (organic).

The advantage that I see here is that Tilray has established strong presence in the U.S. The company potentially has the strategic infrastructure for aggressive expansion if cannabis is legalized at the federal level.

Cannabis Segment Growth Remains Disappointing

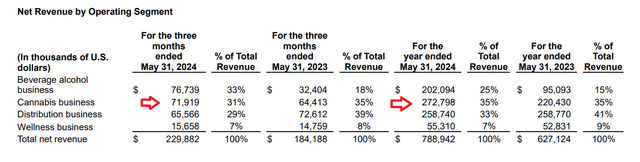

It’s worth noting that for the last financial year, the cannabis business contributed to 35% of the total revenue. Further, the beverage and distribution business contributed to 25% and 33% of the total revenue respectively. The business is therefore well diversified, but I don’t see any growth acceleration catalyst.

As mentioned above, the craft beer business is likely to witness steady growth that’s in-sync with the projected industry growth rate. Further, there was no growth in the distribution business, that also has slim margins.

For FY2024, cannabis business growth was healthy at 23.8% on a year-on-year basis to $272.8 million. However, this growth was supported by the acquisition of HEXO in the second half of 2023. Further, for Q4 2024, revenue growth in the cannabis segment was just 11.6%. Clearly, for the financial year, growth has been robust, but there is deceleration and that’s concerning.

If we dig deeper, there is a bigger reason to worry.

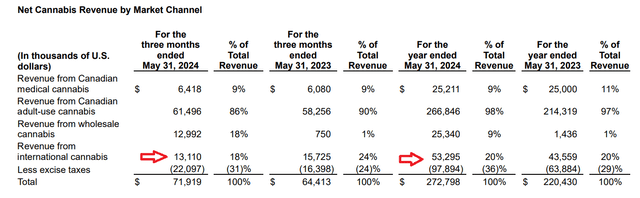

In the last financial year, Tilray derived most of its cannabis revenue from Canada. This includes the recreational and medicinal cannabis business. Tilray has, however, been aggressively pushing for international growth and there seems to be disappointment on that front.

As the numbers above show, Tilray reported 22.2% revenue growth on a year-on-year basis from the international cannabis segment in FY2024. However, for Q4 2024, revenue de-growth from the international markets was 16.6% on a year-on-year basis. The company has significant concentration in Canada, where the competition is intense. According to Tilray’s annual report, there are 1,000 licensed producers in Canada.

I would also point out here that Tilray’s performance has been disappointing on the organic growth front. Be it overall revenue growth or segments, the key triggers have been acquisitions that’s supported by dilution of equity. In May 2024, Tilray announced an at-the-market program of $250 million to fund acquisition or expansion when cannabis rescheduling is effective.

Last month, I had discussed Cronos (NASDAQ:CRON) as a good investment opportunity. The company has a strong balance sheet and a cash buffer of $848 million. Further, it’s a pure-play cannabis company and quarterly revenue growth has been accelerating with international expansion.

The point I want to make here is that there are relatively better opportunities in the cannabis business. Further, I would invest in a pure-play than a diversified business that’s chasing growth at any cost.

Fundamentals Remain Weak

On the financial front, there are multiple reasons to be bearish on Tilray Brands.

First, Tilray reported revenue of $788.9 million for FY2024 and an adjusted EBITDA of $60.5 million. This implies an adjusted EBITDA margin of 7.7%. However, for FY2023, the company’s adjusted EBITDA margin was 9.4%. While year-on-year growth has accelerated on the back of acquisitions, margin compression is a concern and among the reasons for Tilray stock trending lower.

Second, a business is valued based on the cash flow potential. For FY2024, Tilray reported cash used in operating activity of $30.9 million. In the prior financial year, OCF was $7.9 million. Clearly, operating cash flows are unattractive and will continue to impact valuations. This also underscores my view that Tilray might continue to dilute equity to pursue growth.

Third, considering the EBITDA and cash flow potential, I believe that the company’s balance sheet is already stressed. If we consider the lease liabilities and convertible debentures payable, the total debt burden stands at $369 million. With FY2024 adjusted EBITDA at $60.5 million, Tilray Brands has a leverage of 6x. Even if the convertible debentures are excluded, the leverage is 4x. This is a concern with the company struggling to deliver healthy growth and margin expansion.

Fourth, Tilray reported interest expense of $36.4 million for FY2024. Considering an EBITDA of $60.5 million, the EBITDA-interest-coverage ratio comes to 1.7x. If margins remain under pressure, debt servicing metrics will worsen.

Overall, the above numbers clearly indicate that Tilray has weak fundamentals. With operating cash flows being negative or negligible in the last two financial years, financing growth has been through dilution or leveraging. However, the results are disappointing, and it’s therefore not surprising that Tilray stock has trended lower.

Concluding Views

In July, Tilray received the first new cannabis cultivation license in Germany under the new regulation. In the same month, the company received cannabis trading license in Germany. It’s a potential growth market for Tilray Brands in the next few years. However, the market is unlikely to have an impact on overall growth in the foreseeable future.

Given the discussion, I believe that organic growth acceleration is critical for Tilray. However, there are no visible catalysts on the horizon. With significant credit stress, the company is likely to pursue dilution of equity than leveraging. This is likely to be negative for existing shareholders.

From a valuation perspective, Tilray stock trades at a forward EV/EBITDA of 18. This is at a premium to the sector median of 13.7. This underscores my view that the stock is poised for further downside. An equally important point is that there are better cannabis players with a laser-sharp focus on the business than diversified operations. I would therefore stay away from Tilray stock and I expect the bearish momentum to sustain.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.