Summary:

- Home Depot has had a strong track record of success.

- However, the market may be focusing too much on the rear view mirror, with risks not fully priced in.

- The stock is prohibitively expensive, and I highlight a better alternative.

M. Suhail

Home Depot (NYSE:HD) is a stock that looks appealing based on price action alone. For one thing, the stock has fallen by 21% over the past year and sits well below its 52-week high of $418. This may lead some investors to think that HD is now a bargain.

However, just because a stock becomes cheap doesn’t mean that it can’t get cheaper. In this article, I highlight why not all risks may be baked into HD’s stock price, and why it may have further to fall from here, so let’s get started.

HD: Way More Risks Than Reward

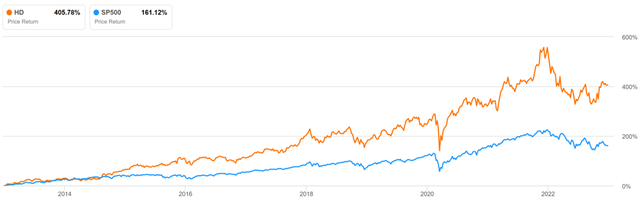

Home Depot is the largest home improvement retailer in the U.S., with over 2,300 warehouse format stores, offering a broad range of building materials, lawn and garden products, and home improvement products. HD stock has also done well for its shareholders, giving a 406% total return, far outpacing the 161% total return of the S&P 500 (SPY) over the same timeframe, as shown below.

HD Total Return (Seeking Alpha)

A key driver of Home Depot’s long-term success is its strategic focus on expansion and innovation. The company has a long history of expanding its store base and entering new markets, which has helped to drive growth and increase its market share. In recent years, The Home Depot has also made significant investments in technology, including the development of an e-commerce platform and the deployment of new in-store technologies, such as mobile checkout.

HD could also be a victim of its own success, however, as there are limited expansion opportunities for its physical stores, as they are virtually omnipresent in most addressable markets. Moreover, HD is also seeing slowing revenue growth, as sales comparable sales grew by just 4.3% YoY during its third quarter. For the full fiscal year 2022, management is guiding for EPS growth in the mid single digits.

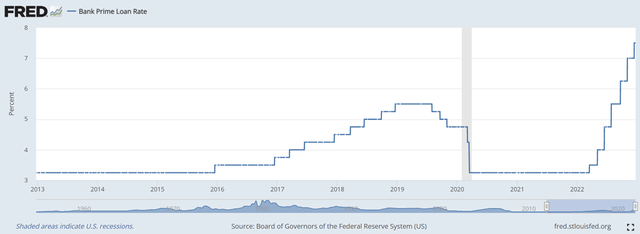

Looking ahead, sales could be under continued pressure, considering that interest rates remain stubbornly high, especially with the market anticipating another 50 basis point hike in rates at the next Fed meeting. At present, the prime rate stands at 7.5%, which is the highest level in over a decade, as shown below.

Prime Rate (FRED Economic Data)

This makes it expensive for homeowners to draw money against home equity lines of credit to do home renovation projects. New homeowners are more likely to do home renovation projects. This segment may see little to no growth with mortgage rates over 7%, sending mortgage applications down 41% from last year. Morningstar also highlighted risks to the housing landscape, as noted in its recent analyst report:

We now project housing starts to decrease 18% year over year in 2023 to 1.275 million, down from our prior projection of 1.4 million units, which is about in line with the level of residential construction activity in 2018-19. However, we expect starts will begin to rebound in 2024 as lower mortgage rates and home prices improve affordability and entice buyers back into the market.

Specifically, we project the average 30-year fixed mortgage rate will decline from 6.25% in 2023 to 4.5% in 2024, and we see new and existing home prices decreasing 15% and 5% between 2022-24, respectively.

Repair and remodel spending has historically been less cyclical than new residential construction, and we see that trend continuing in 2023. Nevertheless, we now expect owner-occupied improvement spending will decrease about 1% in 2023, down from 0% growth previously, amid a weakening housing market and a challenging prior-year comparison.

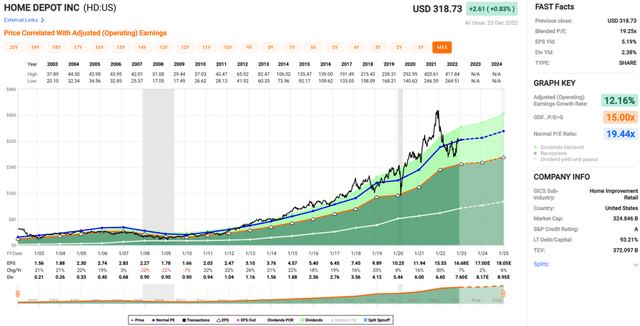

While I remain optimistic around the long-term prospects for Home Depot, I believe it remains prohibitively expensive at the current price of $320, with a forward PE of 19.2. At this valuation, I would expect to see an earnings growth rate of around 10% or more, but that’s not the case, as HD demonstrated with its recent earnings, and with analysts expecting just 1.8% EPS growth next year.

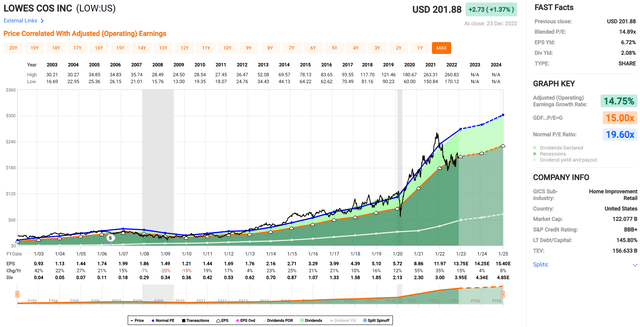

Moreover, investors are not getting a discount for the risks at the current price, as HD is trading at around its normal PE of 19.4, as shown below. Comparatively speaking, I view competitor Lowe’s (LOW) as offering better value at present, with a forward PE of just 14.6, sitting well below its long-term normal PE of 19.6.

HD Valuation (FAST Graphs) LOW Valuation (FAST Graphs)

Investor Takeaway

Home Depot has found plenty of success over its history. However, with the PE being stubbornly high, the market may be focusing too much on the rear view mirror. As such, I don’t see the headwinds from high interest rates and lower housing demand as being fully baked into the share price. While I do see long-term value in the company, the stock price is simply unappealing at the time. As such, investors should be prepared for more potential downturn in the stock price in the near term.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!