Summary:

- Micron’s Q4 business is on fire due to surging demand for high-bandwidth memory products, especially HBM3E.

- AI-driven demand for HBM is set to propel Micron’s growth in the coming quarters resulting in a massive expansion of the total addressable market.

- Micron’s guidance for Q1’25 implies the addition of $1.0B in revenue Q/Q. Margins are expected to continue to grow.

- Micron’s 9X forward P/E ratio is woefully inadequate given its catalyst backdrop and strategic HBM positioning in the fast-growing AI market.

BlackJack3D

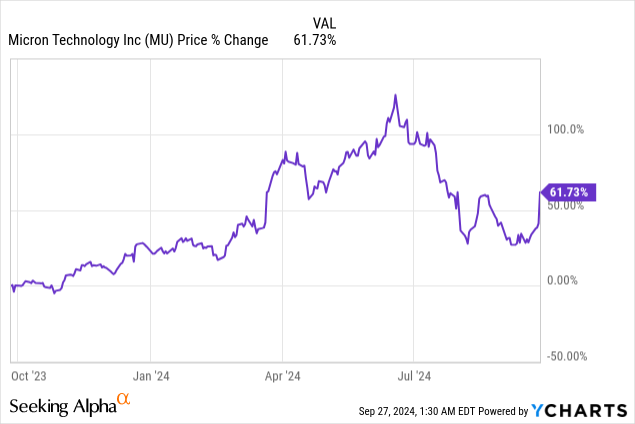

Shares of Micron Technology (NASDAQ:MU) surged 15% after the memory and storage maker presented it earnings sheet for its fourth fiscal quarter on Wednesday. Micron crushed expectations on both the top and bottom line which is due to the shipment ramp up of its high-bandwidth memory solution HBM3E. Micron had a truly outstanding quarter in financial terms, driven by accelerating growth for its HBM products, which resulted in strong margin gains as well. The earnings release also has huge implications for Nvidia (NVDA) and AMD (AMD) both of which are set for similarly strong earnings reports for the current quarter. I believe Micron represents one of the deepest values in the semiconductor industry given its margin growth and low valuation based off of earnings.

Previous rating

A few weeks before earnings, I indicated that Micron had considerable EPS surprise potential given strong demand for its new high-bandwidth memory HMB3E: I Am Buying The Drop Hand Over Fist Before Q4. The EPS revision trend was also widely favorable. With Micron seeing a considerable HBM ramp in the last quarter and submitting a super-strong guidance for Q1’25, I believe Micron is only at the beginning of its HBM ramp. With margin gains set to continue in the current quarter, I believe Micron’s low valuation based off of earnings is unacceptable.

Massive earnings beat

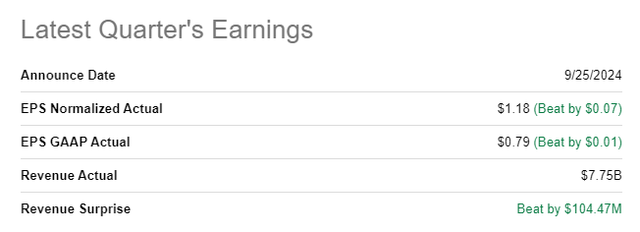

Micron easily surpassed both top and bottom line consensus expectations for the fourth quarter, largely due to surging demand for memory products that are needed in order to keep the AI boom going: Micron generated $7.75B in Q4’24 revenue and earned $1.18 per-share in adjusted earnings. This means revenue came in $105M ahead of the consensus estimate while earnings beat the average prediction by $0.07 per-share.

Seeking Alpha

Top financial accomplishments, margin expansion and higher average selling prices

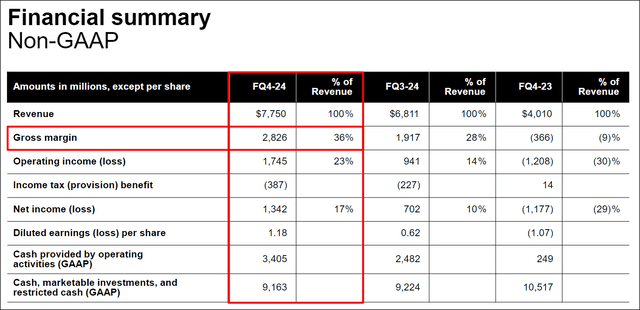

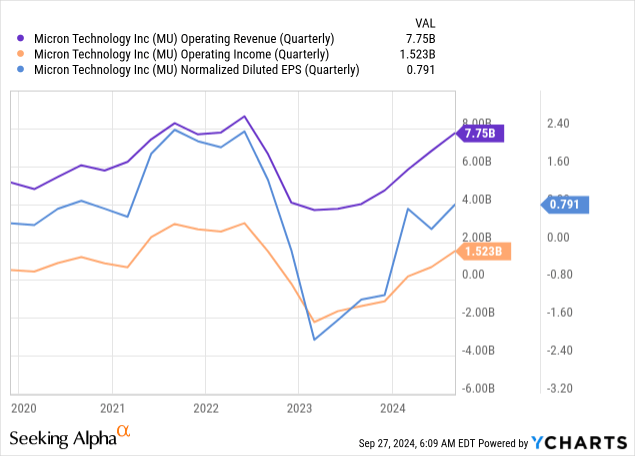

Micron generated $7.8B in revenue in the fourth fiscal quarter, showing 93% Y/Y and 14% Q/Q growth. In the previous quarter, Micron’s top line advanced 82% Y/Y and 17% Q/Q. While the storage and memory maker did not see a revenue growth acceleration quarter-over-quarter, investors can hardly argue with the strength of Micron’s financial performance.

Micron’s revenue momentum — which was once again driven by growing demand (and shipments) of high-bandwidth memory products — resulted in an 8.4 PP sequential margin gain: Micron’s non-GAAP gross margin in Q4’24 was 36.5% which also came in 1 PP above the firm’s top-end margin guidance issued in the previous quarter. On a full-year basis, Micron has also seen quite a nice margin rebound: Micron achieved a non-GAAP gross margin of 23.7% in FY 2023, showing a year-over-year margin swing of 31.4 PP.

Micron

This growth is driven by higher margins for Micron’s high-bandwidth memory solutions, shipments have which continued to ramp up in the last quarter. All major key metrics, including revenue, operating income and gross margins are pointing upward, indicating that Micron has considerable momentum in its core business.

AI is set to remain a key growth driver for Micron as well, so the company should be able to see continual margin growth going forward. Micron’s management has said that it expects the total addressable market for HBM to go from $4.0B in FY 2023 to $25.0B in FY 2025 which represents a 6.25X factor increase.

Micron earlier this year projected that HBM will yield revenue gains of several billion dollars in the current fiscal year. To participate in the growth of this market, Micron is set to launch a new, higher-performance HBM product, the 12-hi HBM3E, which is set to come to market in early 2025. The 12-hi HBM3E 36GB version, according to Micron, offers 20% lower energy consumption and 50% higher DRAM capacity, making the chip obviously an attractive choice for compute-intensive Data Centers. With a catalyst set to be unleashed in FY 2025, Micron has a strong lever to build on its current HBM momentum.

Further, the earnings release has implications for Nvidia and AMD, the latter of which soon going to report earnings at the end of October. Growing demand for high-bandwidth memory is a strong indicator for resilient demand for Data Center GPUs (as they are used together). Considering that HBM shipments continued to ramp up for Micron in the last quarter, the market is showing continually high demand for Data Center chips as well which in turn implies that the corporate sector is not scaling back AI hardware investments. For this reason, I continue to see AMD as fairly at the beginning of its Data Center-related revenue ramp: The AI Boom Is Just Getting Started For AMD.

Strong revenue guidance amid HBM ramp

Micron’s revenue guidance for Q1’25 implies a top line, at the mid-point of guidance, of $8.7B +/- $200M which widely beat the Wall Street estimate of $8.27B. Obviously, demand for memory products is much stronger than expected which bodes well for Micron’s margin development in the next several quarters as well: as per Micron’s outlook for the next quarter, the memory and storage maker expects its non-GAAP gross margin to come in at 39.5% +/- 1 PP (+3 PP Q/Q, at the mid-point).

Micron’s valuation

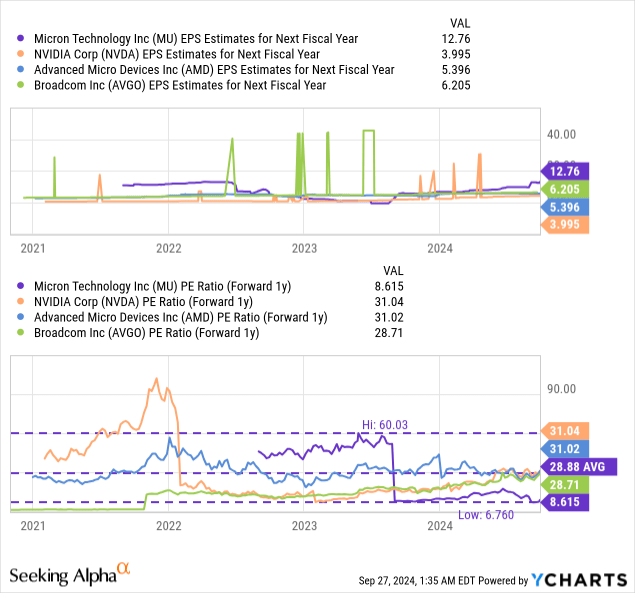

Micron is an especially attractive investment from a valuation point of view. The producer of computer memory and data storage products is priced at a well-below average P/E ratio of 8.6X which implies an earnings yield of 11.6%.

The low valuation likely relates to investor concerns that memory and storage demand is kind of cyclical and Micron has historically seen huge fluctuations in its gross margins and earnings. My counterargument here would be that Micron benefits as a major HBM player from a broad-based upgrading of AI-optimized infrastructure which is at least a multi-year trend, in my opinion, if not a secular one.

In my article on Nvidia — The AI Fatigue Myth — I indicated that I see AI investments not as cyclical, but as structurally permanent which means semiconductor companies like Nvidia or AMD are shortening their product cycles and customers need to therefore update their AI chips more frequently. This creates a long term demand driver for companies selling AI hardware products, including Nvidia, AMD, and Micron.

In my opinion, Micron could trade at a forward P/E ratio of 10.0X which, based off of a consensus FY 2026 EPS estimate of $12.76, implies a fair value of $127.60… which reflects a $2.60 per-share increase in my stock price target due to rising consensus estimates. However, in the longer term, given the secular nature of AI hardware investments, I believe Micron could re-price significantly higher. Rival companies that benefit from the AI hardware boom obviously include Nvidia, AMD and Broadcom (AVGO), all of which trade at significantly higher forward price-to-earnings ratios.

It would be entirely realistic, in my opinion, for Micron to trade up to a 15.0X P/E ratio in the long term, implying a LT fair value of $191 per-share, assuming that Micron can consistently benefit from AI Data Center investments. Since Micron is also set to start shipping its hi-12 HMB3E memory product next year, I believe the company also has the necessary catalyst in order to drive a major revaluation to the upside.

Risks with Micron

The biggest risk, as I see it, relates to Micron’s margin trajectory. Margins in the semiconductor market tend to be as volatile as earnings which means investors are dealing with a considerable amount of short term earnings risks. What would change my mind about Micron is if the company were to see a decline in its gross margins which I consider to be the canary in the coal mine. A downturn in the semiconductor market tends to be foreshadowed by a considerable margin contraction (as we have seen in 2023) and the appearance of weaker gross margins would be a major red flag for me.

Closing thoughts

Micron is doing really well right now which is not surprising. Micron is strategically well-positioned to benefit from the AI boom as Data Centers need better memory and storage capacity. The outlook for the next quarter, which also implies continual gross margin expansion is highly favorable, as is Micron’s general projection of a significant expansion in total addressable market for HBM products. What makes shares of Micron especially appealing is the low valuation based off of earnings: Micron is trading for a mere 8.6X forward P/E ratio despite other AI beneficiaries managing to trade at significantly higher valuations. I believe shares of Micron continue to be greatly undervalued in the long term and the risk profile is still very much favorable.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, NVDA, AMD, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.