Summary:

- Micron Technology, Inc.’s F4Q24 outperformance and better-than-expected FY2025 outlook continues to reinforce its mission-critical role in enabling the AI transformation.

- Yet, the stock continues to trade discounted on both an intrinsic and relative basis following its steep sell-off since June despite the post-earnings upsurge.

- Micron’s attractive valuation at current levels is further supported by improved durability to its long-term demand outlook against an inherently elevated exposure to cyclical risks.

- Ensuing margin accretion will also be supportive of sustained growth in cash flows, underpinning the stock’s valuation prospects.

vzphotos

In our previous coverage of Micron Technology, Inc. (NASDAQ:MU) stock, we had remained incrementally cautious about its lofty valuation. Admittedly, the company has been a key beneficiary of AI momentum over the past year. This continues to be driven by its competitive advantage as one of few memory makers that can produce high bandwidth memory (“HBM”) at scale. Yet, we believed the company’s lucrative growth outlook being priced into the stock’s valuation premium at the time of our previous coverage was unattainable given anticipated capacity constraints.

Fast track to today, Micron’s latest F4Q24 earnings results and FY 2025 guidance continue to reinforce a performance outlook that is consistent with our previous expectations. The stock’s valuation has also corrected sufficiently since mid-June, in our opinion, to better align with the underlying business’ tangible fundamentals.

In addition to the stock’s attractive valuation today, Micron’s delivery of margin accretion from the newly introduced HBM revenue stream is also supportive of free cash flow expansion. This continues to be a critical factor underpinning the stock’s upside potential from current levels.

More importantly, Micron’s high revenue visibility, driven by HBM volumes that have already been accounted for through calendar 2025 at contracted prices, remains a key differentiator from its memory peers. Specifically, the combination of long-term and volume agreements forged between Micron and its customers for HBM partially mitigates the company against the memory industry’s inherently elevated exposure to cyclical headwinds.

Solid HBM demand is further complemented by an emerging cyclical recovery in non-HBM memory applications, such as the PC, smartphone and automotive markets. This is incrementally supported by higher memory content requirements in chips to power next-generation AI-enabled products. Taken together, the Micron stock represents a favorable investment opportunity at current levels, with confidence in its long-term outlook reinforced by its latest earnings outperformance.

Sustained HBM Margin Accretion

Micron reported full-year fiscal 2024 gross margin of 23.7%, an impressive reversal from losses in the prior year, underpinned by a 31-point expansion. The company delivered sequential gross margin expansion in every quarter of fiscal 2024, with the figure reaching 36.5% in F4Q. This continues to be driven primarily by ongoing pricing tailwinds and an improving ramp of HBM volumes. Specifically, the company disclosed that HBM’s gross margins have achieved margin accretion at both the DRAM and corporate levels during F4Q.

Further, HBM margin expansion is expected as volumes continue to ramp through FY 2025. This is corroborated by management’s expectations for significant operating leverage improvements through the current fiscal year. Specifically, operating expense growth was guided in the mid-teens percentage range, inclusive of continued increases to R&D spending, versus implied revenue growth of more than 50% over the same period.

The current ramp progress and cost structure of HBM products are corroborative of sustained long-term margin expansion for the newly introduced revenue stream despite its higher trade ratio. Recall that HBM has a higher trade ratio than traditional memory products. Specifically, Micron’s HBM3E is already more capital-intensive to produce, requiring 3x the wafer supply to get the same number of bits as one DDR5.

Meanwhile, the next-generation HBM4/HBM4E will have an even higher trade ratio due primarily to “die size growth”:

HBM die size is larger than standard products in the same node in order to be able to provide the high bandwidth capability and performance capability that defines HBM… you can kind of imagine that as the performance gap between the HBM standard at the time and the standard products of LP and DDR, as the performance gap between those widens, then that’s what’s the biggest driver in terms of the trade ratio because more and more of the die size is dedicated to providing high bandwidth capability on the die that’s differentiated in HBM versus standard DDR and LP products.

But despite further trade ratio increases on the next-generation HBM4/HBM4E, the rapid ramp of HBM3/HBM3E volumes towards margin accretion builds confidence in Micron’s future yield efficiency. This will be further complemented by incremental capacity coming online at the Idaho facility in FY 2027 to support next-generation HBM4/HBM4E volumes. The additional supply is expected to alleviate compression in the mix of non-HBM DRAM bit share and drive further margin accretion for Micron in the long run.

Durable Demand Environment

Micron’s rapid growth trajectory observed in the past 12 months has been primarily driven by data center demand – particularly for HBM critical in AI chip applications. This has been a stark reversal from the cyclical downturn sustained in the preceding year, given Micron’s elevated exposure in PC and smartphone end-markets.

Looking ahead, we expect Micron’s demand environment to deliver a sustained pace of growth over the longer term. Specifically, management has highlighted the broadening of demand drivers beyond data center applications in F2H25. This will be driven primarily by the emerging cyclical recovery in consumer-focused end-markets, such as PC and smartphone memory applications, which will complement the current strength in HBM sales. In addition, we expect Micron’s long-term growth trajectory to be reinforced by improved HBM revenue visibility given contracted volumes through at least calendar 2025. And, more importantly, the advent of generative AI and its compute-intensive workloads both in the cloud and at the edge will, inadvertently, increase memory content requirements going forward. We believe this represents a structural upward shift in Micron’s demand outlook that remains underappreciated and overshadowed by current market interest in the HBM ramp trajectory.

1. Broadening Demand Drivers

In addition to resilient memory demand in next-generation AI server deployments, management has also highlighted observations of recovering growth from general purpose / traditional servers as well during F4Q. This was primarily driven by the rise of existing infrastructure upgrades aimed at optimizing efficiency in the AI-first era. And new generation traditional server deployments are expected to incorporate more efficient technologies, which, inadvertently, require greater DRAM and NAND content. This “consolidation” of existing traditional server data centers enabled by newer and more efficient technologies is further corroborated by similar observations from industry peers including Advanced Micro Devices, Inc. (AMD) and Dell Technologies Inc. (DELL) this year:

In the enterprise, we have seen signs of improving demand as CIOs need to add more general purpose and AI compute capacity, while maintaining the physical footprint and power needs of their current infrastructure.

Source: AMD 1Q24 Earnings Call Transcript.

…customers are looking for room to put AI into their infrastructure. And to do that, we think there’s a consolidation that is beginning to occur to make room. And that consolidation is important because the new technologies today are incredibly more efficient than what you might be replacing that’s four or five years old. For example, if I were to look at a 14G product we shipped four-plus years ago to a 16G that we ship today, our product today has 2.5 times to 3 times more cores in it. It’s 25% to 35% more power-efficient and a single 16G server can replace 3 to 5 14G servers in a rack. So consolidation is going to occur because that space and power is needed.

Source: Dell F2Q25 Earnings Call Transcript.

In addition to the broadening of data center memory demand across both AI and traditional server deployments, management also anticipates incremental growth from the emerging cyclical recovery in PC and smartphone end-markets through FY 2025. Specifically, the emerging PC market recovery is expected to be fuelled by upgrades from COVID-era purchases, and complemented by the advent of next-generation AI PCs and the transition to Windows 12.

Management has already disclosed early observations of inventory build at PC makers, anticipating tightening memory supply and rising prices. Recall that non-HBM memory capacity in the industry has become increasingly compressed by HBM demand over the past year. This has essentially exacerbated the impact of reduced DRAM and NAND wafer capacity since 2022 due to limited industry investments during the extended cyclical downturn. As a result, the constrained supply environment ahead of an emerging PC market recovery is expected to reinforce favorable pricing dynamics for Micron and add incremental durability to its growth trajectory. This will be further complemented by expectations for restored demand from smartphone OEMs beginning spring of 2025.

2. Long-Term HBM Revenue Visibility

Micron’s long-term growth trajectory also benefits from improved revenue visibility on HBM volumes. Specifically, the company has already sold out of its HBM capacity through calendar 2025 with prices fixed under long-term contracts.

And the upcoming shipments of HBM4/HBM4E in FY 2027 are likely to demonstrate a similar pace of demand durability. Specifically, Micron now benefits from “deep engagements” already forged with customers on their respective multi-year R&D roadmaps for the ongoing transition to accelerated computing. With many AI chipmakers having already announced their long-term product roadmaps this year, it is likely that Micron already has revenue visibility for its next-generation HBM solutions as well.

For instance, NVIDIA Corporation (NVDA) has already committed to introducing a new platform every two years. The next-generation Rubin platform, which features HBM4, will roll out in 2026. The timeline coincides with Micron’s planned start of volume production for its HBM4 technology in FY 2027, highlighting the company’s potential share of the relevant opportunity.

Micron has also continued to demonstrate industry-leading performance and TCO, which remains a competitive advantage against peers and reinforces its continued revenue share gain in emerging HBM opportunities. Specifically, Micron’s 12-high HBM3E will begin volume shipments in early calendar 2025; current customer sampling of the product has already received positive feedback.

Despite emerging competition from a prospective third supplier in the industry – currently speculated to be Samsung Electronics Co., Ltd. (OTCPK:SSNLF) – Micron is expected to protect its market share with competitive technological advancements. Specifically, its 12-high HBM3E product boasts “20% lower power consumption than [its] competitors’ HBM3E 8-high 24 GB solutions while providing 50% higher DRAM capacity,” which makes it an attractive choice for data center customers.

3. Structurally Transformed Demand Outlook

Aside from lucrative HBM demand, Micron is also well-positioned to capitalize on a structural upward shift in non-HBM requirements driven by the ongoing AI transformation. In addition, incremental growth anticipated from the emerging recovery in consumer-focused end markets as discussed in the earlier section, the advent of AI-enabled devices will also be upping base memory and storage requirements. This accordingly represents an additive tailwind for Micron’s long-term growth trajectory, which we believe continues to be overshadowed by current momentum in HBM demand.

Specifically, AI PCs have a higher memory and storage requirement than traditional PCs due to their requirement for inferencing at the edge (i.e., processing workloads on the device instead of in the cloud). Micron management has recently disclosed that AI PCs require at least 16 GB of DRAM, with the memory requirement going up to as much as 64 GB in premium models marketed for commercial use cases. This compares to the average memory content of about 12 GB in traditional PCs shipped in the past year. A similar trend is also observed in AI-enhanced products stemming from the smartphone and automotive markets.

Admittedly, non-HBM capacity remains compressed by the rising allocation of bit share to HBM products. However, incremental capacity from the Idaho facility, which comes online in FY 2027, will provide much-needed alleviation for Micron to take advantage of the incremental AI-driven memory requirements.

Micron’s product portfolio is also well-positioned to capitalize on the related opportunities. For instance, the company’s latest LPCAMM2 product, which integrates low-power DRAM with a compression-attached memory module, offers competitive power and performance capabilities. The product delivers “up to 60% lower power and up to 70% better performance, along with 60% space savings” when compared to traditional modular D5-based solutions. This accordingly makes the LPCAMM2 an optimal choice for processing compute-intensive AI workloads at the edge, thus reinforcing Micron’s prospective share of relevant deployments.

Attractive Valuation

The Micron stock’s sell-off since mid-June, paired with the company’s continued financial outperformance, has made its valuation attractive at current levels on both an intrinsic and relative basis. Specifically, Micron’s sustained growth trajectory underpinned by long-term HBM revenue visibility and margin accretion, broadening revenue drivers, and structural demand tailwinds favors a durable upward re-rate to its valuation.

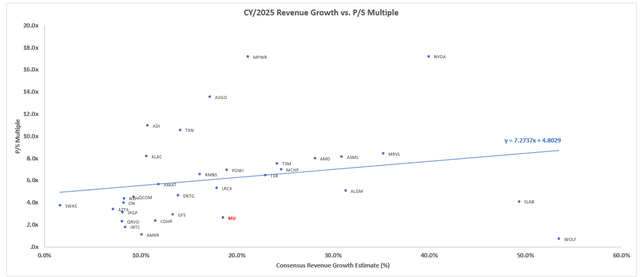

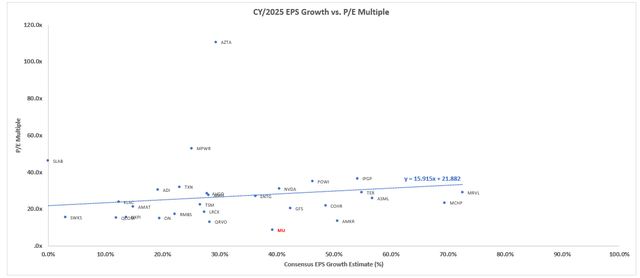

Micron is currently trading at about 2.6x CY 2025 sales and 8.6x CY 2025 earnings. This is a significant discount to the average of 8x and 26x CY 2025 sales and earnings, respectively, observed at comparable semiconductor peers with a similar growth and earnings profile. Admittedly, Micron’s inherently elevated sensitivity to cyclical risks has historically been an overhanging multiple compression factor for the stock. However, improved durability to Micron’s long-term fundamental trajectory, and its mission-critical role in enabling the AI transformation warrants a sustained valuation uplift from current levels, in our opinion.

Data from Seeking Alpha Data from Seeking Alpha

Meanwhile, on an intrinsic basis, the stock’s valuation pullback this year also provides an opportunity for sustained upside supported by tangible cash flow growth. This will be further discussed in detail in the later section, where we provide an analysis on the price target set for the Micron stock.

Fundamental Considerations

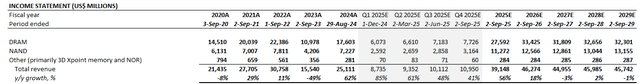

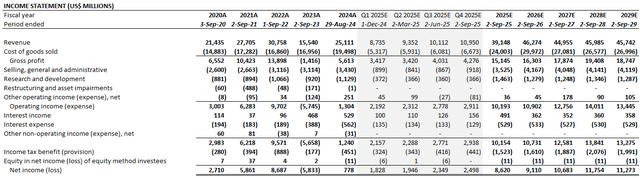

Adjusting our previous forecast for Micron’s actual F4Q24 results and forward outlook as discussed in the foregoing analysis, we expect the company to grow revenue by 56% y/y to $39.1 billion in FY 2025.

Specifically, we expect DRAM revenue to expand 57% y/y to $27.6 billion. This will be primarily driven by continued pricing tailwinds, primarily from contracted HBM volumes stemming from AI-related deployments, and, to a lesser extent, an improving supply/demand balance in non-HBM wafers. Meanwhile, NAND revenue is expected to expand 56% y/y to $11.3 billion. This is consistent with anticipated NAND bit demand growth in the mid-teens percentage range through calendar 2025, complemented by continued price expansion as the segment’s supply/demand balance also improves from peak capacity observed in 2022.

On margins, we expect the continued ramp of HBM volumes to drive incremental accretion to Micron’s profitability through FY 2025. This will be evident at both the gross profit and operating income levels. Specifically, improving DRAM prices driven by both the increasing mix shift towards premium HBM volumes and restored demand-supply balance in non-HBM volumes will be critical to enabling sustained gross margin expansion. Meanwhile, operating leverage improvements will become more evident with the continued ramp of HBM volumes, especially with incremental 12-high HBM3E shipments starting calendar 2025.

Valuation Considerations

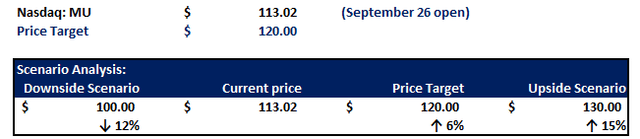

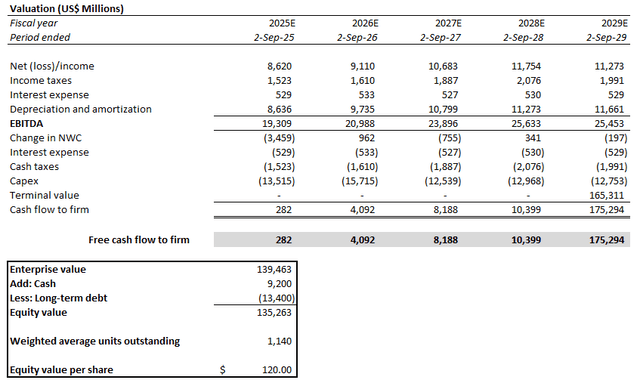

Based on the foregoing analysis of Micron’s outlook, we are setting our base case price target for the stock at $120 apiece. This represents upside potential of 6% from the stock’s post-earnings open at $113.02 on September 26.

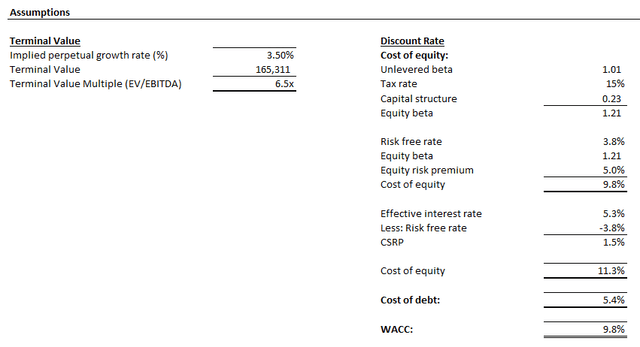

The price target is derived from the discounted cash flow (“DCF”) approach, which is an adequate reflection of Micron’s estimated intrinsic value based on tangible underlying business fundamentals. The DCF analysis considers cash flow projections in line with our updated fundamental forecast for Micron, as discussed in the earlier section. A 9.8% WACC in line with Micron’s capital structure and risk profile is considered. The analysis also applies an implied perpetual growth rate of 3.5% on FY 2029E EBITDA to determine Micron’s terminal value. The assumption applied is consistent with the higher range of anticipated economic expansion across Micron’s core operating regions and is reflective of the company’s leading participation in high-growth AI opportunities.

Conclusion

Micron’s latest earnings outperformance reinforces its role as a key beneficiary of ongoing AI infrastructure investments. The company is currently one of few that can provide HBM, a critical component in AI accelerators, at scale. And sold-out volumes through calendar 2025 at contracted prices effectively improves Micron’s revenue visibility. This continues to be crucial for alleviating investors’ recent concerns over the durability of a currently elevated AI spending environment.

The further broadening of growth drivers beyond HBM shipments, driven by the emerging cyclical recovery in consumer-focused end-markets, will be complementary to existing AI momentum through FY 2025. More importantly, the advent of AI and its mass market adoption will be a key reinforcement to Micron’s long-term demand outlook. The increased memory and storage content requirements for supporting AI training and inferencing workloads, both in the cloud and at the edge, will be an additive long-term growth driver for Micron.

Taken together with the stock’s corrected valuation recently, Micron Technology, Inc. stock currently represents an attractive investment opportunity for sustained an upside potential underpinned by tangible underlying business fundamentals.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.