Summary:

- AECOM reported strong order and backlog growth in the last quarter.

- The Omnibus appropriation bill passed in March and the IIJA funding will support the company’s medium to long-term growth.

- The company’s growth prospects look good and it is attractively valued.

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

During the last quarter, AECOM (NYSE:ACM) witnessed strong demand across its end markets as reflected in the backlog growth and new order wins. The government clients of AECOM will benefit from the Omnibus appropriation bill passed in March, which will support the company’s growth in the second half of 2022 and 2023. Furthermore, the Infrastructure Investment & Jobs Act (IIJA) funding is expected to underpin the order pipeline growth and revenue in 2023 and beyond. The company is investing to better support its clients and capitalize on this opportunity for growth. Despite rising inflation, the company has been able to improve its margins by incorporating inflation protection in its contracts with its clients. As a result of this, the bottom line of the company improved last quarter. We expect similar margin resilience looking forward. AECOM is trading at 19.17x FY22 consensus EPS estimates and 17x FY23 consensus EPS estimates. We believe the stock is attractive given its growth prospects and hence have a buy rating on it.

Recent Quarter Earnings

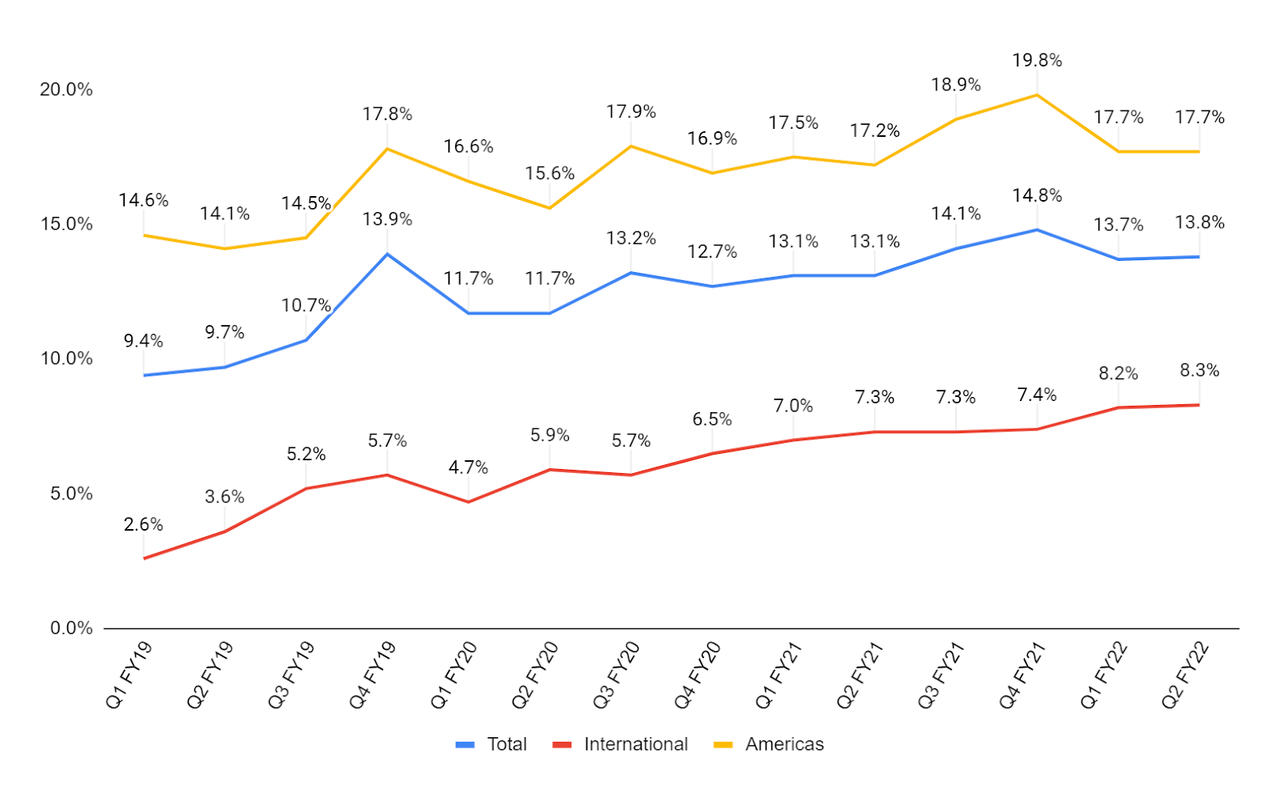

AECOM recently reported Q2 2022 net sales of $3.21 billion (down 1.6% Y/Y) which was lower than the consensus estimate of ~$3.4 billion. However, the Net Service Revenue (NSR), a key performance indicator for AECOM, was up 4% Y/Y in the quarter on a constant currency basis. The increase in NSR was due to a 3% increase in NSR in the Americas business, while the International business grew by 6% on a constant currency basis despite employee absenteeism due to Omicron. During the quarter, adjusted EPS increased by 24% year over year, from $0.67 in Q2 2021 to $0.83 (vs. the consensus estimate of $0.78). The company’s bottom line benefited from the increase in margins during the quarter. The adjusted operating margin increased 70 basis points year over year to 13.8%, owing to growth in higher-margin areas such as advisory and program management, as well as built-in protection from inflation in client’s contracts.

Backlog Growth Opportunities

During the quarter, the book to burn ratio and total backlog, both of which are the leading indicators for future growth, increased. The quarter’s 1.6x book-to-burn ratio and a 20% year-over-year increase in contracted backlog demonstrate the strength across end markets. In Q2 2022, the book to burn ratio in the Americas business was ~1.6x, with contracted backlog growing ~24% Y/Y and total backlog growing ~3% Y/Y. The international business had an exceptional quarter, with new wins totaling $1.2 billion and a book-to-burn ratio of 1.5x. The wins were mostly in ACM’s biggest and most profitable end markets, such as transportation, water, environmental sustainability, and program management.

The United States government passed its fiscal 2022 Omnibus budget in March 2022, which should benefit AECOM’s government clients in the United States in the second half of this year and fiscal 2023. The outlook for the next several years in the United States appears positive, as the funding from the Infrastructure Investment & Jobs Act (IIJA) of ~$1.2 trillion should also benefit ACM’s clients. The benefit from the US federal budget for 2022 should help the company’s backlog in the second half of 2022 and 2023, while the benefit from the IIJA funding should help in 2023 and beyond. The company is taking steps to better position its clients for the funding, and as part of its Digital AECOM offering, it has launched an IIJA-specific digital tool. Through AI and machine learning, this tool should assist ACM’s clients in navigating the complexities of the competitive grant process for funding. This should boost the company’s growth when funding from IIJA enters the market.

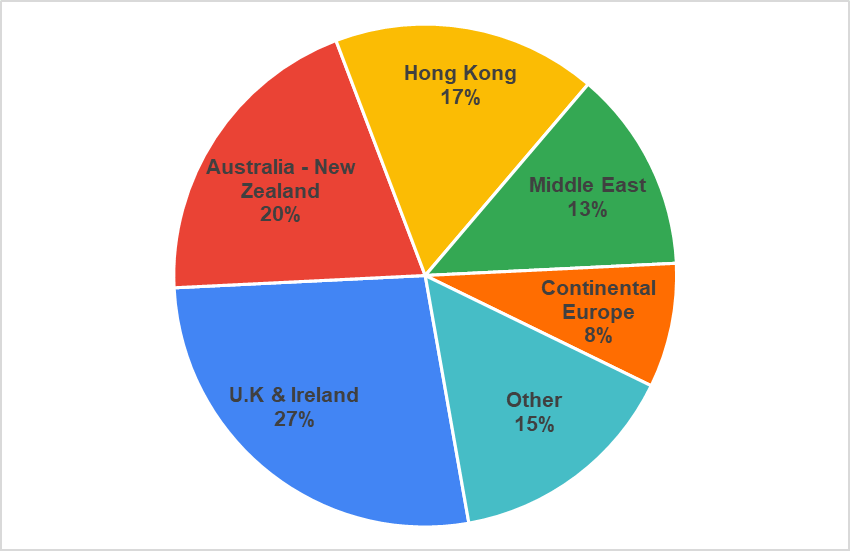

AECOM’s International NSR Distribution (TTM as of Q2’22) (Company Data, GS Analytics Research)

Within international business, the United Kingdom’s levelling-up strategy, focusing on ending geographical inequality and providing equal opportunity to all, with elements of infrastructure driving it should benefit AECOM. The United Kingdom accounts for ~27% of the International segment’s revenue and the ~£4.8 bn levelling up fund will support town center and high street regeneration, local transport projects, and cultural and heritage assets. Investments in modern ESG-focused cities such as NEOM and AIUIA in Saudi Arabia are also creating opportunities for the company in the Middle East. AECOM was appointed in 2020 to design the transportation and utility infrastructure for the NEOM city, which is the centerpiece of Saudi Vision 2030.

Looking ahead, ACM’s growth opportunities in the Americas and International business should support the order pipeline, boosting its backlog. The company’s NSR growth guidance for 2022 remains unchanged at 6% Y/Y, as the design business continues to grow strongly, while backlog conversion should drive further NSR growth during the year.

Margins

In Q2 2022, adjusted operating margins in the Americas business increased 50 basis points year over year to 17.7%. Increased NSR revenue and growth in higher-margin areas like advisory and program management fueled the expansion. As a result of increased operating income and NSR growth, the International business’s margin increased 100 basis points year over year to 8.3%. Despite rising inflation, supply chain disruptions, and geopolitical tensions, the company was able to post good margins as it has incorporated inflation protection in the majority of its contracts.

AECOM’s Adjusted Operating and Segment margins (Company Data, GS Analytics Research)

To drive the company’s growth and improve profitability, the company has made investments in its business such as PFAS-destruction technology, Digital AECOM, ESG, and increasing employee headcounts. AECOM’s profitability should benefit from these investments, as well as the restructuring initiatives that the company has taken. In 2022, the company expects an adjusted operating margin of 14.1% or higher, 15% or higher in 2024, and 17% in the long run. The company’s bottom line is expected to grow in fiscal 2022 due to accelerating NSR growth and expanding margins.

Valuation And Conclusion

ACM currently is trading at an adjusted forward P/E of ~19.17x (FY22 consensus EPS of $3.46) and ~17x (FY23 consensus EPS of $3.90) which is higher than the five-year historical adjusted P/E (FWD) of 16.23x. While the stock is trading at a slight premium to historical levels the company’s growth prospects appear strong, and the company’s additional investment to fully take advantage of the funding environment gives us confidence in the business. The stock is also trading at a significant discount to its peer Tetra Tech (TTEK) which is trading at an adjusted forward P/E of ~29.82x. With the company’s execution improving, I believe AECOM’s P/E multiple will continue to re-rate higher. Hence, we have a buy rating on the stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.