Summary:

- Upgraded Micron Technology, Inc. to “Strong Buy” with a fair value of $160 per share, driven by rapid HBM3E growth and capacity expansion plans.

- The HBM market is expected to grow significantly, with Micron’s HBM products projected to generate multiple billions in revenue by FY25.

- Micron plans $8.1 billion in CAPEX for FY25, focusing on greenfield fab construction and HBM investments to meet rising demand.

- Anticipate 50% revenue growth in FY25 and 30% in FY26, driven by AI and high-performance computing, despite high depreciation costs.

mesh cube/iStock via Getty Images

I reiterated my “Buy” rating for Micron Technology, Inc. (NASDAQ:MU) in my previous coverage in July 2024, highlighting their HBM3E’s production ramp-up in Q3. Micron released its fiscal Q4 result on September 25th after the market close, with a better-than-expected outlook for Q1 FY25. I am encouraged by the rapid growth in Micron’s High Bandwidth Memory (HBM) products and their plan for capacity expansion. I am upgrading Micron stock to a “Strong Buy” rating with a fair value of $160 per share.

HBM Growth Continues in 2025

Over the earnings call, Micron’s management indicated that HBM consumed 1.5% of the industry’s bits with a total addressable market (TAM) of $4 billion in 2023. However, in 2025, they anticipate the HBM will represent around 6% of total bits with the TAM expanding to $25 billion. As discussed in my previous coverage, Micron, Samsung Electronics Co., Ltd. (OTCPK:SSNLF) and SK hynix Inc. (OTCPK:HXSCF), the three major HBM suppliers, have been expanding their manufacturing capacities for HBM products. As such, I anticipate the supply constraints will slightly improve in 2025.

With the technological advancement in GPUs, more HBMs are required in graphic cards. For instance, NVIDIA Corporation’s (NVDA) H200 features a total of 141 GB of HBM3e memory across six HBM3e stacks. In contrast, the H100 only has 80 GB of HBM3 memory. To achieve higher performance computing, these GPUs rely on increased HBM memories to store temporary data. As such, the rapid growth of AI and high-performance computing is driving the demand for Micron’s HBM products, and I anticipate this momentum will sustain into 2025.

During the earnings call, the management said it expects to ramp their HBM3E 12-high output in early 2025 and increase the 12-high mix in their shipments throughout 2025. It is encouraging to see their management confirm that HBM will generate multiple billions of dollars of revenue in FY25, indicating a strong confidence in the end market demands.

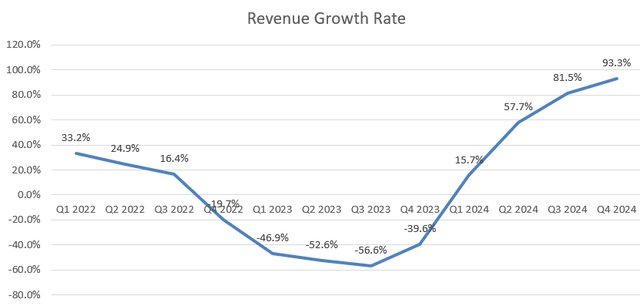

Due to the strong growth in Compute/Networking and storage businesses, Micron delivered 93.3% revenue growth during the quarter, finishing FY24 with a 61.6% year-over-year growth.

Capacity Expansion

Another key takeaway from the quarter is their future plan for capacity expansions. The company plans to spend $8.1 billion in capital expenditure in FY25, with growth in both greenfield fab construction and HBM capex investments comprising the majority of CAPEX spending. The significant CAPEX spending underscores the strong demands for the DRAM and NAND market, driven by rapid data center and AI workloads.

Micron’s competitors, including Samsung Electronics and SK Hynix, are also increasing capital spending for their HBM products, as discussed in my previous coverage. As such, I think Micron is making the necessary investments to meet the fast-growing demand for HBMs.

Outlook and Valuation

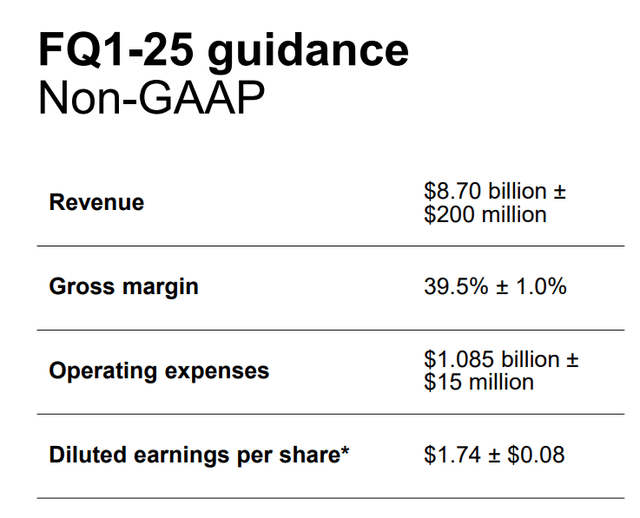

As shown in the table below, Micron is guiding for $8.7 billion plus or minus $200 million in revenue for Q1 FY25, beating the market expectations.

I am considering the following factors for their near-term growth:

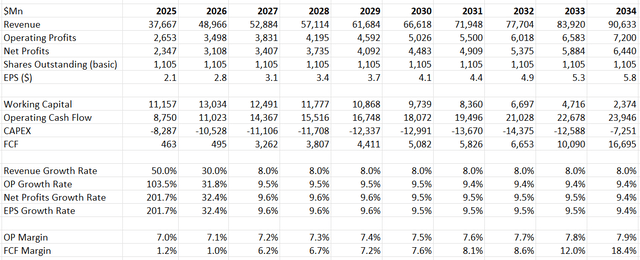

- As Micron’s manufacturing capacity has already been committed by their customers for FY25 and FY26, their business growth will be subject to their capacity. For FY25, I estimate the company can generate more than $37 billion in revenue, representing around 50% year-over-year growth.

- As AI investments are primarily coming from hyperscalers and data center service providers currently, there is a considerable runway for future growth when AI enters the inference stage. Enterprises are expected to increase their investments gradually in edge AI computing, which will contribute to the growth of Micron, in my view. As such, I anticipate Micron’s revenue will grow by 30% in FY26, reflecting the increasing investments from enterprise customers.

- For the normalized growth from FY27 onwards, I continue to forecast Micron will grow by 8%, aligned with the industry growth.

- I lowered my margin expansion assumptions in the current model, as Micron will invest heavily in their CAPEX in the near future, which will increase their depreciation costs. The high depreciation costs will pose challenges for their margin expansion. As such, I only model 10bps annual margin expansion, primarily driven by operating leverage.

- I changed the WACC to 11.2% assuming: risk-free 3.8%; beta 1.34; equity risk premium 7%; cost of debt 5%; equity balance $44 billion; debt $13 billion; tax rate 10%.

With these assumptions, the DCF can be summarized as follows:

Discounting all the free cash flow, the fair value is calculated to be $160 per share, according to the discounted cash flow (“DCF”) model.

Key Risks

Thanks to the 2022 CHIPS and Science Act, Micron will receive $6.1 billion from the U.S. government for their capacity expansion in New York and Idaho. Including the government support, Micron has committed to investing $100 billion in New York over the next two decades. It is a long-term and substantial commitment for Micron. With the coming Presidential election, there may be some uncertainties regarding their capacity expansion and government support in the U.S.

During the earnings call, the management indicated that their investment in Idaho and New York will not contribute to bit supply in fiscal 2025 and 2026. As such, the investments will take several years before they begin to drive revenue growth for Micron.

Conclusion

I favor Micron’s technology advantages in the HBM market, with structural growth drivers from AI and high-performance computing workloads. The potential capacity expansion will boost Micron’s business growth in the future. I am upgrading Micron stock to a “Strong Buy” rating with a fair value of $160 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.