Summary:

- Micron’s strong earnings and market reaction don’t justify its valuation, with FCF annualized at sub 1%, making it a poor investment.

- Heavy investments in fabs and AI could strain financials, with capex growth potentially risky if the market downturns.

- Competition from SK Hynix and Samsung, both ahead in AI memory technology, poses significant challenges to Micron’s market position.

- Despite AI-driven demand, Micron’s history of weak capital returns and cyclical industry risks make it a less attractive long-term investment.

SolStock/E+ via Getty Images

Micron (NASDAQ:MU) is one of the largest memory companies in the world in an oligopoly with much larger peers Samsung, and SK Hynix. The company surged after-hours, towards a market capitalization of $130 billion, as its earnings revealed a stronger than expected market. The company has dropped double-digits versus the S&P 500 since our July article, where we also considered it as overvalued.

However, the company does not have the earnings to justify its valuation, and as we’ll see in this article, is a poor investment in our view.

Micron Result Overview

The company had strong results as 2024 demand came in stronger than expected, enabling double-digit QoQ growth in prices.

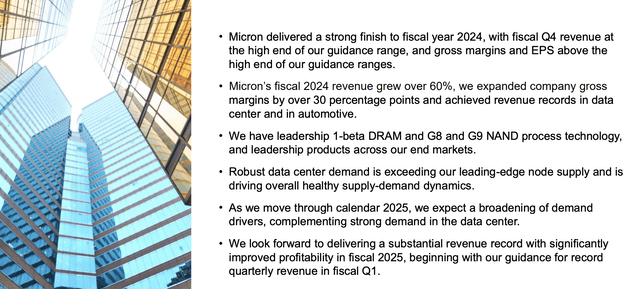

Micron Investor Presentation

The company’s revenue grew over 60% and gross margins grew by over 30%. However, this cash flow picture doesn’t take into account the company’s continued lofty investments in its business. The company expects data center to be strong in 2025; however, even tech companies argue they could be over-investing in the artificial intelligence arms race.

Even in a great quarter, the company’s shareholder returns for the quarter were 0.2%, indicating struggles in generating the high single-digit to double-digit returns we like to see to invest in a company over the S&P 500.

Micron Fab Buildup

Micron is investing in building up its fabs, partially after receiving more than $6 billion in Chips Act investment, increasing the U.S. job count.

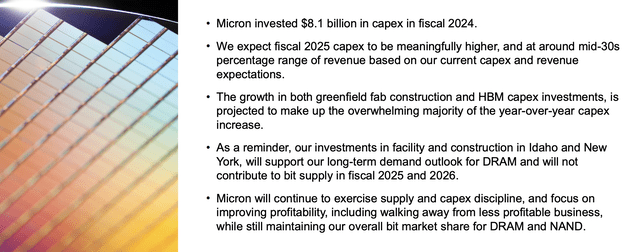

Micron Investor Presentation

The company’s Idaho fab is the largest investment in that state’s history, at $15 billion. The company is keeping investments lofty for new fabs, but these won’t show benefits for the company until the end of the decade. The company has a number of projects it’s investing in, but at the end of the day, the takeaway is it’s investing in growing production, which can be risky.

Micron Investor Presentation

The company is planning for fiscal 2025 capex to be in the mid-30s percentage range. With annualized revenue based on its guidance is $35 billion, that implies roughly $12 billion in capex, or a 50% growth rate. The company is barely FCF positive at the current rate, and ramping up capex if the market has a downturn, could put a strain on its financials.

Micron Financial Results

Financially, Micron had strong results for the quarter, but its guidance and history doesn’t justify its valuation.

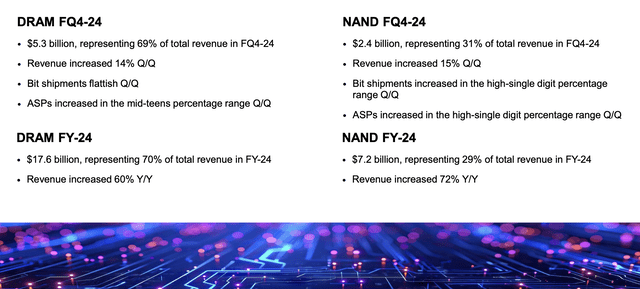

Micron Investor Presentation

The company earned $7.7 billion in revenue for the quarter, with an almost 15% QoQ increase. The company’s bit shipments were roughly flat as it primarily benefited from a recovery in ASPs. YoY the financial recovery was clear, pushing the company to an EPS of almost $5 annualized, and giving the company a P/E in the low-20s.

Micron Investor Presentation

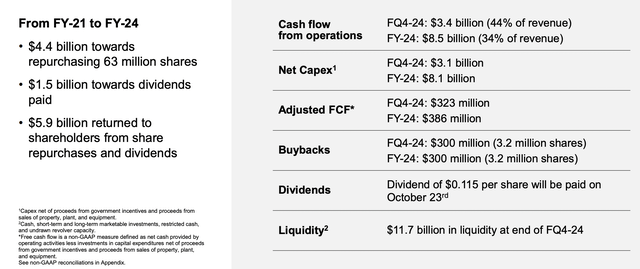

The company has a history of capital returns that don’t justify its valuation, and despite strong FCF in the quarter, returns remained weak. The company’s capital expenditures remain hefty at $2 billion per quarter, and the company’s FCF for the quarter was only $320 million, with more than 90% spent on share buybacks.

Buying back shares in an expensive market is quite risky. Over the past four years, the company spent almost $6 billion on shareholder returns, putting it at an annualized return of just over 1%. Those are incredibly weak returns that don’t justify an investment versus the S&P 500. The DRAM and NAND industries remain cyclical and downturns come every few years.

The company’s history of returns over a 4-year period, two of which have included Open AI’s ChatGPT, indicate its current overvalued nature.

Micron Competition and Market

At the same time, it’s worth noting that Micron continues to face well capitalized competitors, SK Hynix and Samsung, both of which are larger.

SK Hynix just announced it’s planning to start ramping 12-layer HBM chips, several months ahead of Micron. This high-capacity HBM is essential for artificial intelligence and the required memory capacity. The company is planning to start shipping the HBM3E chips to customers by the end of the year, while Micron doesn’t plan to start ramping until next year.

Samsung, on the other hand, is also planning to ramp by year-end. Samsung hit the biggest market share it’s had since 2016 earlier this year, and Samsung is investing the most out of its peers into DRAM. The company has shown an interest in growing its market share before, when it ramped DRAM investment during the last downturn in 2022, and it will continue to be a competitor.

Thesis Risk

The largest risk to our bearish view is the continued optimism around artificial intelligence and the size of the events. This is in the $10s of billions worth of investment, and DRAM is essential to the continued success of AI processors. That’s also true with SSD storage, which the company is well positioned in. That could enable the company to outperform in the immediate future.

Conclusion

Micron released its earnings and the market reacted extremely positively after realizing that artificial intelligence fueled demand appears to be here to stay for now. The company has continued to benefit from an increase in ASPs, however, even in a strong market, FCF annualized remains at sub 1%, a pitiful return.

The company is working to ramp up capital spending next year, taking advantage of new trends. However, a 50% increase in capital spending could put the company in a tough position, hurting its ability to drive future shareholder returns. That makes Micron a poor long-term investment. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated, and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.