Talaj/iStock via Getty Images

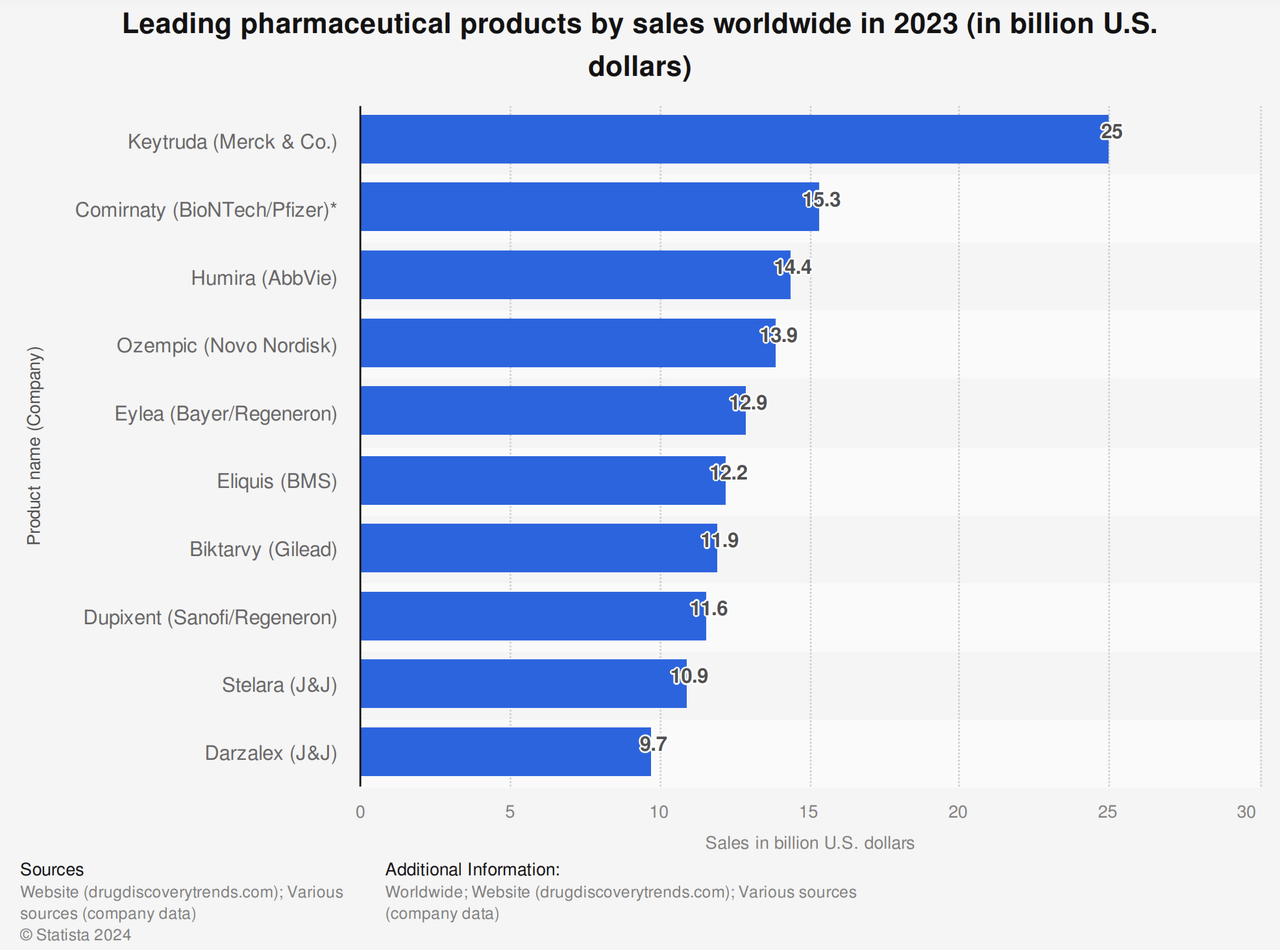

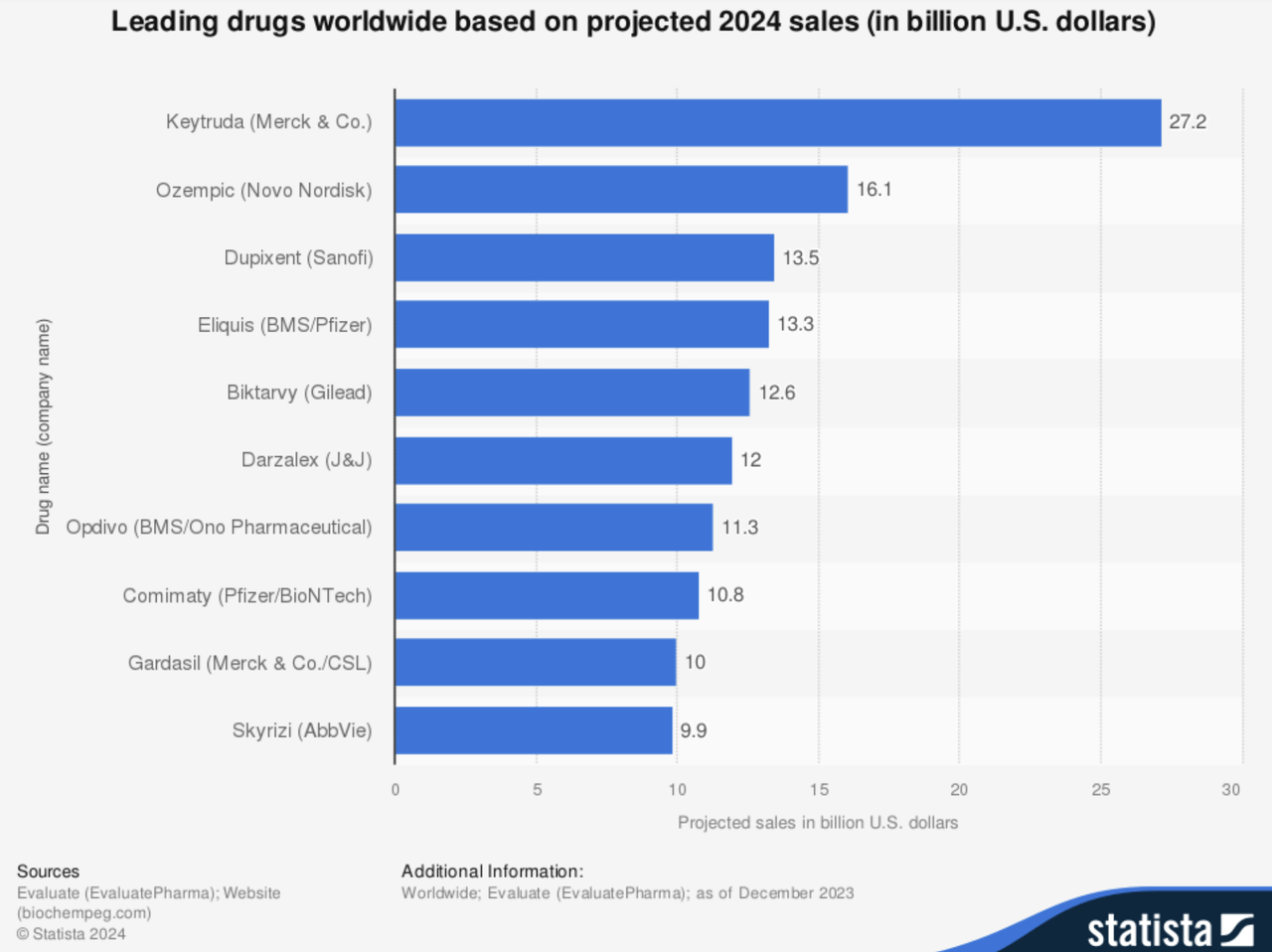

AbbVie’s (NYSE:ABBV) autoimmune disease biologic Humira (adalimumab) and Pfizer (NYSE:PFE)/BioNTech’s (BNTX) COVID-19 shot Comirnaty are projected to not make it into a list of the top 10 drugs based on worldwide sales in 2024, after taking the No. 2 and No. 3 spots in 2023.

In their places are projected to be Novo Nordisk’s (NVO) type 2 diabetes med Ozempic (semaglutide) and Regeneron Pharmaceuticals (NASDAQ:REGN)/Sanofi’s (SNY) Dupixent (dupilumab), used for allergic disease such as eczema and asthma, according to Nature Reviews Drug Discovery.

Ozempic and Dupixent were, respectively, the No. 4 and No. 8 top pharma drugs worldwide according to data from company websites.

Humira’s possible elimination from the top 10 list this year is a result of biosimilars hitting the market. The first one in the U.S., Amgen’s (AMGN) Amjevita, launched in January 2023, and there are at least eight additional ones available now.

However, a July report found that more than 80% of patients on branded Humira were still on it, an indication that adalimumab biosimilars aren’t making much of a dent. Humira had ~$14.4B in sales in 2023. In 2024 Q2, it brought in $2.81B.

Meanwhile, the declining impact of COVID-19 in many parts of the world combined with falling COVID vaccination rates explains why Pfizer and BioNTech Comirnaty 2024 sales may not be enough to keep it on the top 10 list. In its Q2 financial results release, Pfizer updated its 2024 Comirnaty revenue projection to $5B. It generated $195M in revenue in Q2, an 87% year-over-year drop.

Merck’s oncologic Keytruda (pembrolizumab) is set to remain as the No. 1 best-selling drug in 2024, with expected sales of $27.2B, according to estimates from Nature Reviews Drug Discovery and EvaluatePharma. That compares to $25B in 2023, according to Drug Discovery & Development. In Q2 alone, the biologic generated ~$7.3B in sales.

Matej Mikulic, a pharma and biotech researcher with Statista, recently wrote that Keytruda’s dominance as the top-selling drug illustrates the increasing significance of cancer treatments to drug companies. He noted that global oncology therapy spending reached $218B in 2023, more than two times the $102B seen in 2017.

He added that Merck, along with AstraZeneca and Johnson & Johnson, are projected to lead global oncologic sales in 2030.

Ozempic (semaglutide) sales are booming thanks to the immense popularity of GLP-1 medications. Although the drug is indicated for type 2 diabetes, it has been used off-label extensively for weight loss. Novo Nordisk has Wegovy, which also semaglutide, approved as a weight loss treatment, but has been plagued until recently by supply shortages. The FDA reports that only one of five dosage strengths of Wegovy is in shortage, and no Ozempic shortages are.

Ozempic alone is set to bring in $7.3B in 2024 (Wegovy isn’t projected to be in the top 10 list this year). In Q2, Ozempic saw sales of DKK 56.68B (~$8.5B), with Wegovy sales of DKK 11.66B. (~$1.7B).

Meanwhile, Dupixent from Regeneron and Sanofi is set to bring in $13.5B this year, up from $11.6B in 2023. The drug is set to gain from for a label expansion granted on Sept. 27 for certain patients with chronic obstructive pulmonary disease. Sanofi reported $3.2B in sales in Q2.