Summary:

- Micron is well-positioned for the next wave of data center buildouts, driven by strong AI training and inferencing demand that outstrips GPU capacity.

- Management is expanding capacity through new foundries in Idaho & New York and is converting an LCD facility in Taiwan to a DRAM production test facility.

- HBM capacity is sold out for CY24 and CY25, indicating strong demand, while DRAM and NAND pricing are expected to improve due to balanced supply and demand.

luza studios

Micron (NASDAQ:MU) is improving its position for the next wave of data center buildouts as the firm increases capacity and ramps up production of their HBM bits. Though the firm may be limited on capacity in terms of volume production in the near-term, management is taking the steps to construct their Idaho and New York foundries as well as convert an acquired LCD facility to a DRAM production test facility in Taiwan. Given that data center capacity is expected to grow at a 23% CAGR through 2030, I believe Micron will benefit substantially as AI training and inferencing demand outstrips supply capacity. I reiterate my BUY rating for MU shares, with a price target of $205/share at 9.10x eFY26 EV/aEBITDA.

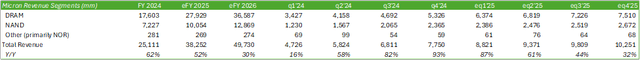

Micron Operations

Corporate Reports

Micron is well-positioned as the broader infrastructure industry accelerates capacity growth as AI training & inferencing demand remain strong. At a high level, data center capacity is expected to grow at a 23% CAGR through 2030 driven by demand for AI training and inferencing. Much of the capacity growth will derive from the hyperscalers as they build out their AI factories. Microsoft (MSFT) is expecting to increase their data center footprint both through development and third-party partnerships with competitors like Oracle Corp. (ORCL). Oracle alone is constructing 100 data centers to cater to regional demand.

At the data center consumption level, demand is expected to persist in the coming years as suggested by management at Microsoft. In their FY24 earnings call, management suggested that demand outstrips supply for GPU capacity, which is driving the necessity for the hyperscalers to build their AI factories. This in turn is driving demand for GPUs and CPUs.

In relation to this, the Advanced Micro Devices (AMD) MI300 and Nvidia (NVDA) H100 GPUs are still ramping up in production, providing consistent demand for HBM3 memory. As for Micron, management has made it clear for the last few quarters that HBM capacity is sold out for CY24 and CY25 as demand outstrips production constraints. Given that HBM requires 3x the wafer of DRAM, this constraint may persist until additional production capacity is built out through their New York and Idaho fabs. Taking into consideration management’s verbiage in their FY24 earnings call, additional capacity will likely not be available until 2027.

To assist with supply constraints, Micron acquired an LCD factory in Taiwan that will be converted to a DRAM production testing facility. This should help alleviate some of the cap in production.

Looking to management’s guidance for Q1 ’25, DRAM bits is expected to grow sequentially, up from their initial “flat” forecast, while NAND is expected to remain relatively flat. Both DRAM and NAND are expected to experience improved pricing on the back of a strong supply and demand balance with minimal expectations of oversupply. I believe management’s rationale behind this relates to the higher wafer requirements for HBM chips and that HBM will take on more production capacity in the DRAM segment. Though margin-accretive, management anticipates higher DRAM costs as more of the product mix shifts to HBM. I expect that pricing will more than offset the additional costs.

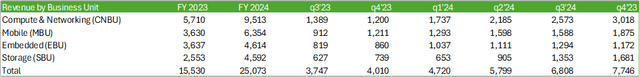

Corporate Reports

As my macroeconomic outlook would suggest, I anticipate that most of the demand will derive from data center expansions. Storage will likely play a role in growth going forward, especially as more enterprises turn from AI training to inferencing. This may also be driven by a potential shift to private data centers as more infrastructure becomes available. Embedded will likely remain flat due to broader macroeconomic shifts in the automotive market, especially as consumer preferences have shifted away from EVs in favor of hybrids and ICE vehicles.

Management discussed strong memory demand for AI-enabled PCs and smartphones; however, I do not believe that this will become a new trend. Analysts expect lackluster sales of Apple’s (AAPL) iPhone 16 given the shorter lead times. On the PC side, I believe AI PCs will experience a similar phenomenon as OEMs invested in early production of AI PCs in order to capture market share. Intel (INTC) had pulled forward A20 production in order to capture market share in the AI PC space; however, PC sales have continued to remain flat in commercial and sharply down in consumer for Dell Technologies (DELL). Though endpoints may have their spot at the enterprise level, I anticipate a challenging market for consumers given consumers’ tighter grips on discretionary spending. Given the recent drop of the consumer confidence index, unemployment is expected to pick up over the course of the next six months, which may impact both commercial and consumer PC sales.

In terms of Micron’s operational outlook, HBM3E 8-high is expected to experience increasing yields and output in FY25 with 12-high ramping up during CY25. Management anticipates the release of HBM4 in 2026. HBM remains to be sold out for the remainder of CY24 and all of CY25. Given the amount of data centers being constructed globally, CY26 may experience similar supply constraints as experienced in CY24 and CY25. Though this will limit volumes sold by Micron, it could also potentially lead to more appealing pricing for HBM.

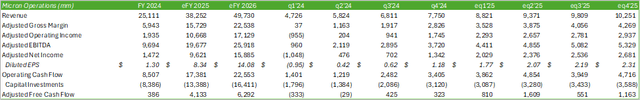

Micron Financials

Corporate Reports

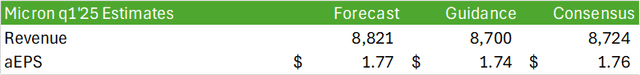

Looking to Micron’s financial performance and outlook, Micron experienced a growth rate of 93% at the top-line with significant sequential margin improvement as the firm realizes strength through scale. Looking to Q1 ’25, I’m forecasting Micron to generate $8.8b in revenue and an adjusted diluted EPS of $1.77/share, slightly above the guidance of $1.74/share +/- $0.08/share.

Corporate Reports

Looking to FY25, I’m forecasting $38b in revenue and $8.34/share in adjusted EPS. In addition to this, I’m expecting Micron to experience a significant cash inflow as management repositions the balance sheet by reducing inventory levels. Through operations and balance sheet improvements, I’m forecasting Micron to generate $4.1b in adjusted free cash flow for FY25 and $6.2b in FY26.

Risks Related To Micron

Bull Case

Strong demand for GPU + CPU capacity will drive HBM demand across hyperscalers and private data centers. Micron is scaling operations to support the growing demand for memory and storage chips through their Taiwan facility acquisition and the investments in the Idaho and New York fabs. Given the tight supply for HBM, Micron may be in a position of pricing power and may realize stronger margins as a result.

Bear Case

Microsoft has made clear that their capital investment outlay is dynamic based on AI demand, meaning that if investments and consumption decline for AI applications, Microsoft will reduce their spend across their data centers. This could potentially hamper Micron’s growth and pricing power for HBM if demand doesn’t remain strong beyond CY25. Micron is also limited by their production capacity and will require additional capital investments to improve volumes.

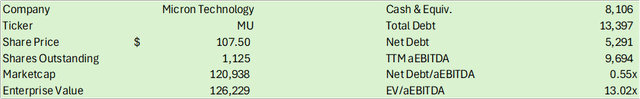

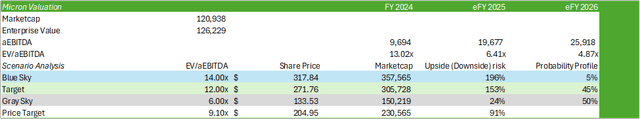

Valuation & Shareholder Value

Corporate Reports

Given the strong operational performance in FY24 and the improved outlook in the coming years, management made the decision to resume their share repurchase program in Q4 ’24 with $300mm allocated to repurchasing 3.2mm shares at an average price of $93.07/share. I anticipate repurchases will persist in the coming quarters, especially as management focuses their attention on strengthening the balance sheet.

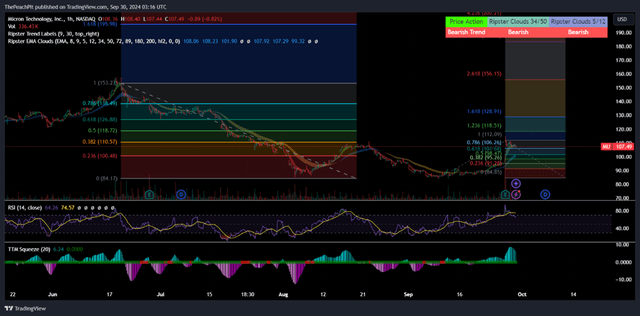

MU shares have been under significant pressure since releasing Q3 ’24 results as it relates to the firm’s higher-than-expected capital investment outlay as the firm positions itself for the next generation of memory and storage chips. From a tactical perspective, it appears that the retracement cycle has been completed and has positioned MU shares for its next upcycle. Given the multiyear data center buildout that’s occurring, MU shares may experience a larger upcycle going forward as operational performance reflects AI factory demand.

TradingView

Considering that Micron may be in the middle of the business cycle, MU shares will likely experience growth as its aEBITDA margin comes inline at the lower end. With the added shareholder benefit of share repurchases, MU shares may hold some additional value to investors as we move through the business cycle.

Using an internal valuation model based on my forecast for adjusted EBITDA and MU shares’ historical trading range, I believe MU shares should be priced at $205/share at 9.1x eFY26 EV/aEBITDA.

Corporate Reports

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, ORCL, AMD, DELL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.