Summary:

- Shares of Micron popped 15% after reporting Q4 results and announcing bullish remarks for FY25, and I recommend holding on for further gains.

- Micron expects substantial profitability, gross margin expansion, and healthy supply-demand dynamics for DRAM and NAND in FY25.

- Data center sales continue to be robust as AI applications demand more HBM chips, while refresh cycles are compressing for both PCs and mobile phones.

- The stock still trades at a very palatable ~12x forward P/E, especially as earnings estimates are likely to glide higher.

JHVEPhoto

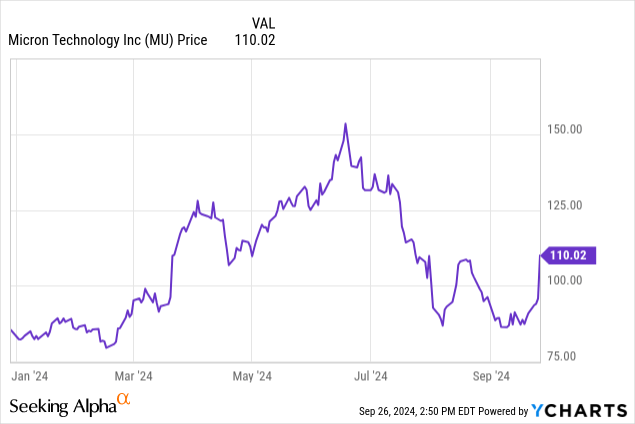

Chip stocks, led by Nvidia (NVDA), were the trade of the year in early 2024… until they weren’t by mid-summer, plagued by concerns on overblown AI demand and businesses stockpiling inventory and potentially not refreshing orders.

Micron (NASDAQ:MU), however, just breathed fresh new life into sentiment for itself as well as for the industry with its blockbuster fiscal Q4 (August) quarter earnings print. Shares of Micron jumped ~15% after hours on the positive news, helping to reverse a sharp slide from ~$150 that began in mid June.

I wrote a bullish earnings preview on Micron ahead of the earnings print, upgrading the stock to a strong buy and encouraging investors to buy the dip before earnings. Now, after digesting the results, I remain at a strong buy for Micron as we enter into the company’s FY25.

More critical to me than the Q4 results (which blew past expectations) was the commentary that Micron provided around supply and demand for FY25. The core takeaways for investors to note are:

- Micron continues to expect substantial profitability next year. Its Q1 outlook displays further gross margin expansion. It’s expecting supply-demand dynamics to be healthy for both DRAM and NAND, while the company expects to see substantial manufacturing cost reductions for both technologies next year.

- End markets are showing healthy trends as well. AI is supporting both consumer and enterprise memory orders, helping to dispel the notion that Micron is oversupplying the market right now with inventory that won’t get rebooked next year. In particular in the consumer space, new device releases are demanding higher memory capacity, which is a boon to Micron.

All in all, the learnings from Micron’s latest update more than justify the sharp rally in the stock. With Micron still down nearly 30% from YTD peaks, there’s still plenty of room to get in on this rebound.

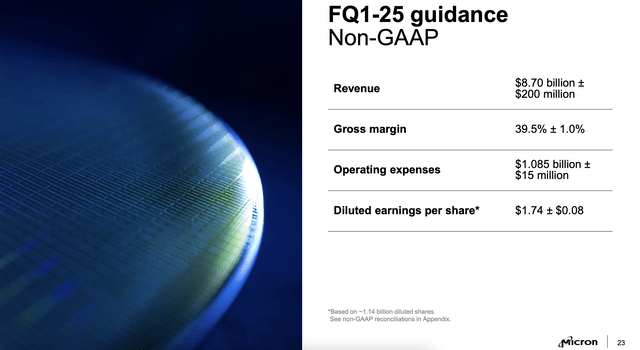

Sky high margins, supported by meaningful cost-downs

As usual, the stock market reacted most strongly to Micron’s excellent guidance for the current quarter. On top of guiding to $8.5-$8.9 billion in revenue (which represents an astounding 80-88% y/y growth range, after delivering 93% revenue growth in Q4), the more important signal to me is that Micron expects to deliver a midpoint 39.5% pro forma gross margin, representing 300bps of sequential expansion from Q4’s 36.5% margin, which was already ahead of consensus’ 34.7% expectations.

Micron Q1 outlook (Micron Q4 earnings)

Micron is a famously volatile stock in a very cyclically driven chip sector, and the company signaling that gross margins still have legs to expand is an incredibly powerful fuel for the stock to rally further. Recall that in down cycles, Micron has often posted near or below-zero gross margins: in Q1 of FY24, the company’s pro forma gross margin was just 0.8%, so current guidance for Q1’25 has roughly forty points of expansion baked in (in Q4, gross margins also expanded roughly 45 points from -9.1% in the year-ago Q4 to 35.4%).

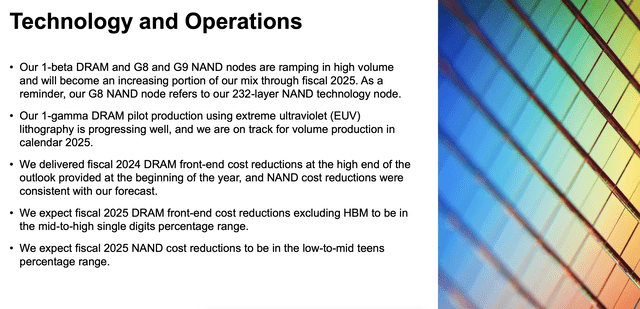

Improved manufacturing efficiencies and cost are driving a big portion of the expected margin upside. As shown in the chart below, the company is expecting mid to high single digit cost improvements in DRAM (roughly two-thirds of the company’s revenue), and low to mid teens cost improvements in NAND.

Micron cost expectations FY25 (Micron Q4 earnings deck)

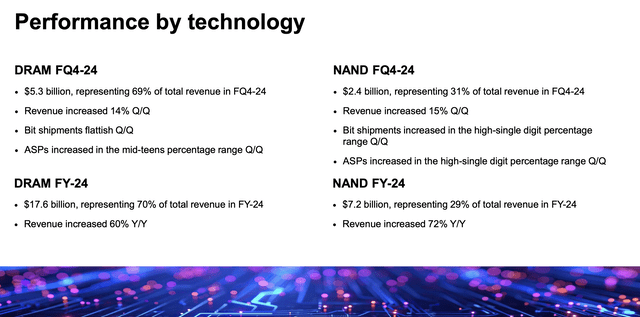

Amid these cost reductions, heavy demand for memory (which we’ll dig further into in the next section) is continuing to power pricing upside for both DRAM (where ASPs grew “mid teens” sequentially in Q4) and NAND (“high single digit” sequential ASP growth).

Micron DRAM/NAND segment results (Micron Q4 earnings deck)

If anything, it feels to me as if the supply-demand balance, at least presently, is weighted far in favor for suppliers like Micron. The industry is sustaining such strong demand for memory that Micron doesn’t have any need to compete on price and share some of its cost-down savings with customers.

Robust end market demand, fueled in large part by AI

For FY25, Micron is expecting mid-teens bit demand growth for both DRAM and NAND, and while the company didn’t comment on bit supply growth, it did emphasize that industry capacity will be well below 2022 peak levels (where oversupply led to negative margins in 2023) and that supply and demand will be in a healthy equilibrium for the year.

Micron FY25 demand outlook (Micron Q4 earnings deck)

The company believes it’s entering 2025 with the “strongest competitive positioning” in history, given a buoy of demand from AI-related hardware and applications. Per CEO Sanjay Mehrotra’s remarks on the Q4 earnings call:

We are entering fiscal 2025 with the strongest competitive positioning in Micron’s history. We have leadership 1-beta DRAM and G8 and G9 NAND process technology, and leadership products across our end markets. Robust data center demand is exceeding our leading-edge node supply and is driving overall healthy supply-demand dynamics.

As we move through calendar 2025, we expect a broadening of demand drivers, complementing strong demand in the data center. We are making investments to support AI-driven demand and our manufacturing network is well positioned to execute on these opportunities.

We look forward to delivering a substantial revenue record with significantly improved profitability in fiscal 2025, beginning with our guidance for record quarterly revenue in fiscal Q1.”

Let’s now review the core end markets in greater detail. On the data center side, the core driver is that the overall market for HBM chips (or high bandwidth memory, which is vital for AI applications to run smoothly) is expected to hit $25 billion in 2025, up from merely $4 billion in 2023.

Micron data center market (Micron Q4 earnings deck)

Even after achieving record sales to the data center segment in FY24, the company still expects to “grow significantly” in FY25.

On the PC side, meanwhile, the company noted that device sell-through is strong in the fall season. The snapshot below showcases Micron’s expectation that PC unit growth is expected to accelerate into the second half of calendar 2025.

Micron PC market (Micron Q4 earnings deck)

Here, the company believes that AI-related marketing is helping to expedite the device replacement cycle for PCs. In addition to that, Microsoft (MSFT) is sunsetting support for the aged Windows 10 OS in October 2025, which is also expected to drive many legacy device users off the sidelines and upgrade to new machines. I had flagged the compression of the PC upgrade cycle in my earnings preview, as it had been a driver for upside in Best Buy’s (BBY) recent well-received earnings release which preceded Micron’s earnings.

And on the mobile phone side, Micron is also expecting strong unit growth in 2025. Again, AI is a big factor here, as the company noted several new flagship Android phones have upped their DRAM requirements, hoping to support the double-digit bit growth that is feeding Micron’s outlook for next year.

Micron mobile market (Micron Q4 earnings deck)

Risks, valuation and key takeaways

Of course, amid post-earnings euphoria for Micron, we should still be mindful of the risks that could derail the rebound rally. I had mentioned previously that enterprise demand is historically volatile and may remain so, as current demand strength particularly in data centers may represent inventory buildup that robs 2025 of fresh bookings. In addition to this, one new risk that’s emerging is heavier capex spending: the company noted its intention to spend a mid-30s percentage of its revenue on capex in FY25 to support development of HBM technology.

Currently, Wall Street analysts are expecting $37.9 billion in revenue for FY25 (+51% y/y). 35% of this revenue estimate indicates a whopping $13.3 billion in capex, well above the $8.1 billion that Micron spent in FY24. Though capex will have a minor impact to FY25 financials beyond free cash flow, it will eventually work its way through the P&L via depreciation and impact the company’s all-important gross margins.

Micron capex intentions (Micron Q4 earnings deck)

Still, Micron presents an incredibly attractive risk-reward proposition. Even after the post-earnings rally, the stock still trades at only a 12.2x forward P/E against Wall Street’s consensus $8.96 pro forma EPS expectations for FY25 (which should climb upward as Wall Street digests the company’s commentary around manufacturing cost efficiencies and strong industry bit demand growth).

I’m holding out for more upside in Micron post-earnings, and recommend you do the same.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.