Summary:

- Micron’s 4Q FY2024 earnings led to an 18% stock rebound, driven by +80% YoY revenue growth momentum and a positive FY2025 industry outlook, indicating robust DRAM demand.

- The company’s gross and operating margins are expected to increase further in 1Q FY2025, expecting to generate 583% YoY non-GAAP EPS growth in FY2025.

- Management anticipates that high-margin products like HBM and eSSDs will increase the revenue mix while reducing exposure to China in FY2025.

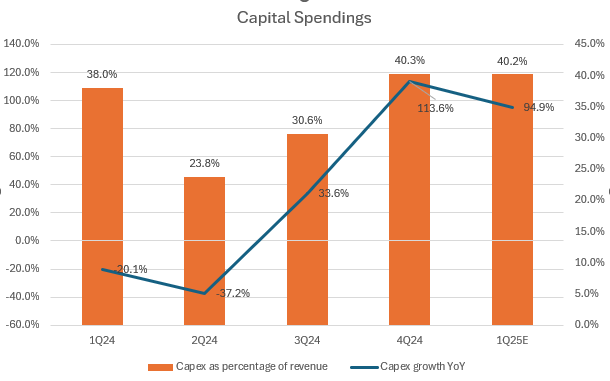

- Its capital investments remain robust in FY2025, with capex projected to be in the mid-30s percentage of revenue, supporting HBM3e ramps and next-gen HBM4 and HBM4E.

- The stock is currently trading at an extremely low valuation of 0.18x non-GAAP PEG forward, matching Nvidia’s PEG on a trailing twelve-month basis.

MF3d

Investment Thesis

Micron’s (NASDAQ:MU) experienced an 18% rebound after delivering a strong 4Q FY2024 earnings report, reversing the recent sharp pullback. This recovery is justified by continued revenue growth acceleration, driven by significant gains in DRAM categories, and an attractive valuation. Additionally, MU issued a strong 1Q FY2025 outlook that topped market consensus, reflecting robust underlying demand for AI servers. The company is expected to generate a nearly 600% YoY growth in non-GAAP EPS in FY2025, following its profitability inflection last year. In my previous analysis, I upgraded the stock to buy, due to its accelerating growth momentum, which has significantly reduced its valuation multiples. Currently, MU’s non-GAAP PEG fwd is trading at 0.18x, similar to Nvidia’s PEG on a TTM basis. Therefore, I’m upgrading the stock to “strong buy” as the recent pullback since my prior rating has made the stock even more undervalued.

+80% YoY Growth Momentum Continues

The company model

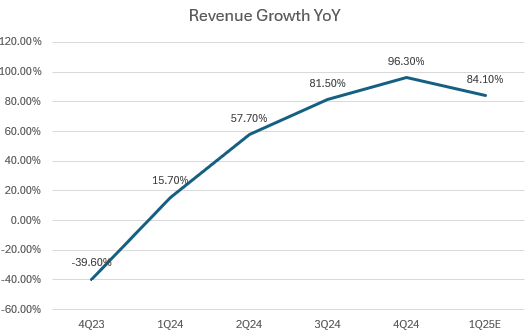

MU topped both revenue and non-GAAP estimates in 4Q FY2024, with revenue growth accelerating to 96.3% YoY, higher than my consensus of 89.5% YoY. The company expects both DRAM and NAND industry binary digit (bit) demand growth to be in the mid-teens range. During the 4Q FY2024 earnings call, the management signaled continued AI-driven growth in FY2025, boosting their 1Q FY2025 outlook. The midpoint of revenue guidance indicates an 84.1% YoY growth. However, based on the historical trend of beating the high end of guidance, I estimate 1Q FY2025 revenue growth to reach at least 88.3%. Furthermore, the management emphasized that the growth in 2H CY2025 will be even stronger, reflecting an improvement in HBM supply constraints. The company achieved its shipment goals in 4Q, and high value-added products like HBM, high-capacity DIMMs, LP, and data center SSDs are expected to become a larger part of the company’s revenue mix in FY2025. Nvidia’s (NVDA) incoming Blackwell series of GPUs are currently using MU’s HBM3E memory.

Strong Margin Expansion

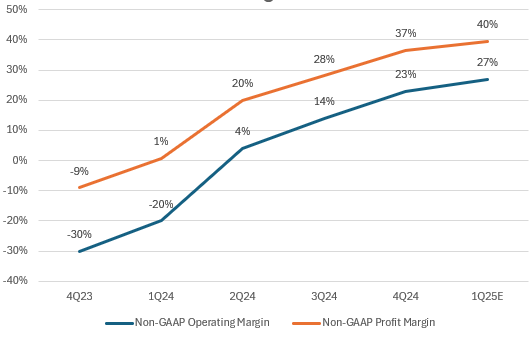

The company model

Despite strong revenue acceleration, it’s encouraging to see that it hasn’t come at the expense of margin deterioration. We can see the company has steadily increased its margins over the past quarters. As shown in the chart, margin expansion continued in 4Q FY2024 and is expected to improve further in 1Q FY2025, based on the midpoint of guidance. This margin growth is largely due to a favorable shift in product mix toward HBM and eSSDs, which are benefiting from strong AI data center demand and supportive pricing trends. Therefore, both strong revenue acceleration and margin expansion and supportive pricing trends are set to significantly boost its earnings outlook in FY2025.

Aggressive FY2025 Capex Supporting HBM

The company model

While the recent slowdown in economic data has prompted some caution regarding continued GenAI-related spending, the company’s strong FY2025 capex outlook further supports positive AI data center demand in the near future. During the earnings call, management noted that FY2025 capex would increase significantly to support the continued ramp-up of HBM3E and the potential release of next-gen HBM4 and HBM4E. They also emphasized other investments in construction, backend operations, and R&D.

As shown in the chart, MU’s YoY capex growth has accelerated significantly since 3Q FY2024. For 1Q FY2025, the company guided $3.5 billion in capex, implying 94.9% YoY growth. In addition, capex as a percentage of revenue has been increasing over the past two quarters, potentially reaching 40.2% in 1Q FY2025. Management expects capex for FY2025 to be in the “mid-30s percent of revenue” range. While this strong capex outlook may pressure FCF in the near term, I believe this will be offset by strong OCF growth, as the company’s FY2025 earnings are expected to grow nearly sixfold YoY.

Limiting China’s Exposure

Approximately 25% of MU’s revenue came from China a year ago. However, due to increasing geopolitical risks, such as export restrictions on advanced chips, the company is planning to further reduce its revenue exposure to China in FY2025. While this could create near-term headwind, similar to what we saw in FY2023, the company’s focus on higher-margin products with advanced technologies, which will gradually represent a smaller percentage of its revenue exposure in China. This is a prudent move to mitigate tail risks if U.S. and China tensions escalate further. Recently, China has encouraged local companies to avoid Nvidia chips, as U.S. restrictions limit the sale of advanced AI chips to China. Stricter measures could come out after the U.S. elections, potentially impacting MU’s stock sentiment.

Valuation

MU’s stock is currently trading at an attractive valuation. Although its P/E TTM may look very expensive due to recent profitability breakeven in 2Q FY2024, the company is expected to grow non-GAAP EPS by 583% YoY in FY2025, according to Seeking Alpha’s earnings consensus. Its non-GAAP P/E fwd for FY2025 is estimated to be 12.1x. Considering MU’s tremendous earnings growth potential over the next 12 months, its non-GAAP PEG fwd is at 0.18x, 90% below the sector average. (Fun fact: Nvidia’s stock has rallied 179% over the past 12 months, driven by +321.5% YoY non-GAAP EPS growth TTM, resulting in the same 0.18x non-GAAP PEG TTM.)

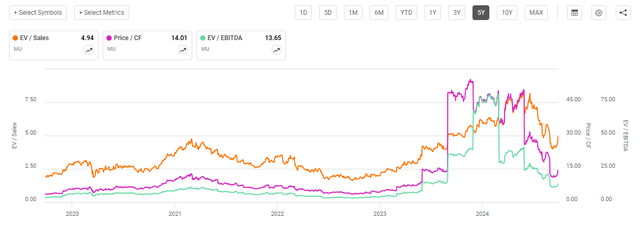

Looking at MU’s other valuation multiples, the stock is also not trading at expensive levels. Its EV/sales fwd is 3.1x, 8% below its 5-year average. Furthermore, as I mentioned earlier, MU is expected to significantly improve its OCF in FY2025, driven by its earnings growth. This will make its P/OCF fwd very attractive, currently at 7.2x, which is 67% below the sector average and 32% below its 5-year average. Therefore, following a sharp pullback in July, I believe MU is significantly undervalued, presenting an even stronger buying opportunity.

Conclusion

Despite a 14% post-earnings rally, MU’s stock price is still significantly below its July level. The company achieved a strong 4Q FY2024 earnings and issued a positive FY2025 outlook, which makes the stock appear extremely undervalued. The company has shown continued revenue acceleration, particularly in its DRAM and AI-driven products, which are anticipated to generate nearly six times YoY earnings growth in FY2025. By focusing on higher-margin products and strategically limiting its exposure to China, MU is well-positioned to capitalize on ongoing industry tailwinds while mitigating geopolitical risks. Furthermore, its aggressive capex outlook for FY2025 reinforces its long-term growth potential. MU’s attractive non-GAAP PEG fwd and P/OCF fwd multiples indicate a strong buying opportunity, particularly when compared to its industry peers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.