Summary:

- I added to my Micron position as the stock recently broke below $100, and I am upgrading my rating to a strong buy ahead of earnings.

- The company will report FQ4 results on Wednesday, September 25.

- Read-through from companies like Western Digital and Best Buy suggest strong memory market fundamentals, as well as healthy end-customer demand for phones and computers.

- Micron trades at a 10x forward P/E multiple, making it a value buy compared to the S&P 500’s ~20x multiple.

vzphotos

After the Fed rate cut and the sharp rally in the stock markets, many investors are thinking the same thing: are there any opportunities left to buy stocks without paying premium multiples? There certainly are, but we have to look for recent losers and have patience in a longer-term rebound.

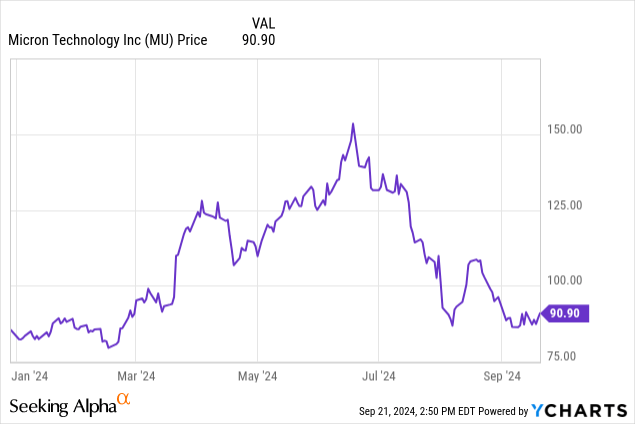

Micron (NASDAQ:MU) (NEOE:MU:CA), in my view, is a great buy-the-dip play. After exhausting the stock market’s enthusiasm for AI and chip stocks this year, shares of Micron have fallen roughly 40% from this year’s peaks above $150 (though it remains up ~10% on the year). In spite of this, the stock remains quite well positioned for a rebound rally given strong industry fundamentals plus a great valuation.

The company will report earnings on Wednesday, September 25; which could be a potent catalyst to kick off a rebound.

I last wrote a bullish note on Micron in July, when the stock was still trading at $130 per share. While I acknowledge that the timing of my buy was premature, the stock’s swooning value since then has emboldened by bull case for Micron, and I’m upgrading my call on the stock to a strong buy.

There are two core reasons why now is a timely moment to buy Micron ahead of earnings:

- Strong read-through from industry peers and the ecosystem. Micron is reporting relatively late in the calendar Q2 earnings season, so we’ve already read reports from many related companies that could point to upside surprise for Micron ahead.

- Cheap valuation in an expensive market, amid heightened expectations for chip stocks. I’m strongly of the view that AI applications are driving a multi-year investment cycle in chips and hardware, positioning Micron for long-term earnings growth that is different from the usual boom-and-bust cycle in the chip sector. With the S&P 500 trading at such lofty valuation multiples, Micron makes for a surprising value buy.

Stay long here and buy this dip.

Favorable read through from Western Digital and Best Buy

Of all the news we’ve ingested this earnings season, two related companies to Micron give us the best read-through information for Micron’s upcoming earnings release.

The first is Western Digital (WDC), a direct peer and competitor to Micron that produces both HDD/hard disk storage as well as NAND flash, the latter of which is the most relevant for Micron.

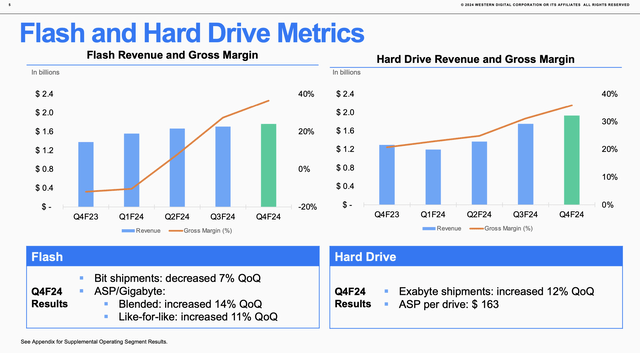

Western Digital reported earnings at the tail end of July. The first observation that we can make here: the company continued to report healthy flash metrics, which directly translates to Micron’s results for the same quarter. As shown in the chart below, blended flash ASPs increased 14% quarter-over-quarter for Western Digital:

Western Digital segment data (Western Digital FQ4 earnings release)

High flash pricing and resulting high gross margins are among the core reasons to be bullish on Micron. Heavy AI-driven demand for flash storage chips has translated into tremendous earnings growth for the company, after a down-year of losses in 2023.

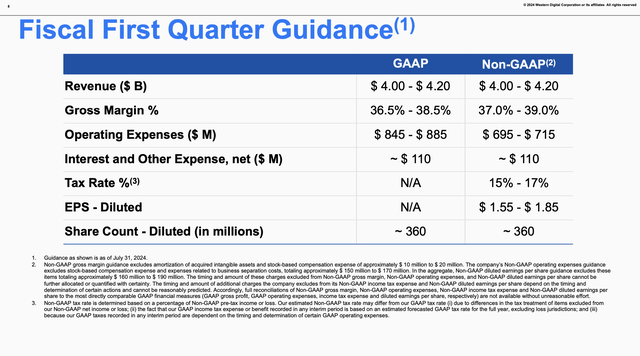

What’s more: though Western Digital didn’t guide to specific flash pricing expectations in the fiscal first (June) quarter, it did guide to pro forma gross margins of 37-39%, which at the midpoint is 170bps higher than 36.3% in Q4.

Western Digital FQ1 outlook (Western Digital FQ4 earnings release)

This, to me, indicates that the pricing environment for memory is expected to remain healthy, if not even improve, heading into the next quarter.

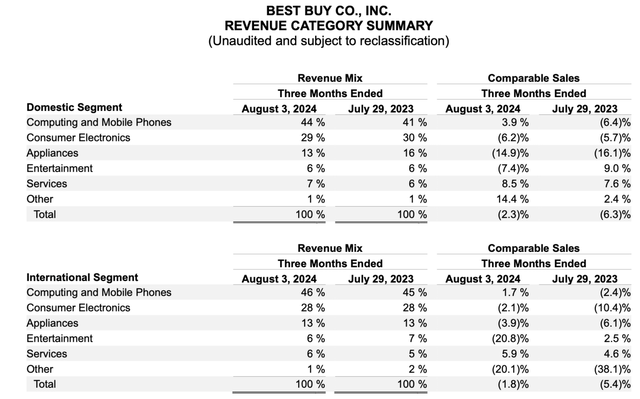

When it comes to end-market health, we can turn to Best Buy’s (BBY) quarter for additional information. Micron’s largest customers are device makers like HP Inc. (HPQ), Dell, Samsung, and the like: as storage chips power all personal computing devices from laptops to smartphones.

It’s no secret that consumer markets have entered into a bit of a frigid territory, as consumers hold on to their higher-quality devices for longer and as they pinch budgets ahead of a potential recession later this year. Best Buy has been a victim of lengthening upgrade cycles and less propensity to buy, but its most recent quarter offered a glimmer of hope.

Domestic sales in the company’s “computing and mobile phones” segment rose to 3.9% y/y growth on a comparable-sales basis (excluding the impacts of new store openings and closures), and also rose 1.7% y/y internationally.

Best Buy Q2 comparable sales by category (Best Buy Q2 earnings release)

Domestic sales in the category accelerated 610bps relative to a -2.2% decline in Q1 for Best Buy, while international sales also accelerated, albeit at a more modest 100bps pace relative to 0.7% growth in Q1. In fact, Best Buy raised its outlook for the year as it expects the second calendar half of 2024 to improve even further relative to the first half, per CEO Corie Barry’s remarks on Best Buy’s recent Q2 earnings call:

As we look to the back half of the year, we expect our industry to continue to show increasing stabilization. Last quarter, we said we were likely trending toward the midpoint of our original comparable sales guidance of flat to down 3%. Today, we are updating our annual sales guidance to a decline in the range of 1.5% to 3%. At the same time, we are raising our earnings per share guidance range as we largely flow through the better-than-expected results of the first half of the year.”

As it relates to Micron, of course read-through from ecosystem and industry participants isn’t a 100% reliable indicator of how Micron itself will fare after its earnings release. But from these earlier earnings prints, we can at the very least ascertain that memory pricing fundamentals are healthy and that refresh rates in computers/mobile phones may be turning around, helping to fuel longer-term demand for Micron’s products.

Valuation

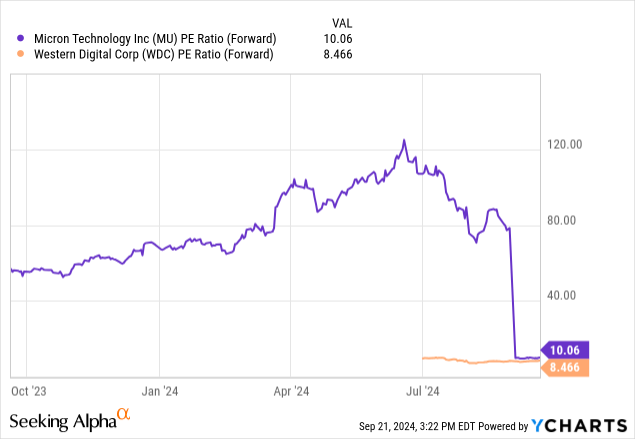

To add even more incentive on top, Micron is considerably cheap after the recent plunge. As shown below, Micron trades at a 10x forward P/E multiple against Wall Street’s FY25 (August 2015 year-end) pro forma EPS expectations of $9.15.

The stock trades at a slight premium to Western Digital, but we’ll also remind investors here that Western Digital has uncertainty from its upcoming October spin-off of its flash division, plus the fact that Micron is growing at a much faster pace than Western Digital. Compared to the rest of the S&P 500 trading at ~20x multiple, Micron trades at an even bigger bargain.

Historically, Micron has vacillated between mid-single digit P/E multiples and higher P/E multiples in boom times. A bet on Micron, however, is a bet that AI is powering a multi-year investment cycle into memory and hardware, which should shield the stock from the boom-and-bust years of the past.

Risks and key takeaways

In my view, Micron is well positioned to recoup some recent losses in its upcoming FQ4 earnings release, especially since data from other companies suggests that memory pricing remains elevated and consumer demand for computers, phones and tablets remains strong.

Of course, there are a number of risks that color the bull case here. Historically, the memory market has been very volatile: and the heightened pricing we are seeing now may be a function of customers buying in bulk to circumvent supply shortages, similar to what happened in the early wake of COVID. There’s a chance that once these stock-up orders are exhausted, pricing may weaken: which would threaten Micron’s sales, margins, and earnings.

That being said, I’m a strong believer in the idea that AI applications are still in the early innings, and providing a refresh catalyst for everything from consumer devices to enterprise data centers. I doubled down on my Micron holdings when the stock breached below the $100 point: I’d recommend using this dip as a buying opportunity ahead of the Wednesday earnings print.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.