Summary:

- Our downgrade thesis played out into earnings, and now we’re upgrading Micron Technology, Inc. stock to buy.

- Micron is uniquely positioned to benefit from industry demand for HBM (used in AI) and should see better top-line growth and margins because of it next year.

- Management is also guiding for FY25 capex to be 35% of total FY25 sales and aiming for their HBM share of the market to reflect their DRAM.

- We see all the right signs for Micron to materially outperform in 2025.

wragg

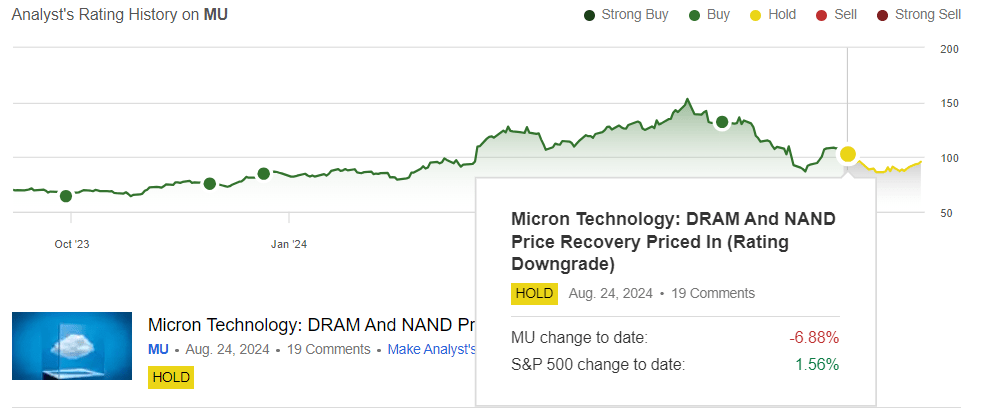

Micron Technology, Inc. (NASDAQ:MU) reported its fourth quarter of FY2024 results and outlook yesterday after the bell, causing the stock to shoot up +15% today. We downgraded MU to a hold in late August as we expected the stock to trade down into earnings, which it did. Since our downgrade, the stock continues to underperform the S&P 500 (SP500), as shown in the chart below.

We’re now upgrading the stock post-earnings with more visibility on how 2025 will play out. Our belief is that MU is currently positioned to outperform in FY25 with heightened industry demand for HBM used in AI and better pricing and demand dynamics for DRAM.

Seeking Alpha

MU reported August quarter sales up 14% Q/Q to $7.80B, ahead of consensus at $7.61B, and is guiding for sales to grow 12% Q/Q in their November quarter, 1QFY25, to $8.7B, comfortably ahead of consensus at $8.33B. Growth for 1QFY25 is expected to be driven by the HBM DRAM ramp again, which includes its HBM3E. The HBM3E is “the fastest, highest-capacity, high-bandwidth memory to advance AI innovation – an 8-high, 24GB cube that delivers over 1.2 TB/s bandwidth and superior power efficiency.” The magic sauce of HBM is that it is seeing high industry demand for use in AI xPU (an auxiliary processing unit that runs inside a data center server or appliance) because it uses 3D stacking technology to balance both high bandwidth and low-power consumption. MU is uniquely positioned to see top-line benefits and share gains from industry demand in HBM in 2025 and even 2026.

AI servers use HBM, and MU is already gaining a share of the up-and-coming market, with management noting.

We have HBM share gains happening. There really is a robust share in high-cap bins, pioneering leaders in LP5 and the data center, and data center SSDs at record share levels.

What makes us more confident about MU’s position in the HBM market is management’s expectation that HBM shares will reflect its overall DRAM market share by the end of 2025. This would translate to a +21% share of the market, as MU’s share of the DRAM market sits at around 21% as of 1Q24 and should be comfortably higher by the end of next year. Management is definitely spending to make this happen, guiding for FY25 capex spend to increase to 35% of its FY25 sales, which is higher than the previous expected 30% to support the high demand. Sumit Sadana, Chief Business Officer at MU, noted that on the call in the Q&A session,

the overwhelming majority in 2025 is to support HBM, CapEx as well as facility, construction, backend and R&D.

We think the higher capex guide is a good sign for demand-supply dynamics for 2025.

The tailwinds between the lines: AI PC & AI smartphone

The bad news is that PC and smartphone end demand remains muted in 2H24; the good news, however, is that MU will be able to offset the less favorable end demand from PC and smartphones with increased a bit growth for AI Servers, AI PCs, and AI smartphone in 2025. The AI PC moment, which we expect will be a 2025 event, will likely be triggered by Microsoft Windows 10 End of Life or EOL, and that should also help show some PC TAM expansion. We think the AI PC moment will see a larger industry adoption, particularly from the commercial PC segment, than AI smartphone, although we must say we have more limited visibility on the latter. With favorable demand-supply dynamics for AI PC, AI smartphone, and AI server, MU’s DRAM sales should have the benefit of pricing as well as that of demand in its pocket for 2025. DRAM and NAND are expected to recover, but DRAM has more midterm catalysts that are working in its favor.

MU expects DRAM bit shipments to grow sequentially in Q1 and NAND bits to be flat. We’re still seeing ASP recovery at a faster rate than bit shipment. This quarter, the company reported that DRAM sales were up 14% Q/Q and saw that DRAM ASP increased 14% Q/Q but experienced flat Q/Q growth in bit shipment. This shows that better pricing can support outperformance even with slower bit shipment. On the other hand, NAND sales grew 15% Q/Q, with ASP growing 8% Q/Q and bit shipments growing 7% Q/Q.

These positive factors remain at play and drive better pricing, and higher HBM sales in the mix will support more non-GAAP gross margin expansion. Management expects gross margins to improve 300 basis points to 39.5% after reporting an 840 basis point expansion this quarter to 36.5% on again better pricing and sales plus written-off inventory.

Valuation & Word on Wall Street

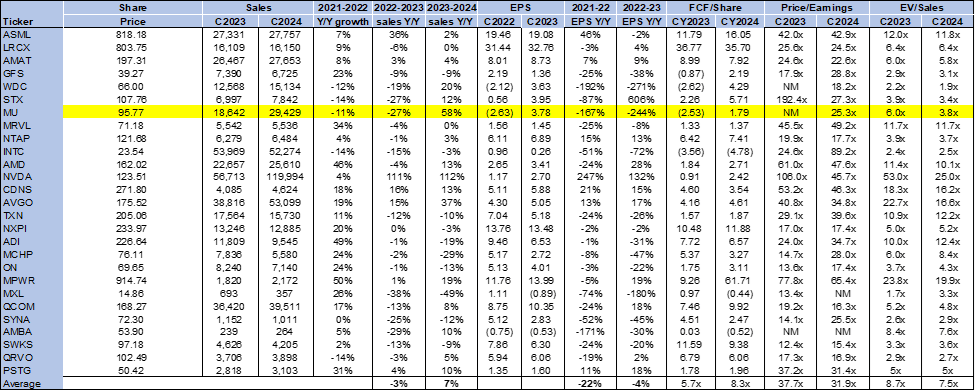

MU continues to be cheap relative to the semi-peer group; the stock is trading at 25.3x C2024 on a P/E basis, compared to the peer group average of 31.9x. The stock is trading at 3.8x EV/Sales C2024, compared to a group average of 7.5x. Interestingly, MU is cheaper than it was at our downgrade when its P/E ratio was 26.0x, and its EV/Sales ratio was 4.0x. We continue to favor MU as a top memory pick for 2025, eyeing mid- to long-term investors.

The following chart outlines MU’s valuation against the peer group average.

Tech Stock Pros

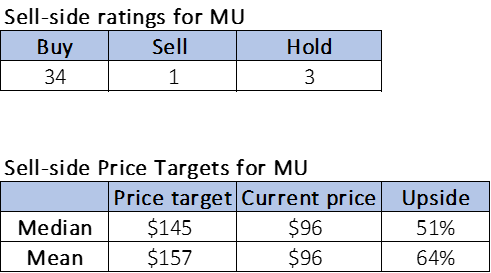

Wall Street is still bullish on the stock, but is more mixed than it was in August. Of the 38 analysts covering the stock, 34 are buy-rated, three are hold-rated, and the remaining one is sell-rated; this is compared to 35 buy-ratings and two hold-ratings in August. The following chart indicates MU stock’s sell-side ratings and price targets.

Tech Stock Pros

What to do with the stock?

We’re moving MU back to a buy, expecting the stock to outperform in 2025 on better pricing, higher industry demand for HBM, and better bit growth for AI PC, AI smartphone, and AI server end demand. We think management’s raised FY25 capex guidance is a positive sign for next year. Any concerns about exposure to China were also de-risked, with management noting, “the portion of the business that’s exposed to those kinds of trends in China are really becoming smaller as a percent of our revenue over time.” We think MU is a golden semi for 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.