Summary:

- We correctly identified Micron Technology’s short-term Sell signal and long-term Buy signal, with recent earnings confirming the long-term Buy outlook.

- The weekly chart shows a switch from a Sell to a Buy signal, with MU outperforming the Index and forming a bullish double bottom.

- Short term, MU’s price is dropping due to day traders filling the gap from panic buying, but we don’t expect it to retest the bottom.

- The Company is on our Model Portfolio Watchlist with a low SID score, but we anticipate a 32% move up, supported by strong analyst and Quant ratings.

vzphotos

In our last article, we correctly identified Micron Technology’s (NASDAQ:MU) short-term Sell signal but were surprised at how low that Sell signal would take the price. We also correctly identified MU as a long-term Buy, and now that earnings are out that appears to be true.

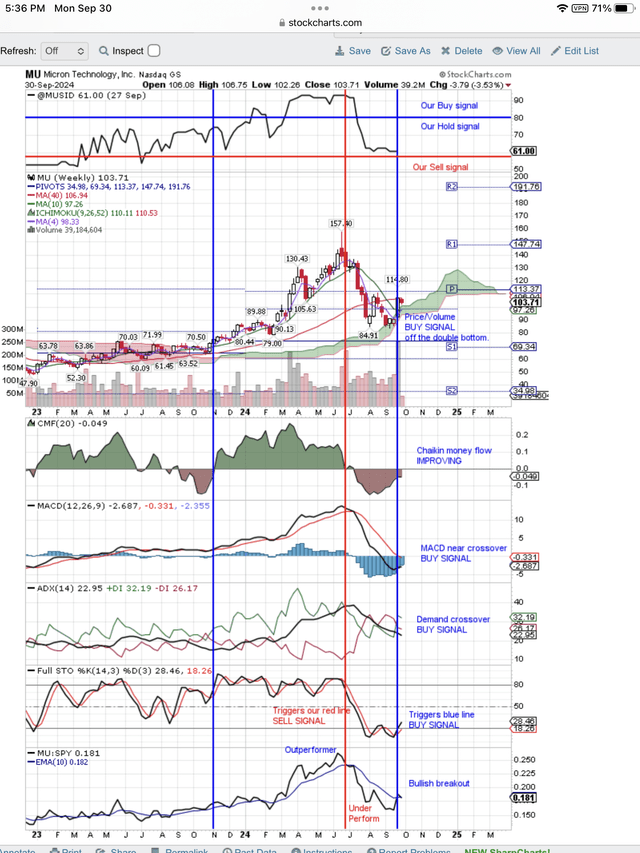

As you can see on the weekly chart below, the longer-term signals have changed from Sell to Buy signals. The red, vertical line Sell Signal has changed to a blue line Buy signal as MU triggered a Buy signal at the double bottom.

Here is the weekly chart showing the switch from the red line Sell signal to a blue line Buy signal in place for this article:

MU weekly chart with bottom fishing Buy Signals (StockCharts.com)

Notice on the above chart that this is the second attempt to get off the bottom. Double bottoms are usually bullish. Encouraging this positive signal is the performance breakout where MU is now outperforming the Index. This positive did not happen on the first bounce up from the bottom. So this is a much stronger bounce off the bottom. As you know, bottom fishers wait for a retest of the bottom before they buy again. MU price is dropping again to attract those bottom fishers.

Not all is positive in the short term for MU. Notice that the price is dropping as day traders try to fill the big gap-up in price after the post-earnings Price/Volume Buy signal. That gap-up was probably created by panic buying as the shorts were caught in a short squeeze and price-triggered stop-loss orders.

Now that panic Demand is gone, and it is relatively easy for day traders to take the price down to fill the gap, some big shorts, who did not cover, will join in the selling to take the price down so they can then cover at lower prices. Let’s see if they can take the price down to the bottom again. (We don’t think so.)

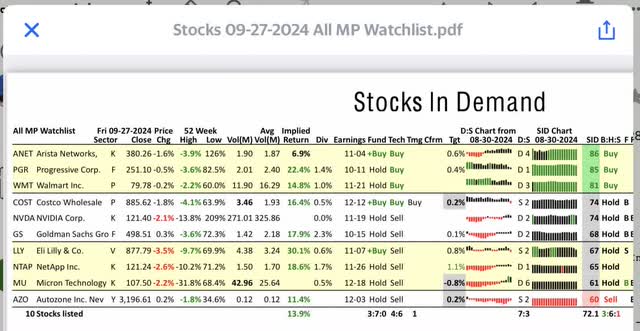

We have put MU on our Model Portfolio Watchlist and you can see it is at the bottom of our list because of a low Stocks In Demand or SID score shown in the far-right column of the report shown below. Bottom fishing stocks will always have our lowest SID score.

We expect bottom fishing stocks with Buy signals like MU to move up in our SID to a Buy signal, above 80 and to 100 the highest score. In the above chart, you can see how the MU SID score went up as the price went from the bottom last time to the top. Then you can see our red line Sell signal when it topped out.

Here is our Watchlist showing MU near the bottom of the list because it is a bottom fishing stock:

Our daily list of possible 2025 Model Portfolio stocks. (Daily Index Beaters)

As you can see on the above report that was published on Friday, we are looking for a 32% move back up to the old high for MU. In the far-right columns, you can see that the SID score is 61 and that is a weak Hold signal. Right next to “Hold” is a “B” and that is a Stop & Reverse Buy signal, telling us what we already know from the chart, namely that the Sell signal has reversed to a Buy signal. This is a short term SAR signal and changes frequently. The blue line, vertical line Buy signal on the weekly chart is longer term.

Our final due diligence step is to check with SA to see what analysts are saying about MU and to check the Quant ratings. The SA analysts have a Buy rating while Wall St. analysts have a strong Buy, which may explain the bottom fishing. The SA overall Quant rating is a Buy, but we are more interested in the good ratings for Valuation, Growth, Profitability and Momentum that back up the Quant Buy rating. Revisions just miss having a good rating, but the latest MU earnings may improve this rating. These good ratings also support the bottom fishers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails, or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes, and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell, or hold are not recommendations to buy sell, or hold any security. They are used here strictly for educational purposes. Analysts' price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

To understand completely our fundamental and technical approach to making money in the stock market, read my book "Successful Stock Signals" published by Wiley. This is the method that I taught to professional portfolio managers on Wall St. and now I share these secrets with you with 50 stock picking programs picking winners every day. You receive our daily email of stocks with Buy Signals before the market opens.